The Gold Update by Mark Mead Baillie — 780th Edition — Monte-Carlo — 26 October 2024 (published each Saturday) — www.deMeadville.com

“Gold Taps a Ten-Year Frontier”

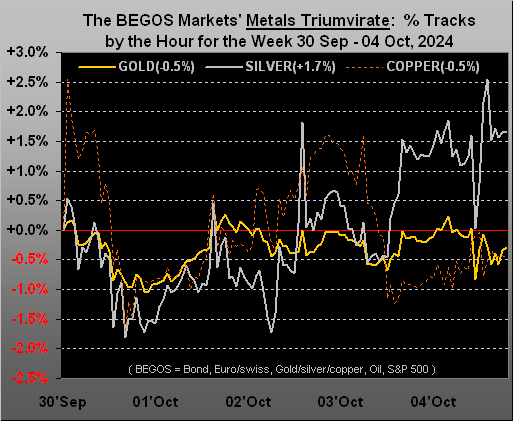

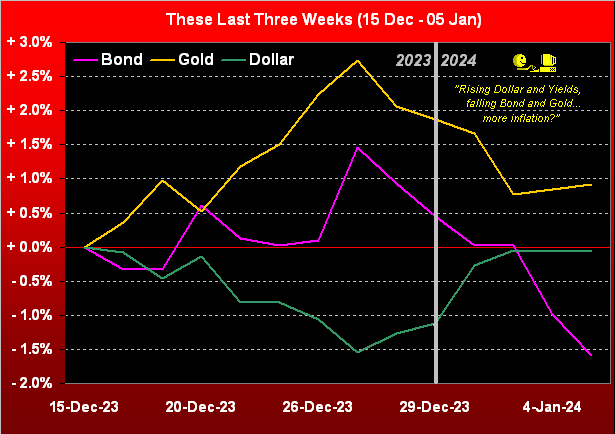

‘Tis taken ten years, but what just happened?

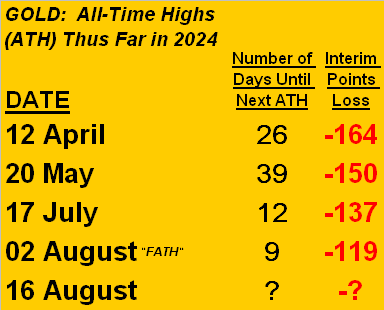

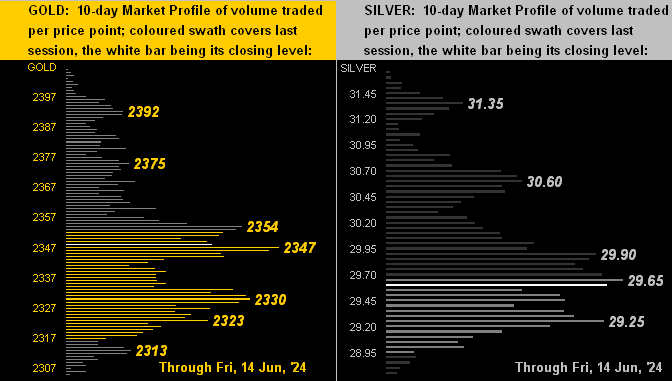

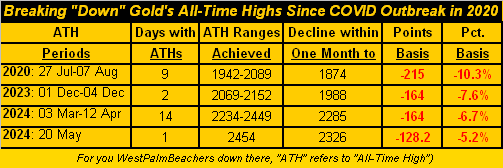

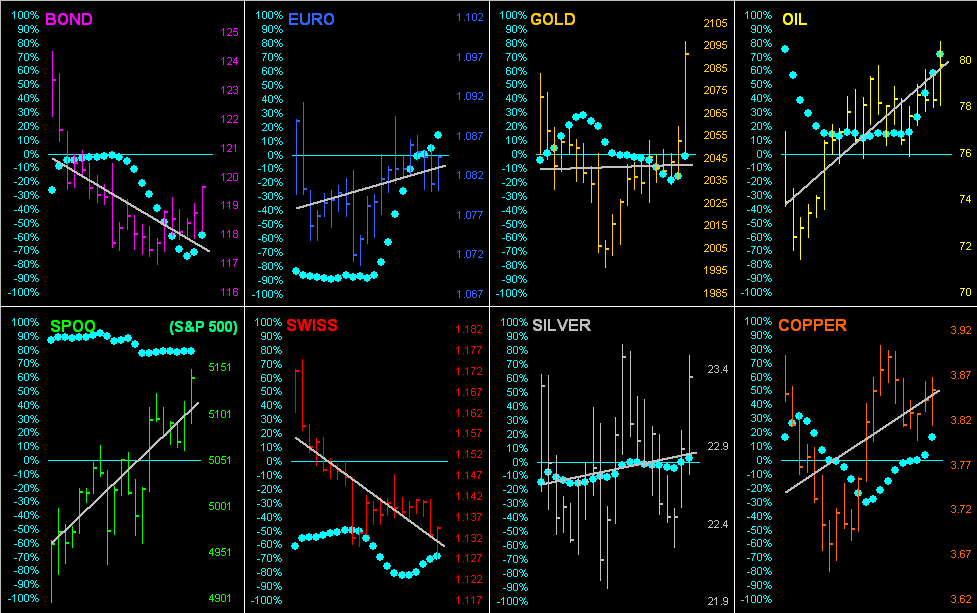

“Well, mmb, I’m gonna take a stab at this: for the 207 trading days so far this year, Gold has made a record high for 37 of ’em.”

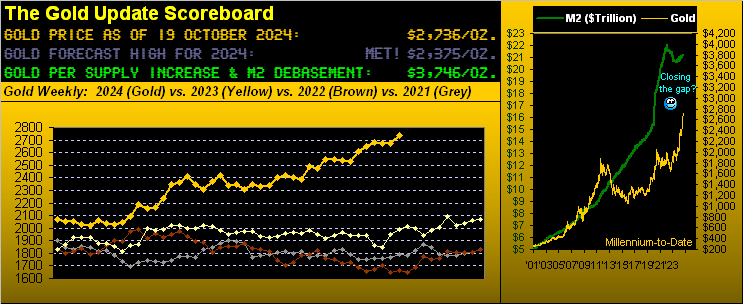

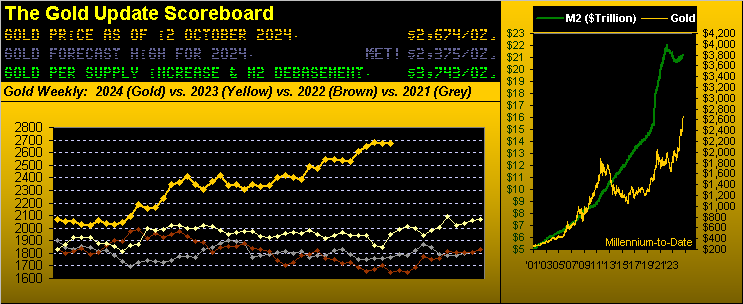

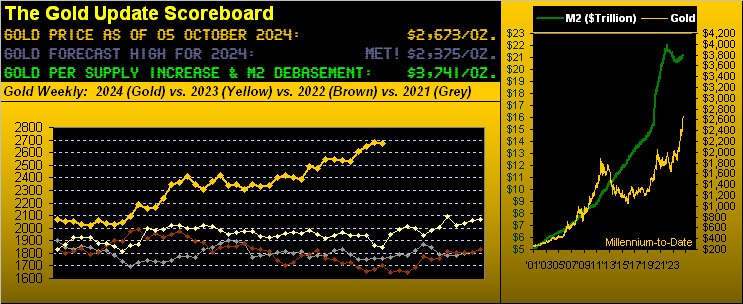

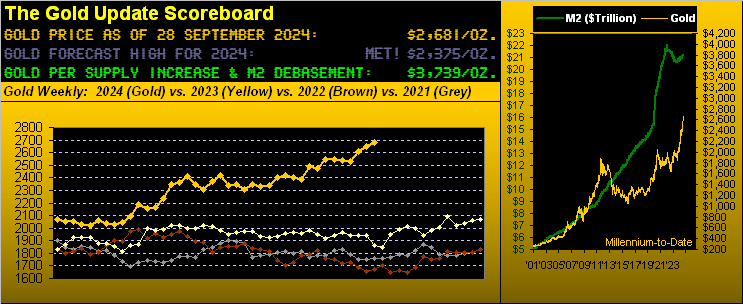

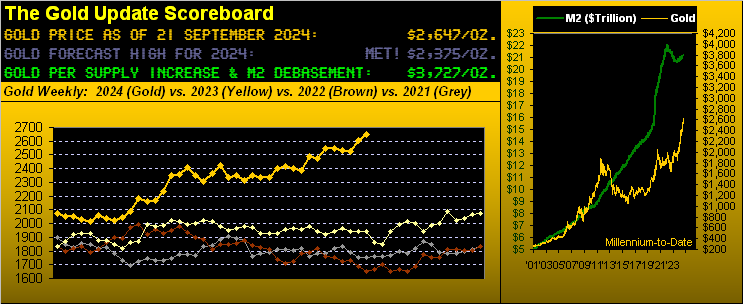

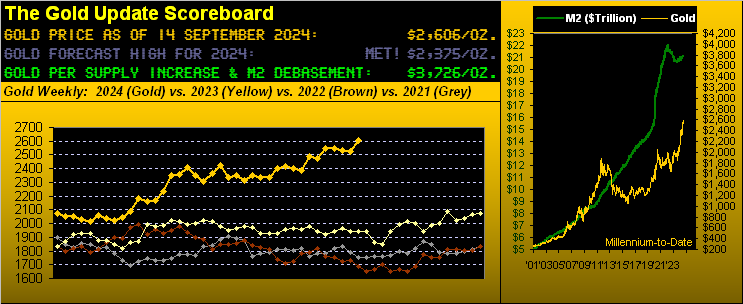

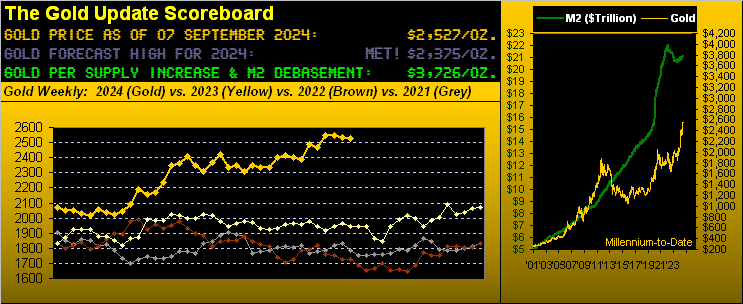

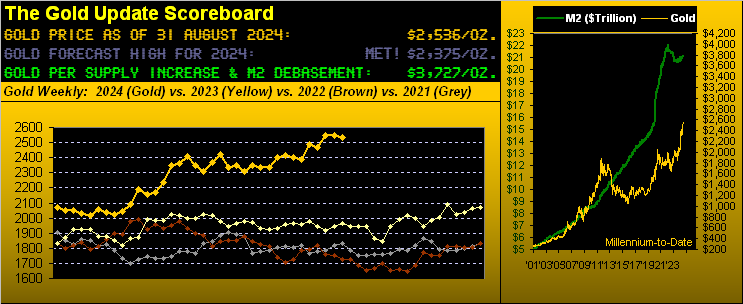

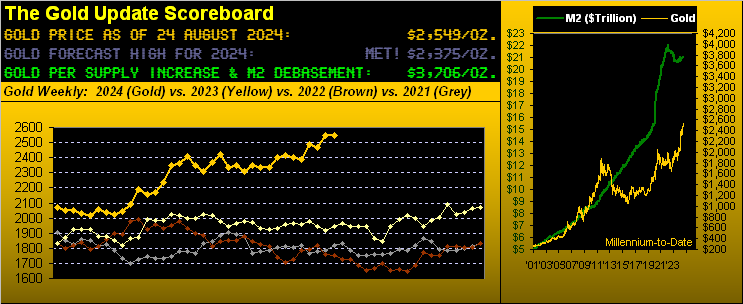

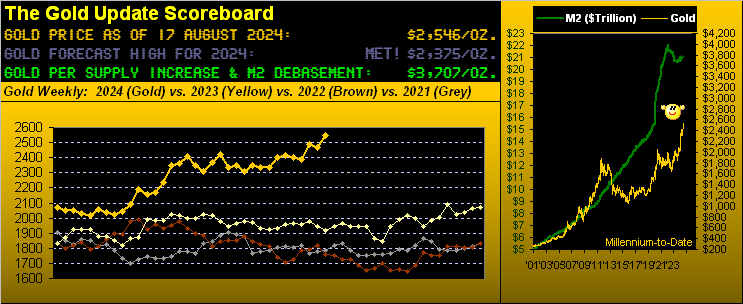

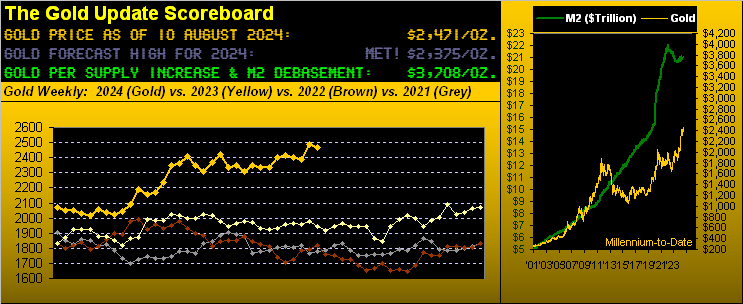

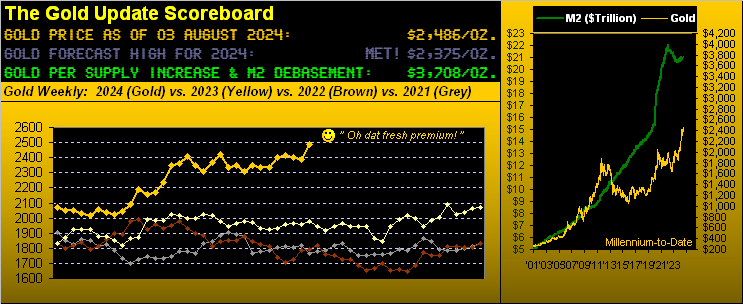

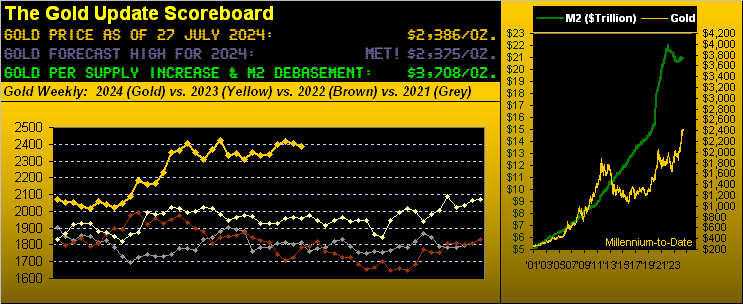

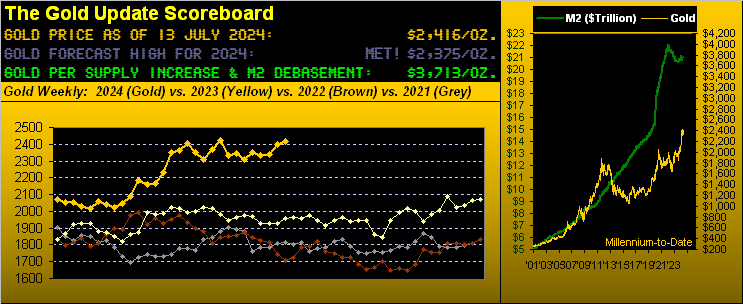

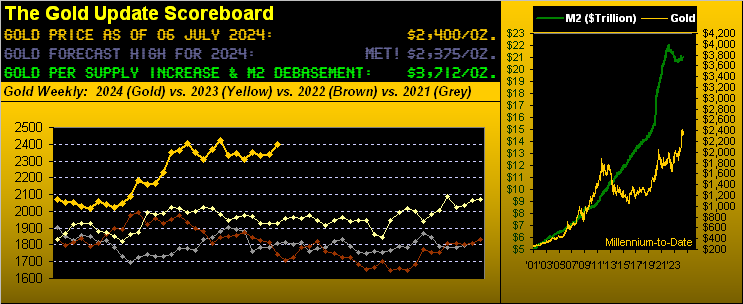

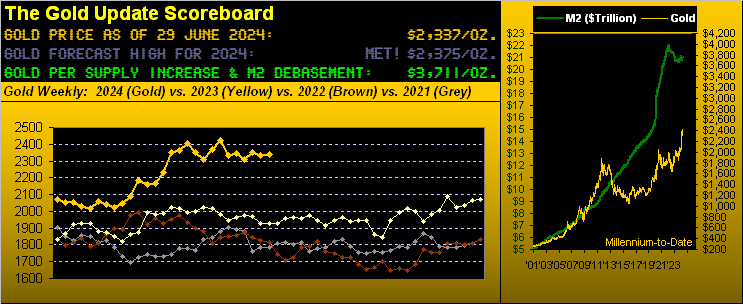

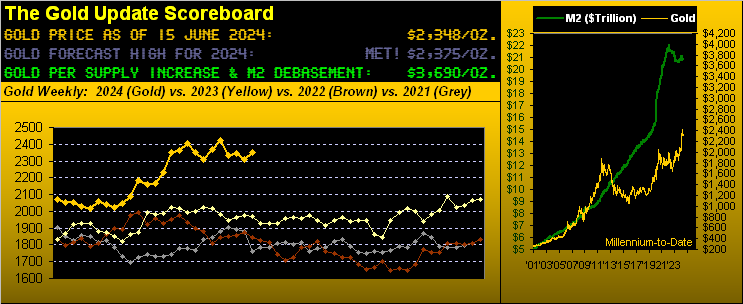

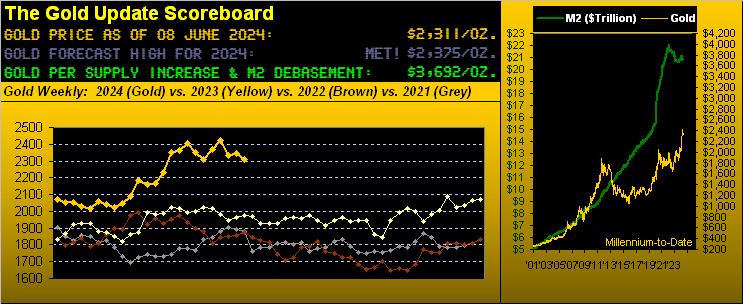

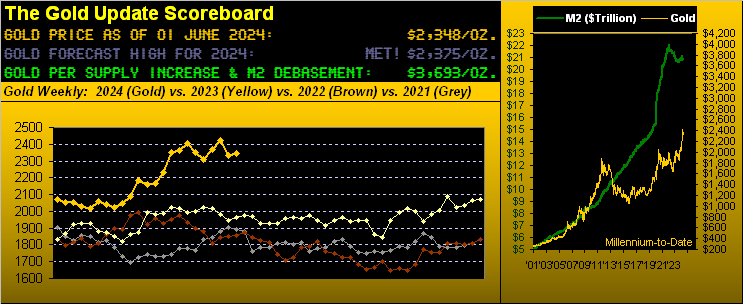

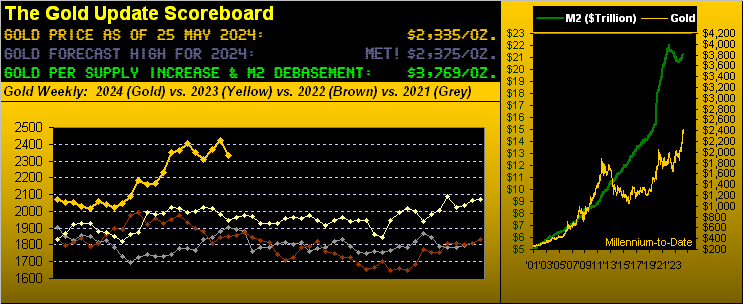

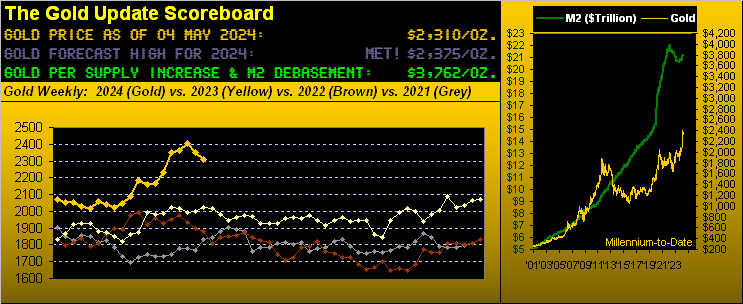

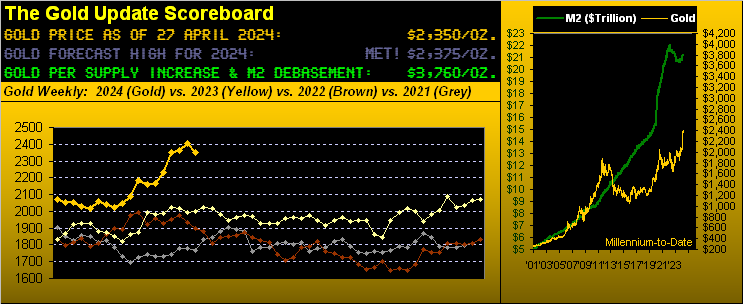

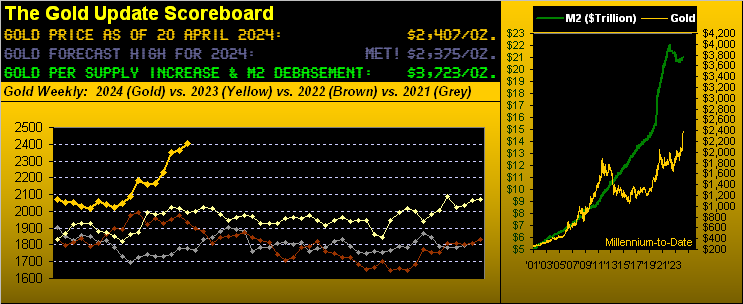

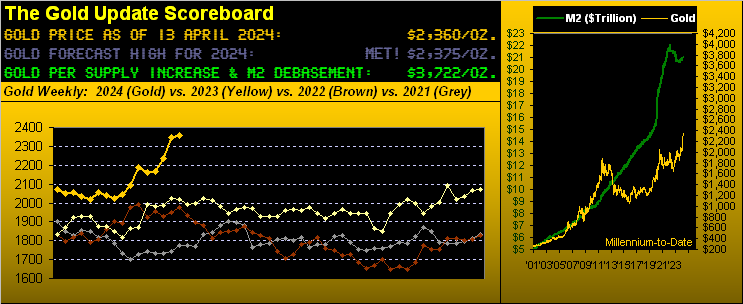

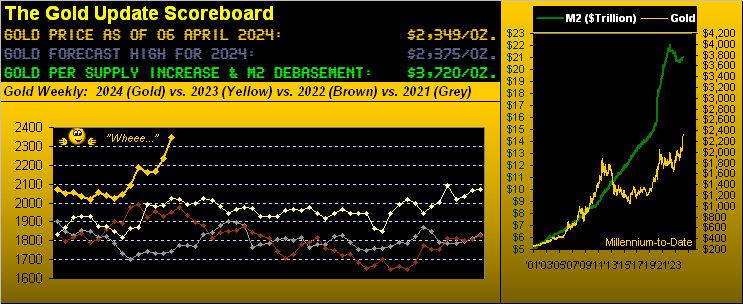

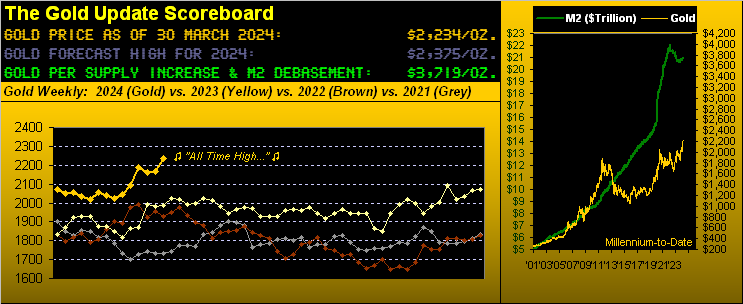

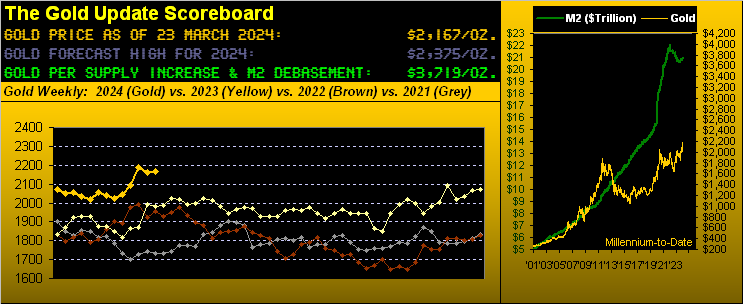

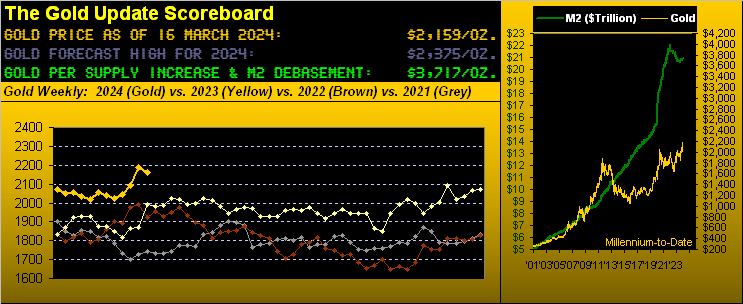

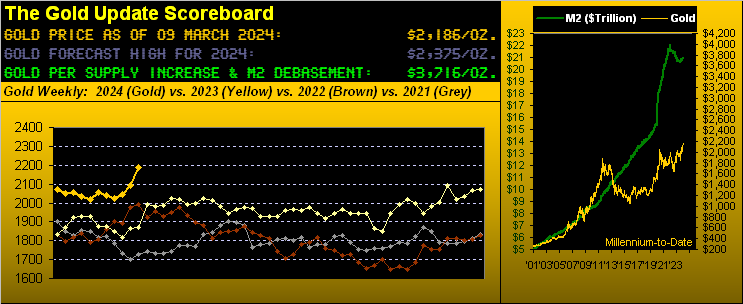

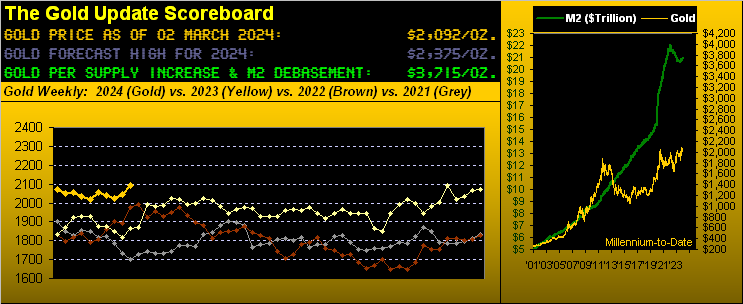

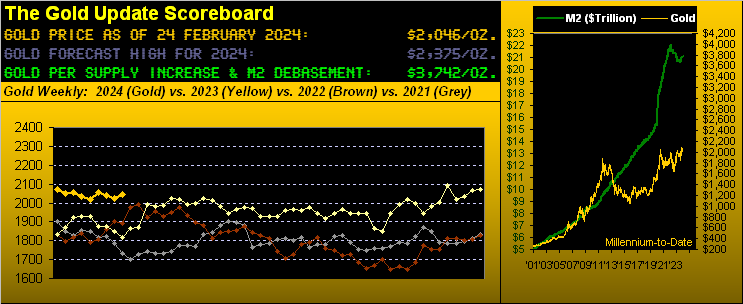

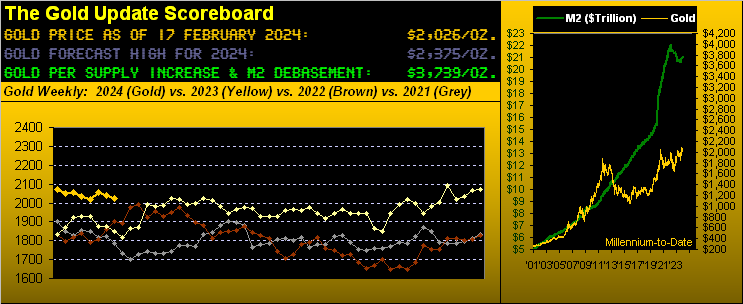

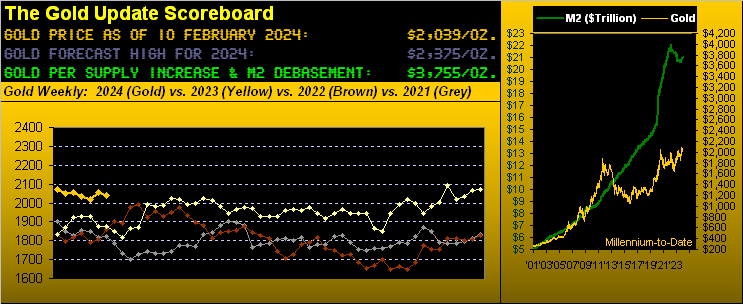

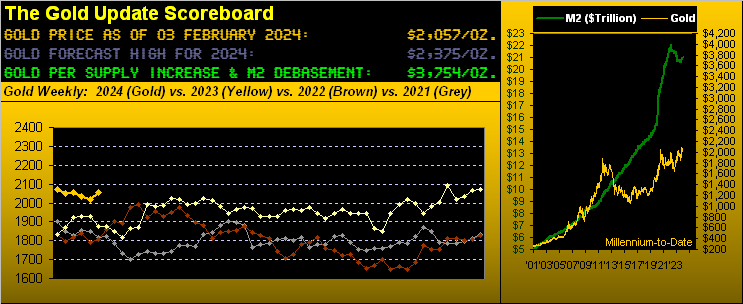

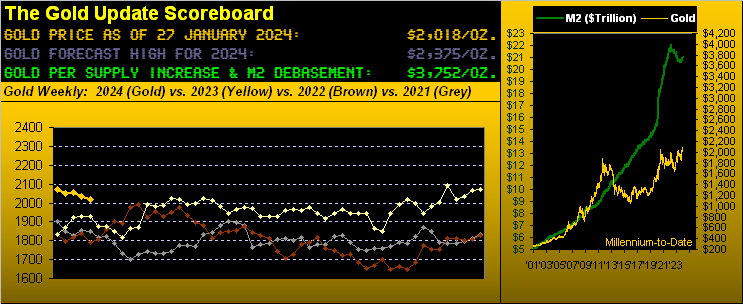

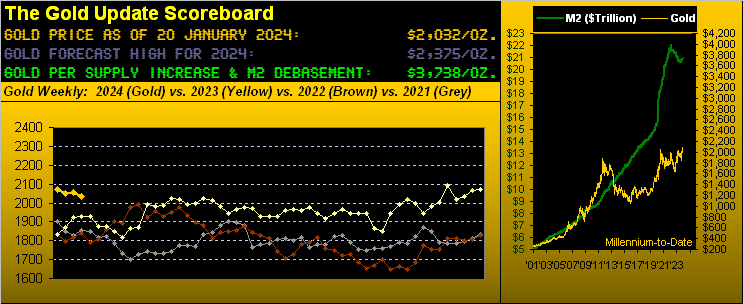

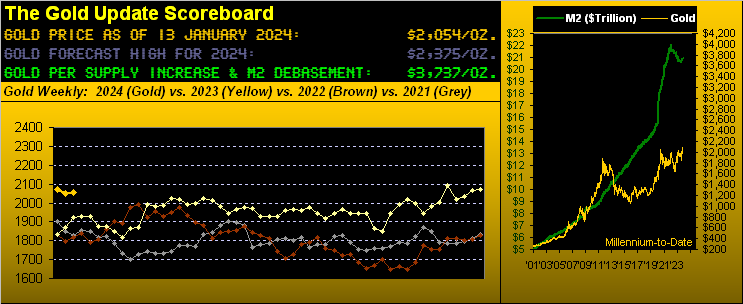

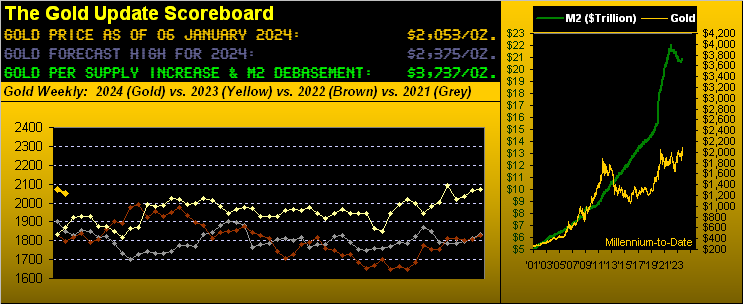

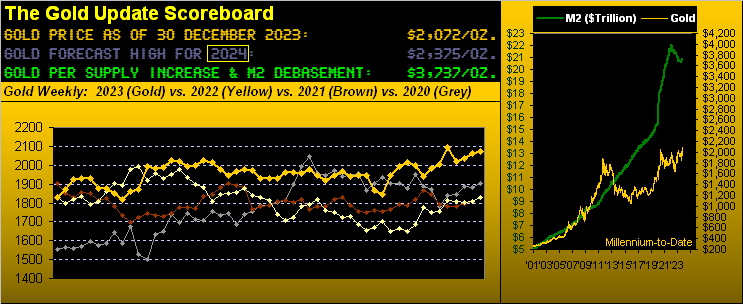

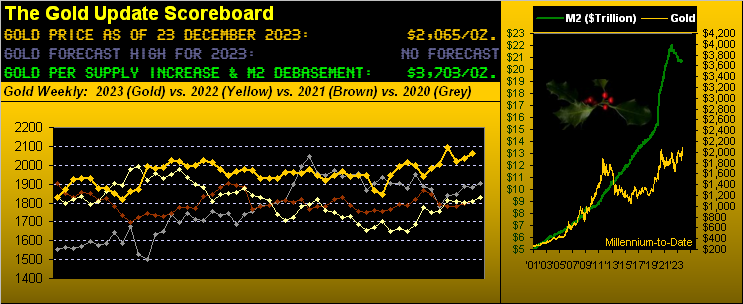

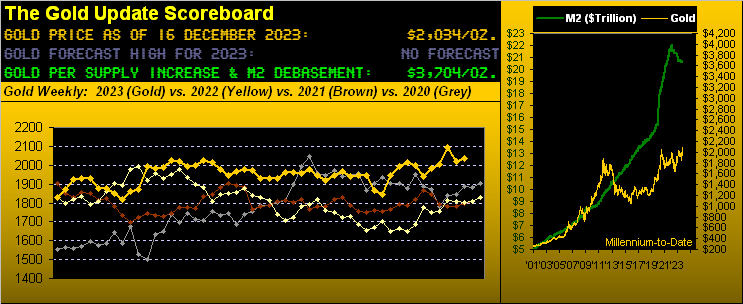

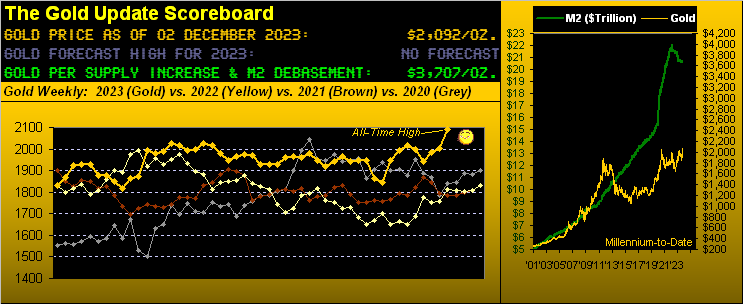

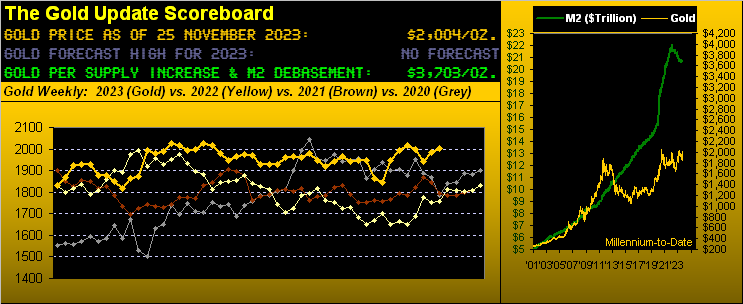

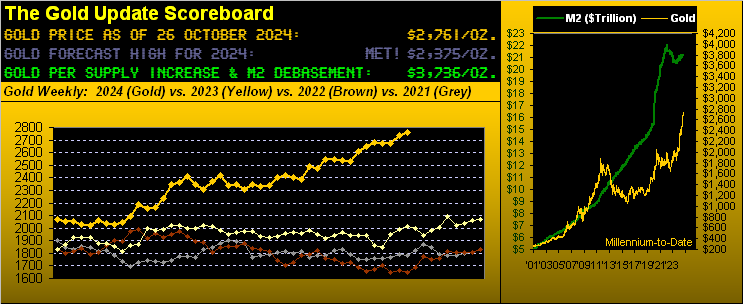

A spot-on and well sussed-out observance there, Squire, but that’s not our highlight. Rather, the answer is in the above Gold Scoreboard’s math. Ready? Here we go:

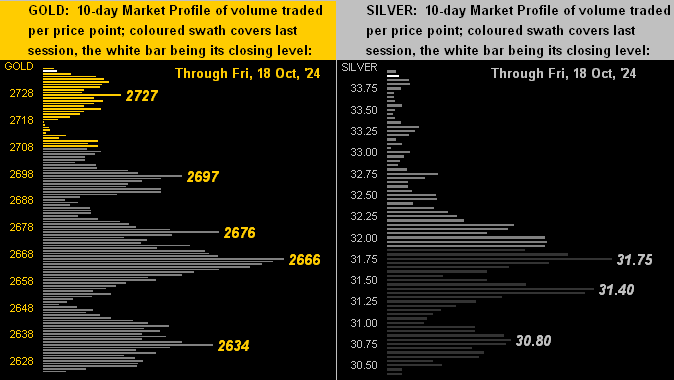

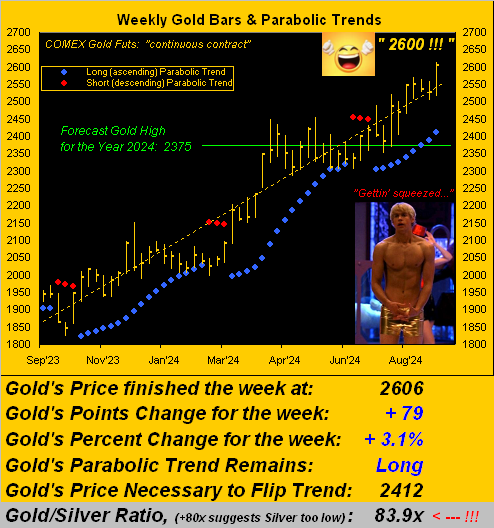

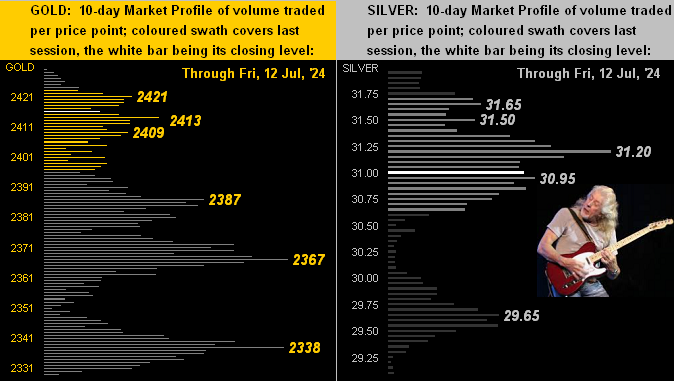

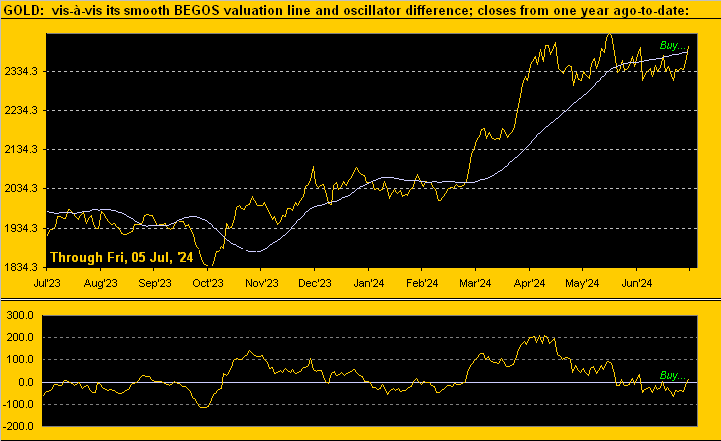

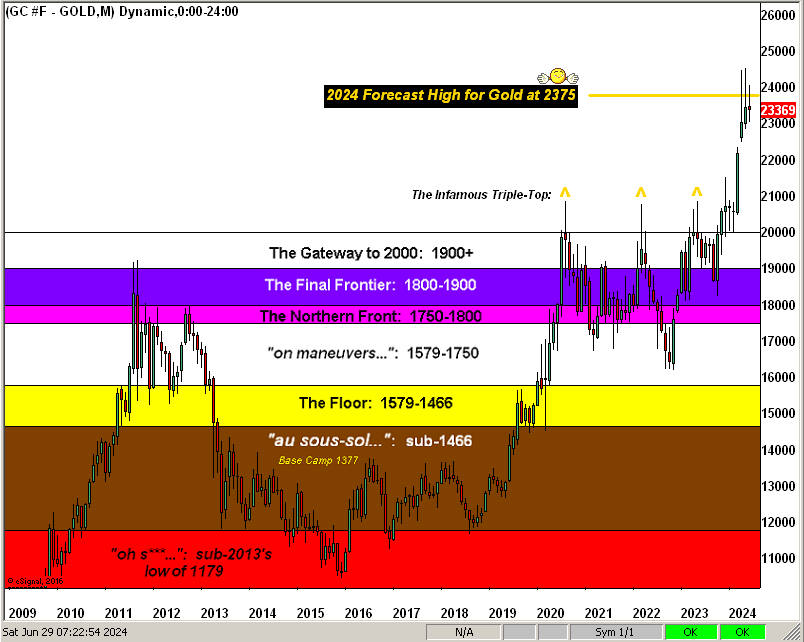

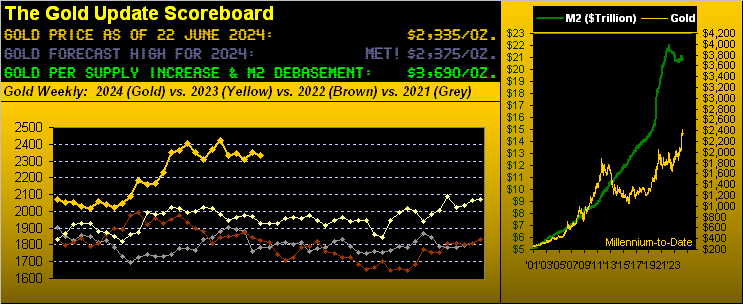

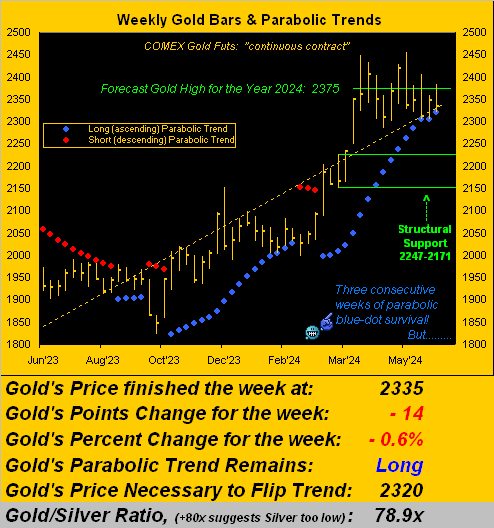

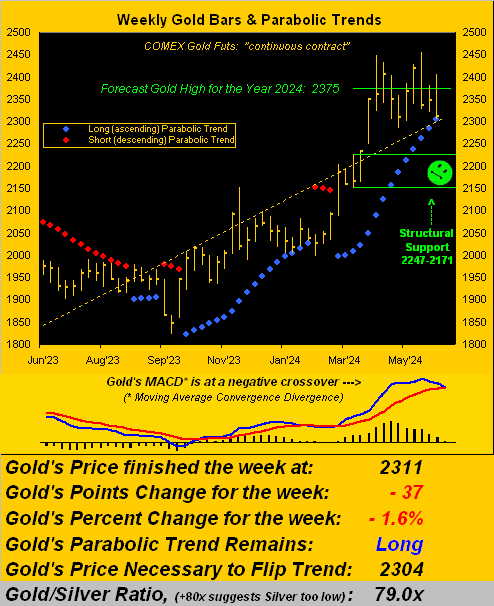

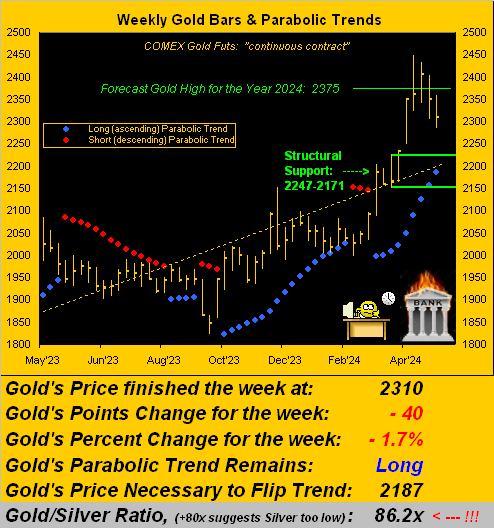

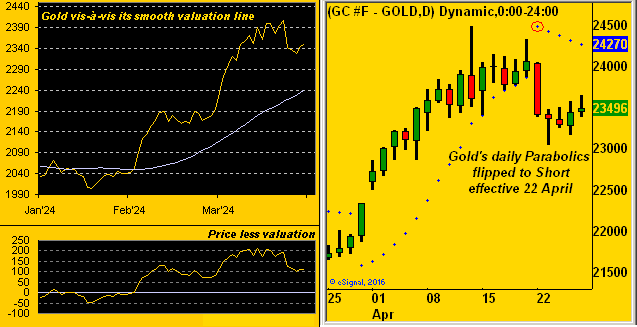

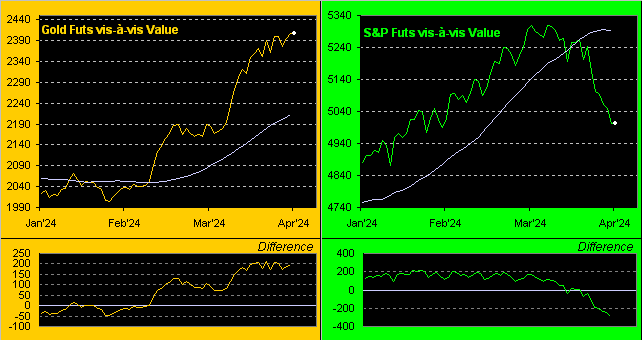

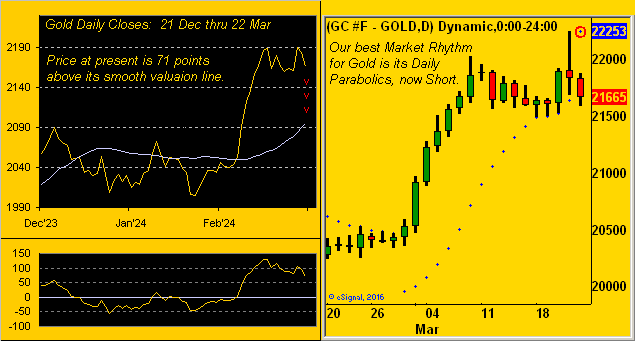

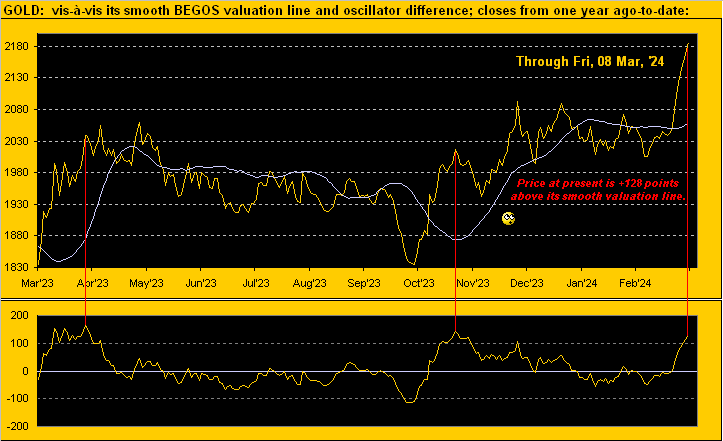

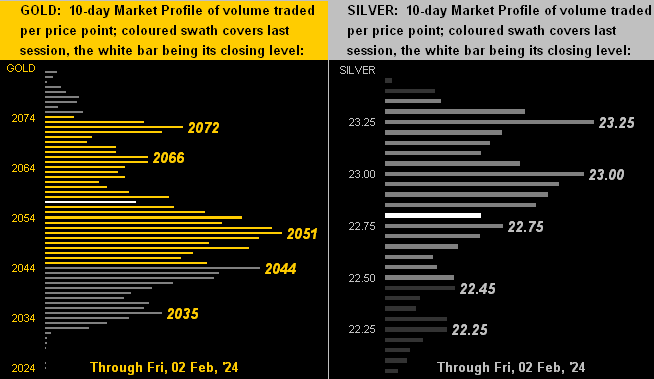

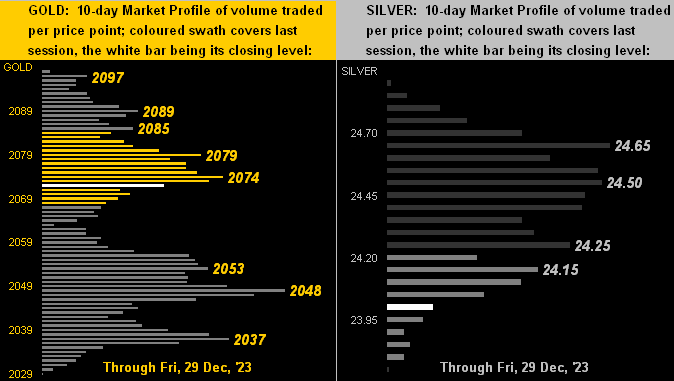

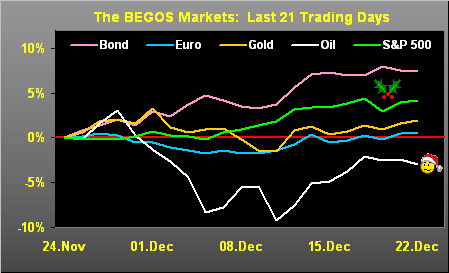

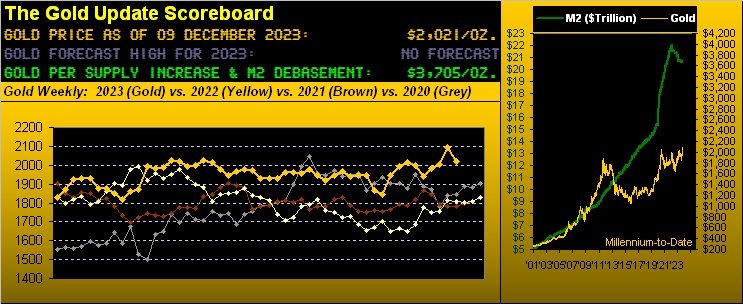

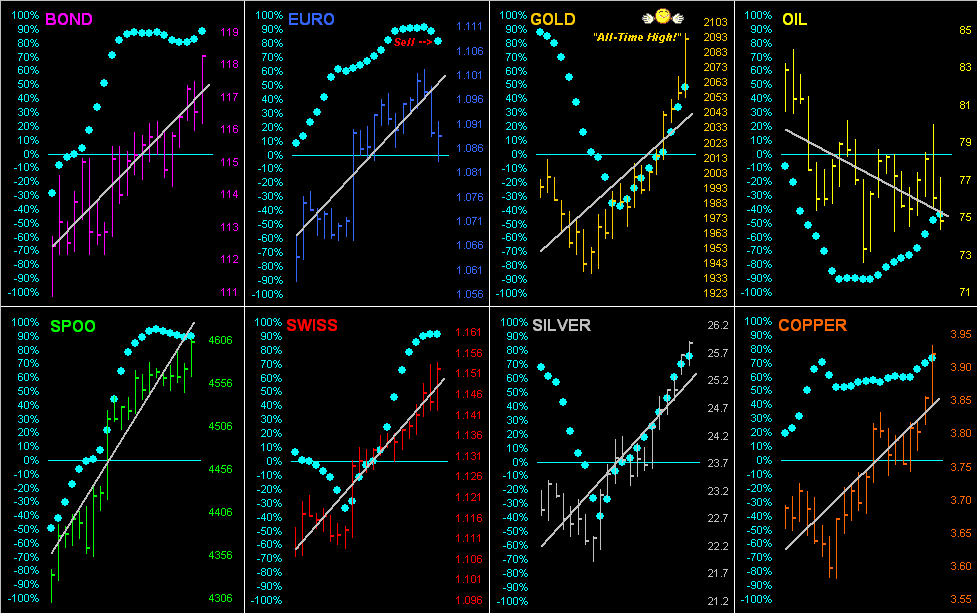

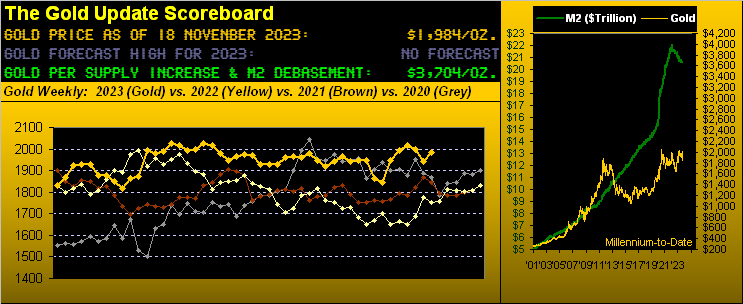

- As shown, Gold settled out this past week yesterday (Friday) at $2,761/oz.

- Gold’s valuation (even given its own supply increase) relative to debased M2 is now $3,736/oz.

- The difference? $2,761 – $3,736 = -$975.

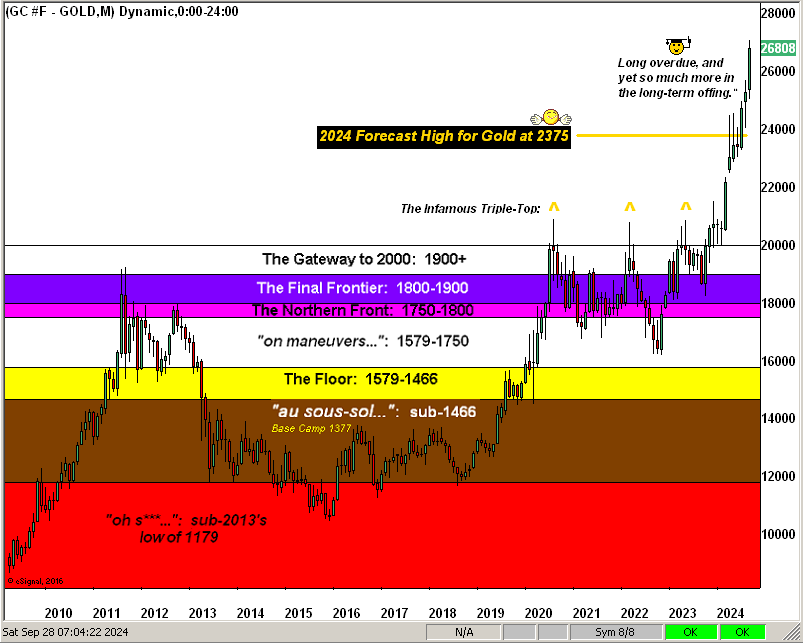

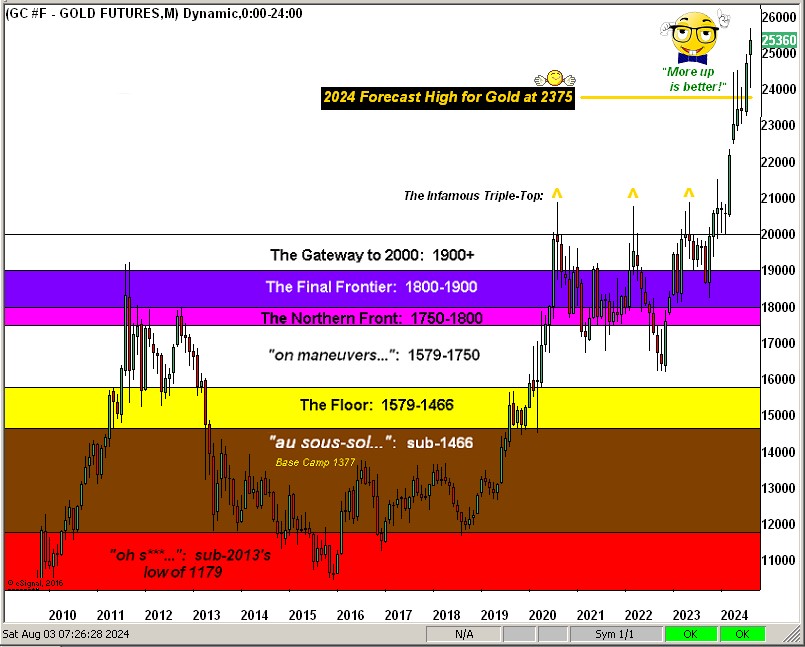

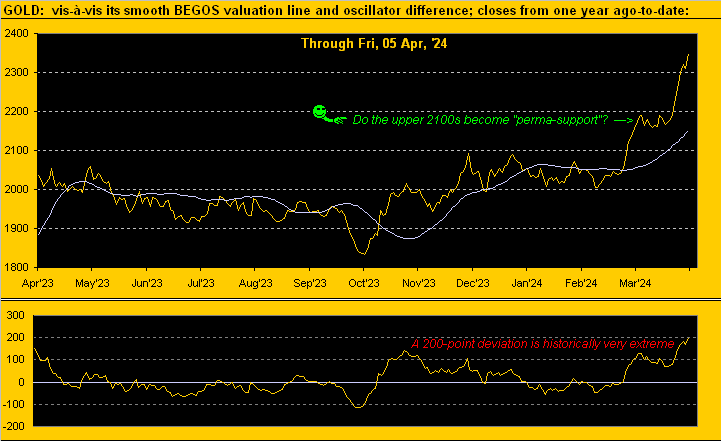

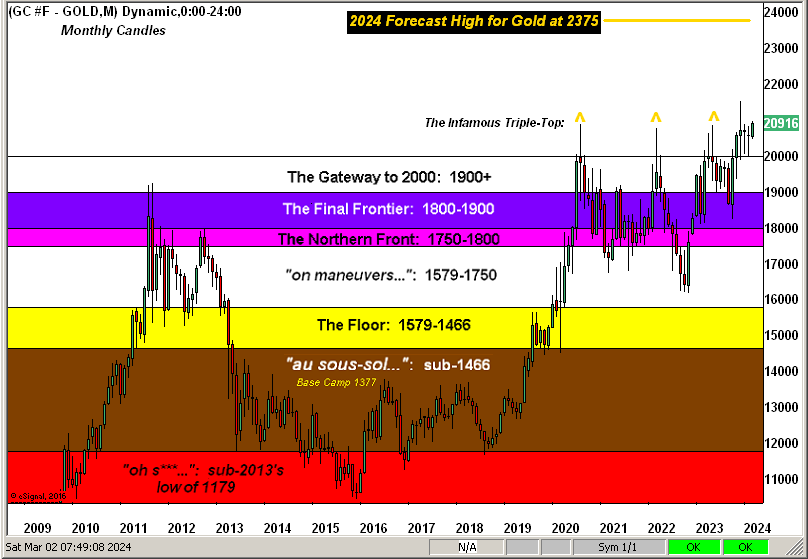

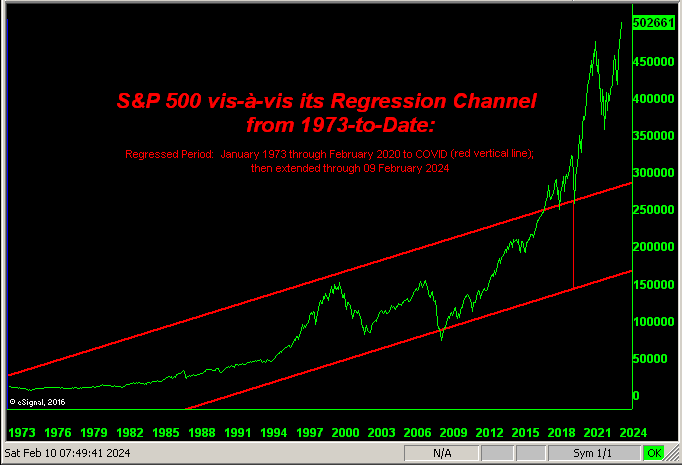

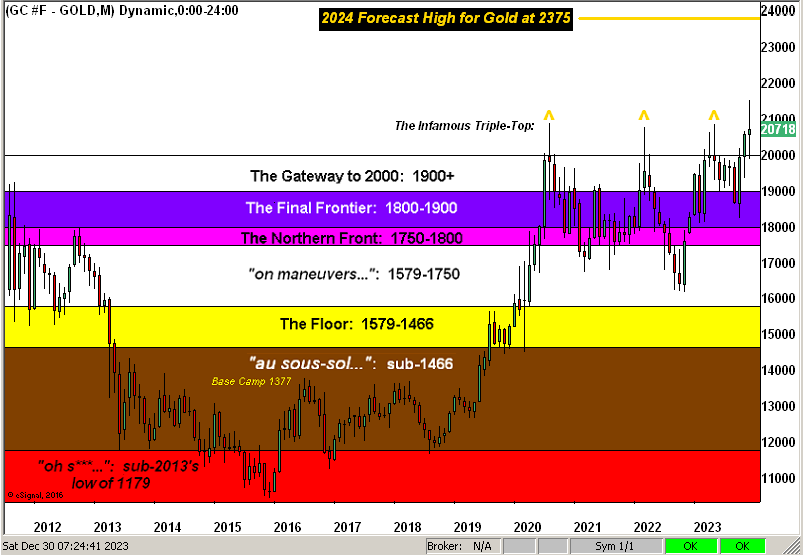

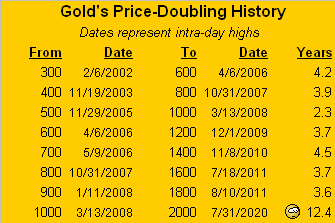

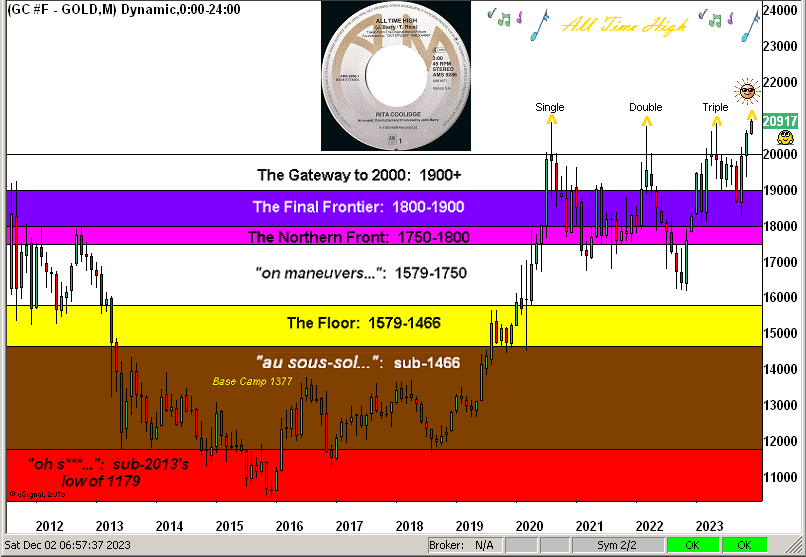

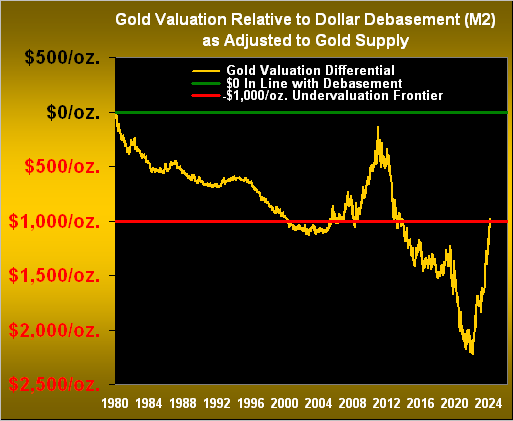

Thus for the first time in ten years (since the week ending 25 July 2014), Gold at week’s end is now above the -$1,000 undervaluation frontier relative to where it ought be given Dollar debasement. ‘Tis all there to below behold across the past 45 years, the rightmost pip having just eclipsed that red frontier:

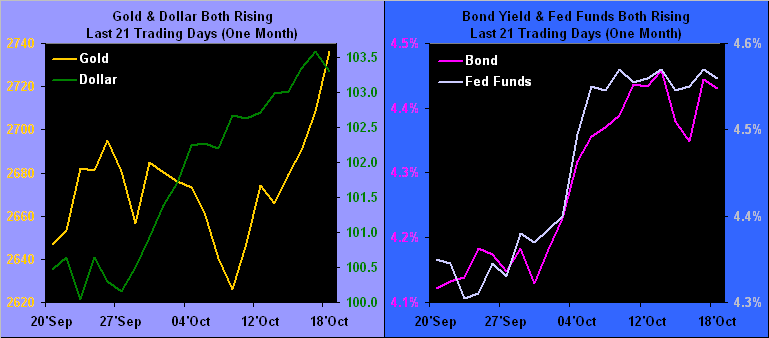

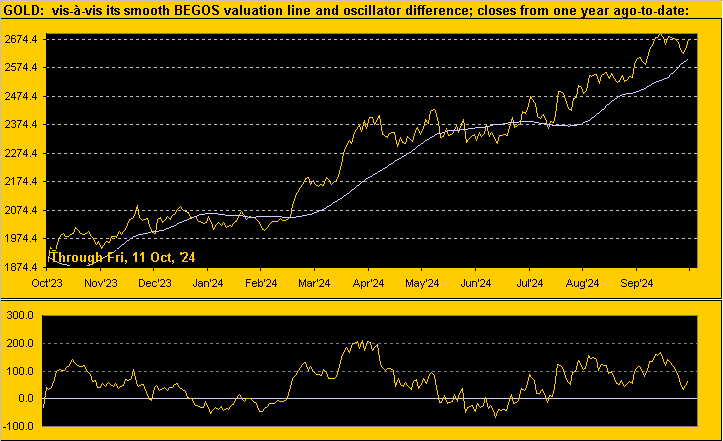

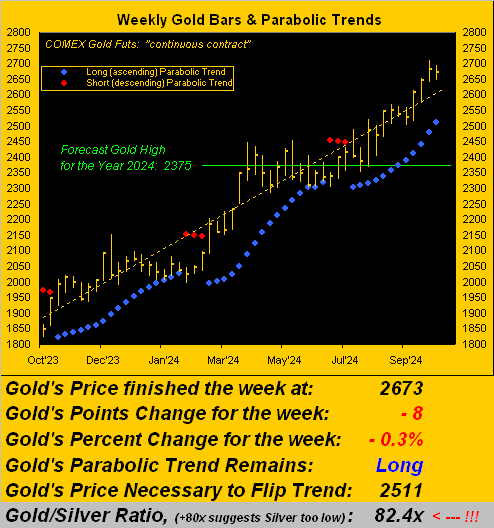

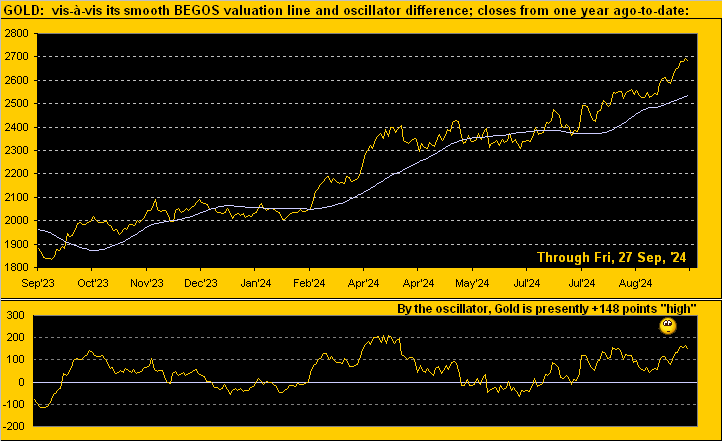

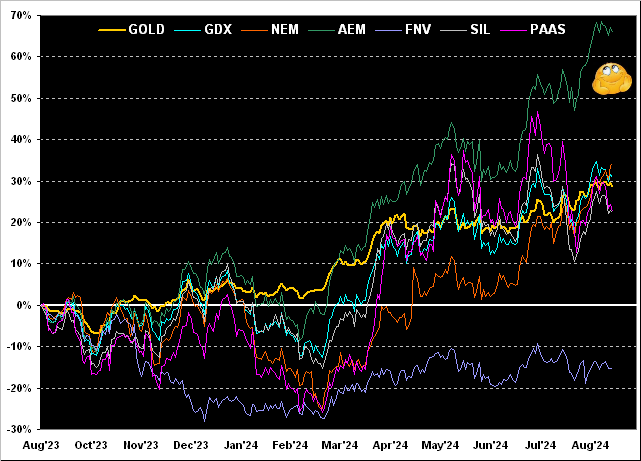

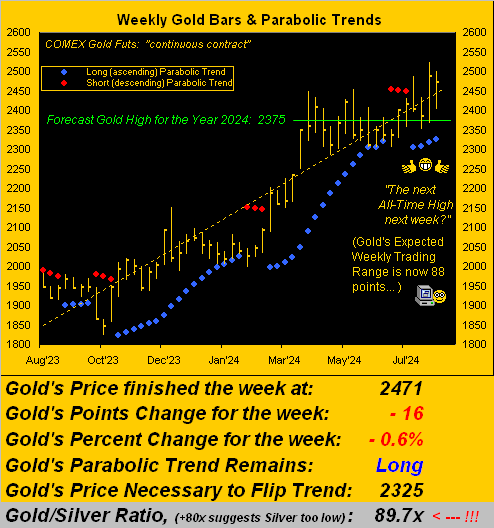

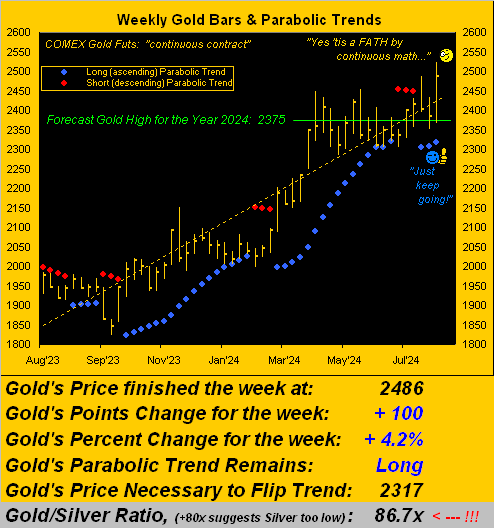

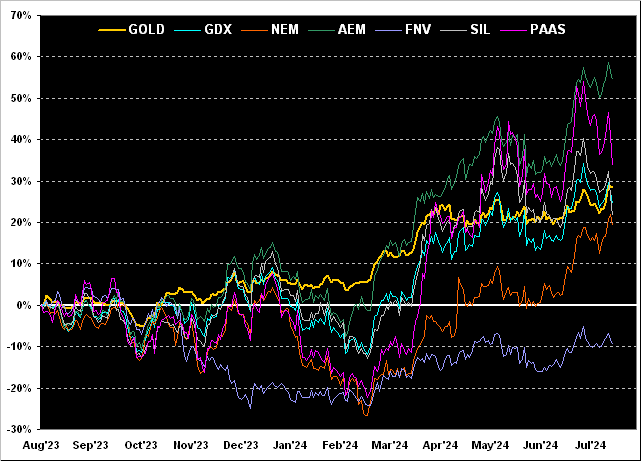

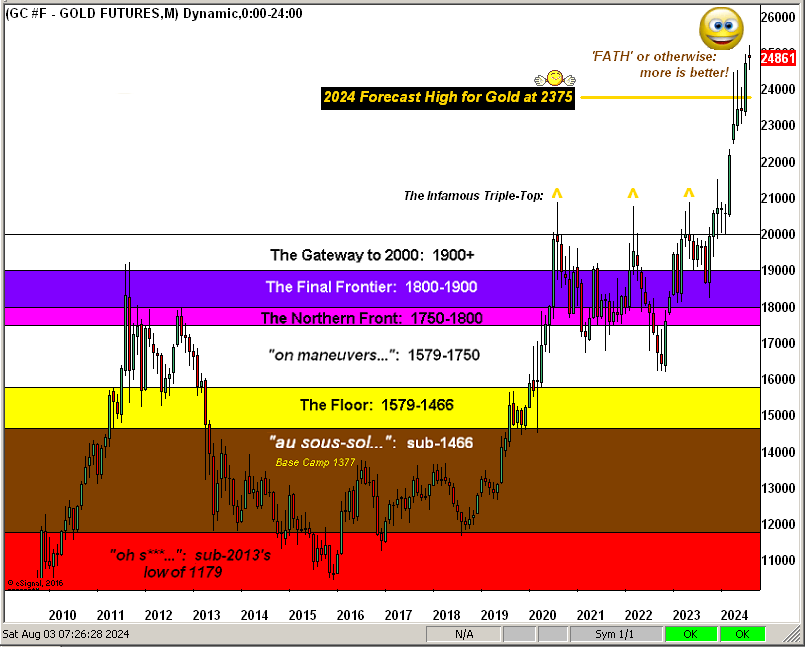

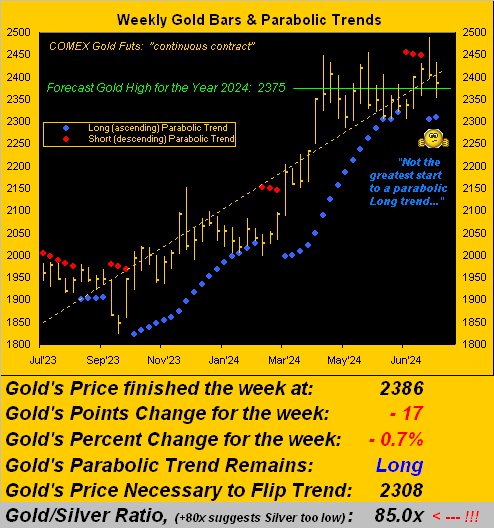

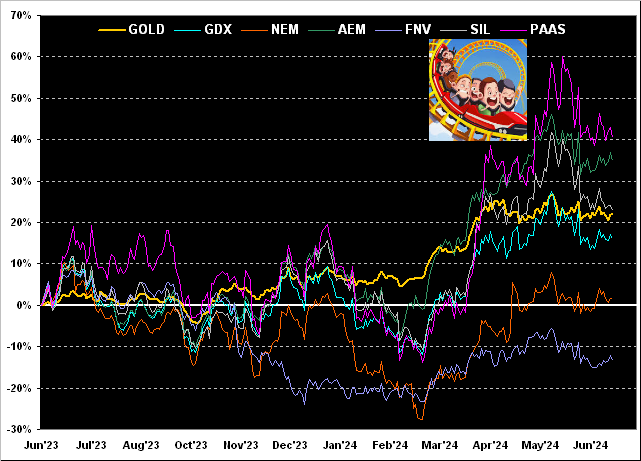

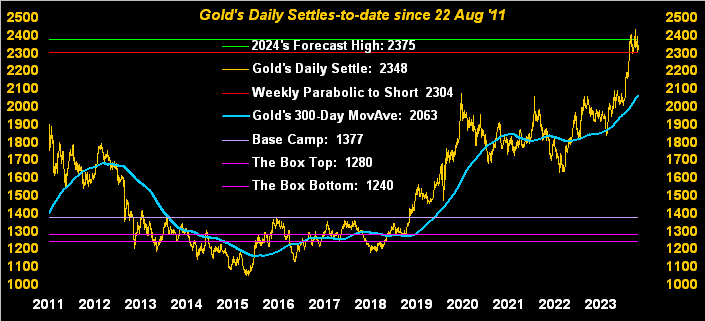

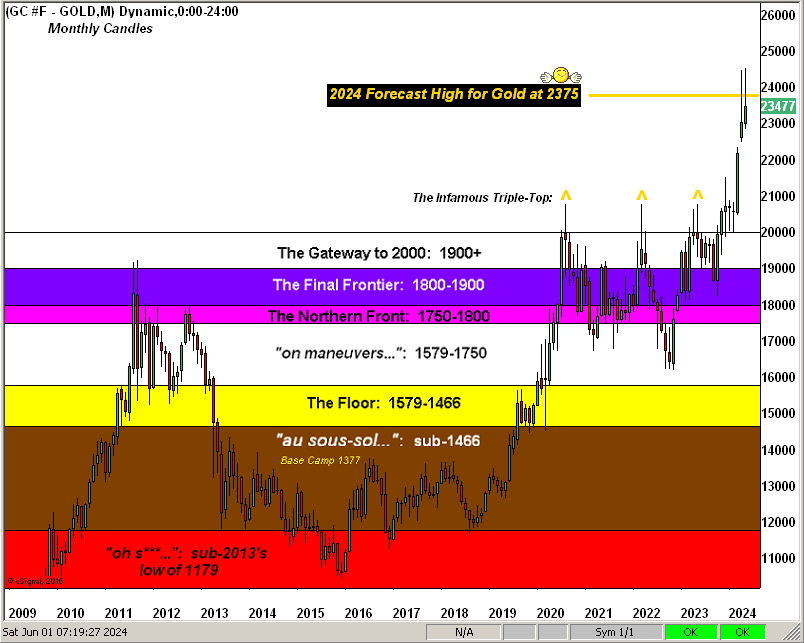

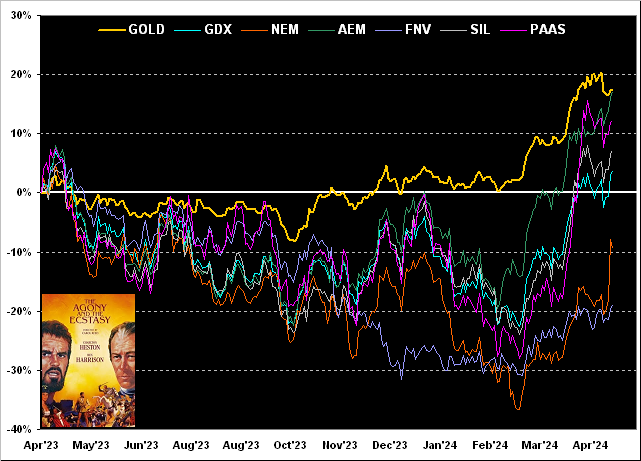

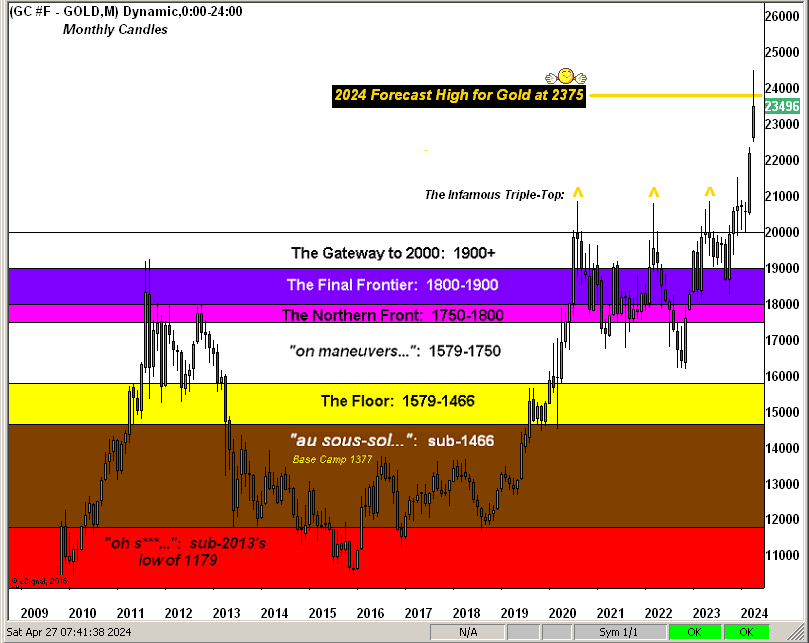

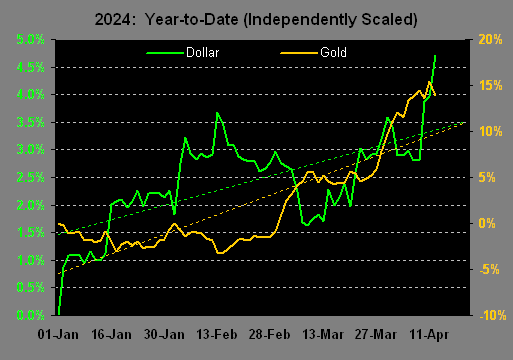

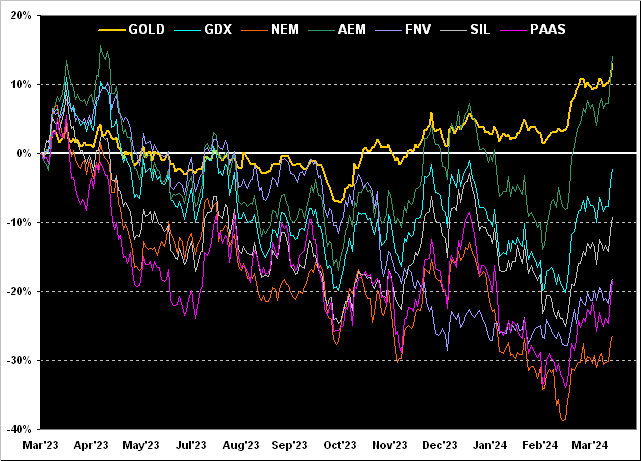

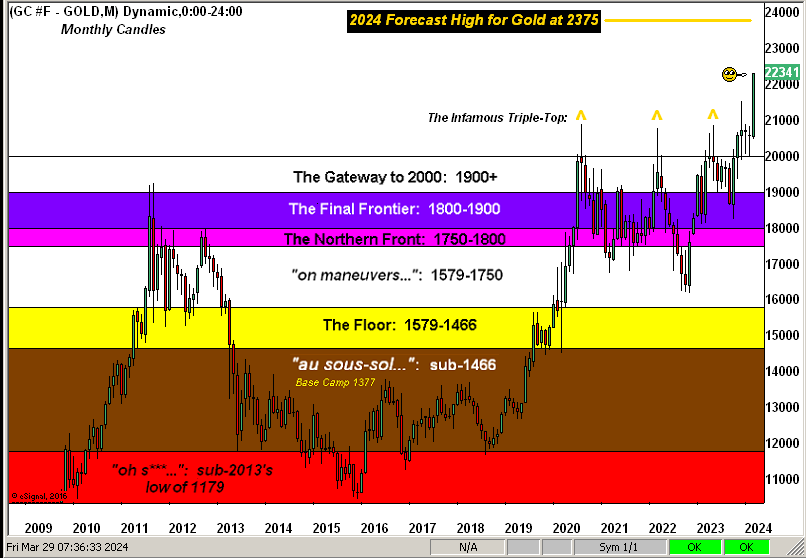

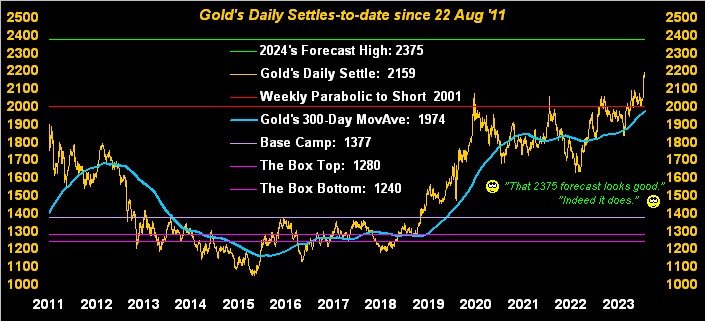

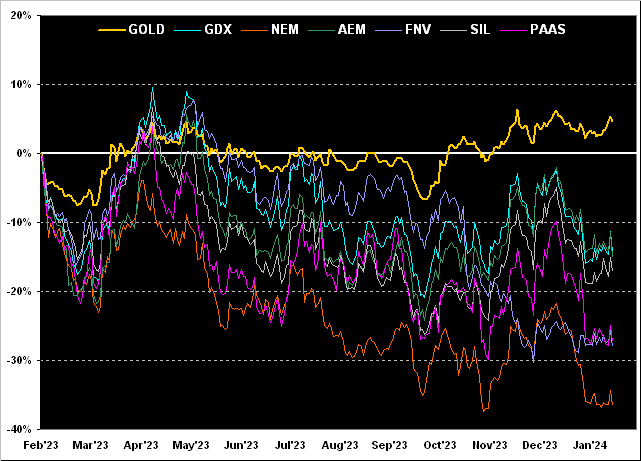

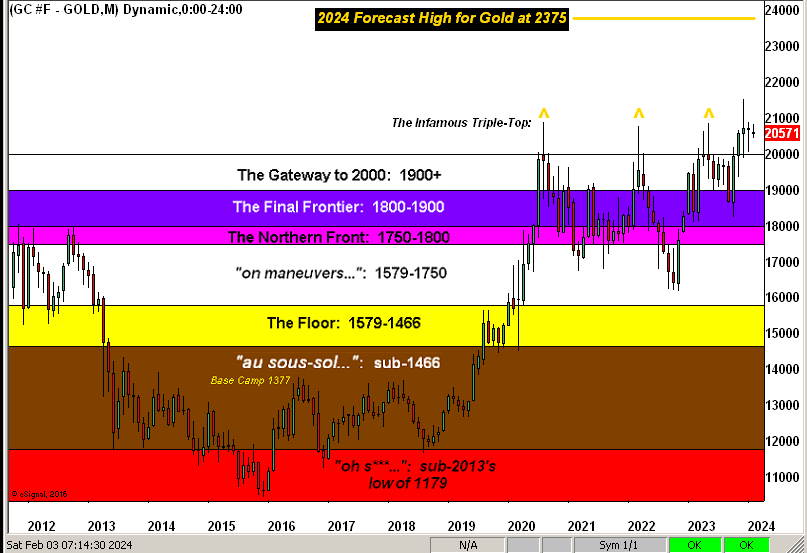

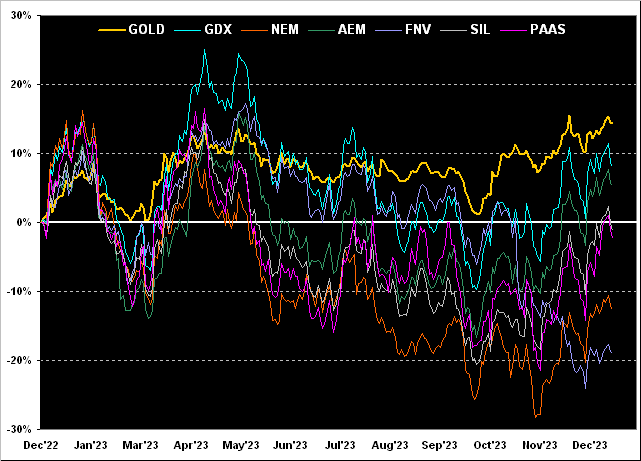

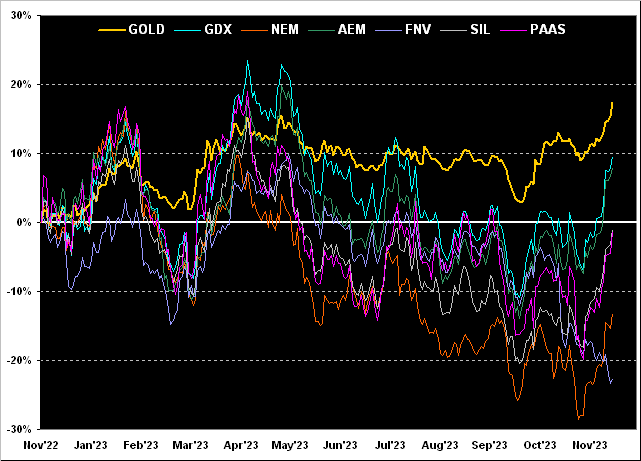

Gold’s firm rally so far this year (correctly incorporating Squire’s 37 days of All-Time Highs) has remained magnificently intact, indeed having well-exceeded our “conservative” (as ’twas couched at New Year) forecast high in 2024 of 2375.

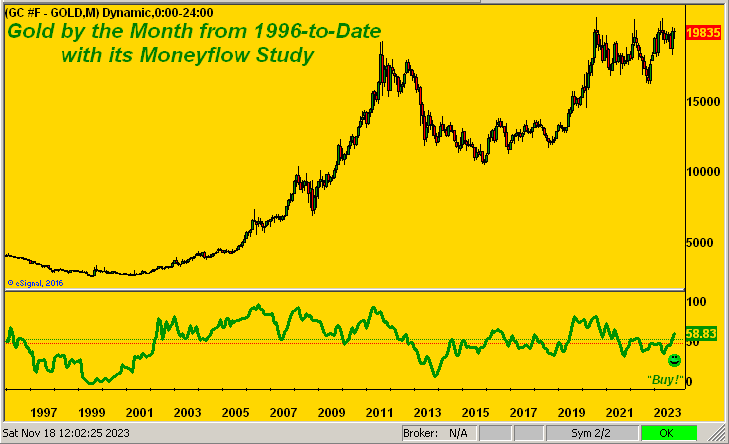

So per the above graphic, having surpassed (at least for the moment) the -$1,000/oz. undervaluation frontier, does this mean Gold finally is en route in racing up to where it “ought be”, (i.e. at the horizontal green line)?

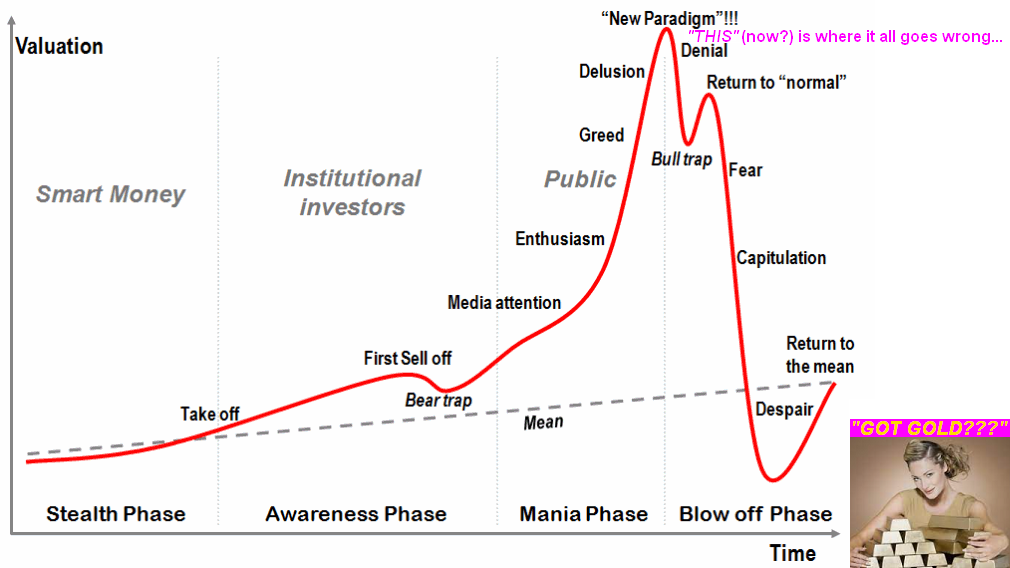

To be sure, Gold (cue the yucky woke word) “awareness” is certainly increasing at least per the pages of the FinMedia. But is that translating into enough substantive buying to power Gold to its proper 3700+ perch? A good many years ago on a Merrill Lynch “call to clients” in which a piece of our work was featured, the host opined that only some 5.0% of managed portfolios carried Gold exposure. Then in more recent years, (Al Gore’s invention of the internet having since extrapolatively expanded), such number has been bandied down to as low as 0.5%.

We’ve thus decided to go with something assumed to be in the modern-day know: “AI“. So in specifically querying such “Assembled Inaccuracy”, the salient part of its responding was: “…75 percent of private client discretionary investment managers have under 2.5 percent gold exposure…”, followed by the available sources “AI” scrounged, and in turn, its disclaimers.

‘Course for this to have any meaningful relevancy, we need know the status of the other 25%. Otherwise ’tis all (per The Stones from ’65): ![]() “…About some useless information, Supposed to fire my imagination, I can’t get no … Satisfaction…”

“…About some useless information, Supposed to fire my imagination, I can’t get no … Satisfaction…”![]() let alone accuracy as to managed Gold ownership.

let alone accuracy as to managed Gold ownership.

The bottom line being: as long as stocks remain “the only thing”, Gold shan’t immediately the 3700+ bell ring.

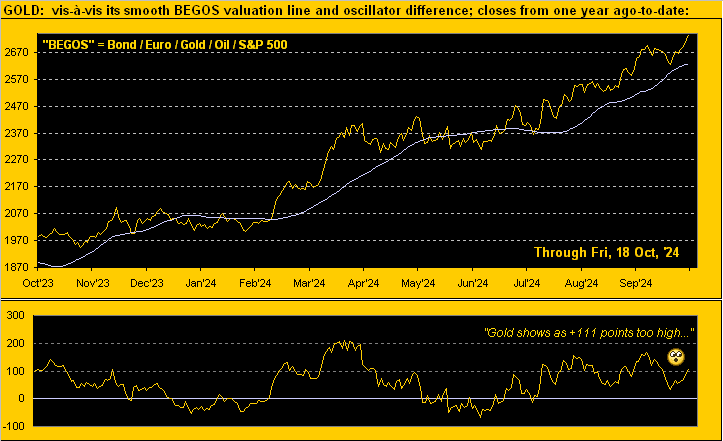

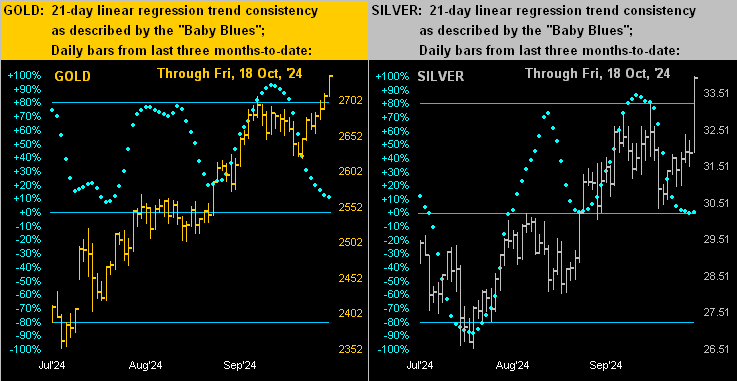

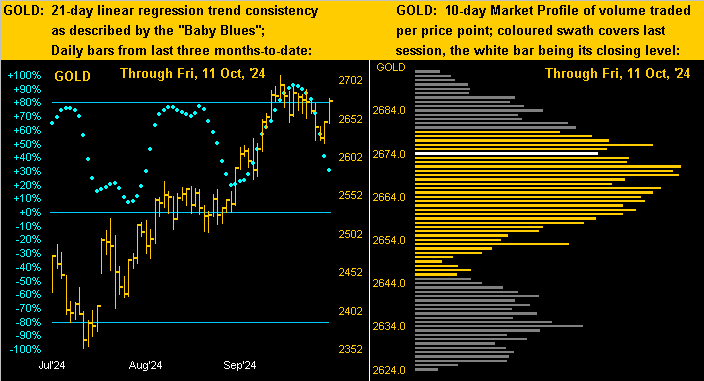

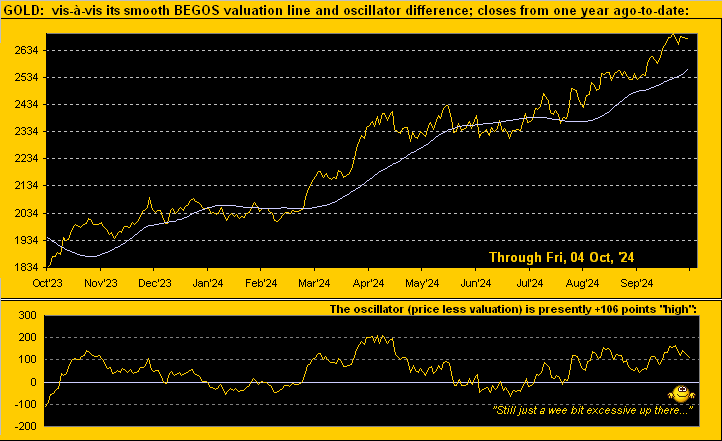

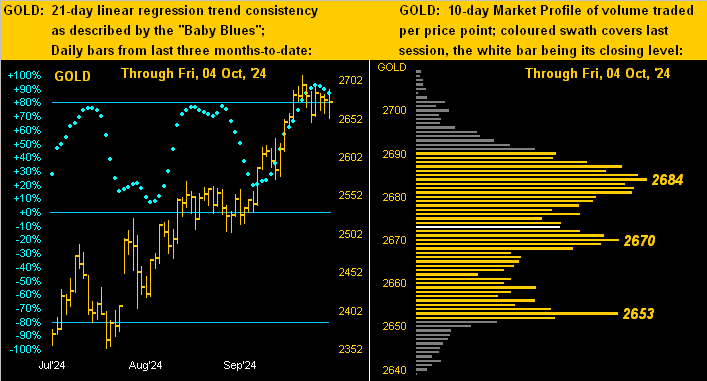

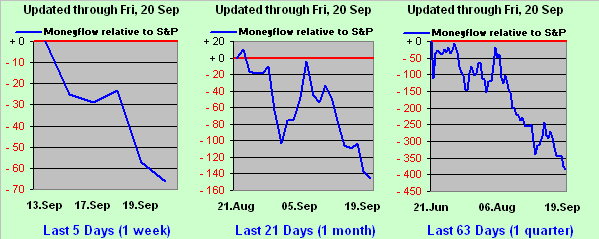

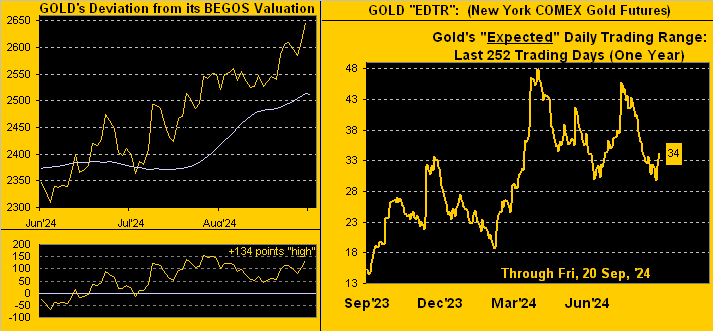

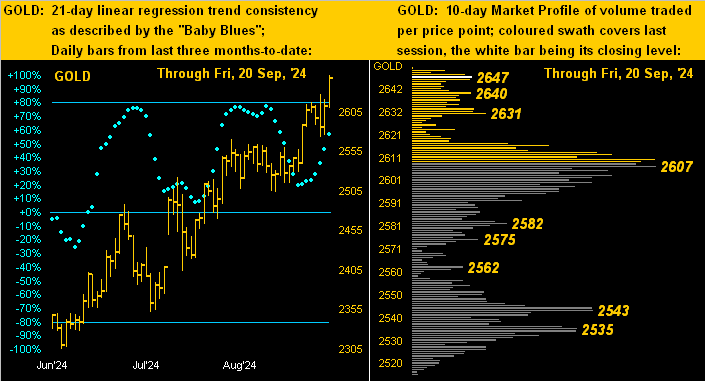

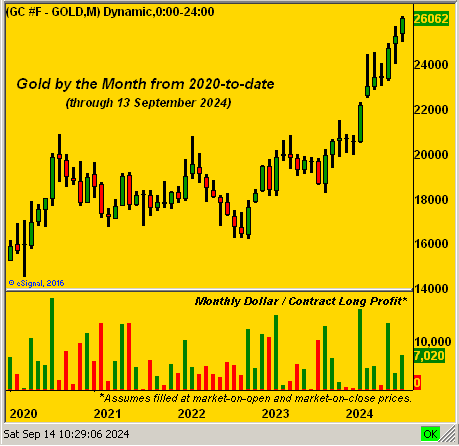

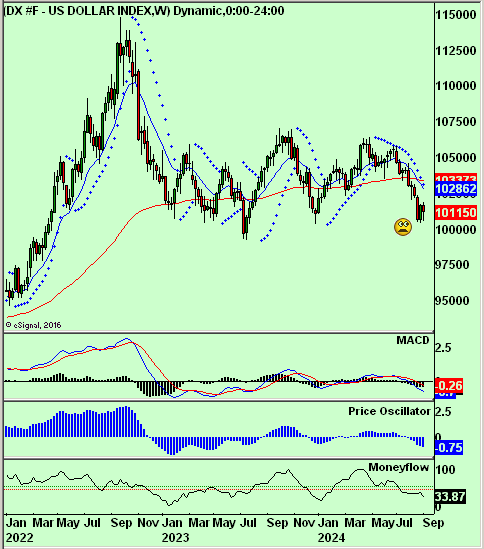

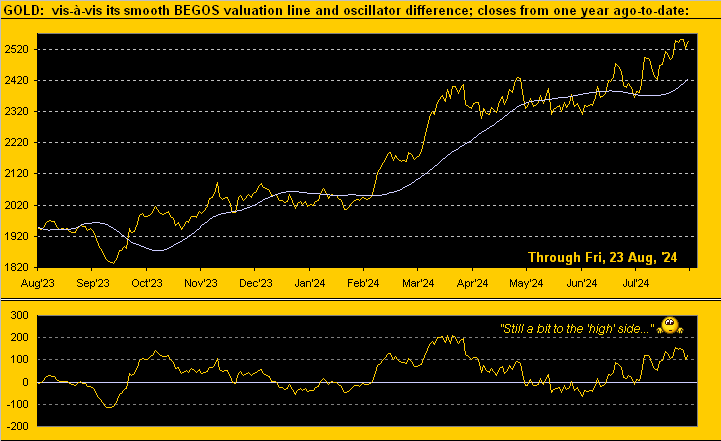

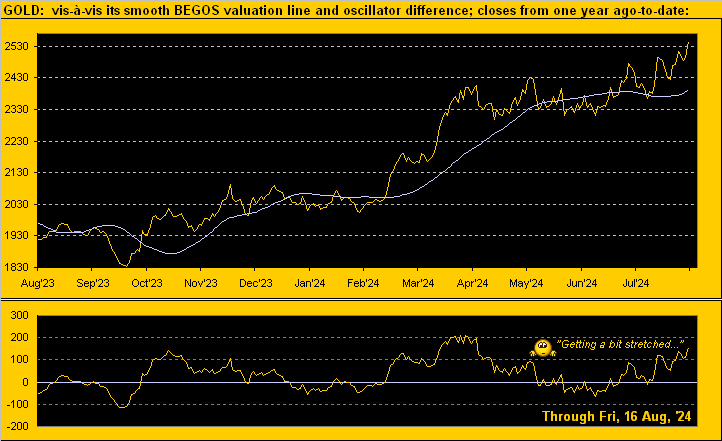

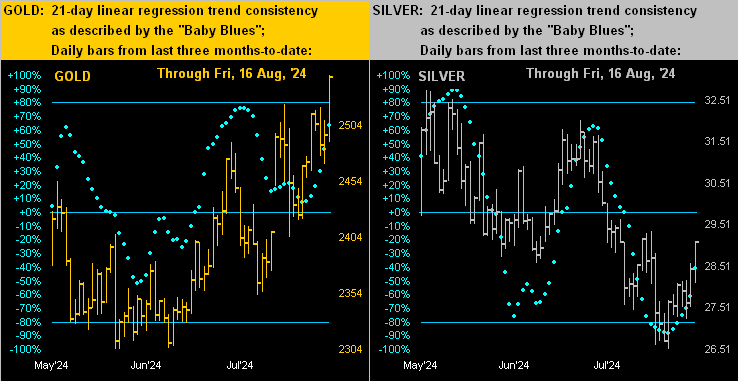

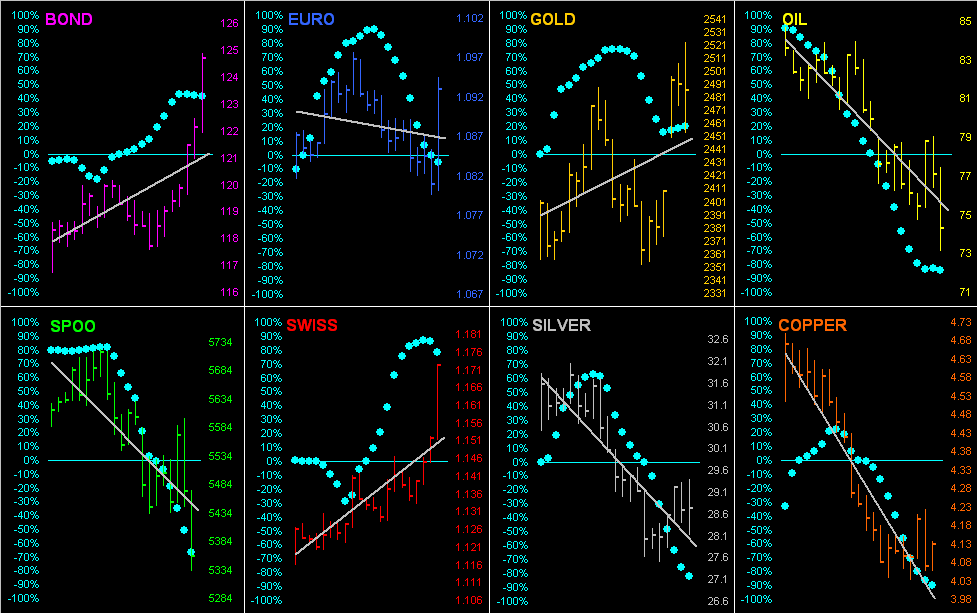

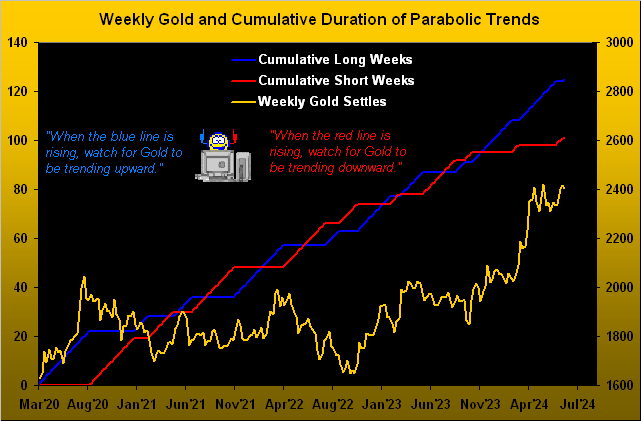

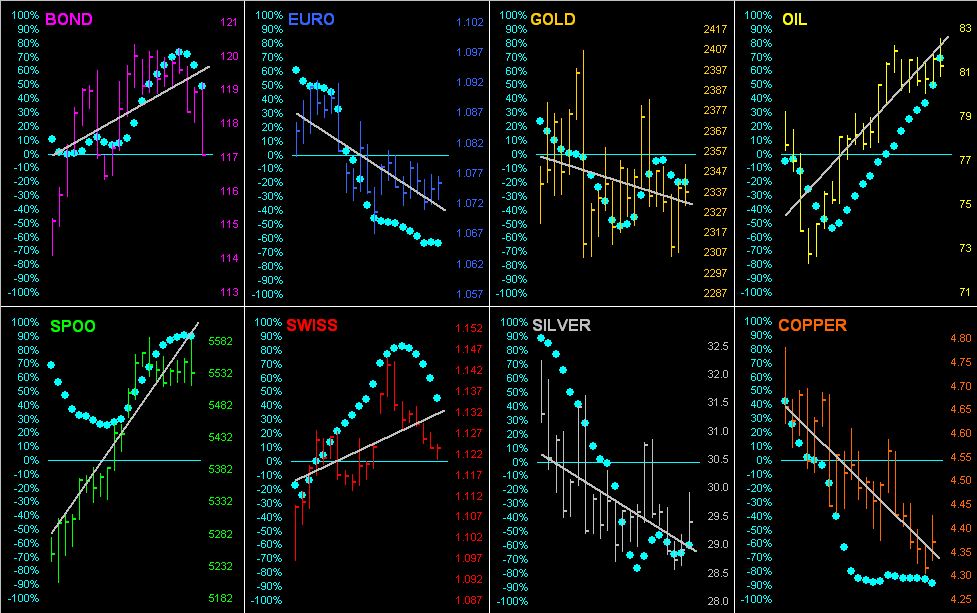

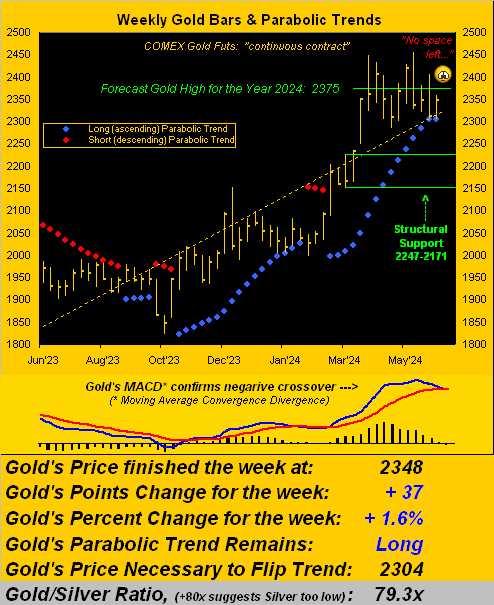

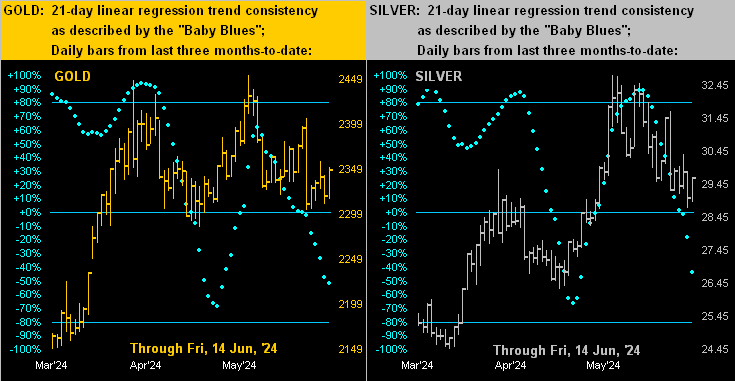

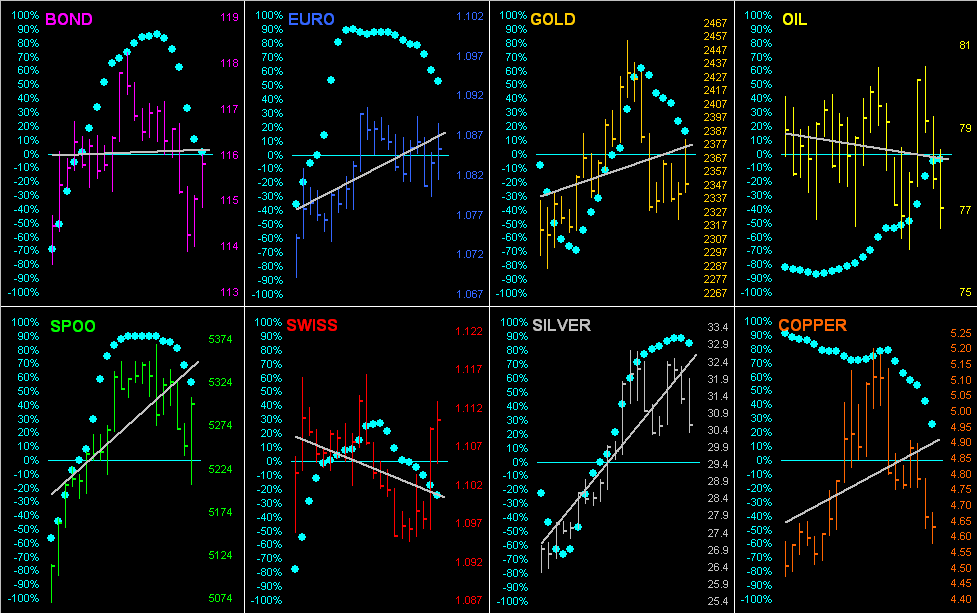

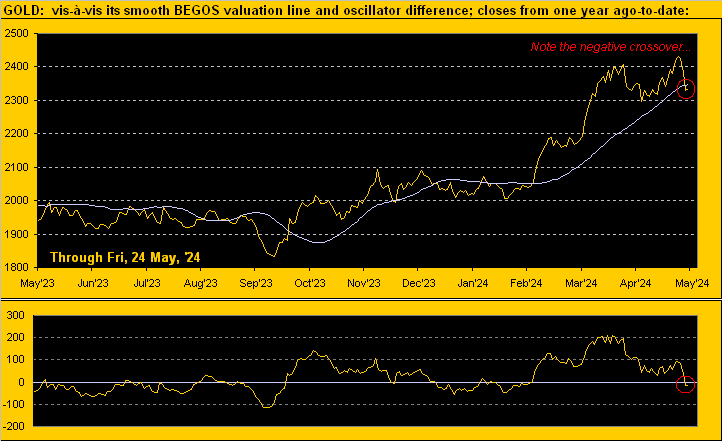

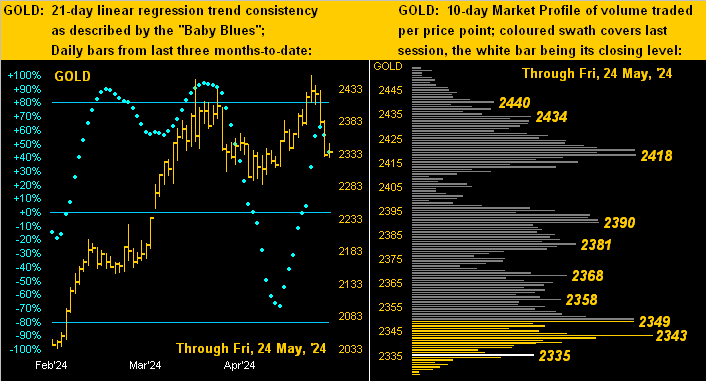

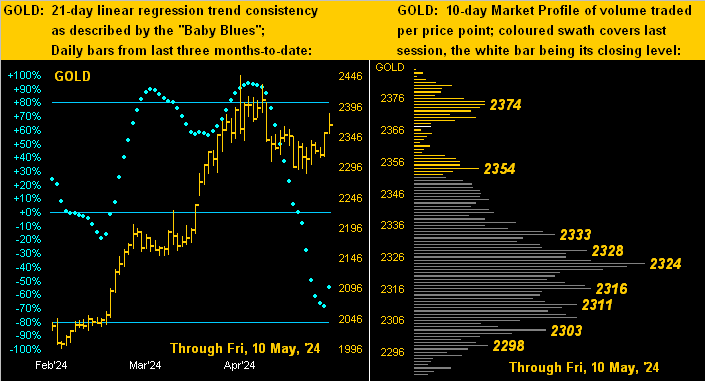

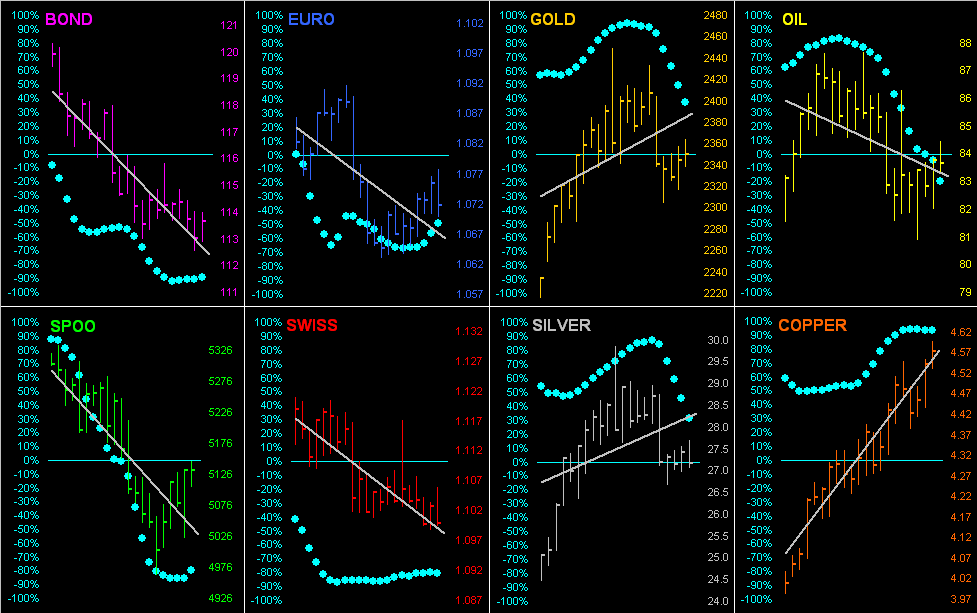

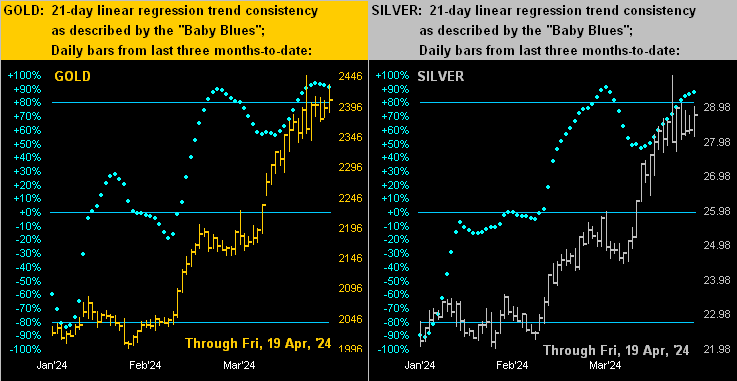

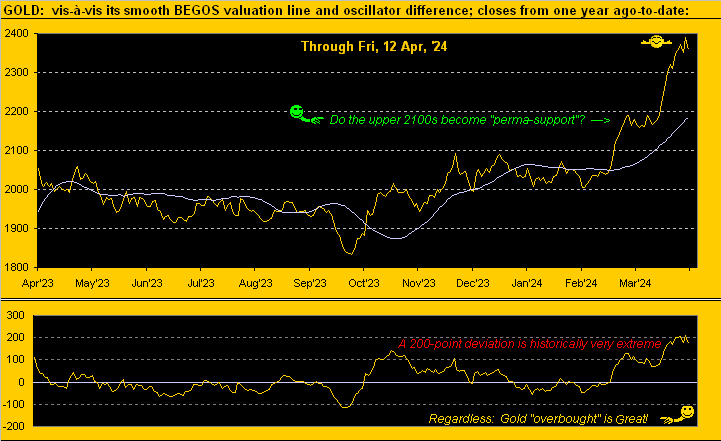

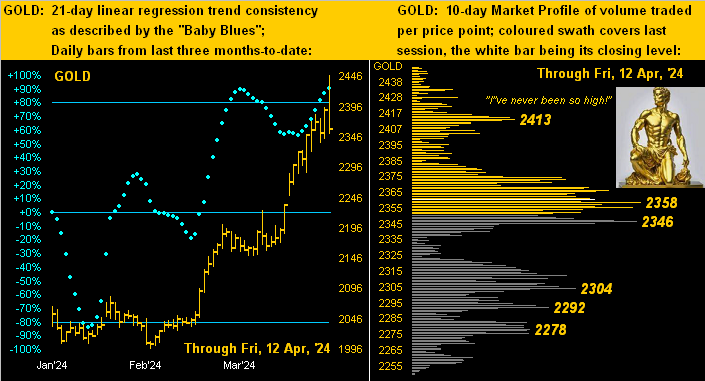

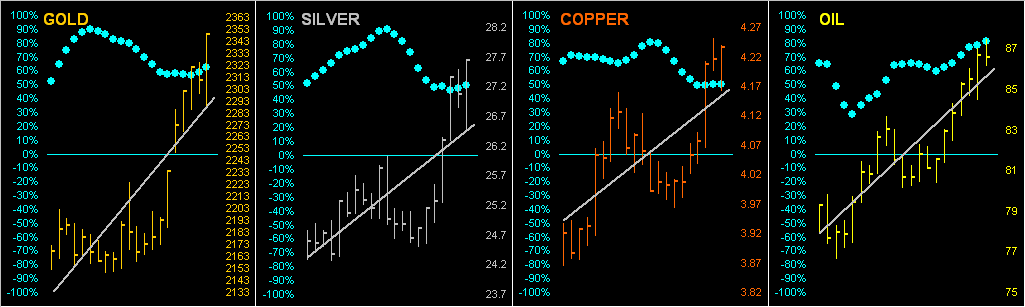

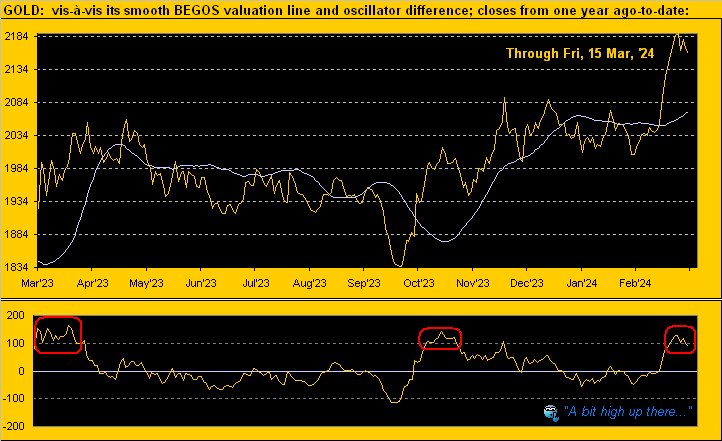

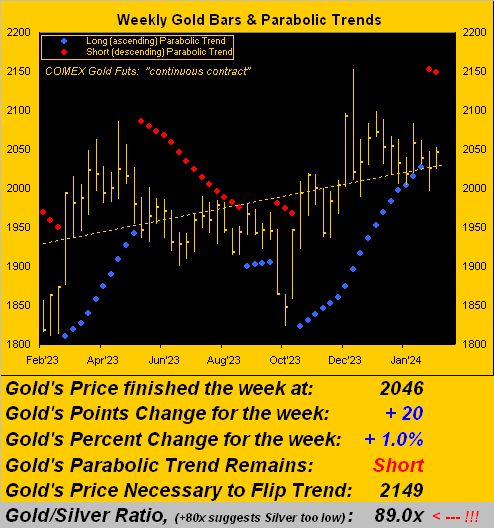

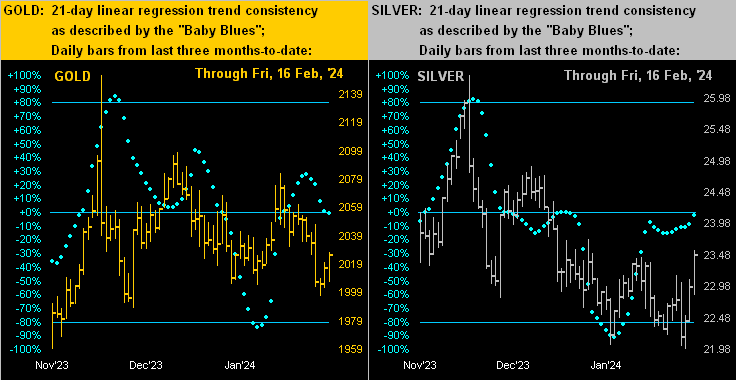

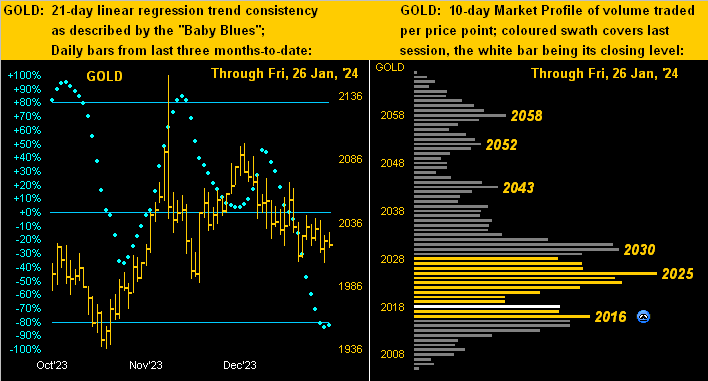

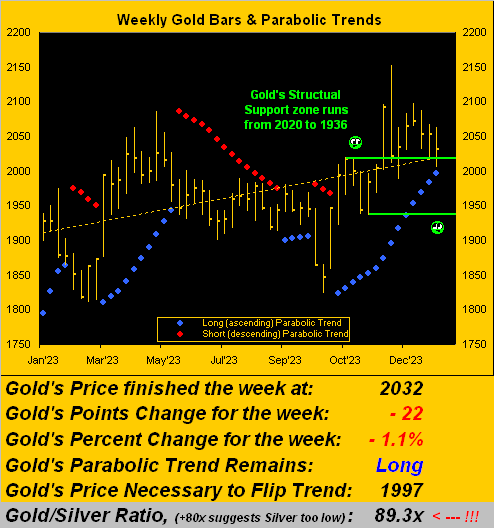

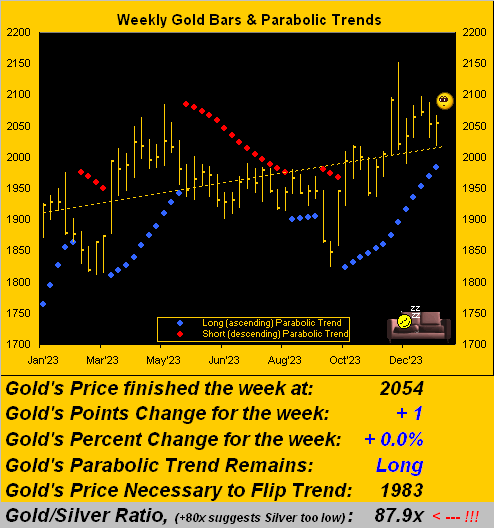

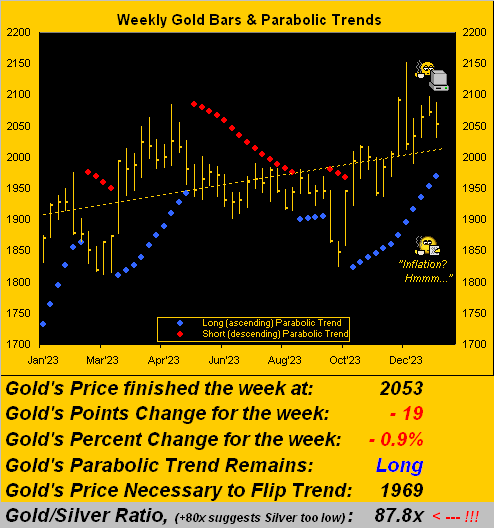

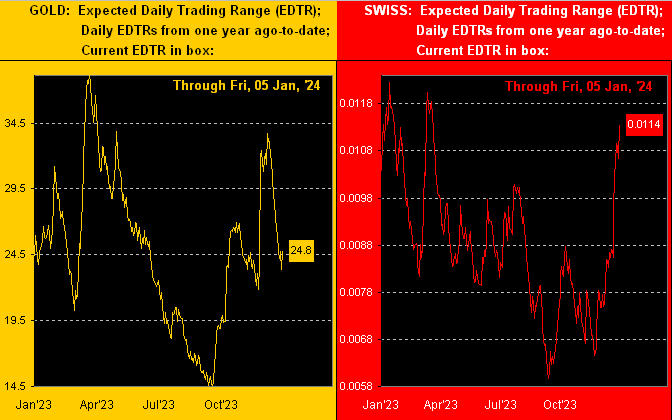

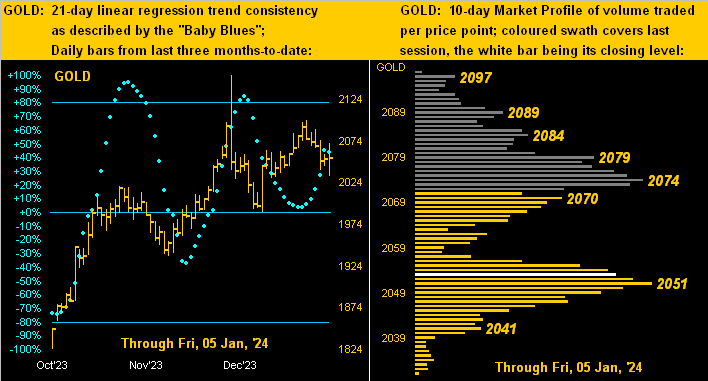

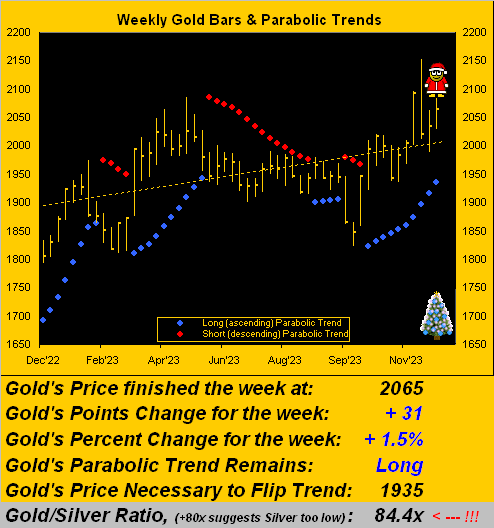

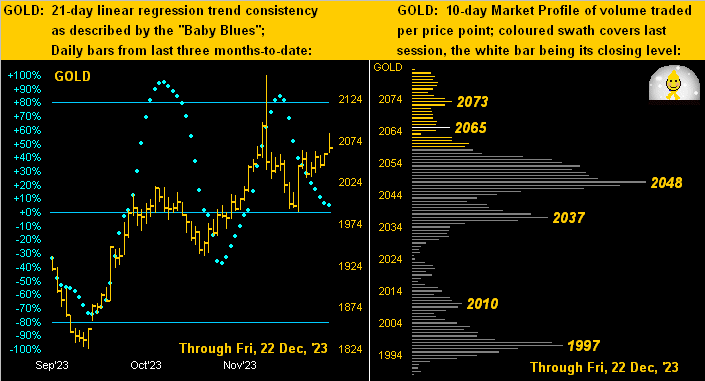

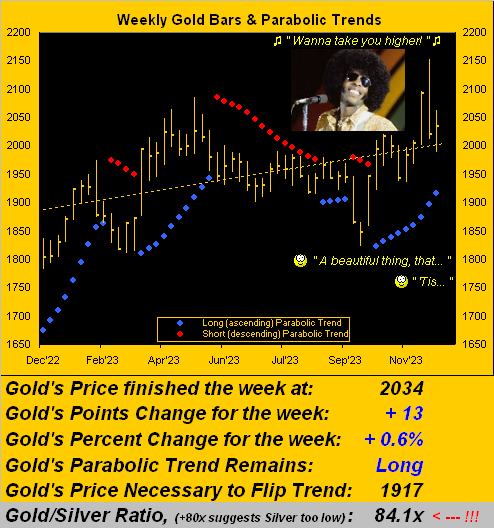

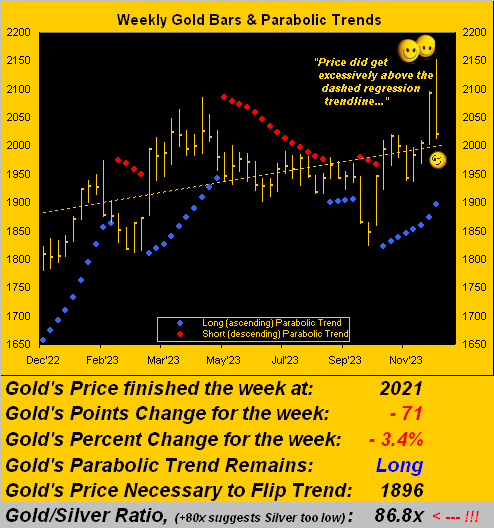

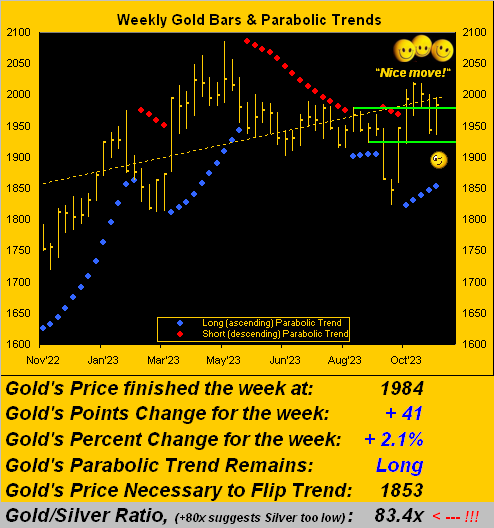

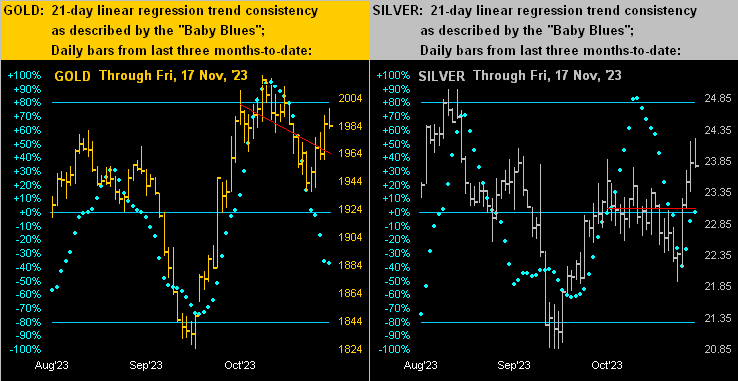

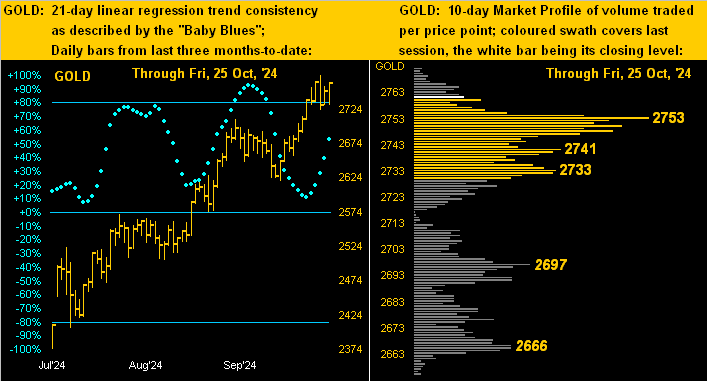

Still, one can’t argue with the golden brilliance of price’s weekly bars from a year ago-to-date, the current blue-dotted parabolic Long trend having completed its 15th week with still plenty of room (154 points) between present price (2761) and the “flip to Short” level (2607, itself now rising at a rate of some +30 points per week). Either way, wherein understanding range is critical to cash management, Gold’s expected weekly trading range is now 73 points; the daily range (see the website’s Market Ranges and/or Gold page) is currently 31 points. So notwithstanding the near-term overvaluation note therein, our Gold graphic here points as positively as one could prefer:

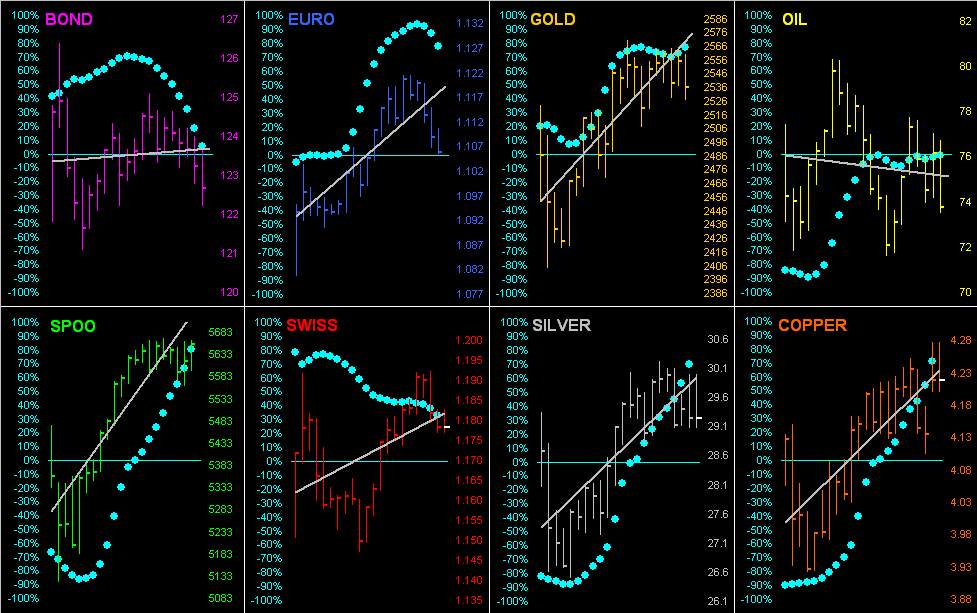

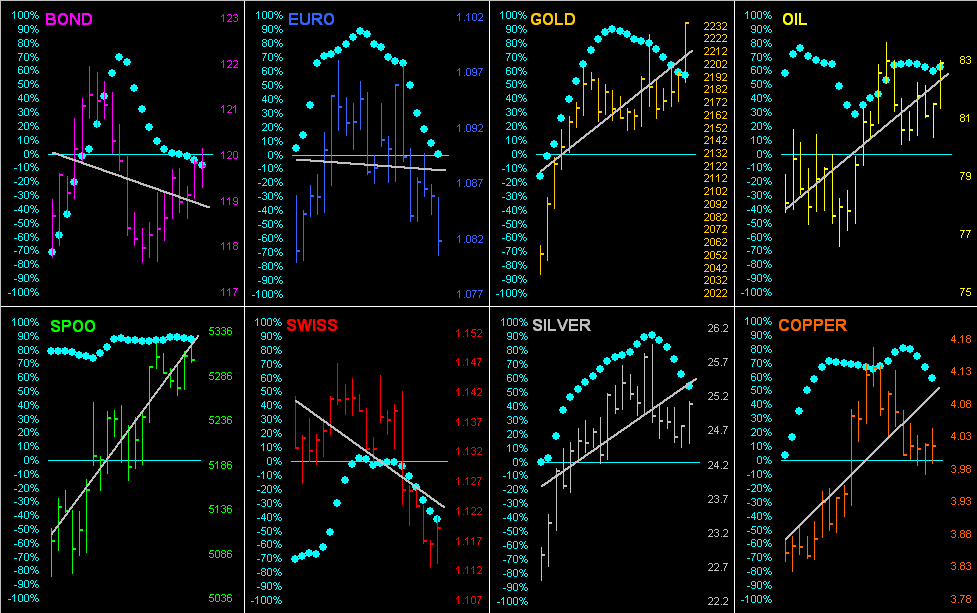

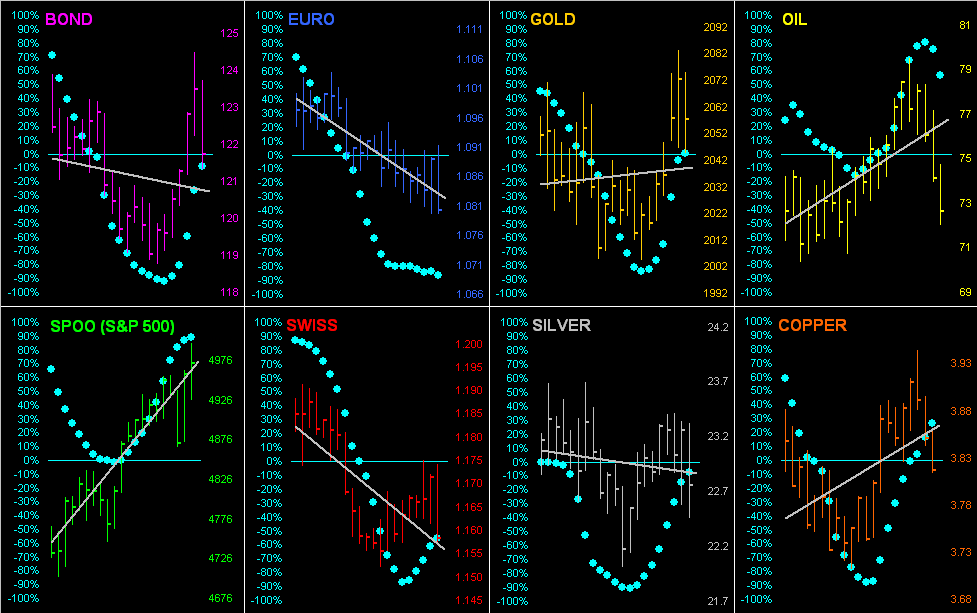

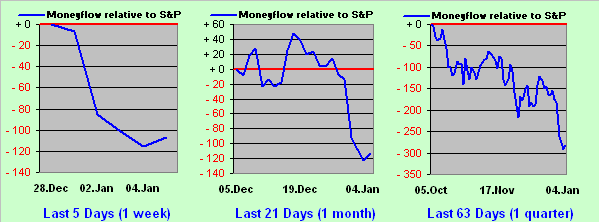

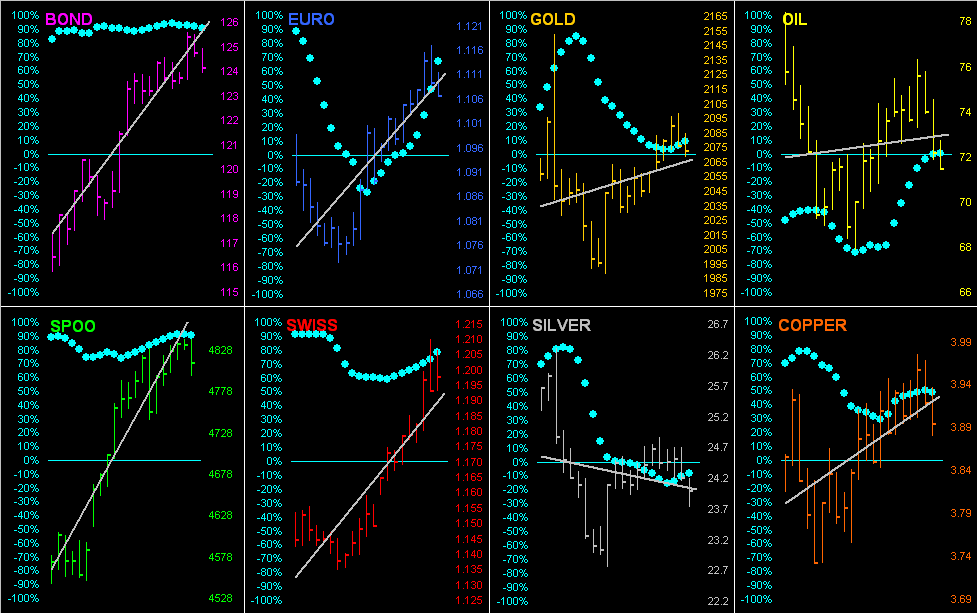

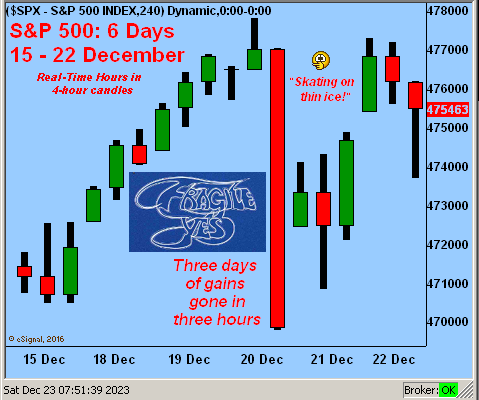

As to the StateSide economy, our Economic Barometer points to it of late as trendless, the International Monetary Fund with a more optimistic view than that of the Fed per the latter’s Tan Tome for October released this past Wednesday. And specific to the Baro, ’twas a very light “50/50” week with just six incoming metrics of which three bettered their prior period. Amongst the batch was the Conference Board’s “Leading Indicators” (to which we refer as “lagging” because the Baro leads them) for September which were negative for the seventh consecutive month, and further, for the 28th negative month in the last 30. (Recall as well from the Econ Baro a week ago the “WaPo” OpEd quote about this being “one of the best economic years of many Americans’ lifetimes” … but suddenly they’ve decided not to endorse “re-election” of the “current” Administration … That’s gonna bruise). Here’s the Baro:

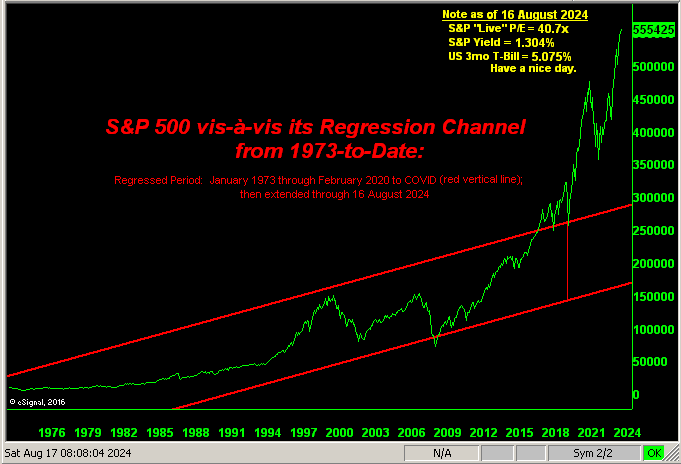

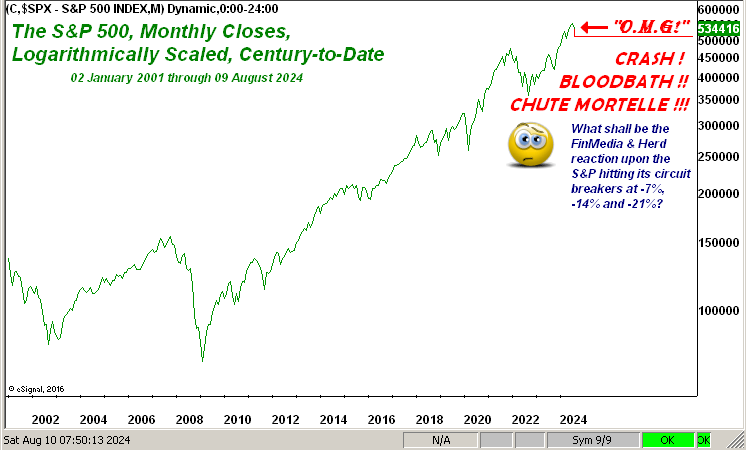

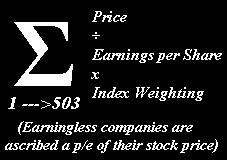

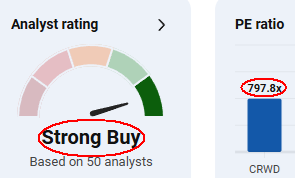

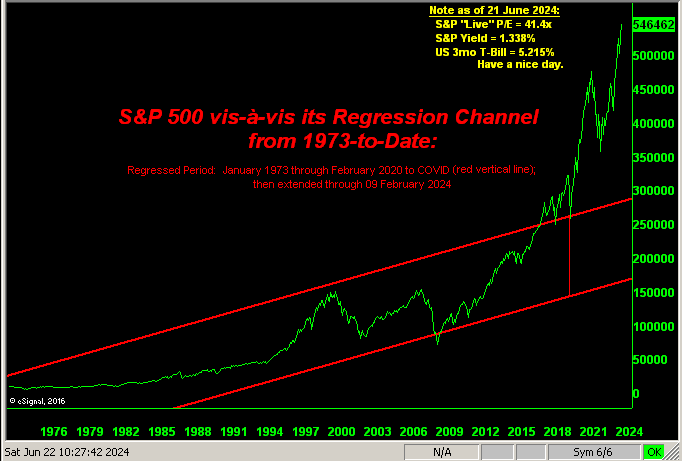

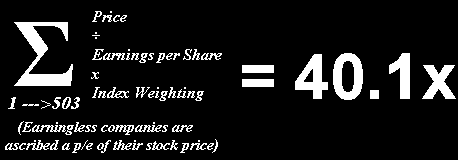

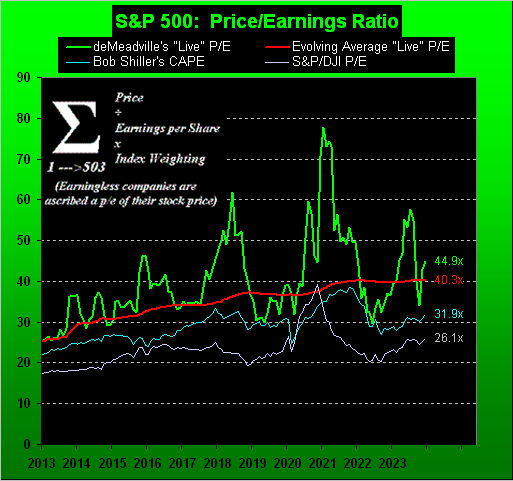

And stark in the Baro’s upper-right corner we’ve the “live” price/earnings ratio of 43.6x for the S&P 500. Obviously toward approaching the midpoint of Q3 Earnings Season, there’s not been significant enough improvement to bring that ratio down. In fact for those of you scoring at home, of the 503 S&P constituents, 161 have reported, of which 109 bettered their bottom lines from a year ago. That is a 68% bettering pace which is “average” vis-à-vis recent years, even excluding 2020’s COVID profits-dearth. One wonders how might ol’ Jerome B. Cohen (“in bull markets the average level would be about 15 to 18 times earnings”) might react to this data: only 160 (32%) of the S&P 500 entities have P/Es less than 20, with 52 companies either exceeding 100x or without earnings at all. (‘Tis again why — instead of the stock market — we prefer the safe, serene, security of the futures markets). And if that’s too complex for you WestPalmBeachers down there, then we simply ask: “Got Gold?”

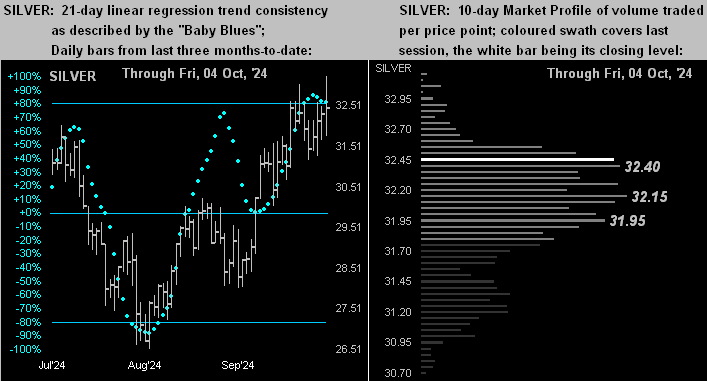

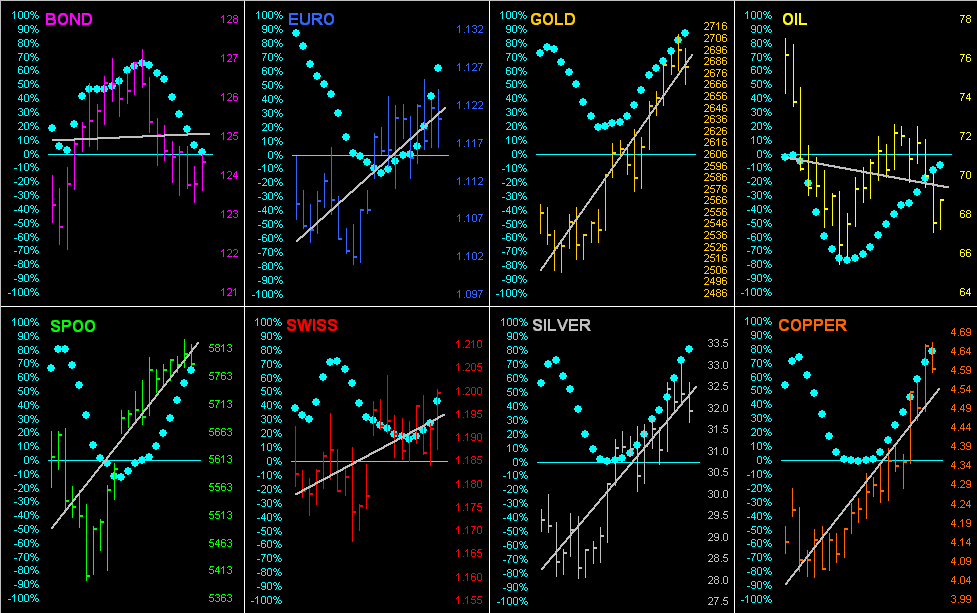

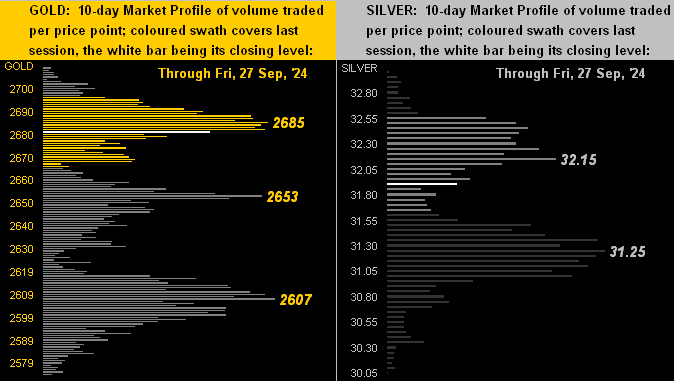

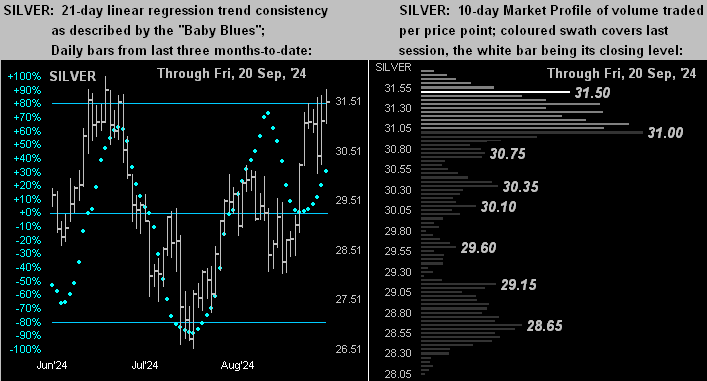

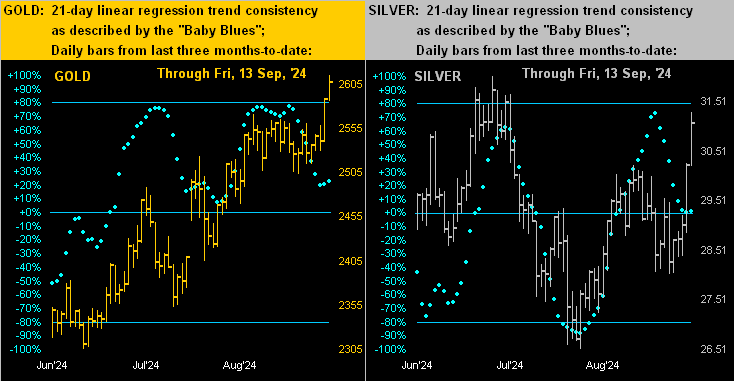

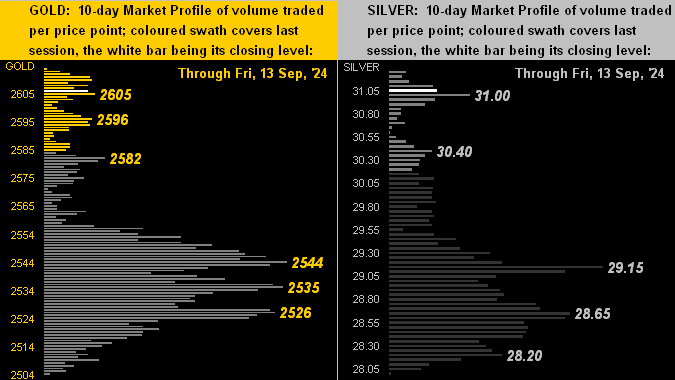

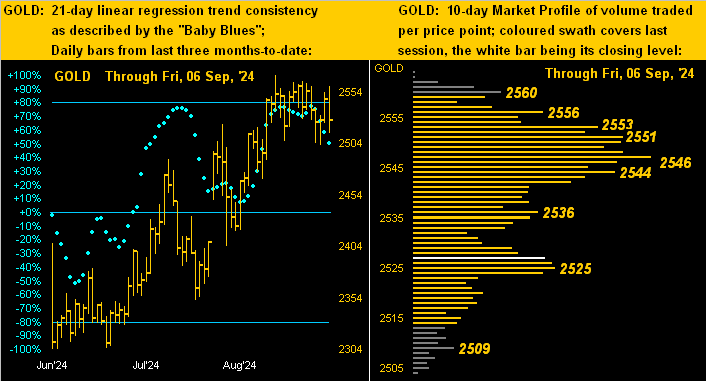

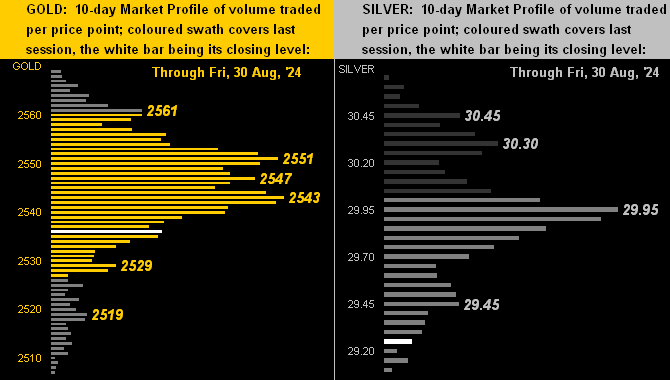

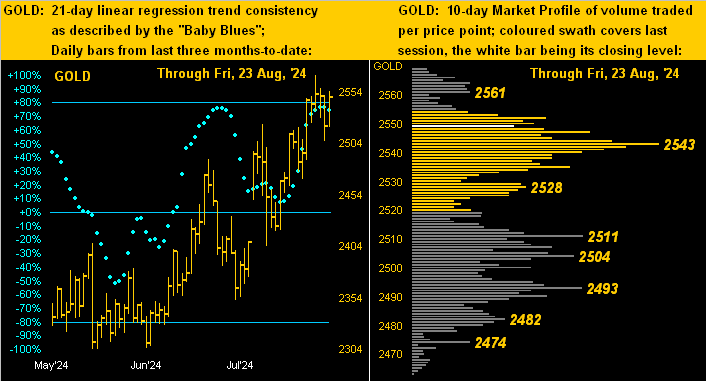

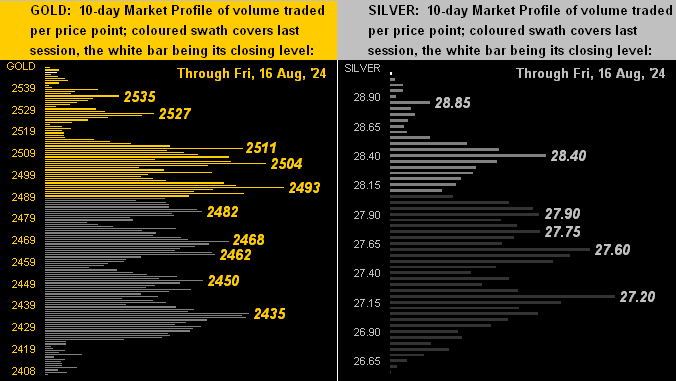

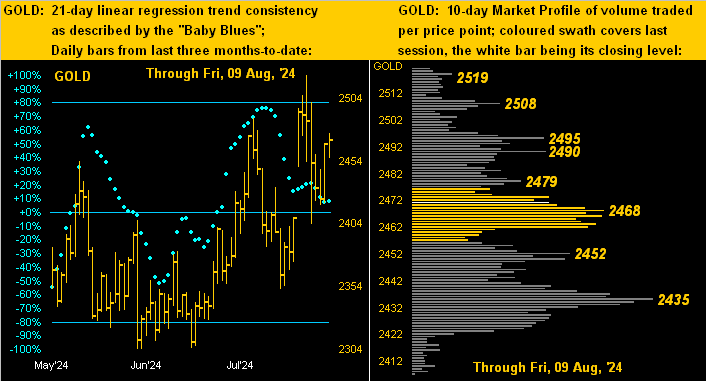

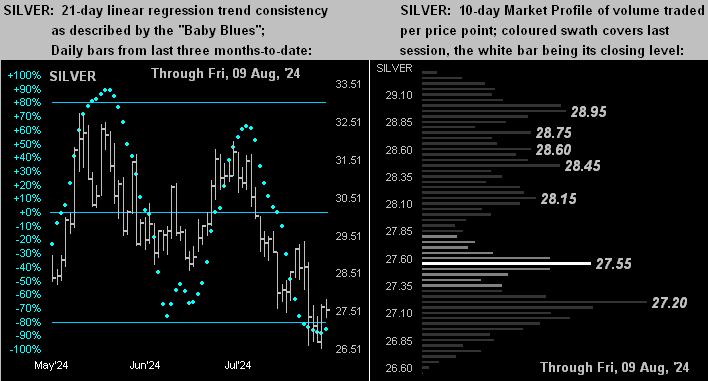

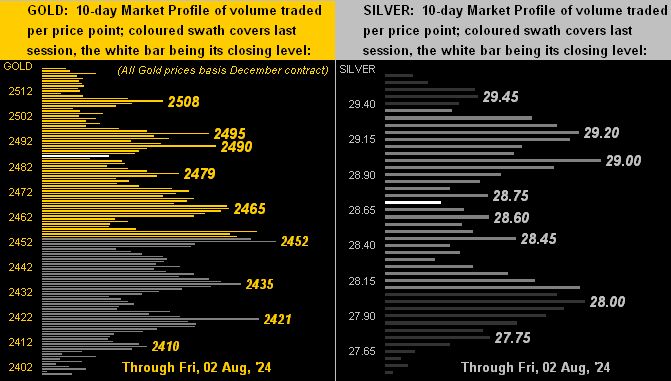

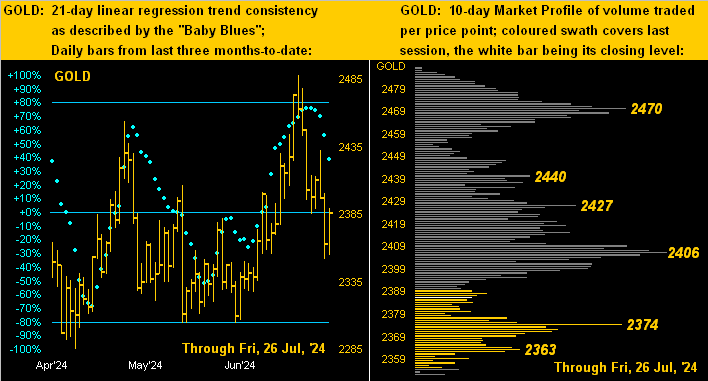

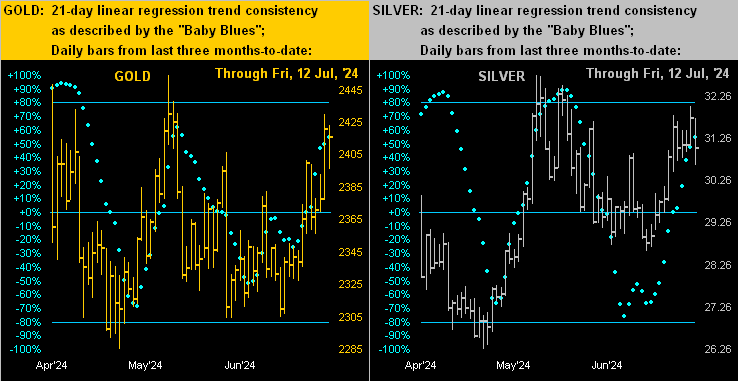

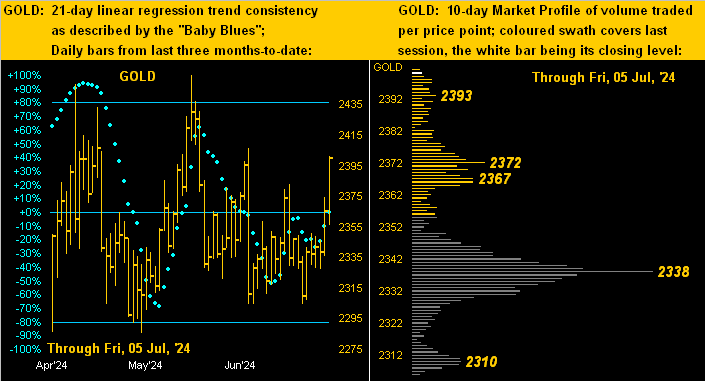

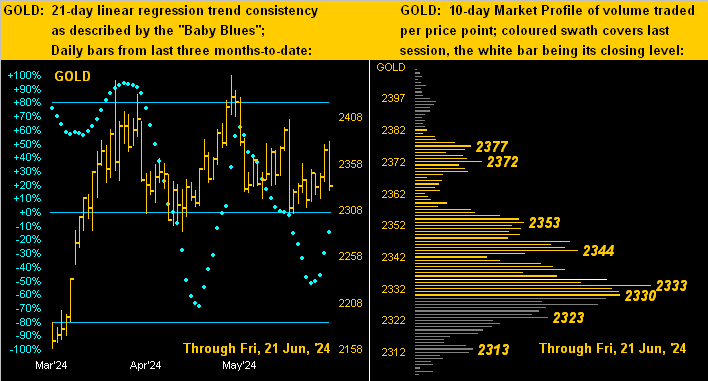

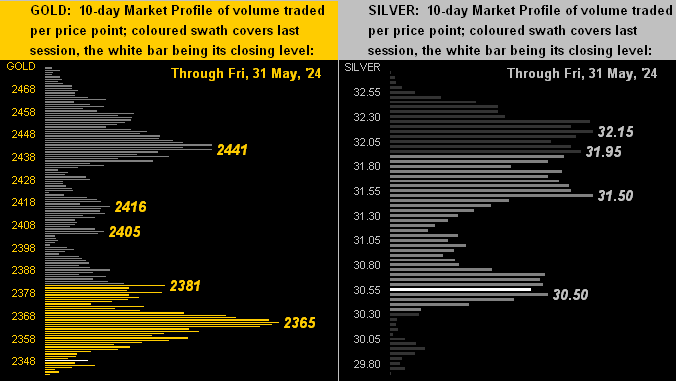

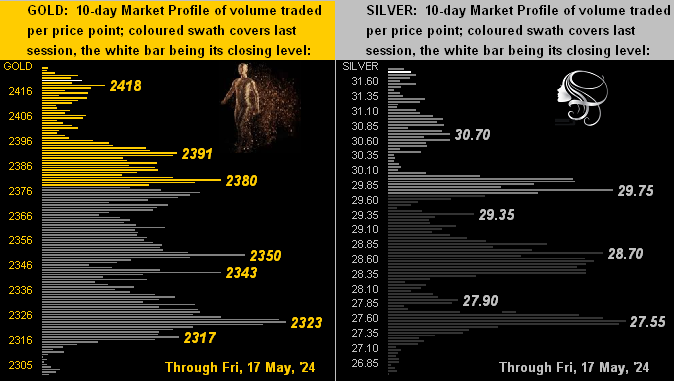

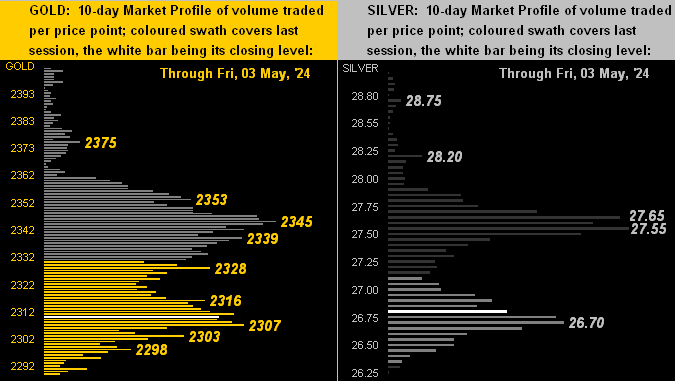

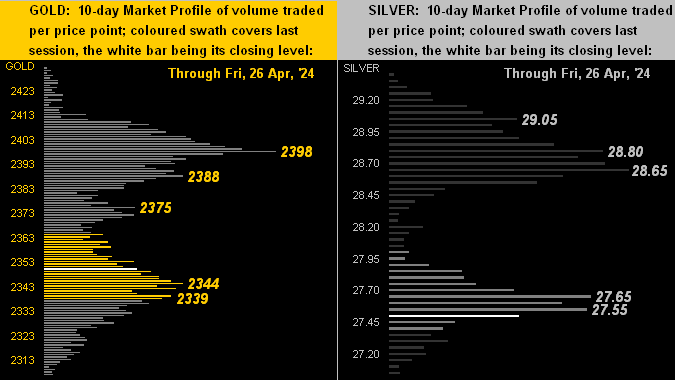

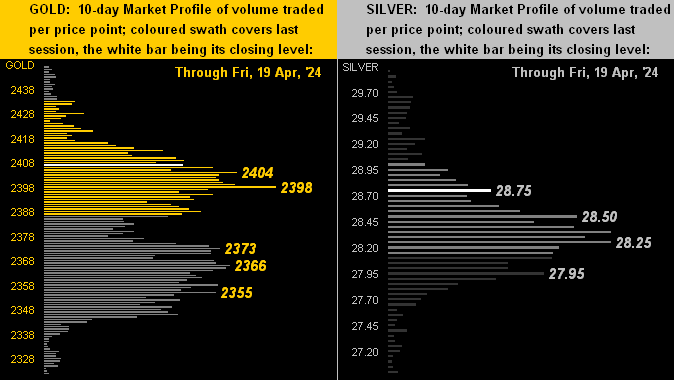

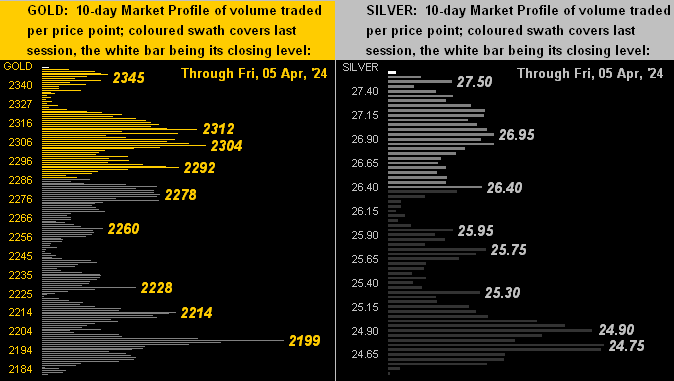

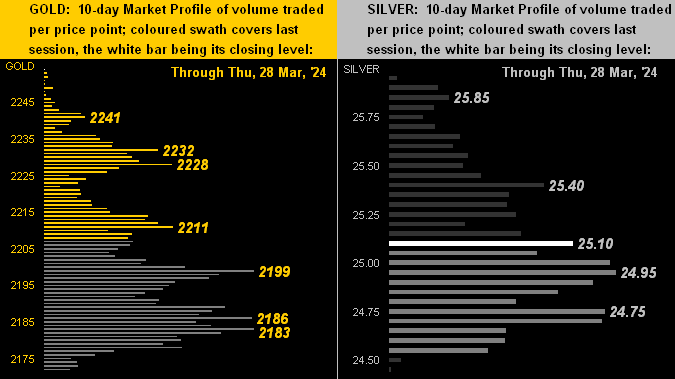

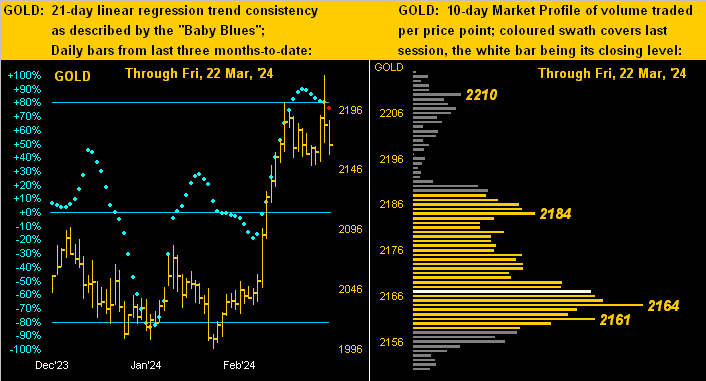

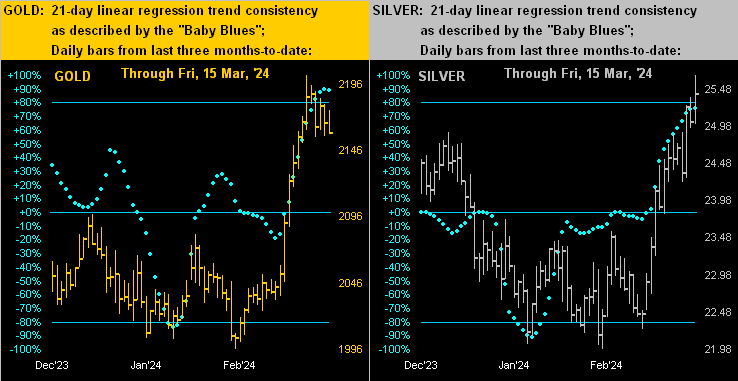

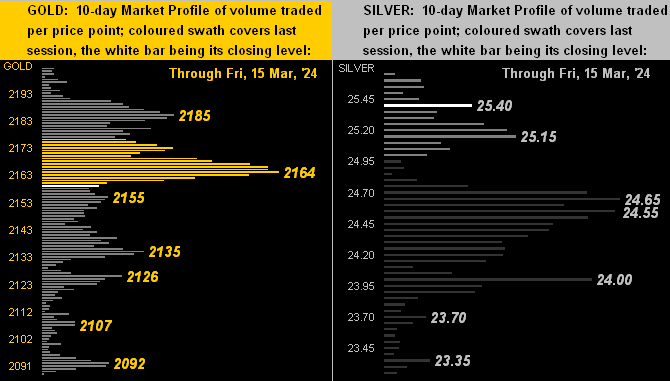

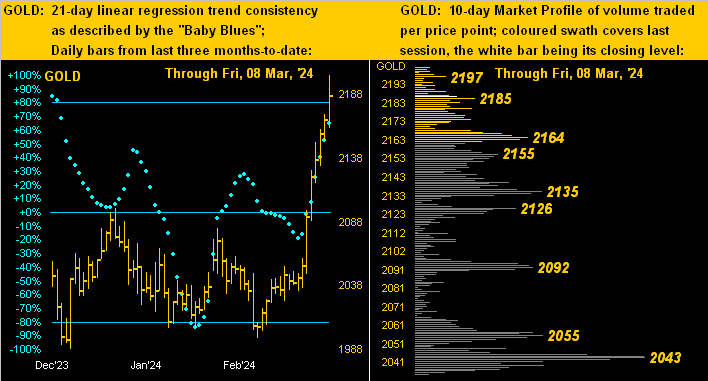

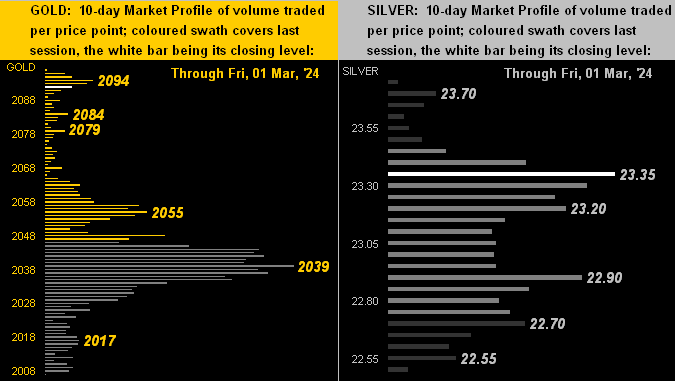

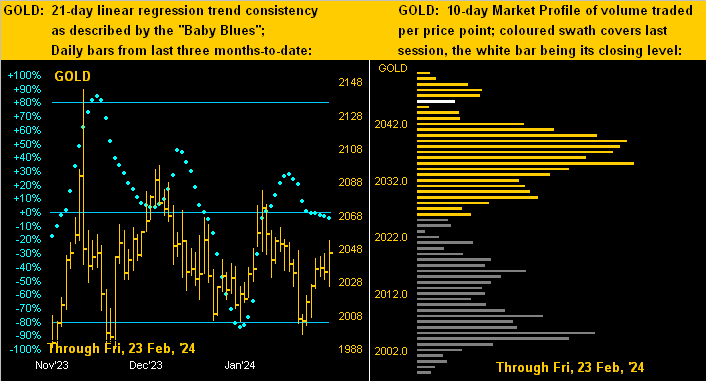

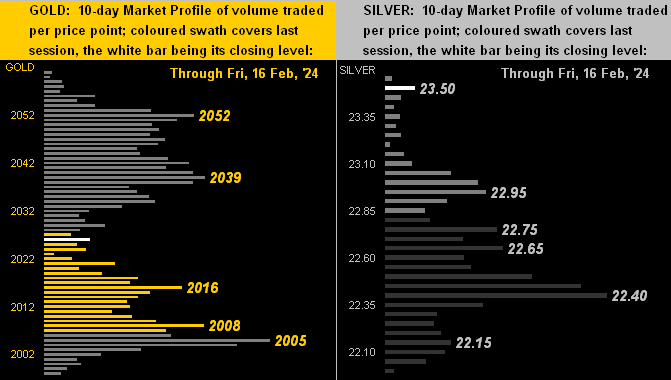

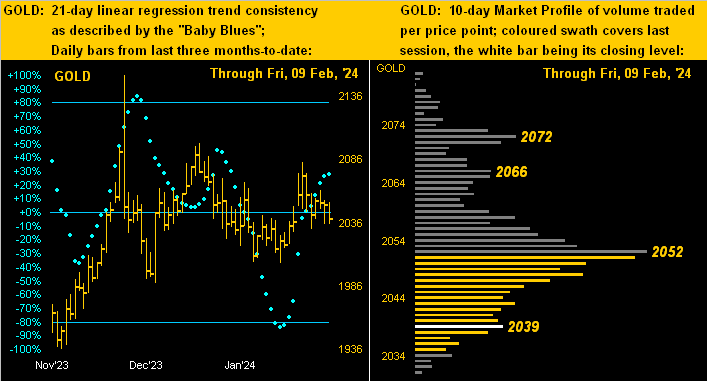

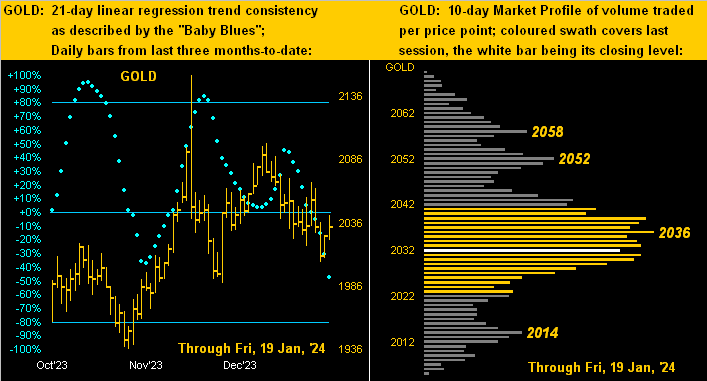

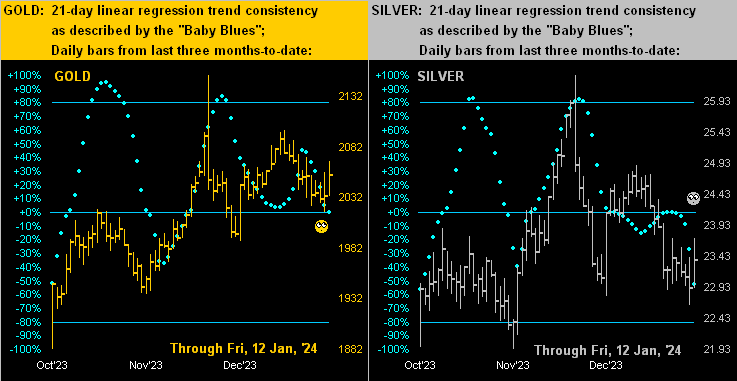

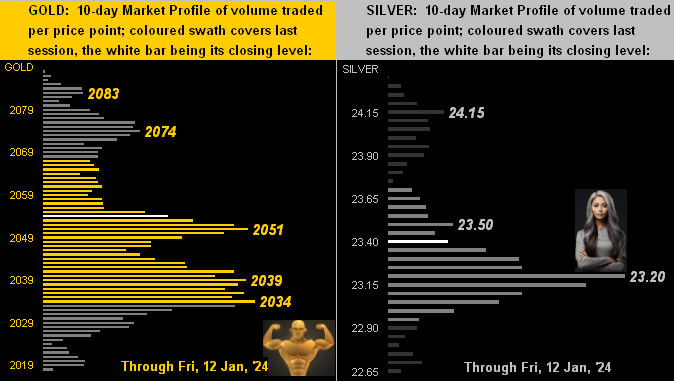

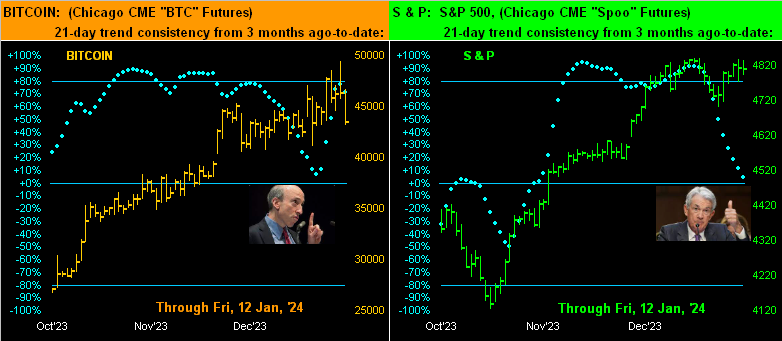

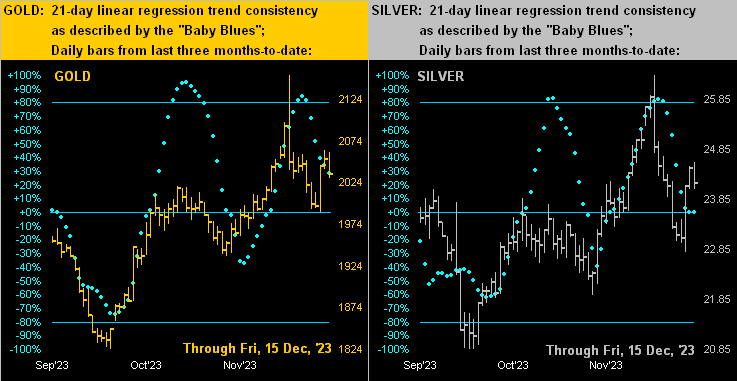

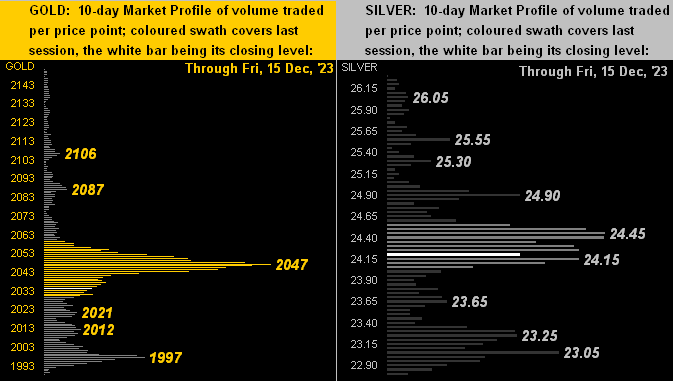

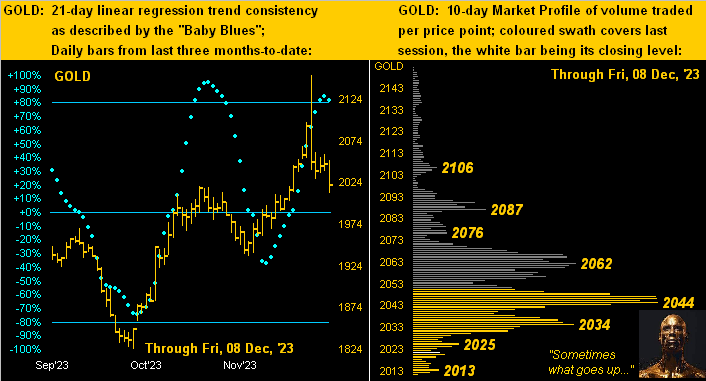

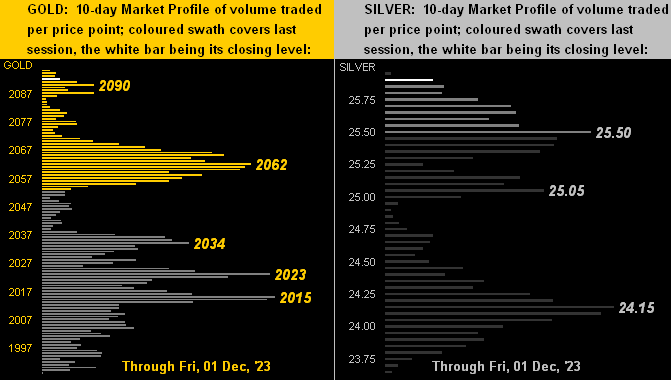

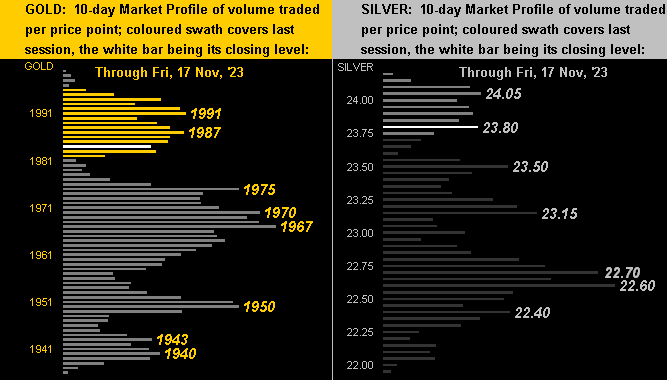

Here’s Gold via our two-panel display, featuring on the left price’s daily bars from three months ago-to-date, whilst on the right is the 10-day Market Profile such that you can see which prices having been carrying the most trading volume. For both panels, as herein inferred a week ago, ’tis hard to improve upon perfection. Still, as aforementioned, we’re wary of near-term price reversion to its smooth valuation mean of presently 2644:

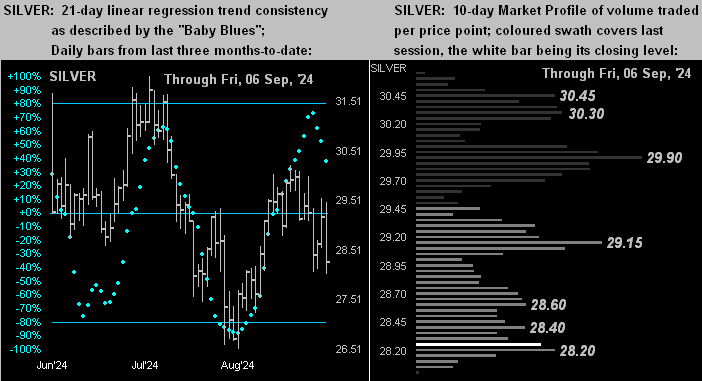

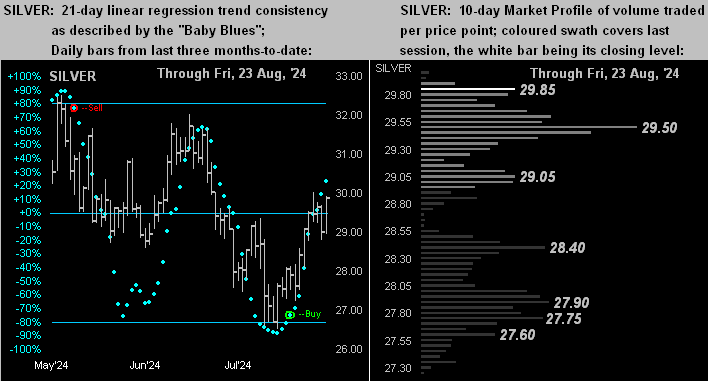

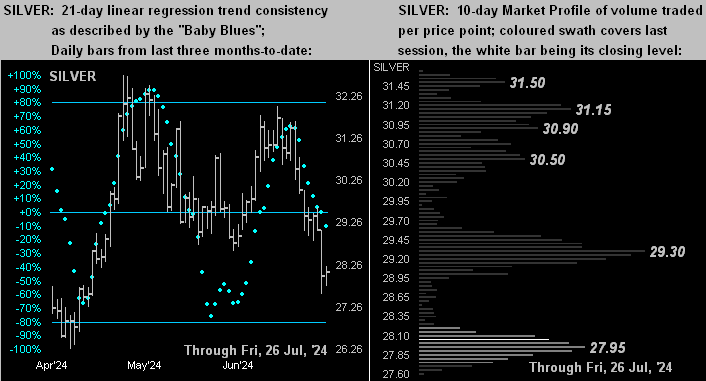

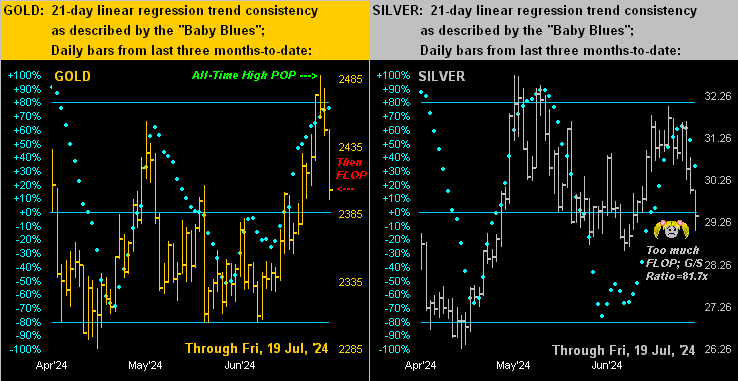

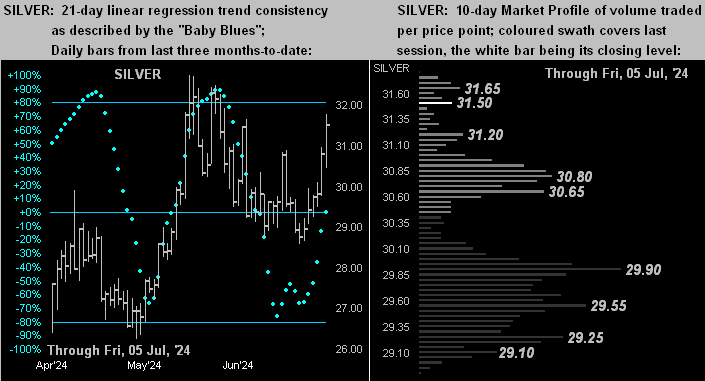

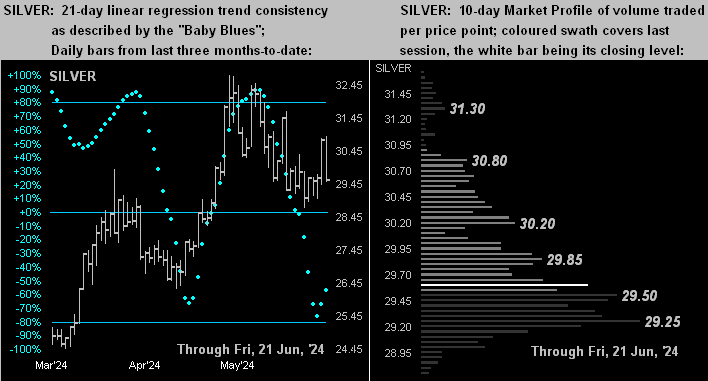

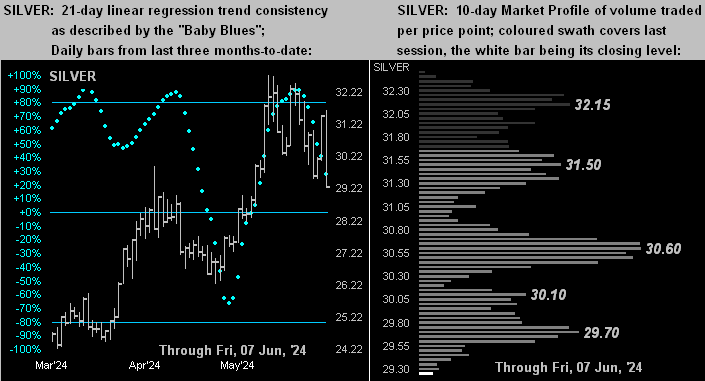

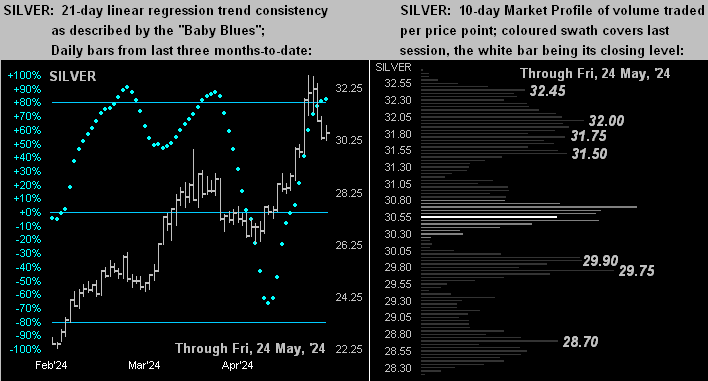

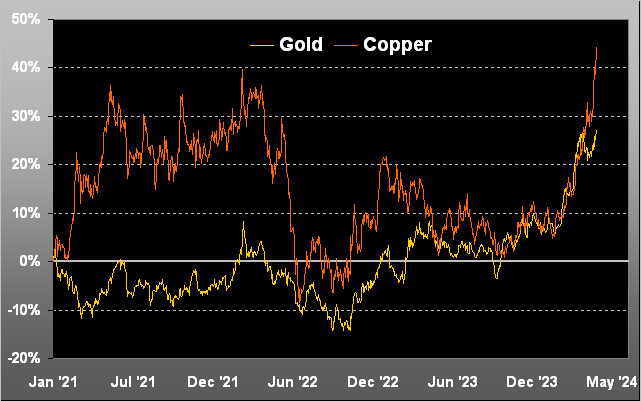

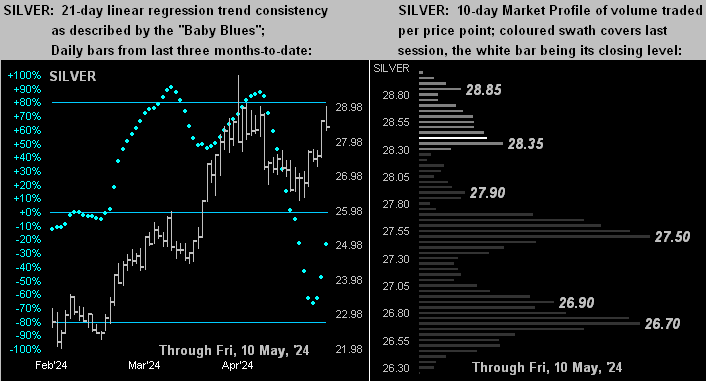

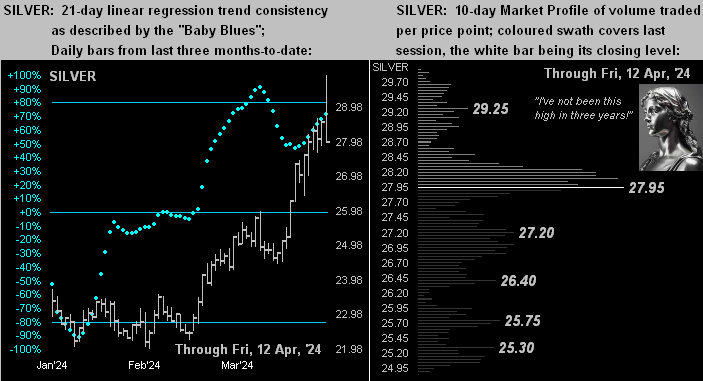

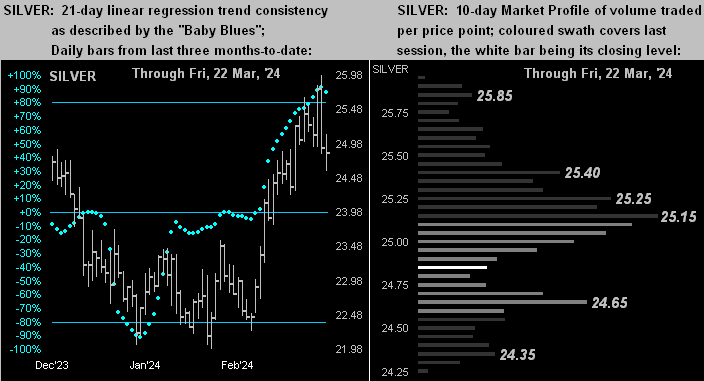

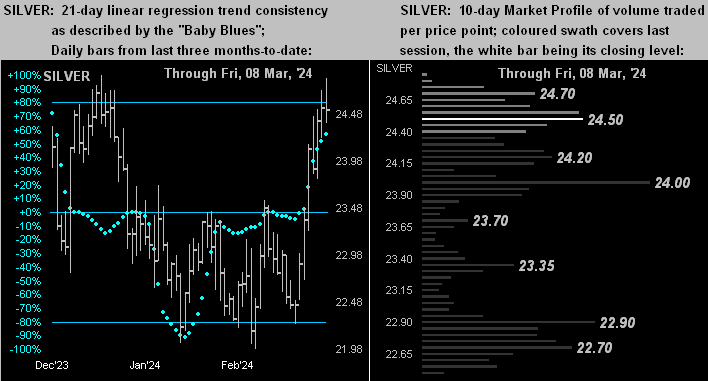

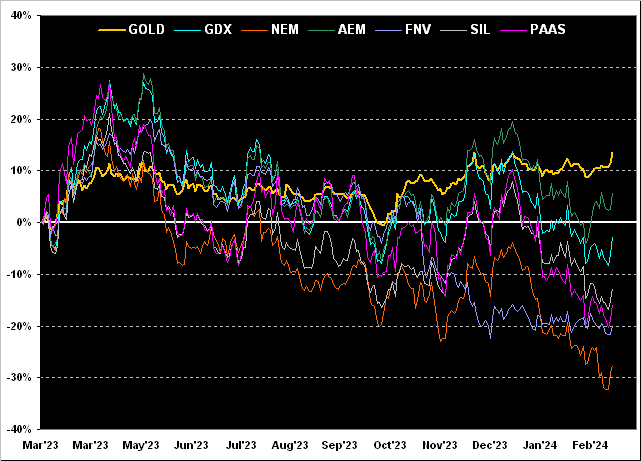

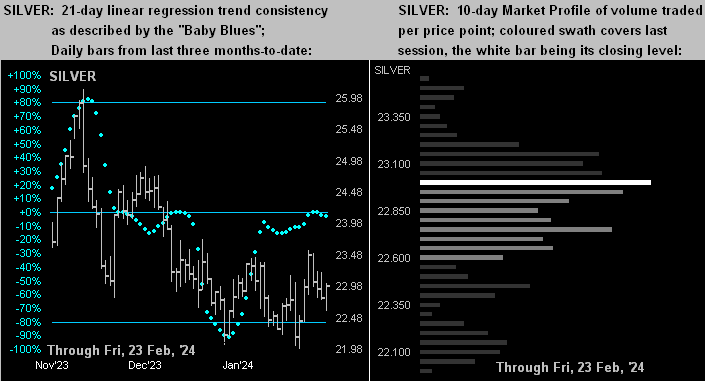

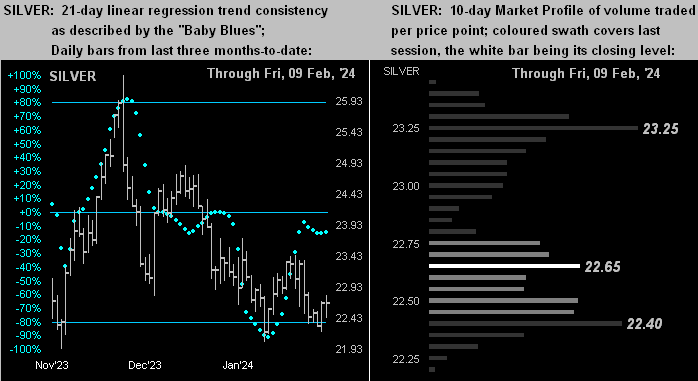

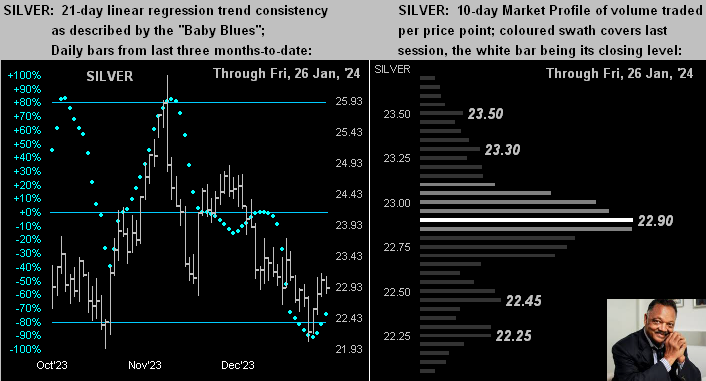

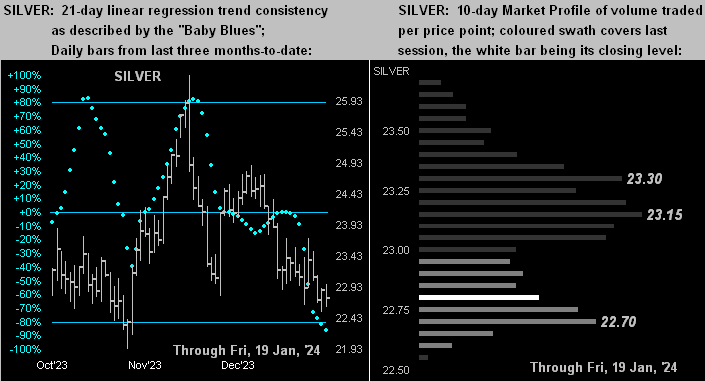

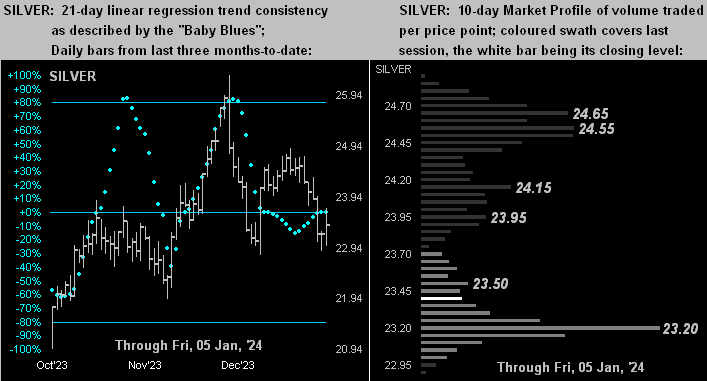

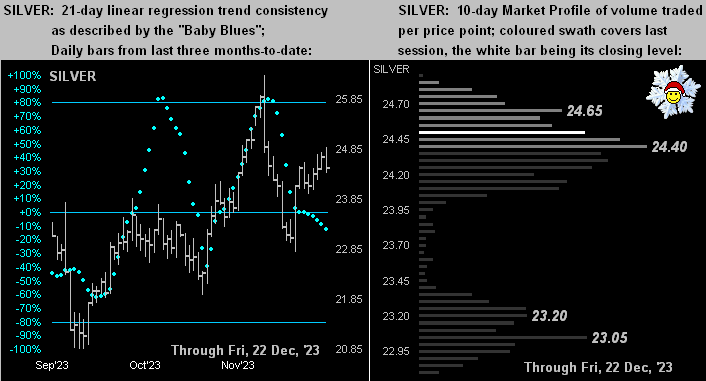

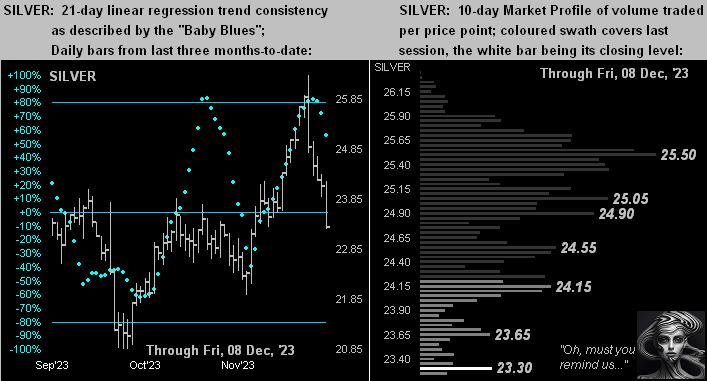

With the same drill for Silver, we might as well photocopy that for the yellow metal and merely change the colour to this for the white metal. ‘Course, the important inference here is Sister Silver having been adorned in her precious metal pinstripes as opposed to her industrial metal jacket, (the latter being her preference when acting as the bad girl with Cousin Copper). But that clearly is not the current case, the red metal’s own “Baby Blues” of trend consistency being comprehensively in the dumpster (per the website’s Market Trends and/or Copper page). So stay sweet, Sister Silver!

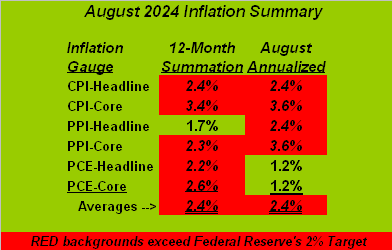

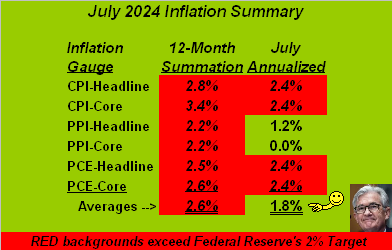

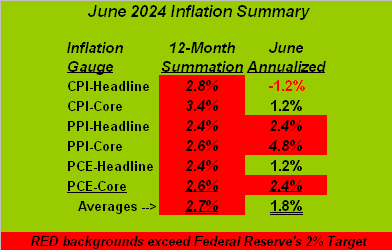

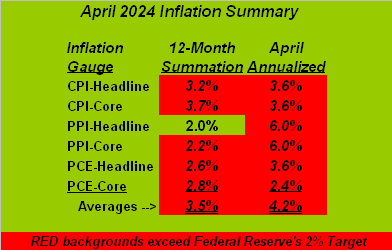

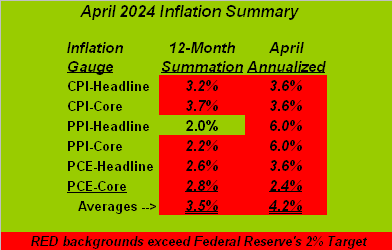

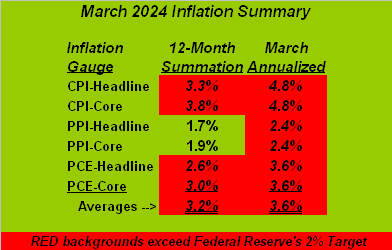

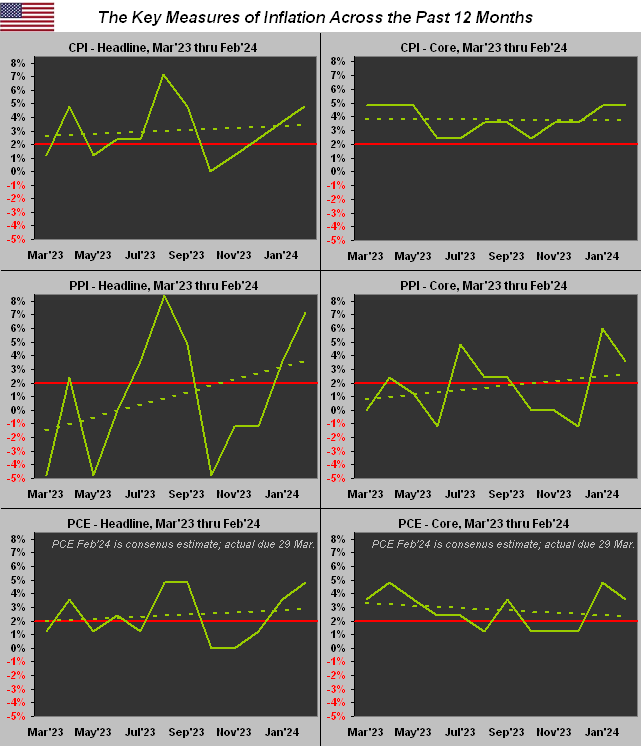

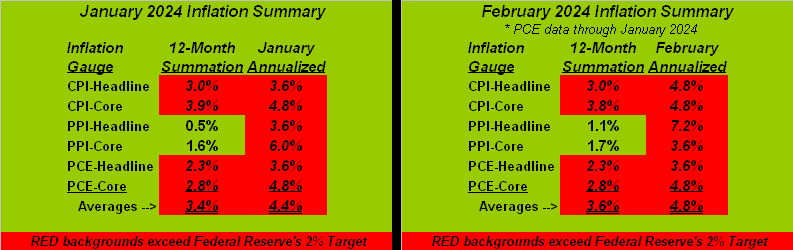

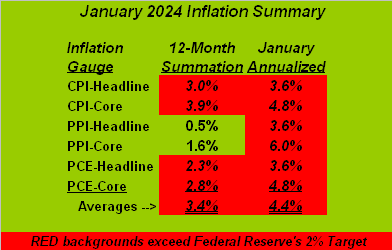

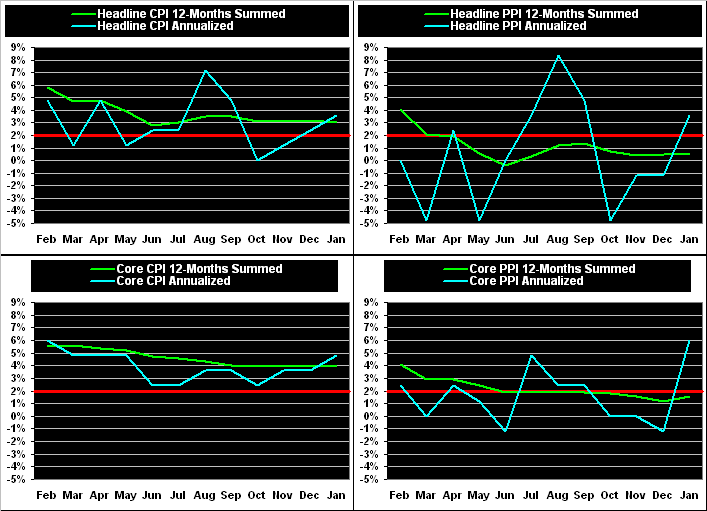

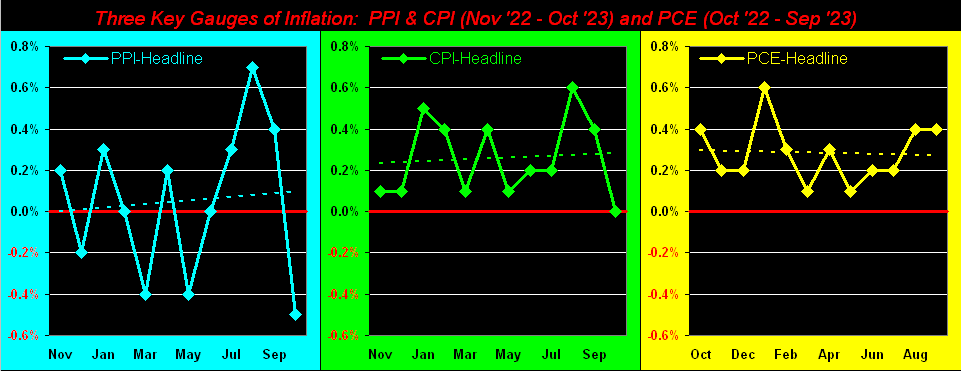

Then there’s next week, for which the load of incoming economic metrics is massive(!). 17 reports come due for the Econ Baro, including the “Fed-Favoured” inflation gauge of Core Personal Consumption Expenditures Prices for September. And the “consensus” expection is for it to have risen … we even read within the mist of the past week’s FinMedia the query (paraphrased) “What if the Fed instead raises rates?” come its Open Market Committee’s post-election meeting (06-07 November). We’ll be updating our inflation table for next week’s piece.

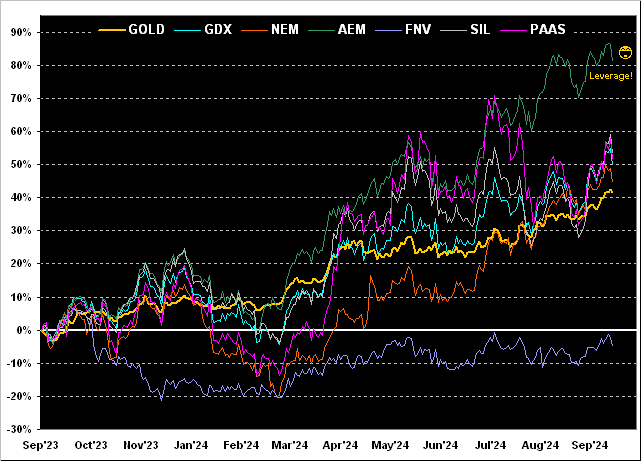

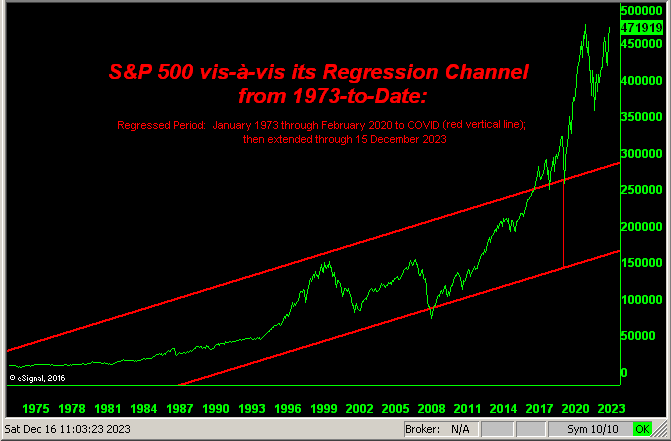

Meanwhile, creativity abounds in the headlines. Try this CNBS (truth be told) from yesterday: “In this time of uncertainty, markets seem to rely on logic.” Folks, you cannot make this stuff up, (except, they’re doing their best to so do). If markets were relying on logic, today’s S&P 500 (5808) given its ghastly P/E would be half that (2904), whilst Gold (2761) would be ’round its Scoreboard valuation (3736). True, the markets are never wrong, but misvalued opportunities abound! Especially for the precious metals all ’round!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro