The Gold Update by Mark Mead Baillie — 719th Edition — Monte-Carlo — 26 August 2023 (published each Saturday) — www.deMeadville.com

“Gold Grips a Bit, but Silver Rips!“

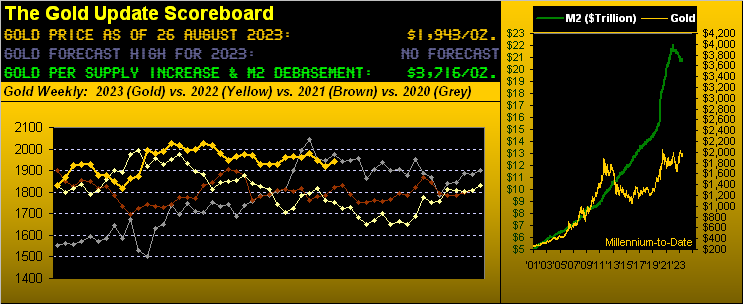

This past week wherein Gold finally garnered a wee bit of grip, ’twas Sweet Sister Silver who showed how to rip! Whereas Gold settled yesterday (Friday) at 1943 for a +1.3% weekly gain, Silver settled at 24.285 for a reigning +6.8% weekly gain. Let us thus duly start with the white metal in revisiting a few phrases from recent of these missives as below dated:

- 15 July –> “How many times have we herein written ‘Don’t forget the Silver!‘”

- 12 August –> “…from the ‘Means Reversion Dept.’ to price Silver via the century-to-date mean [Gold/Silver] ratio of 67.7x puts it at 28.76, (i.e. +21% above today’s 22.75). Again: ‘Got Silver?’”

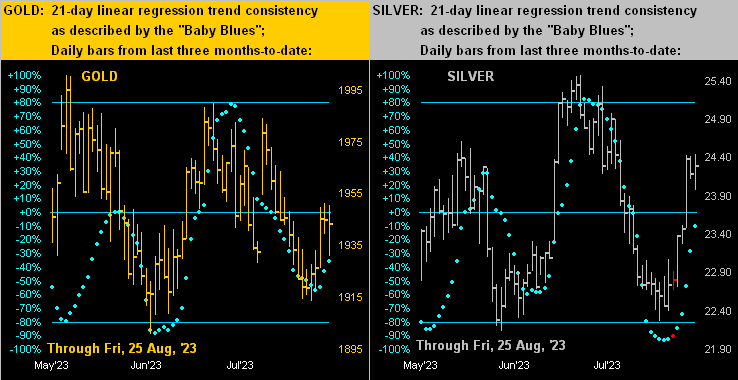

- 19 August –> “Silver’s ‘Baby Blues’ … are just starting to curl upward, whilst price sits just above major trading support (22.75) in the Profile … Can Sweet Sister Silver actually lead Gold? Absolutely!“

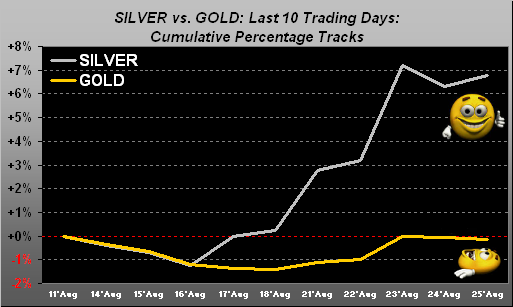

And so justifiably it came to pass this past week that Silver indeed did rip, and moreover, she did so before Gold itself at least sought some grip. In fact: all-in from Silver’s low of 22.265 on 15 August, it took but six trading days for price to touch 24.430, a low-to-high gain of +9.7%. Had you been impossibly lucky enough to have bought that low and sold that high for a gain of +2.165 points, your single contract gain (at $5k/pt) equated to $10,825 … or as a deep-pocketer had you instead bought 100 contracts, your six-day gain equated to $1,082,500 … (just in case you’re scoring at home). Visually, here are the respective cumulative percentage tracks (per net daily closes) for Silver and Gold from two weeks ago-to-date, wherein the latter still looking rather flat is saying “Gimmie more lift, baby!”

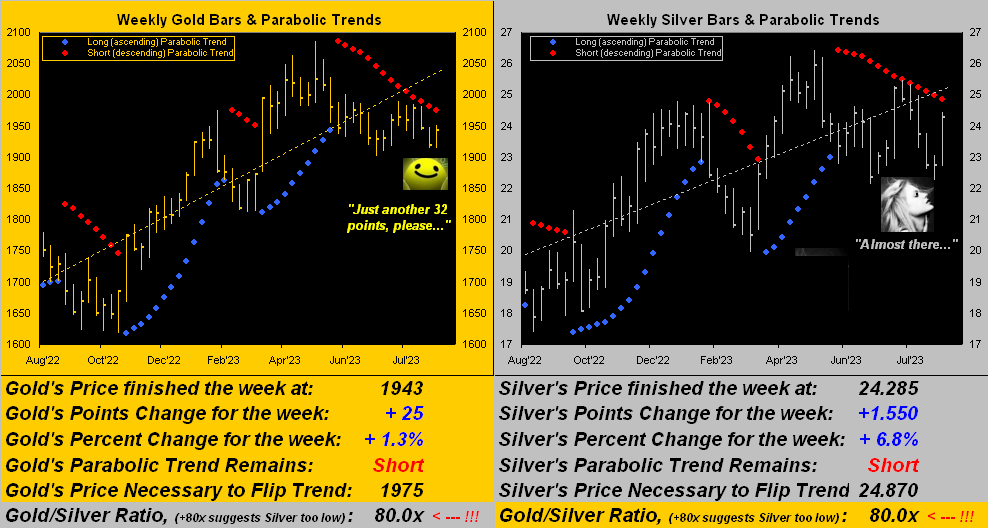

Significantly intrigued by Silver’s finally coming ’round, we warrant her being paired with Gold in displaying the weekly bars and parabolic trends for both precious metals from one year ago-to-date. In each case, such trend remains Short (per the declining red dots), but with prices knocking on their respective doors to flip Long:

Indeed with Silver less than one point away from flipping her trend from Short to Long, the question is begged: “How much farther does Silver then climb?” Answer: across Silver’s past 10 weekly parabolic Long trends (extending back into December 2018), the “median maximum” price gain from each Long confirmation at week’s-end until again flipping back to a Short trend is +13.2%, and such average max gain is +19.6%. Strictly in that vacuum, were Silver’s trend to flip Long in the ensuing week at 24.870, a match to that median max gain would bring 27.480 — and further to the average max gain — 29.040. As for duration, the average Long trend across those 10 prior cases has lasted for 11 weeks. A lot of statistics there, but the prudent trader/investor looks to both time as well as range in cash management.

“Which means that 90% are not very prudent, right mmb?“

So say various studies, Squire. Or as a dear futures mentor of ours from many years ago might say: “They all knew better than the market which is why they’re not around anymore.” In other words, investing as Smart Alec on a wing and a prayer won’t get you anywhere, (e.g. how’s that “live” 41.5x price/earnings ratio of the S&P 500 gonna work out for ya?). Scary remains the story there.

As to the “when” for these two precious metals’ Short trends to end: Gold is 32 points away from flipping to Long with the “Expected Weekly Trading Range” now 47 points; and Silver is 0.585 points away from same with an “EWTR” of 1.315 points. Thus it is plausible one if not both precious metals’ weekly trends can be Long in a week’s time. “Stay tuned to this channel for further developments…”

Meanwhile in briefly reviewing our “non-events” take from a week ago, ‘twould seem that (after all the FedMedia hype as was anticipated) both the Fed’s Holiday Camp and the BRICS’ Revamp had almost no sway on our primary BEGOS Markets: week-over-week, the Bond was +0.6%, the Euro -0.7%, Gold (as noted) +1.3%, Oil -1.7%, and the S&P 500 +0.8%. Add to that the quiet Economic Barometer producing just a mild thud, and the week on balance (save for that of Silver) was a dud. Here’s the Baro as Federal Reserve Chairman Powell keeps a tight grip on the money whilst BRICS’ arguably succumbed to its namesake in adding six bricks to its mix:

But let not too much summertime complacency enter your veins as next week’s incoming Econ Baro metrics shall bring both losses and gains. Wherein this past week was weathered just five economic data points for the Baro, the ensuing week brings 16 metrics, the key highlight being Thursday’s (31 August) release of July’s Fed-favoured Core Personal Consumption Expenditures Index, the consensus for which is an annualized pace of +2.4%, (i.e. +0.2% for the month). Yet, if you really want to get into the weeds, recall the recently reported/leading July Core Producer Price Index having registered +0.3%; moreover the Core PCE’s 12-month regression level also “suggests” +0.3%. Too much information perhaps, but should +0.3% be the number, we shan’t be too surprised whilst all around are “expecting” +0.2%.

Either way, one must deem Silver as the anticipated “surprise” of the past week. Per our tweet (@deMeadvillePro) on Thursday, Silver’s “Baby Blues” of trend consistency were well on the northerly move after pointing to their commencing a fresh up-curl in last week’s missive. Such is recalled below in the following two-panel graphic of the precious metals’ daily bars from three months ago-to-date with Gold at left and Silver at right. And specific to the latter, we’ve coloured in red Silver’s bar and dot from Friday a week ago, from which point she truly did go. Way to rip, Sister Silver!

In so “ripping”, the Gold/Silver ratio in a mere week fell from 84.1x to now 80.0x: such like week-over-week drop has happened but one other time this year, indeed just recently so from the first-to-second week of July. Thus our interpretation? Sister Silver is getting a long overdue bid!

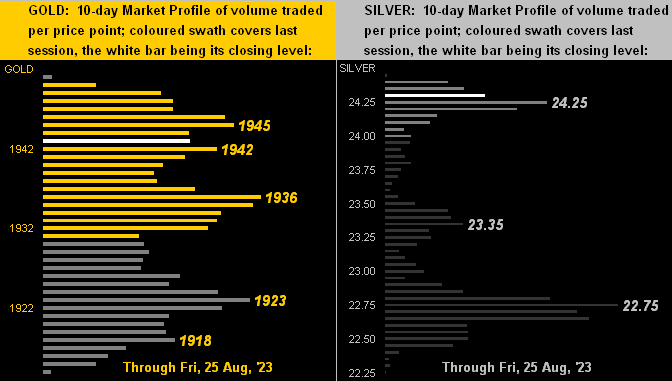

Long overdue, too, to rise from their respective Market Profile basements were both Gold next on the left and Silver on the right. The volume-dominant supporters and resistors are as labeled:

So with Sister Silver having put in a semaine superbe, let’s wrap it here with something hardly superb. As you regular readers of The Gold Update know, we’ve become more and more skeptical these recent years of the FinMedia’s foundational grounding and market understanding, (i.e. in referring on more than one occasion to the once-mighty and revered Barron’s as having become a children’s writing pool). And to wit, we balked again at a headline yesterday from ever-lovin’ Bloomy. Ready? “Stock Rally Has a Ways to Go Before Americans Feel Rich Again”. Instantly, we had a John Patrick McEnroe moment: “You canNOT be SERious!” What rally is being cited? ‘Course having virtually vanished from essentially the entirety of bullish market musings is the “E” word (Earnings) — which themselves haven’t actually vanished — but are, on balance, unsupportive of the S&P 500’s present level (4406 and its ghastly-high aforementioned P/E of 41.5x).

In fact, let’s go all the way back to The Gold Update penned on 28 January with respect to the S&P: “The S&P is today priced at [then] 4071. Morgan Stanley already is well on the record of it reaching down this year to 3000. We anticipate sub-3000. The P/E reverting to its historical mean (22.4x) suggests — were there no growth in earnings — 2313.” Yet to be fair for Q2 Earnings Season, as you know S&P cap-weighted profits grew at a +6% pace; but the overall level (as just stated) remains Index unsupportive.

Regardless, from here with just over four months remaining in 2023, ‘twould be a terrific tumble: from today’s S&P 4406 level to 3000 = -32% with 87 trading days to go. Has the S&P ever fallen by -32% within 87 trading days? Of course it has: during 1987, 2002, 2008, and most recently in 2020. Shall it so do in the remainder of 2023? Until we see fear at the website’s MoneyFlow page, the answer is “No” and our sub-3000 notion we’d have to forego.

Still, let us also reprise that: “Marked-to-market, everybody’s a millionaire; market-to-reality, nobody’s worth squat.” Or translated for you WestPalmBeachers down there: shall you be out of stocks before it all goes wrong?

And better yet: be in Gold and Silver!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on Twitter: @deMeadvillePro