The Gold Update by Mark Mead Baillie — 710th Edition — Monte-Carlo — 24 June 2023 (published each Saturday) — www.deMeadville.com

“Gold Sinks in Sync with its Parabolic Short Trend“

Five weeks have passed since Gold flipped its weekly parabolic trend from Long to Short, (effective the week ending 26 May). And yet through these recent weeks, Gold really hasn’t seen much sink … until that just past as price is now finally falling from the brink.

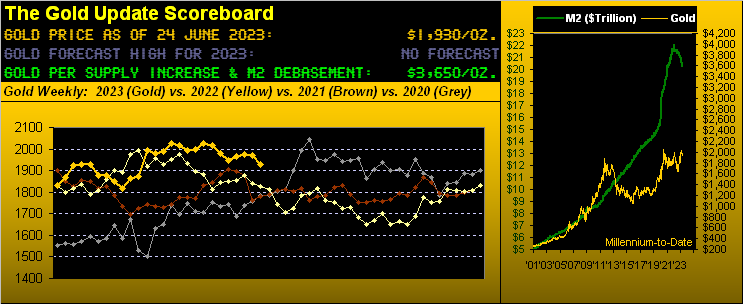

That noted, in assessing the above Gold Scoreboard, seasonally this time of the year has typically brought sinking prices for Gold, the only line of exception therein being 2020’s grey one as Gold was getting the COVID bid ultimately toward the All-Time High of 2089 come 07 August of that year.

But today, given Gold’s present parabolic Short trend, price itself is now in downside sync, indeed having reached its lowest level (1920, last seen on 16 March) toward settling yesterday (Friday) at 1930.

Straightaway, here are the weekly bars and parabolic trends from one year ago-to-date. Therein we’ve again placed the green bounds that form the Feb-Mar structural support zone. The center green line is the midpoint, again suggesting that just sub-1900 can curtail further downside on this run. ‘Tis thus dubbed “Support-ish” as by the current front month August Contract (still with 10 points of price premium) we’d see 1903, or by spot, 1893:

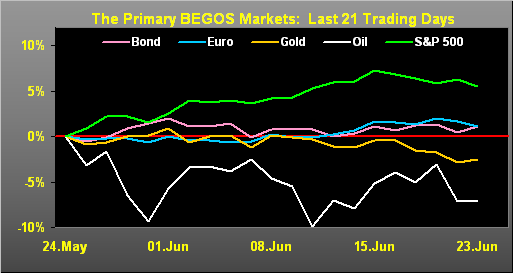

Still, as we next glance at the percentage performance of the five primary BEGOS Markets from one month ago-to-date (i.e. the last 21 trading days), Gold has more or less been an “also-ran” along with the Bond and Euro, whereas Oil has been the weakest and the S&P 500 the firmest (more later on that latter calamity-in-waiting).

Regardless, with all the up-and-down-and-up-and-down exhibited by our Economic Barometer, plus the Federal Open Market Committee pausing FedFunds rate rises before resuming them, and now vicissitudes verbalized by FedChair Powell this past week at his Humphrey Hawkins (indeed hawkish) Congressional testimony, there’s yet to be really much substantive markets’ reaction as we see here, the Bond market surprisingly being the least changed of the BEGOS bunch:

And hawkishly lending to the FedChair’s stance was some rebound this past week in the aforementioned Econ Baro as housing metrics ruled the roost: of note, the National Association of Home Builders Housing Index for June recorded its highest level (55) since June a year ago; and more impressively, Housing Starts for May made their largest monthly leap (by 291k) in better than 17 years (since January 2006). ‘Course, the bummer for the Baro was the negative measure of Leading Indicators (to which we refer as “lagging” because the Econ Baro actually leads them) that the Conference Board has not reported as positive since their March reading back in 2022.

‘Course as you regular readers and website users know, the red line in the above graphic is the track of the S&P 500 astride the Econ Baro from one year ago-to-date. And even as the S&P has come off from its recent high (4448 on 16 June), the mighty Index nonetheless through yesterday’s close (now 4348, exactly -100 points off that high) remains to what we refer as “textbook overbought” using a series of near-term, widely-observed technical indicators.

Further, as we tweeted (@deMeadvillePro) on Thursday with respect to the S&P Futures: “Spoo (4410) daily parabolic flipping Short: last 10 Shorts “averaged” -100 points; so test of Market Profile 4319 apex is reasonable.” Also this past Thursday, the VIX quietly reached its lowest level of complacency (12.73) since pre-COVID January 2020. (That courtesy of the “What, Me Worry? Dept.”)

And yet just a week ago, from one FinMedia source to the next we read ’twas nothing but “The next bull market is just underway!” they say. “Ya gotta be in it to win it!” they say. “S&P targeting 5000!” they say.

But now just four trading days hence (give the StateSide holiday), a 180° turn took sway. Dow Jones Newswires just ran with this headline as tipped by J.P. Morgan: “U.S. stocks head for punishing selloff as ‘unknown unknowns’ could drag market lower…” Oh no, say it ain’t so! Make up yer mind already!

Moveover, now comes this from the childrens’ writing pool over at the once-brilliant Barron’s: “Here’s how to know when to start worrying about the market.” Heck, we’ve been addressing that ad infinitum, as ’tis the easiest query with respect to equities (hat-tip to one Mike Holland from many years ago that “…at the end of the day, stocks are valued by earnings…”). Ready? Per yesterday’s S&P 500 close:

‘Tis not actually that bold of a statement; just the do the math. Still, the parrots cling to “twenty-something”. And given means-reversion, in due course we shall actually — indeed mathematically — revisit a true “twenty-something”. Or to coin a phrase from Madison Avenue: “Watch this space.”

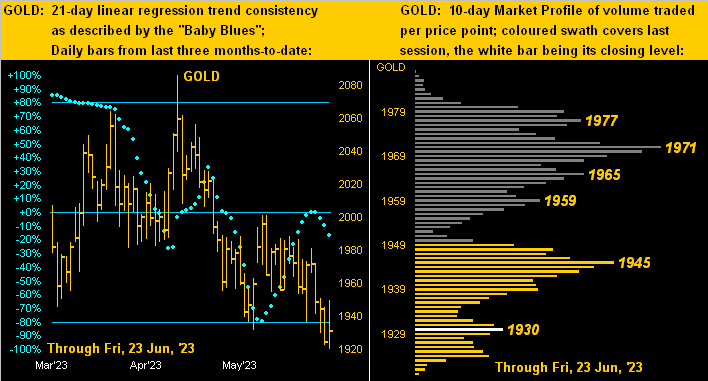

Watch as well from the website our daily updating of these Gold panels. On the left we’ve price’s daily bars from three months ago-to-date. The most recent days highlight the downtrend picking up steam, the blue dots of trend consistency as well curling southward, for which you know the quip: “Follow the blues instead of the news, else lose yer shoes.” On the right is Gold’s 10-day Market Profile with its dominant overhead trading resisitors as labeled:

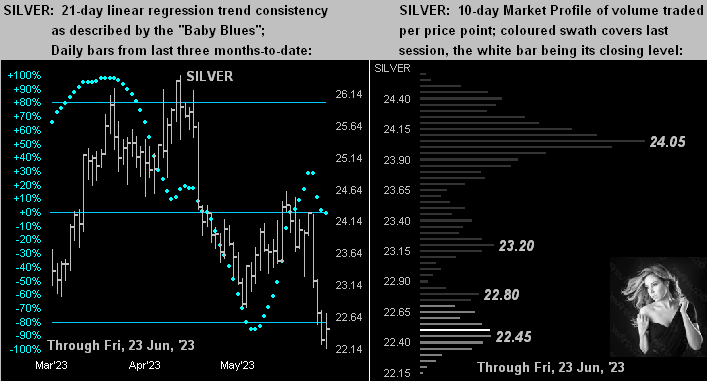

Ever so similar is the same drill for Sister Silver. And you’ll recall she’d be firming up better than Gold of late only to now negatively rotate. Just two weeks back, the Gold/Silver ratio was 81.0x; today ’tis 86.0x. And be it by her daily bars and Baby Blues (below left) and/or her Market Profile (below right), poor ol’ Sister Silver is hardly her true self:

Looking ahead, as if we’ve not had enough of the Fed planted in our head, comes their favoured inflation gauge: Core Personal Consumption Expenditures, due Friday, 30 June. “Happy Mid-Year!”

Recall for April the annualized Core PCE pace came in at +4.8% (the 12-month summantion being +4.3%). Now for May, “expections” are for a month-over-month dip from +0.4% to +0.3%. Should that be the case, the annualized pace becomes +3.6% and the 12-month summary still +4.3%. Either way, both are still well above the Fed’s inflation target of +2.0%, their “pause” notwithstanding.

Still, in fervent anticipation, our FinMedia friends are out to keep us educated: “What is inflation? And why for so long? And why so high?”

“Well, hardly is it ‘high’, mmb…”

Exactly right Squire. But a lot of these folks weren’t around in the Carter years. We recall seeing a rate sheet barely pre-Reagan away back in our banking days in early ’81 declaring the best customers could borrow “at prime” for 22.5%. That’s nearly triple today’s 8% rate. And it hasn’t been for very long at all.

‘Course for you WestPalmBeachers down there as to what really is inflation, ’tis simple: the more there is of something (i.e. Dollars) the less they’re worth and thus the more of ’em it takes to buy the same thing. Or per the famous Santitas example, the less you receive for the same number of Dollars:

And remember: regardless of trend, shorting Gold is a bad idea; so hang on to your Gold!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on Twitter: @deMeadvillePro