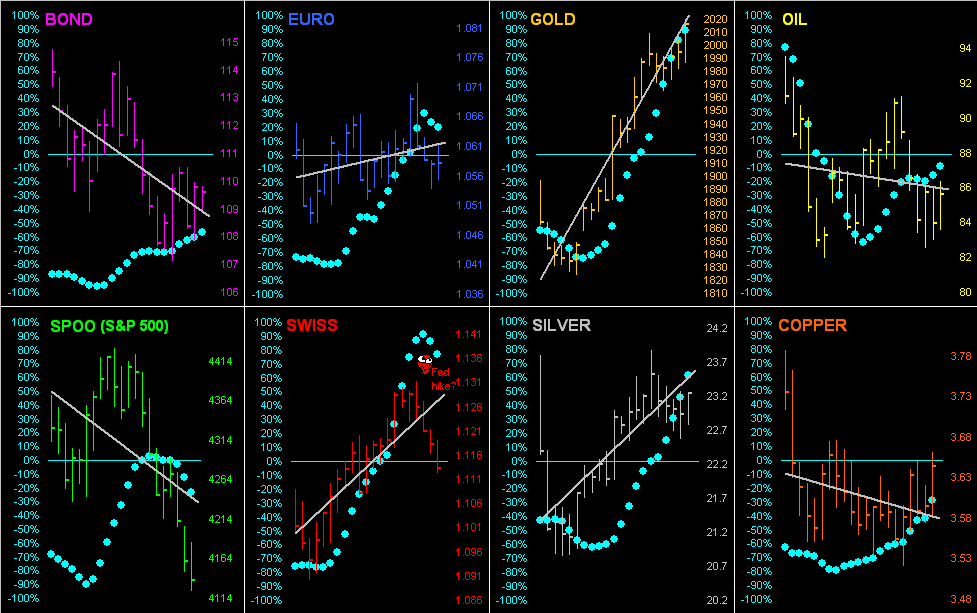

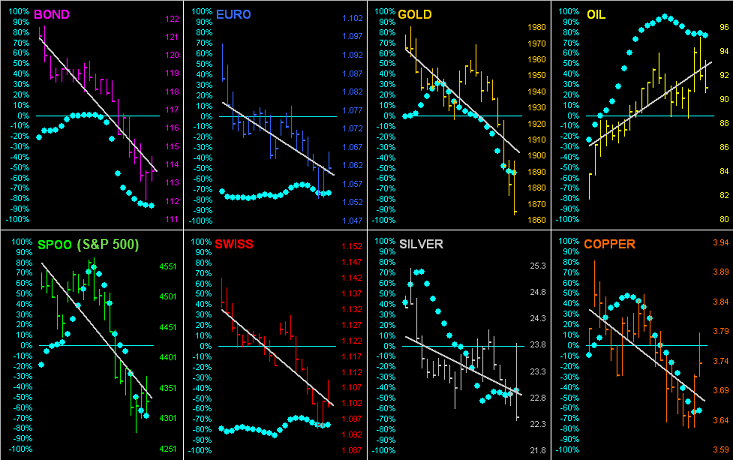

The Bond, Swiss Franc, Gold and Silver are all at present above their respective Neutral Zones for today; the other BEGOS Markets are within same, and volatility is leaning toward moderate, (the non-BEGOS Yen having again exceeded 100% of its Expected Daily Trading Range). The S&P 500 is now “textbook overbought” through the past 10 sessions, the last five of which are at an extreme overbought reading: the “live” P/E (futs-adj’d) is 44.7x, essentially double the 66-year historical mean. The Econ Baro awaits October’s Existing Home Sales; and late in the session comes the FOMC’s 31 Oct/01 Nov meeting minutes.

Mark

Mark

20 November 2023 – 09:17 Central Euro Time

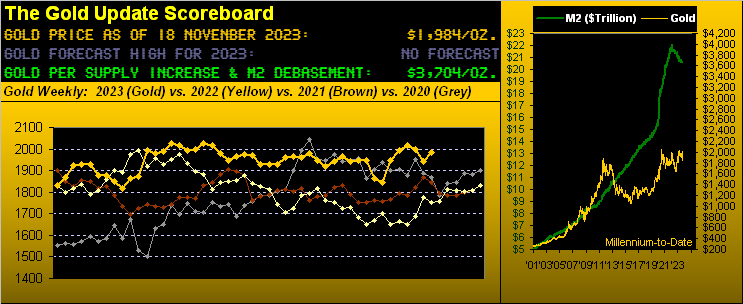

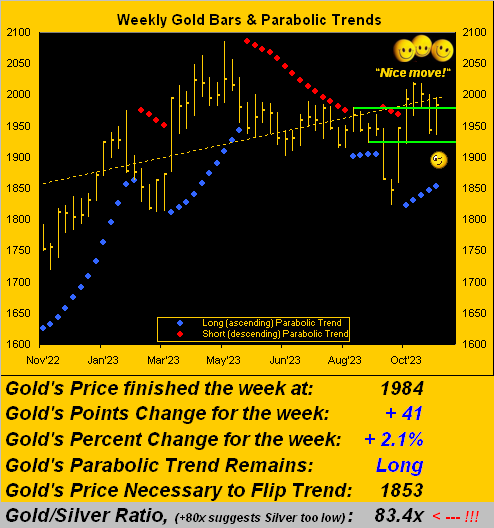

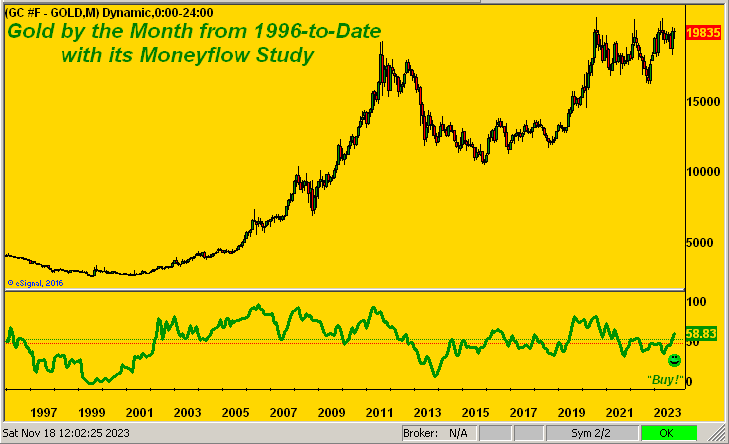

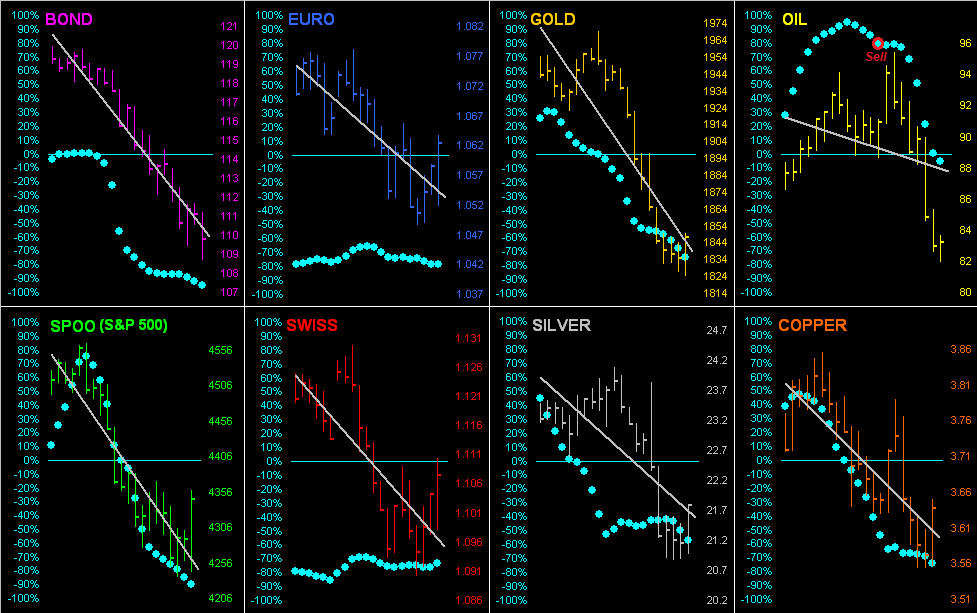

The abbreviated trading week gets going with the Swiss Franc and Oil at present above today’s Neutral Zone; below same is the Bond: recall our noting to mind the Bond’s “Baby Blues” (at either the Bond or Market Trends page); the Blues in real-time are beginning to roll over (albeit still are above their key +80% level). BEGOS Markets volatility is moderate; indeed for the Yen (not yet officially a BEGOS component), it has already traced 120% of its EDTR (see Market Ranges). The Gold Update cites price having moved back above successfully tested support, in concert with inflation having purportedly come to a halt and the Econ Baro recording its 10th worse 12-day stint since the Baro’s inception back in 1998. The Baro today looks to October’s leading (i.e. “lagging”) indicators, one of just five metrics due for this week.

17 November 2023 – 08:57 Central Euro Time

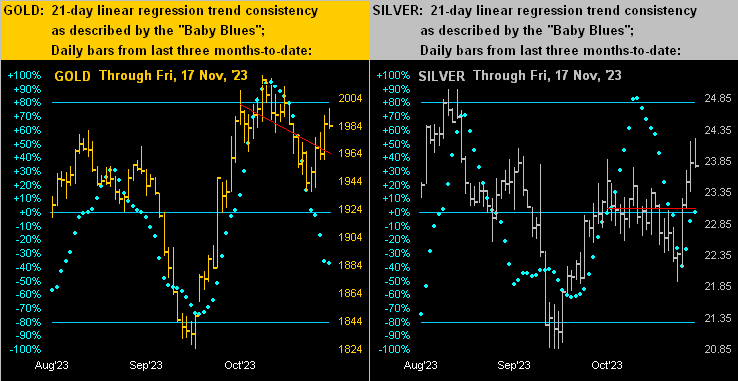

‘Twould appear to be a quiet Friday in the making: all eight BEGOS Markets are at present within their respective Neutral Zones, and volatility is very light. October’s Housing Starts/Permits come due for the Econ Baro, which itself has had quite the torrid week (https://demeadville.com/economic-barometer/); more on that in tomorrow’s 731st edition of The Gold Update. In real-time at Market Trends, the 21-day linreg trends are now perfectly flat for both the Swiss Franc and Silver, (the latter nonetheless getting a boost from the aforementioned daily Parabolics having flipped to Long). ‘Tis the final day of Q3 Earnings Season, for which the S&P 500 constituents finds 64% having improved their bottom lines of a year ago.

16 November 2023 – 08:58 Central Euro Time

Both the Bond and Gold are at present above today’s Neutral Zones; the rest of the BEGOS Markets are within same, and volatility is mostly light ahead of a busy day for incoming EconData. Silver’s daily Parabolics flipped to Long effective today’s open (23.510): the average maximum follow-though of the past 10 such studies (either Long or Short) is 1.695 points. At Market Trends, the Bond’s “Baby Blues” are above the key +80% axis; upon their eventual decline below that level, we’d then anticipate lower price levels. Included amongst today’s seven incoming metrics for the Econ Baro are November’s Philly Fed and NAHB Housing Indices, along with October’s Ex/Im Prices and IndProd/Cap/Util.

15 November 2023 – 08:59 Central Euro Time

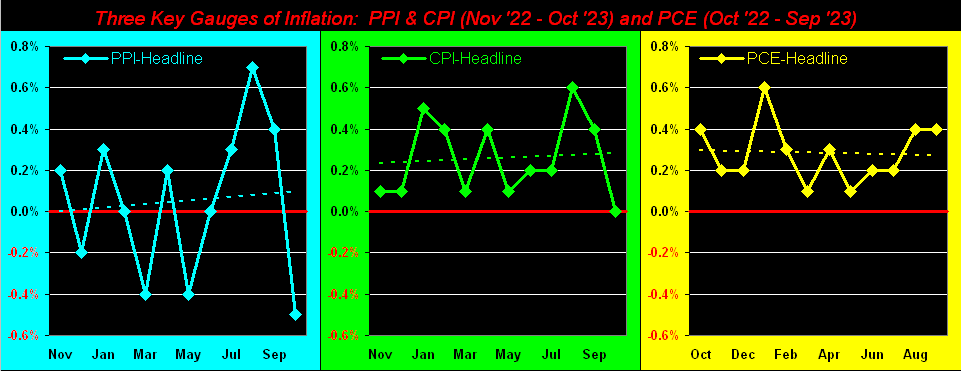

October’s CPI indeed was “center stage” (per yesterday’s comment), the headline retail level coming in “unch”. In turn the Dollar dove and the BEGOS Markets unimpededly rose. Today ahead of wholesale inflation we’ve both Gold and Silver at present above their respective Neutral Zones for today; the other BEGOS components are within same, and volatility is light. Yesterday’s S&P 500 +1.9% rise now finds the Spoo (in real-time) +216 points above its smooth valuation line (see Market Values): historically such extreme deviation leads on average to price descending by well over -100 points within the ensuing weeks such that we may soon see the S&P below where ’twas prior to the inflation data (4411 vs. now 4491); too there’s the “live” P/E of the S&P now 44.9x. Overall today for the Econ Baro we’ve November’s NY State Empire Index, October’s PPI and Retail Sales, plus September’s Business Inventories.

14 November 2023 – 09:08 Central Euro Time

The Bond is the sole BEGOS Market at present outside (above) its Neutral Zone for today; session volatility is very light, the Econ Baro awaiting October’s CPI to take center stage. Heading our Market Rhythms for trading consistency are (on a 10-test basis) the Euro’s daily Moneyflow, Oil’s 30mn Parabolics and Silver’s daily Parabolics, (too, whilst not a BEGOS component, the Yen’s 1hr Moneyflow also qualifies). The “live” (futs-adj’d) p/e of the S&P 500 is now 42.9x and the yield 1.569% whereas that for the “riskless” U.S. three-month T-Bill is an annualized 5.260%. And in real-time, the Spoo is +127 points above its smooth valuation line, the S&P itself now “textbook overbought” through the past five sessions.

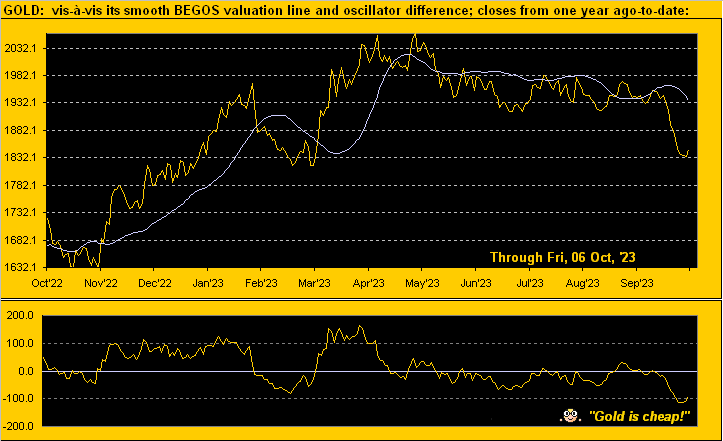

13 November 2023 – 09:04 Central Euro Time

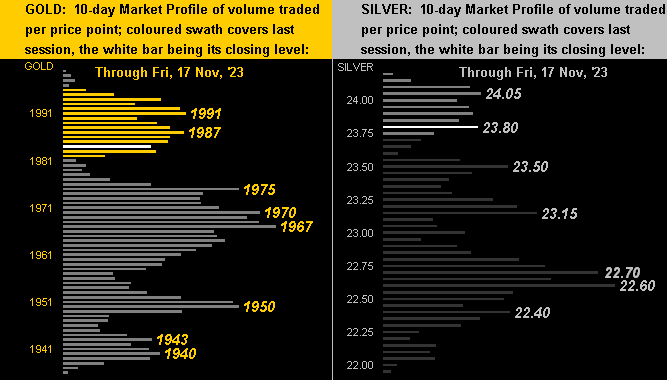

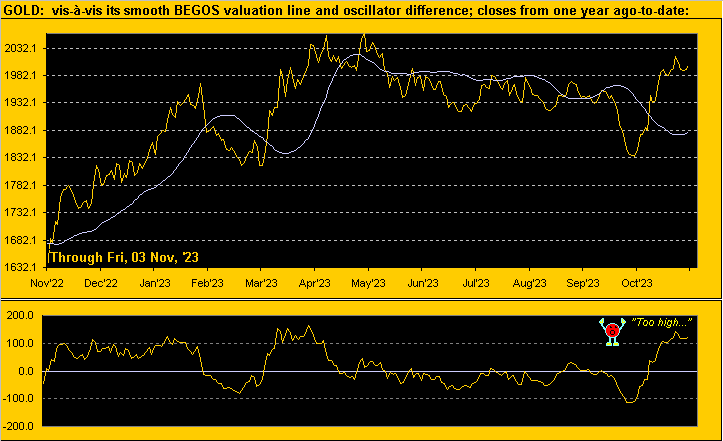

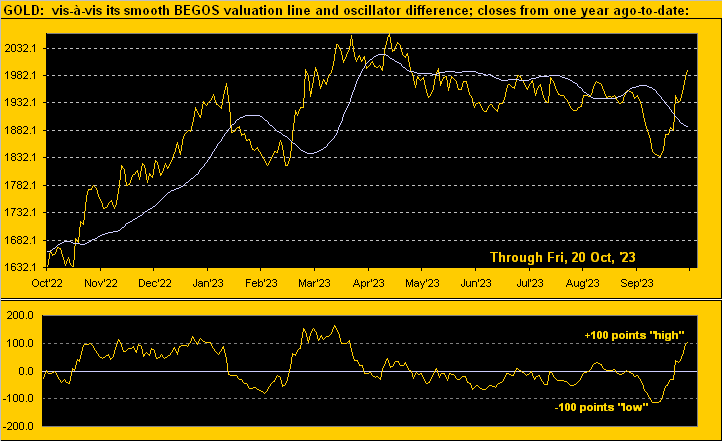

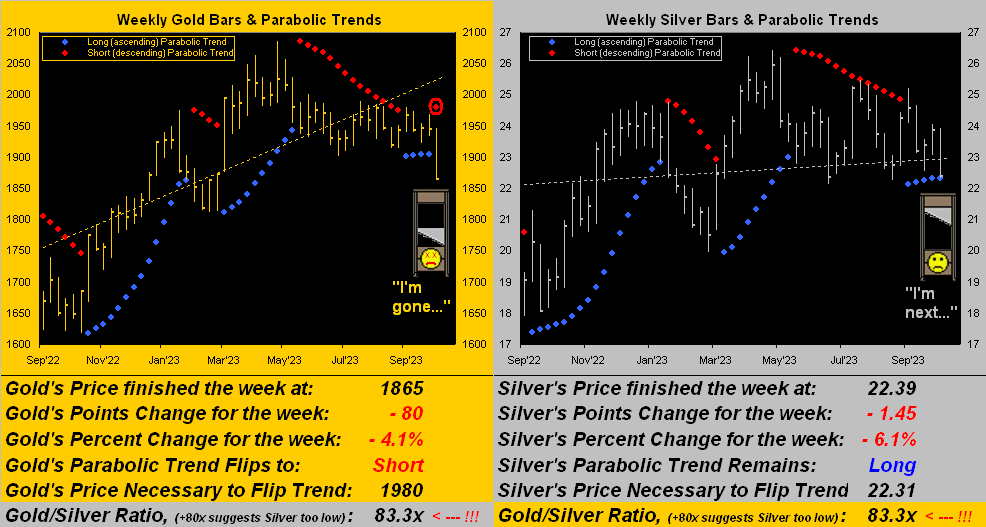

Both Silver and Oil are at present below today’s Neutral Zones; above same is Copper, and BEGOS Markets volatility is pushing toward moderate. The Gold Update confirms our anticipated typical post-geopolitical price pullback: visually therein on the Weekly Bars graphic we’ve placed the 1980-1922 support structure, (expandable to 2001-1901 if need be); and in real-time, Gold is now just +35 points above its smooth valuation line (see Market Values) after having been some +120 points above it. ‘Tis a very busy week for the Econ Baro with 18 metrics due, beginning (again purportedly) today with October’s Treasury Budget. Too, ’tis the final week of a “so-so at best” Q3 Earnings Season.

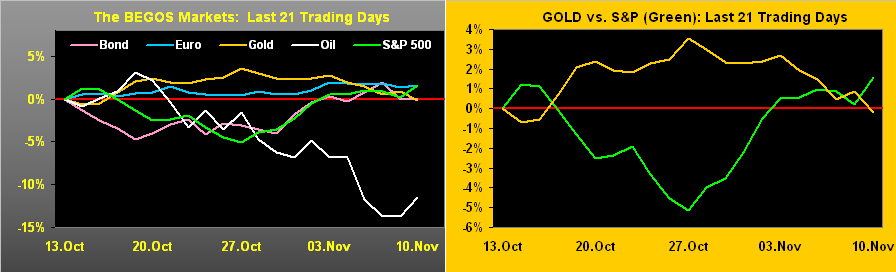

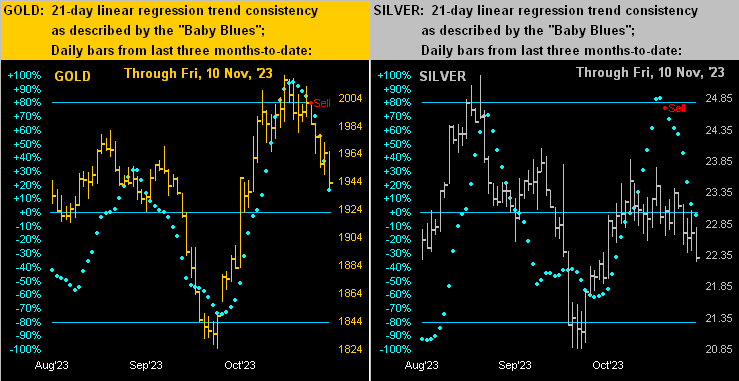

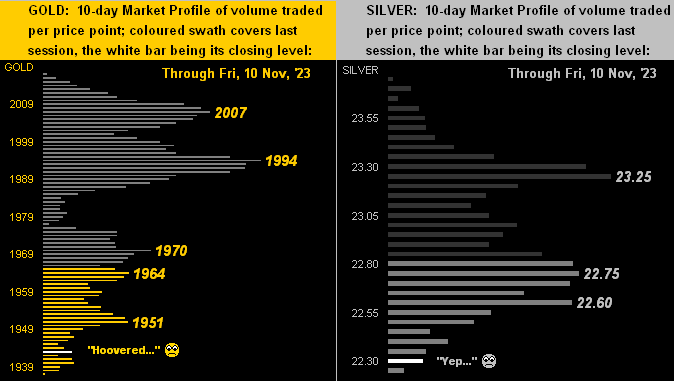

10 November 2023 – 09:04 Central Euro Time

The Bond is at present above its Neutral Zone for today; the Swiss Franc is below same, and BEGOS Markets volatility is mostly light. Looking at Market Profile resistors for the Spoo (presently 4372) we’ve the 4381-4384 area followed more dominantly by 4396; whilst by Market Trends the Spoo’s linreg in real-time has just rotated to positive, there is broader structural resistance running from 4341 up to 4431; and by Market Values, the Spoo is now +59 points above its smooth valuation line; for the S&P itself, ’tis now “textbook overbought” through these past three trading days. The Econ Baro concludes its quiet week with November’s UofM Sentiment Survey and (purportedly) October’s Treasury Budget.

09 November 2023 – 08:54 Central Euro Time

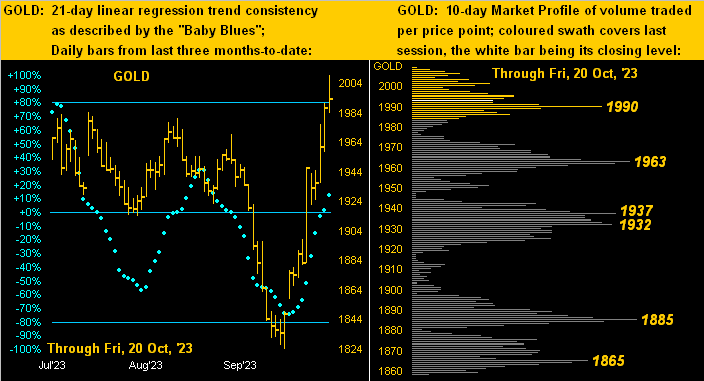

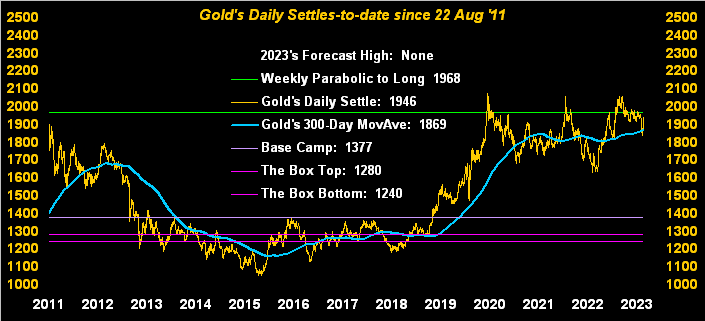

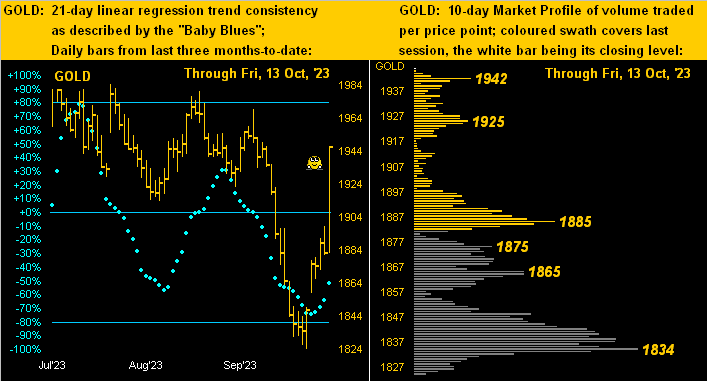

Copper is the sole BEGOS Market at present outside (below) its Neutral Zone for today; session volatility is light, save for Copper which has traced 57% of its EDTR (see Market Ranges). As Gold’s “Baby Blues” continue to descend, price has thus far traded to as low as 1953: recall from the current edition of the Gold Update the mention of 1951 as a mid-structural support level; currently priced at 1955, Gold is now +58 points above its smooth valuation line (see Market Values) after having been better than +100 above it through recent days. Indeed for Gold, Silver and the Swiss Franc, their “Baby Blues” all having fallen below the key +80% level have in turn seen lower price levels. As the Econ Baro’s subdued week continues, only due today are the usual weekly Jobless Claims.

08 November 2023 – 09:01 Central Euro Time

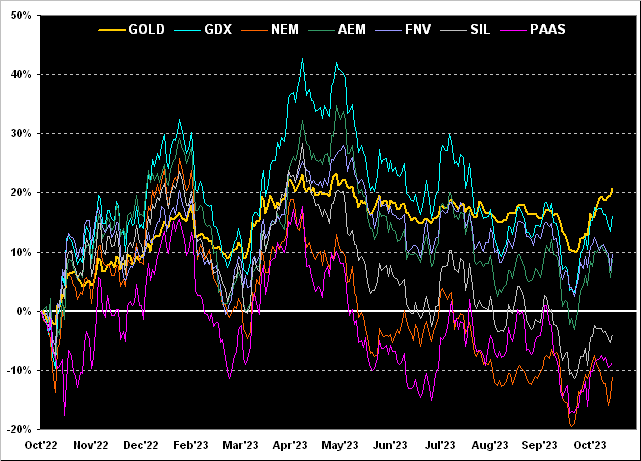

The Bond and EuroCurrencies are at present below today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is light. At Market Ranges, the recent EDTR widenings for the Bond, Gold, Silver, Oil and the Spoo appear for now to have peaked. Following Gold’s “Baby Blues” falling below their key +80% level, price (now 1974) has since weakened to as low as 1963 yesterday; the Blues in real-time continue to drop as do those for the Swiss Franc, Silver and Oil. The “live” (fut’s adj’d) P/E of the S&P is now 42.5x and the Gold/Silver ratio a very “Silver-attractive” 87.4x despite the present Blues negativity. The Econ Baro awaits September’s Wholesale Inventories.

07 November 2023 – 09:03 Central Euro Time

All eight BEGOS Markets are in the red and all at present (save for the Bond) are below their respective Neutral Zones for today; volatility is mostly moderate. Gold confirmed its “Baby Blues” (see Market Trends) dropping below their key +80% level; priced now at 1976, we can see 1946 trading near-term, well within the context of the support zone described in the current edition of The Gold Update. By Market Rhythms, the most consistent on a 10-test basis is the Euro’s daily Moneyflow which has been near or at the top of all 405 studies now for some time; on a 24-test basis, both the Bond’s 15mn Parabolics and Moneyflow studies top the list, along with the Spoo’s 15min Parabolics. The Econ Baro’s rather “un-busy” week looks to September’s Trade Deficit and Consumer Credit.

06 November 2023 – 08:33 Central Euro Time

The BEGOS Markets’ volatility is light-to-moderate as the new week unfolds. At present, Copper is above its Neutral Zone for today, whilst Gold is below same. The Gold Update anticipates a typical post-geopolitical price pullback is nigh; indeed at Market Trends, Gold’s “Baby Blues” are in real-time slipping below their key +80% axis, (as have Silver’s already so done); confirmation of the “Baby Blues” settling below that level generally leads to lower prices near-term; too, Gold by Market Values is (in real-time) +106 points above its smooth valuation line. Despite all the excitement over the S&P’s recent rally, price has merely returned to where ’twas three weeks ago, the P/E ratio accelerating last week now to 40.9x as Q3 Earnings Season remains rather average at best; (’twas 39.0x those three weeks ago). Nothing is due today for the Econ Baro as it faces a fairly light load this week with just six metrics due through Friday.

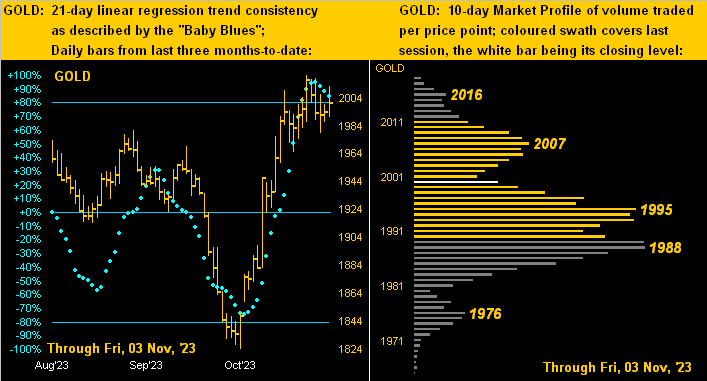

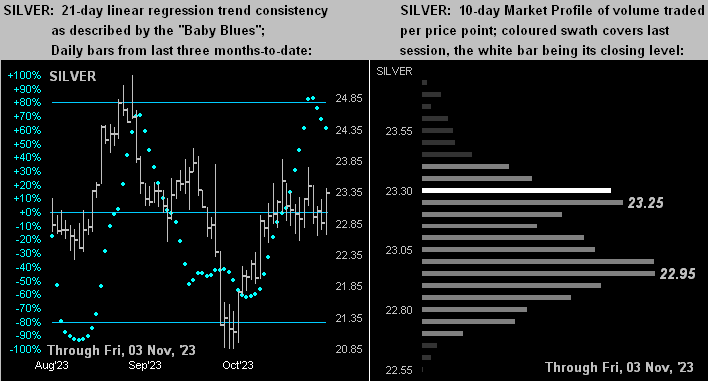

03 November 2023 – 09:02 Central Euro Time

Silver is the only BEGOS Market at present outside (below) today’s Neutral Zone; session volatility is light with October’s Payrolls data in the balance. Yesterday’s +1.9% S&P 500 rise was sufficient to fully unwind the “textbook oversold” stance that had been in place since 23 October; too on Thursday, the S&P’s P/E rose from 34.7x to now 38.8x: with still some 100 Q3 earnings reports due for the S&P, fully one-third thus far have not improved their year-over-year bottom lines; (as penned in last Saturday’s edition of The Gold Update, for the S&P we’re seeing that “…bounce before the next trounce…”); and by Market Values, this bounce has lifted the Spoo up to its smooth valuation line, price back to where ’twas two weeks ago. In addition to the Econ Baro’s incoming jobs data, we’ve also October’s ISM(Svc) Index.

02 November 2023 – 09:01 Central Euro Time

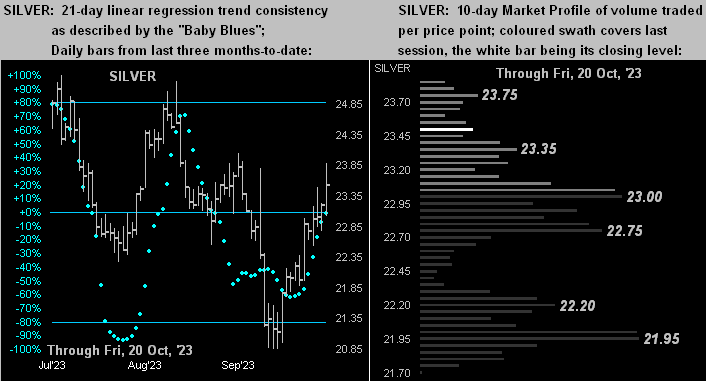

Post-Fed the EuroCurrencies are getting a bid, both the Euro and Swiss Franc at present above their respective Neutral Zones for today, as is Copper; the other BEGOS Markets are within same, and volatility is light-to-moderate. Silver confirmed its “Baby Blues” (see Market Trends) moving below the key +80% level, indicative of lower prices near-term: we are eying 22.18 (current is 23.10) barring geo-political price-rise resumption. As the S&P 500 works through Q3 Earnings Season, with 318 constituents having thus far reported, 65% have bettered their bottom lines from a year ago; however more broadly, only 52% have improved. For the Econ Baro, today’s incoming metrics include the initial read of Q3 Productivity and Unit Labor Costs, plus September’s Factory Orders.

01 November 2023 – 09:00 Central Euro Time

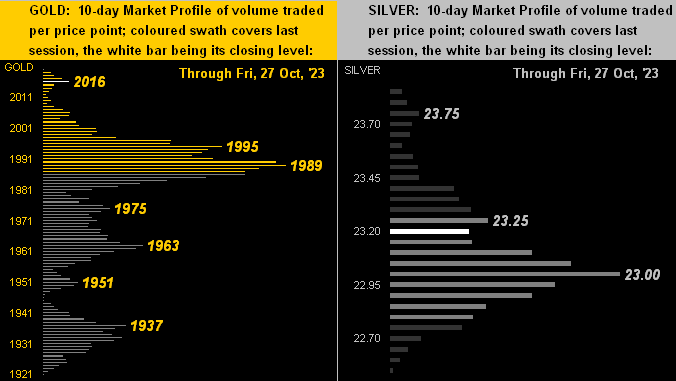

As Mid-East headlines fall a bit from above the fold, so too falling are the precious metals’ prices: both Gold and Silver are at present below their Neutral Zones for today; the other BEGOS Markets are within same, and volatility is light with the FOMC’s Policy Statement in the balance. By Market Profiles, Gold is testing its 1989 trading support, the next such level being 1963; for Silver, its key 23.00 level is being tested. Also by Market Trends, Gold’s “Baby Blues” have started to roll over to the downside, and moreover, those for Silver (in real-time) have provisionally dropped below their +80% level suggestive of lower prices near-term. The Econ Baro looks to October’s ADP employment data and ISM Index, plus September’s Construction spending.

31 October 2023 – 08:59 Central Euro Time

The Bond is at present above its Neutral Zone for today; the balance of the BEGOS Markets are within same, and volatility is again light-to-moderate; thereto of note, whilst not (yet) a BEGOS component, the Yen has traced 235% of its EDTR (see Market Ranges for those of the BEGOS Markets) as the BOJ maintains its long-term debt rate of 0% (as opposed to going negative). StateSide, the S&P 500 yesterday gained +1.2%: however the MoneyFlow was only +0.5%, indicative of the relief rally (from the Index’s still “textbook oversold” condition) lacking substance. Going ’round the Market Values page (in real-time) for the primary BEGOS Markets, we’ve the Bond nearly +3 points “high” above its smooth valuation line, the Euro +0.016 points “high”, Gold +131 points “high”, Oil -4.89 points “low” and the Spoo -143 points “low”. The Econ Baro awaits October’s Chicago PMI and Consumer Confidence, plus Q3’s Employment Cost Index.

30 October 2023 – 09:05 Central Euro Time

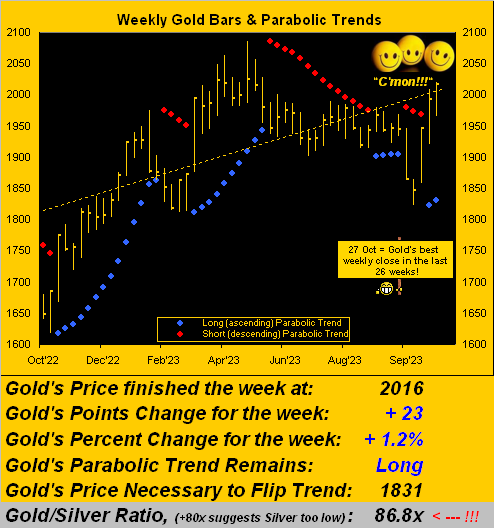

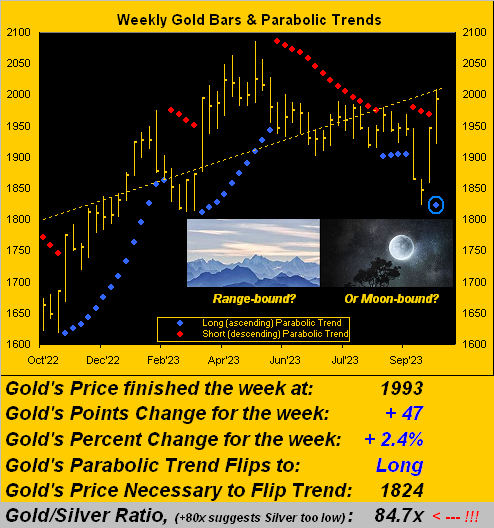

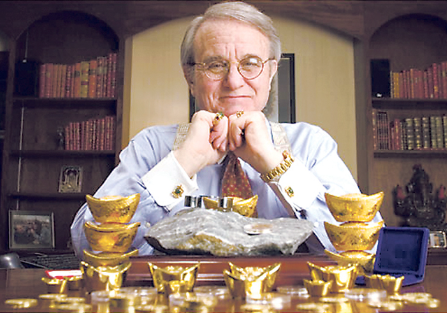

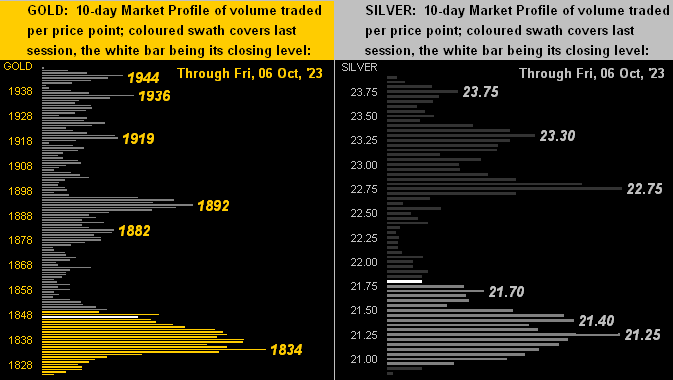

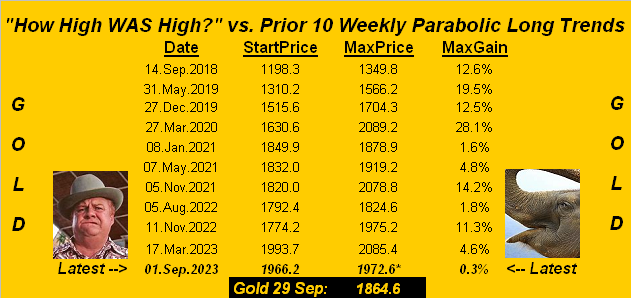

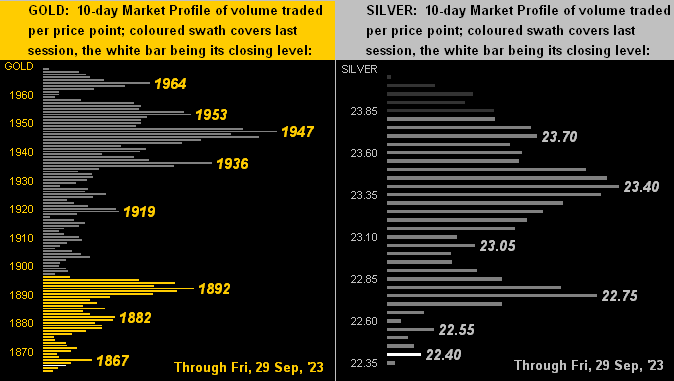

The “textbook oversold” S&P 500 looks to get a boost at the open, the Spoo at present above today’s Neutral Zone; below same are both Gold and Oil, and volatility is light-to-moderate. The Gold Update reiterates the yellow metal still as “range-bound” rather than “moon-bound”: 1989 is dominant trading support by the 10-day Market Profile; we’re wary as well that by Market Values, Gold (in real-time at 2005) is +131 points above its smooth valuation line. Leading the Market Rhythms for consistency (10-test basis) is Silver with a variety of studies: its daily Parabolics, 12hr MACD, 8hr Price Oscillator, and both the 6hr Price Oscillator and Moneyflow; too, is the Euro’s daily Moneyflow. ‘Tis a busy week for the Econ Baro with 15 metrics on the table, (none due today).

27 October 2023 – 09:01 Central Euro Time

The Bond is at present below its Neutral Zone for today, whilst above same are Copper, Oil and the Spoo; BEGOS Market’s volatility is mostly light. As tweeted (@deMeadvillePro) last evening, we’re finally seeing some “fear” in the Flow, the S&P 500 falling -1.2% yesterday, but its MoneyFlow regressed into S&P points was -2.4%; still, the Index for the present is “textbook oversold”, so perhaps some bounce to unwind that condition, followed then by lower levels sub-4000 (S&P at present is 4137). At Market Trends, the Swiss Franc’s “Baby Blues” have (in real-time) provisionally slipped below their +80% level, suggestive of lower prices near-term, which coincident with a Fed rate hike would further foster Dollar strength. Indeed ahead of next Wednesday’s FOMC Policy Statement, the Econ Baro’s incoming metrics for today include the “Fed-favoured” Core PCE Price Index along with the month’s Personal Income/Spending.

26 October 2023 – 09:03 Central Euro Time

At present we’ve the Metals Triumvirate higher and the EuroCurrencies lower. Notably for the second straight session (to this point), both Gold and the Dollar are gaining, (“Gold plays no currency favourites”). The Spoo continues to work lower: as we’ve (yet) to see “fear” in the S&P’s MoneyFlow, (when otherwise Flow falls at a faster rate than the Index itself), this feels mildly reminiscent of the old so-called “Gentlemen’s Crash”, although hardly has price fallen nearly to any crash proportion. These next two days have key incoming metrics for the Econ Baro ahead of next Wednesday’s FOMC Policy Statement: today we await the first peek at Q3’s GDP, along with other reports including September’s Durable Orders and Pending Home Sales.

25 October 2023 – 09:07 Central Euro Time

At present, all eight BEGOS Markets are within their respective Neutral Zones for today, and volatility is at best light. In looking at Market Rhythms on a 10-test basis, the most profitably consistent through yesterday are Silver’s 8hr Price Oscillator, 12hr MACD, 6hr Moneyflow and daily Parabolics, plus Oil’s 4hr Moneyflow, the Euro’s daily Moneyflow, and the Swiss Franc’s daily MACD. On a 24-test basis, the best is Gold’s 1hr Price Oscillator. By our S&P MoneyFlow page, we’ve still yet to detect any real fear, even as our “live” P/E (futs-adj’d) is now 36.9x. The Econ Baro gets its back-loaded week underway with September’s New Home Sales.

24 October 2023 – 09:02 Central Euro Time

The Bond, Gold and Copper are at present above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is light, save for Copper having already traced 67% of its EDTR (see Market Ranges). By Market Values we’ve Gold in (real-time) +107 points above its smooth valuation line. In tandem with the Dollar having weakened across the past two weeks, by Market Trends the linregs for Gold, Silver, the Euro and Swiss Franc all have rotated to positive; those for the other four BEGOS components remain negative. Yet Silver is still a laggard to Gold, the G/S ratio at 86x vs. the century-to-date average of 68x: as we from time-to-time quip in The Gold Update: “Don’t forget the Silver!”

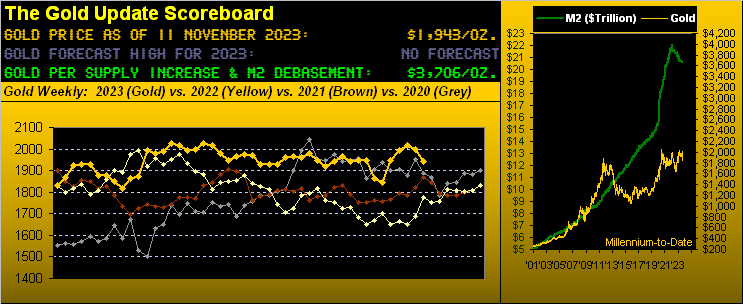

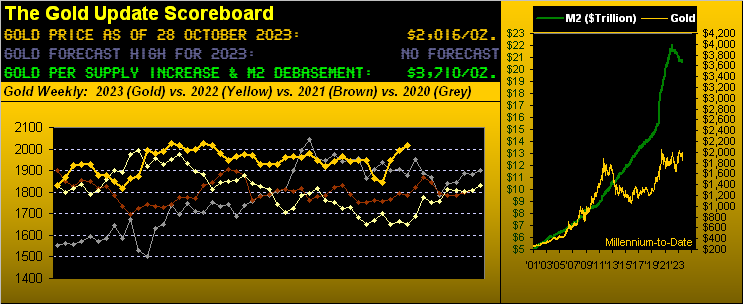

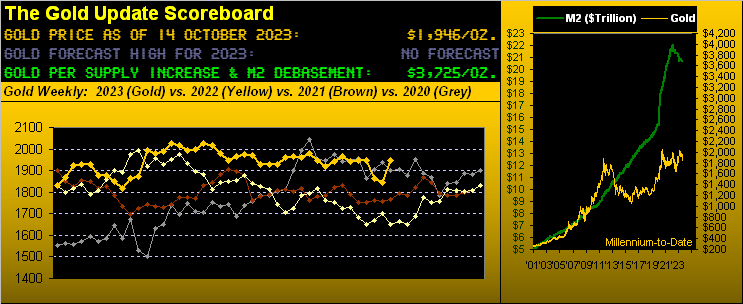

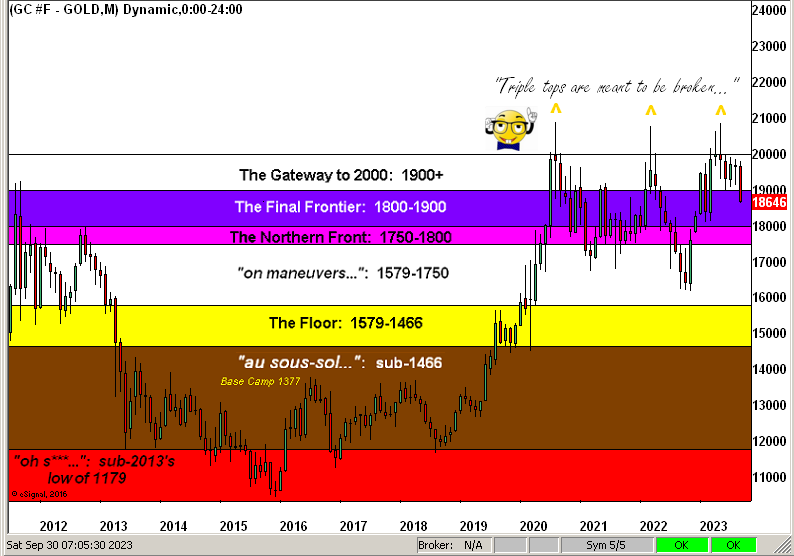

23 October 2023 – 09:24 Central Euro Time

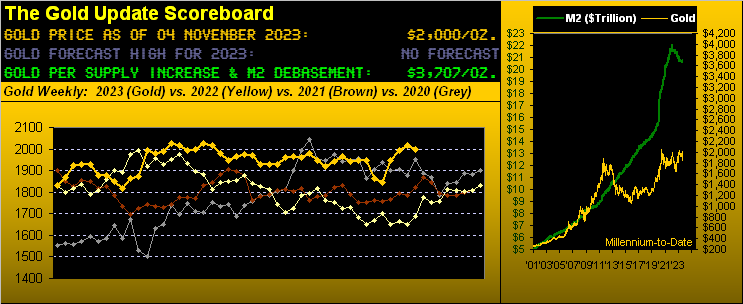

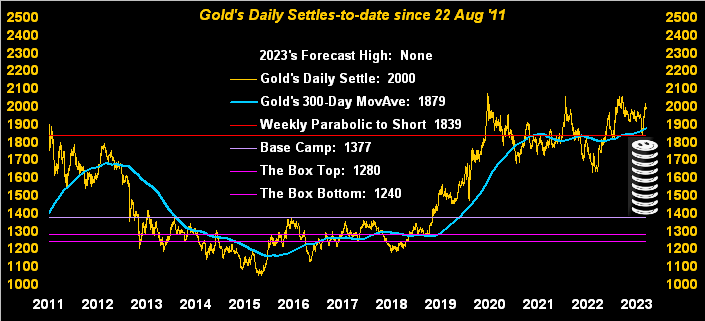

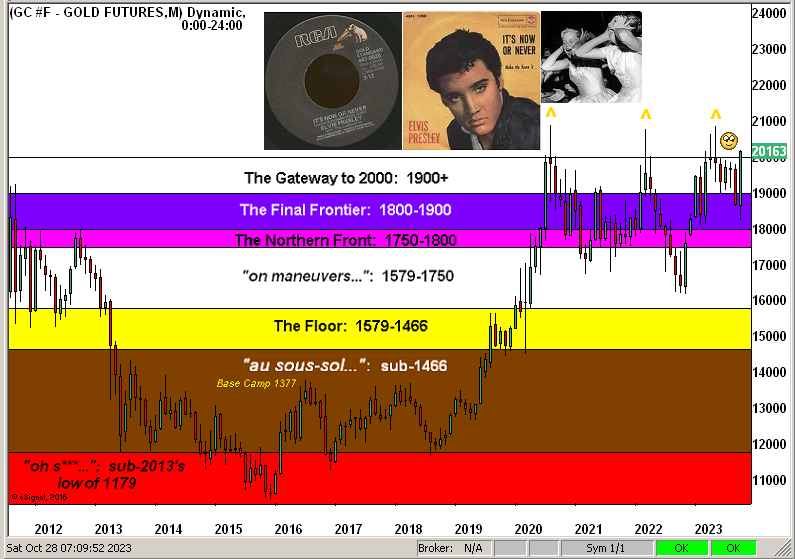

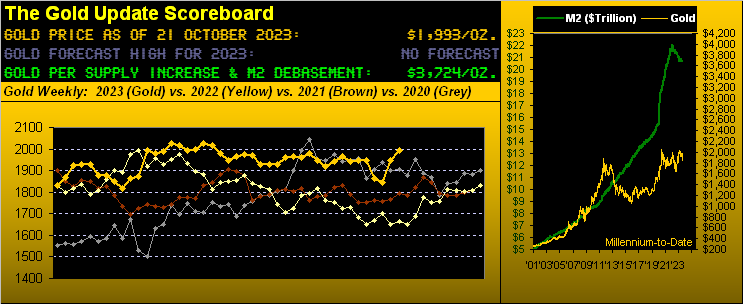

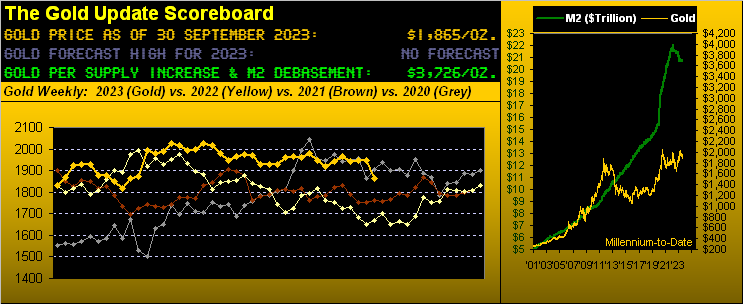

Save for the Spoo, the other seven BEGOS Markets are in the red, all at present below their respective Neutral Zones for today; session volatility is pushing toward moderate. The Gold Update sees the yellow metal as remaining “range-bound” until the All-Time High (2089 vs. the current 1986) is eclipsed, (from which Gold then becomes “moon-bound”, ideally to its present Dollar debasement value of 3724). The Econ Baro is back-loaded this week from Wednesday on, key reports including Q3 GDP and the “Fed-favoured” Core PCE Index. And thus far, Q3 earnings by year-over-year comparison is relatively weak: mind our Earnings Season page.

20 October 2023 – 08:53 Central Euro Time

Per our tweet (@deMeadvillePro) last evening, “Flow leads dough…” as is now being depicted on the MoneyFlow page for the S&P 500; too, our notion of the Spoo attaining the 4500 level at least near-term (based on the upside reversal at Market Trends of the “Baby Blues” two weeks ago) is now nixed, even as the Spoo’s 21-day linreg trend has just turned positive; again, 4431 nears to clear for a run to 4500. Today at present, the Bond is above its Neutral Zone; both the Euro and Copper are below same, and BEGOS Markets volatility is mostly light, within the context of Market Ranges (EDTRs) having expanded. Gold’s EDTR is now 26 points, meaning that 2000+ is within range today; presently 1987, Gold’s nearest dominant Market Profile supporter is 1963. The Econ Baro is scheduled to close its week with September’s Treasury Budget.

19 October 2023 – 09:04 Central Euro Time

Narrow ranges thus far characterize the BEGOS Markets: only the Bond is at present outside (below) its Neutral Zone for today, and volatility is notably light, the Bond with the widest EDTR tracing to this point (see Market Ranges) at just 37%. Gold’s weekly parabolic trend has provisionally flipped from Short to Long, (confirmation to come upon Friday’s settle); price, which just two weeks ago was better than -100 points below its smooth valuation line (see Market Ranges) is now (in real-time) 71 points above same. As for the Spoo, should the recent 4431 high not be eclipsed, our 4500 notion likely gets nixed. Incoming metrics for the Econ Baro include October’s Philly Fed Index plus September’s Existing Home Sales and Leading (i.e. “lagging”) Indicators.

18 October 2023 – 10:53 Central Euro Time

The Metals Triumvirate and Oil are the BEGOS Markets’ leaders thus far, those four all at present above today’s Neutral Zones; below same is the Bond, and volatility is moderate. On a $/cac basis, Silver is the broadest mover, at present +$1725. At Market Trends, the Spoo’s “Baby Blues” appear poised to break above their 0% axis by week’s end: again from the week prior we’ve ruminated about the Spoo making a go for 4500, (the S&P’s vastly high “live” P/E of 38.3x notwithstanding). And per the Euro’s page, its best Market Rhythm — the daily MoneyFlow study — triggered a Long signal per yesterday’s open (1.05885). For the Econ Baro we’ve September’s Housing Starts/Permits; then late in the session comes the Fed’s Tan Tome for October.

17 October 2023 – 09:03 Central Euro Time

‘Tis red across the board for the BEGOS Markets, notably with the Bond, Euro, Gold, Copper and Oil all at present below their respective Neutral Zones for today; volatility however is mostly light. On a $/cac change basis, Copper’s is the most at the moment, -$1,012. At Market Trends, whilst all eight components are still in negative linreg trends, all their “Baby Blues” are in ascent, meaning the trends’ downside consistencies are waning. By the Spoo’s Market Profile the most dominant resistor above present price (4394) is 4401. And Oil’s cac volume is rolling from November into December. For the Econ Baro we await October’s NAHB Housing Index, September’s Retail Sales and IndProd/CapUtil, and August’s Business Inventories.

16 October 2023 – 09:12 Central Euro Time

We begin the week with both the Euro and Copper at present above today’s Neutral Zones; below same are the Bond, Gold and Silver. With respect to the yellow metal, note in the current edition of The Gold Update the “tease” as regards Friday’s “Hobson Close”; should Gold further dip, we see structural support in the 1898-1881 zone; as well, 1885 is a key Market Profile support apex for Gold. BEGOS Markets volatility is light-to-moderate. The Econ Baro’s busy week of 14 incoming metrics starts today with October’s NY State Empire Index. And mind our Earnings Season page with reports for Q3 picking up the pace as the week unfolds.

13 October 2023 – 08:58 Central Euro Time

The Bond, Gold and Silver are at present above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is quite light. Even as equities struggled yesterday, there remains no “fear” for the S&P 500 per our cap-weighted MoneyFlow page. Further per our Market Trends page, the Spoo’s “Baby Blues” in real-time continue their ascent; our best Market Rhythm at present for the Spoo on a 10-test basis is its 6hr Moneyflow study; on a 24-test basis ’tis the daily Price Oscillator study. To wrap the week for the Econ Baro, September’s Treasury Budget has been moved to next week; however today we’ve the month’s Ex/Im Prices, plus October’s UofM Sentiment Survey.

12 October 2023 – 08:59 Central Euro Time

Money is moving into the BEGOS Markets this morning: at present, the Bond, Euro, Swiss Franc, Gold, Silver and Copper all are above today’s Neutral Zones; otherwise, Oil and the Spoo are within same, and volatility is again light. At Market Trends, even as all eight components remain in linreg downtrends, respective “Baby Blues” are rising, (save those for Oil). Gold has significantly firmed on the geo-political bid, prior to which price was better than -100 points below its smooth valuation line (see Market Values): that reading in now real-time is just -19 points; whilst as noted the yellow metal tends to decline following geo-political price spikes, price already was overly low pre-event. More in this coming Saturday edition of The Gold Update. The Econ Baro awaits metrics including September’s CPI and the Treasury Budget (originally listed for yesterday).

11 October 2023 – 09:12 Central Euro Time

Copper is the sole BEGOS Market at present outside (above) its Neutral Zone; session volatility is light. As tweeted (@deMeadvillePro) last night, the Spoo did confirm its “Baby Blues” (see Market Trends) moving above the key -80% axis, inferring high price levels: structurally there appears room to move near-term to 4500 (present price is 4393); ‘course as we regularly cite, fundamentally the S&P remains significantly overvalued, its “live” P/E at 38.8x. Gold has (yet) not returned to its pre-Middle East event level of the 1830s: typically such price retrenchments occur following geo-political price-spikes; current price is 1877. The Econ Baro looks to September’s PPI and the month’s Treasury Budget; late in the session we’ve the minutes from the FOMC’s 19-20 September meeting.

10 October 2023 – 09:08 Central Euro Time

A whirl ’round day yesterday for the S&P, arguably getting a safe-haven bid given events in the Middle East; as well the S&P is now “textbook oversold” through 13 days and the MoneyFlow differential is still positive, indicative of “fear” remaining at bay; moreover at Market Trends, the Spoo’s “Baby Blues” are in real-time moving above their -80% level, indicative of further price rise near-term. For today at present, Gold, Copper and Oil are below their respective Neutral Zones for today; the balance of the BEGOS Markets are within same, and volatility is light-to-moderate. And for the Econ Baro we await August’s Wholesale Inventories.

09 October 2023 – 08:58 Central Euro Time

Expectedly, given the incursion in the Middle East, Gold gapped notably higher at last night’s open and the Spoo notably lower. The latter along along with the Euro are at present below today’s Neutral Zones, whilst above same are the Bond, Metals Triumvirate and Oil; BEGOS Markets’ volatility is moderate. The Gold Update looks to 1800 as support: whilst the geo-political event has given Gold the typical boost, history reminds us that such spikes tend to reverse themselves as the ensuing days unfold; still (in real-time) Gold now at 1865 is -66 points below its smooth valuation line (see Market Values). And of course broadly, Gold remains vastly undervalued by currency debasement and the S&P 500 vastly overvalued by unsupportive earnings.

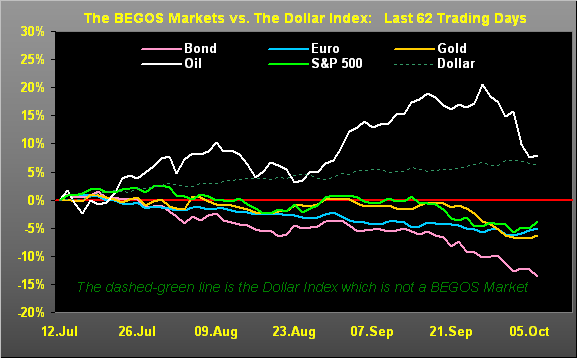

06 October 2023 – 08:58 Central Euro Time

The Eurocurrencies are the weak link thus far with both the Euro and Swiss Franc below today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is light with September’s Payrolls data due (12:30 GMT). Oil having come off, all eight BEGOS components are now in negative 21-day linear regression downtrends. Specific to the S&P 500, there remains no sight of “fear” given the positive differentials of Index change vs. flow per our MoneyFlow page; too, by “textbook technicals”, the S&P stands as “oversold” through 11 trading days; ‘course, the big fundamental bug-a-boo remains the “live” P/E now 37.6 (futs adj’d real-time). In addition to Labor’s jobs data, the Econ Baro also awaits August’s Consumer Credit late in the sessdion.

05 October 2023 – 09:01 Central Euro Time

With EDTRS (see Market Ranges) having ramped up of late, the BEGOS Markets are notably subdued this morning, all eight components at present within their respective Neutral Zones for today; volatility is light-to-moderate. As tweeted (@deMeadvillePro) last evening, Oil (the Market Trends sell signal via the “Baby Blues” having come 7 trading sessions ago on 26 September, albeit price initially zooming higher still into the 95s) has finally come off down into the 84s; price has thus finally returned to its smooth valuation line (see Market Values). As for Gold, currently 1836, ’tis (in real-time) -107 points below its smooth valuation line. Today’s incoming metrics for the Econ Baro include August’s Trade Deficit.

04 October 2023 – 09:05 Central Euro Time

Red returns to the BEGOS Markets this morning for all eight components, only three of which are not at present below their Neutral Zones (Euro, Silver, Oil). Session volatility is again moderate to this time of day, and indeed by Market Ranges, EDTRs are (finally) turning upward toward more relatively “normal” levels across the last 12 months. By Market Rhythms: on a 10-test basis the Euro’s daily Moneyflow study is our most consistent, followed by Silver’s 12hr MACD and then again the Euro’s 4hr Parabolics; on a 24-test basis, the best of the bunch is Copper’s 1hr Parabolics. Mind our Earnings Season page as that for Q3 is underway. And for the Econ Baro today we’ve September’s ADP Employment along with the ISM(Svc) Index, plus August’s Factory Orders.

03 October 2023 – 09:02 Central Euro Time

The gutting of Gold (1839) continues, the Dollar Index approaching its 107 handle, a level not seen since November 2021. However, Gold by Market Values is (in real-time) -115 points below its smooth valuation line, a fairly historical extreme: such prior deviation (per 01 July 2021) then found Gold move up by better than +200 points into the start of the 2022 RUS/UKR conflict, even as the Dollar strengthened across the same stint; (more on that in next Saturday’s edition of The Gold Update). At present, Gold is below today’s Neutral Zone, as are the Swiss Franc and Copper; none of the other BEGOS Markets are above same, and volatility is again moderate. At Market Trends, Oil’s “Baby Blues” are (in real-time) accelerating their drop: with the two recent daily lows in the 88s having been breached, the next structural low is 85.49. The Econ Baro is quiet today ahead of 10 metrics due tomorrow through Friday. And Q3 Earnings Season begins this morning.

02 October 2023 – 09:07 Central Euro Time

The BEGOS Markets begin October on a mixed note. At present, we’ve the Bond, Gold and Silver below today’s Neutral Zones, whilst above same are the Swiss Franc, Copper and the Spoo; volatility is moderate. The Gold Update confirms the yellow metal’s weekly parabolic trend as having flipped to Short; and as anticiapted, such trend for Silver today has provisionally flipped as well to Short. Oil continues to flirt with its 90 handle: at Market Trends, Oil’s “Baby Blues” are slowly slipping lower; and at Market Values in real-time, Oil is +7.36 points above its smooth valuation line; price has not been below such line since 03 July, (price then 69.53 vs. today’s 91.24). The Econ Baro awaits September’s ISM(Mfg) Index and August’s Construction Spending.

29 September 2023 – 09:09 Central Euro Time

Following its fourth-consecutive down day, Gold is at present above its Neutral Zone as are Silver, Copper, the Euro and Swiss Franc; none of the other BEGOS Markets are below same, and volatility is moderate-to-robust, the white metal already having traded 108% of its EDTR (see Market Ranges). Oil, which yesterday traded its widest high-to-low range (-3.64 points) since 22 June, still finds its “Baby Blues” (see Market Trends) not having recovered their +80% level, (thus Tuesday night’s Sell signal remains intact if not over-ridden by prudent cash management): price yesterday reached to as high as 95.03 vs. the present 91.71; 90.50 continues as Market Profile support, followed somewhat structurally by the low 88s. Among today’s income metrics for the Econ Baro we’ve September’s Chi PMI, plus August’s Personal Income/Spending along with the Fed-favoured inflation gauge: the Core PCE Index.

28 September 2023 – 09:09 Central Euro Time

Gold’s weekly parabolic trend has provisionally flipped from Long to Short, (as tweeted [@deMeadvillePro] last evening); more on this outlying exception in next Saturday’s edition of The Gold Update. Tweeted too was Oil’s breaking above its recent high (93.74) such that from a cash management perspective ’tis better to stand aside for the moment. At present, Silver is the sole BEGOS Market outside (below) today’s Neutral Zone: currently 22.70, should 22.32 trade, its weekly parabolic trend would also, like Gold, flip to Short. As for the S&P 500, its down-stint during these past two weeks has lacked “fear” as revealed our MoneyFlow page. Today’s metrics for the Econ Baro include August’s Pending Home Sales and the final read of Q2 GDP.

27 September 2023 – 09:06 Central Euro Time

The BEGOS Markets are at present mixed: both the Swiss Franc and Gold are below their Neutral Zones, whilst above same are both the Bond and Oil; volatility is pushing toward moderate. Gold is a disappointment: trading to as low as 1913, should 1905.1 (precisely) trade, the weekly parabolic Long trend shall provisionally flip to Short. As for Oil, despite it being up today, its “Baby Blues” did confirm settling yesterday below their key +80% axis: the price area of 87 to 85 shows some degree of structural support, whilst nearer Market Profile support shows at 90.50; and by Market Values, Oil’s smooth valuation line (in real-time) is 83.19. The Econ Baro looks to August’s Durable Orders.

26 September 2023 – 09:10 Central Euro Time

Red is the watchword for the BEGOS Markets, all of which at present are below their respective Neutral Zones for today. Session volatility is moderate across the board, which is refreshing given the otherwise narrower-than-average EDTRS (see Market Ranges). Oil (currently 88.69) has its real-time “Baby Blue” dot at +78%: if this provisional sub +80% level is confirmed by close, we look to lower price levels, just as was the case some five weeks ago, albeit the downside follow-through from that signal was muted; the average price follow-through of the four “Baby Blues” signals that have occurred from one year ago-to-date is 5.7 points, (which in that vacuum alone from here “suggests” the 83s, without regards for other measurings). The Econ Baro gets its week going with September’s Consumer Confidence and August’s New Home Sales.

25 September 2023 – 09:00 Central Euro Time

The Bond begins its week on a down note, at present trading below today’s Neutral Zone; the balance of the BEGOS Markets are within same, and volatility is mostly light. The Gold Update points to price’s still not being able to get off the mat even as the weekly parabolic trend enters its fifth week of being Long. As for Oil (currently 90.58), its “Baby Blues” (in real-time) have further slipped to the +86% level as we continue to watch for the +80% level to be breached, toward then anticipating lower price levels; at Market Values, Oil is +7.85 points above its smooth valuation line. The Econ Baro looks to 12 incoming metrics for the week, (with none due today), notably featuring the Fed’s favoured inflation gauge of the Core PCE Index for August come Friday.