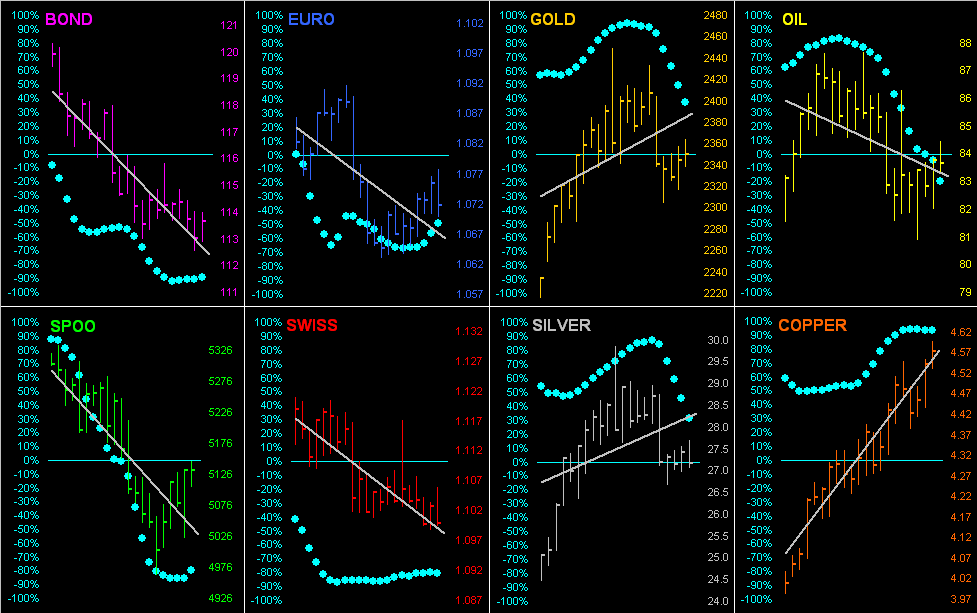

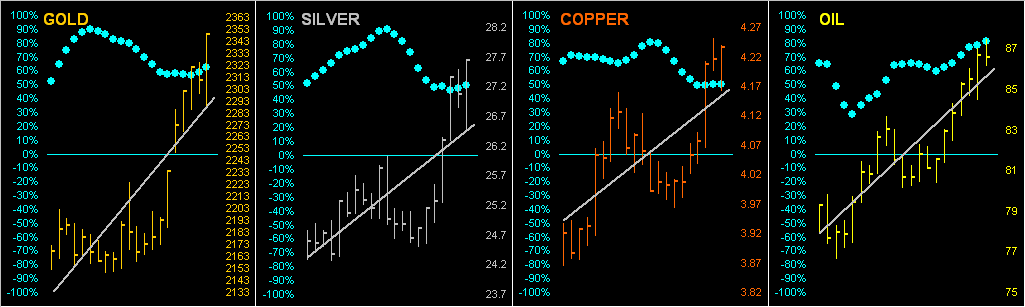

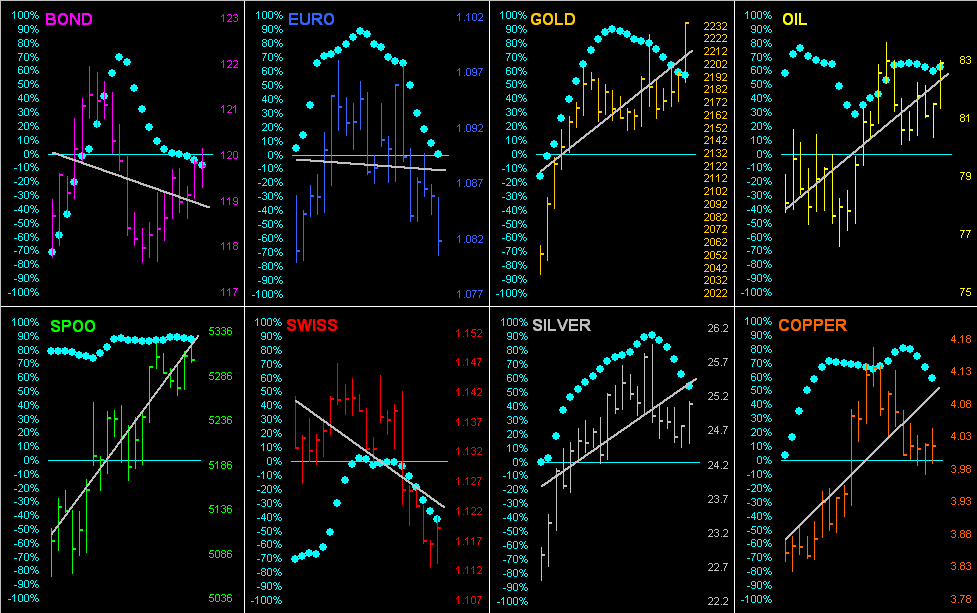

Copper is the sole BEGOS Market at present outside (above) today’s Neutral Zone; the red metal continues to be in play, having already traced 146% of its EDTR (see Market ranges); otherwise, session volatility for the other components is light with a bevy of EconData in the day’s balance. Looking at Market Trends we’ve only two with negative linregs: Gold and Oil; until the former clears at least 2385 (the Golden Ratio retracement cited in the current edition of The Gold Update), the recent near-term correction would technically remain in place; Gold at present is 2362 and its EDTR is 35 points. The Econ Baro’s busy day looks to May’s NY State Empire Index, Business Inventories and NAHB Housing Index, plus April’s reads on retail inflation (CPI) and Retail Sales.

Mark

Mark

14 May 2024 – 08:25 Central Euro Time

Both Silver and Copper are at present above their respective Neutral Zones for today; the other BEGOS Markets are within same, and volatility pre-StateSide inflation data is very light. Of the 405 Market Rhythms we test nightly, Copper (on a 10-test swing basis) is leading for consistency by its 30mn MACD; second-best is Gold’s 12hr Parabolics; too (on a 24-test swing basis) Copper’s 1hr MACD leads for consistency, followed again by its 30mn MACD. As well, Copper is the only BEGOS Market for which its EDTR (see Market Ranges) widened yesterday both day-over-day and week-over-week: thus vis-à-vis the whole bunch, Copper is most in play. And as noted, today the Econ Baro awaits April’s inflation at the wholesale level (PPI).

13 May 2024 – 08:37 Central Euro Time

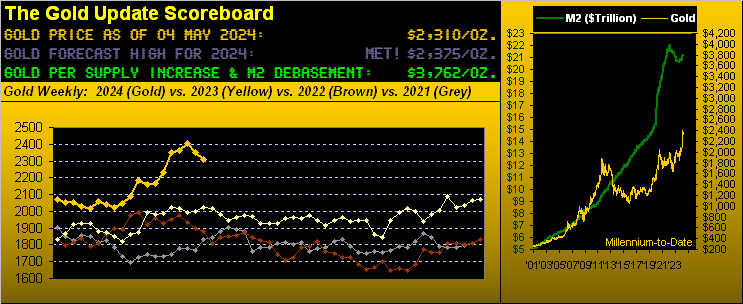

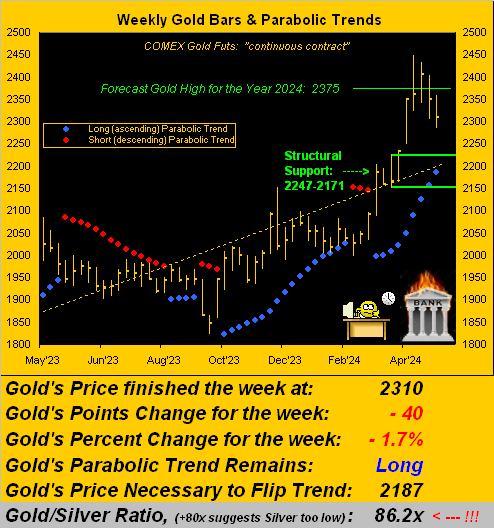

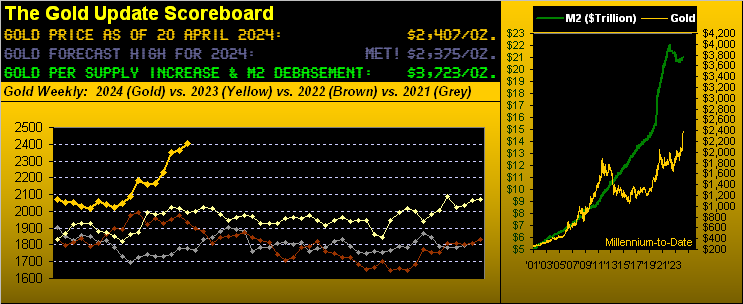

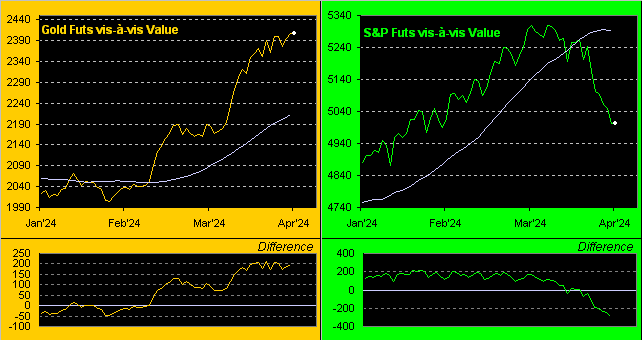

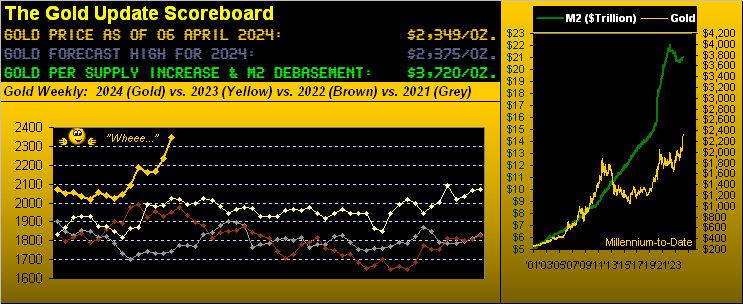

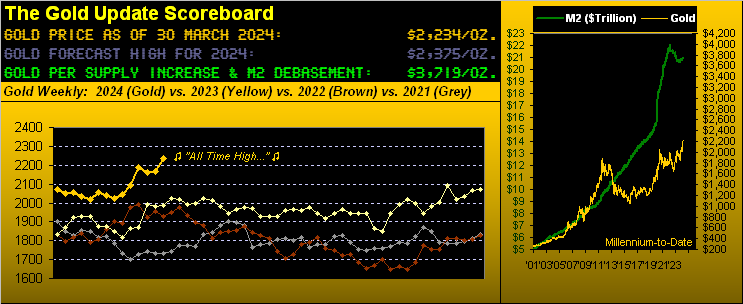

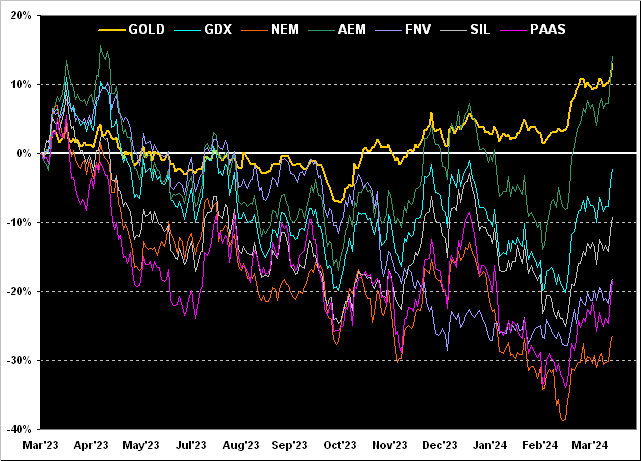

The week begins with Gold at present below its Neutral Zone for today; the balance of the BEGOS Markets are within same, and volatility is light. The Gold Update inconclusively questions as to whether or not the yellow metal’s recent correction off its All-Time High (2449 on 12 April) has run its course: Gold’s rally this past week went precisely up to the perfect Golden Ratio fib retracement at 2385 (from the correction’s low [thus far?] of 2285), but has since pulled back (now 2358); too, by Market Values, Gold (in real-time) is +54 points above its smooth valuation line, and by Market Trends, the linreg remains negative. Whilst the Econ Baro is quiet today, a very busy week awaits with 18 metrics due, including those for April’s wholesale (PPI) and retail (CPI) inflation. As well, this is the final week of Q1 Earnings Season, which by year-over-year comparison has been rather mediocre (and thus is why the P/E of the S&P remains treacherously high, the “live” reading 39.2x).

10 May 2024 – 08:37 Central Euro Time

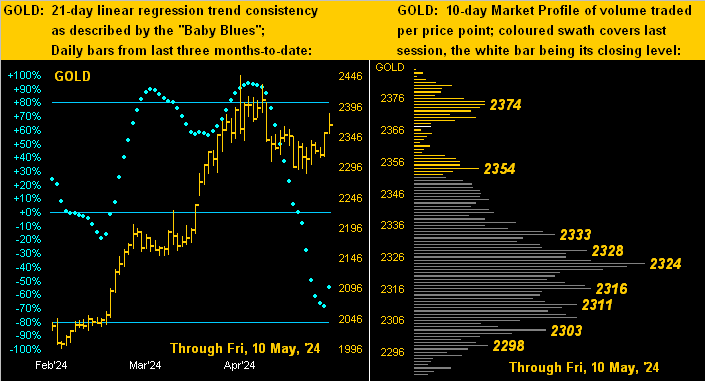

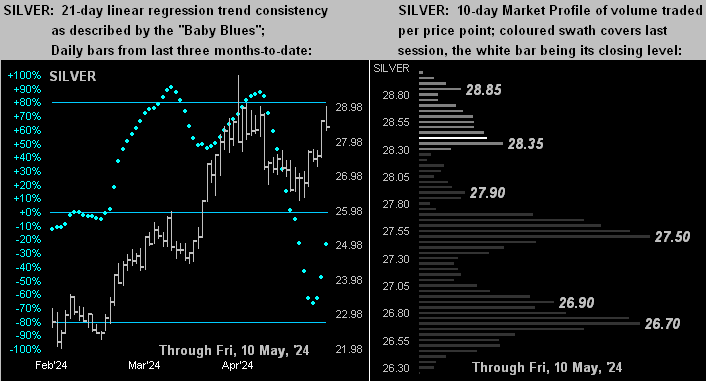

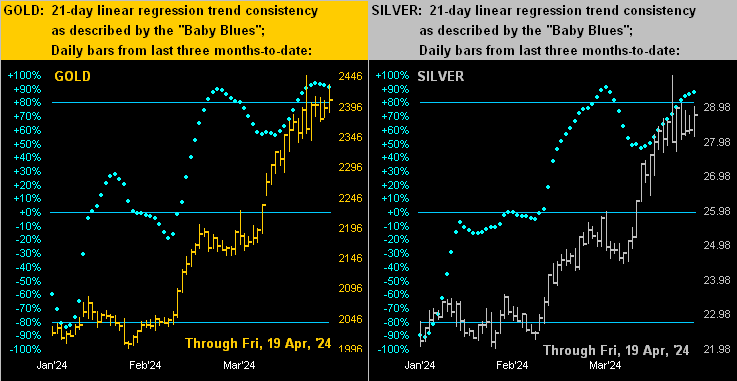

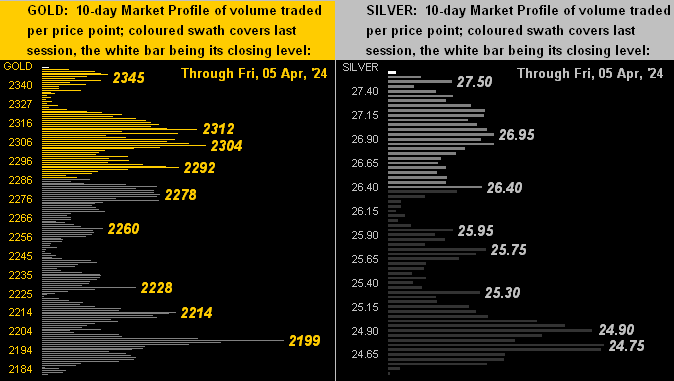

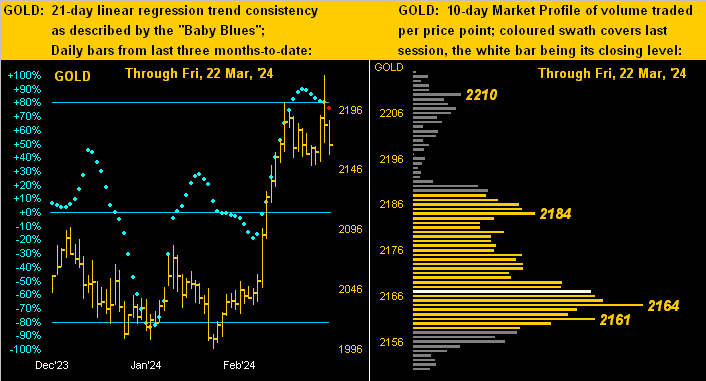

The Metals Triumvirate is on the move this morning as Gold, Silver and Copper are getting the bid, all at present above today’s neutral Zones; the other BEGOS Markets are within same and volatility is mostly light, the exception being Copper having already traced 73% of its EDTR (see Market Ranges). Gold appears on track for a positive weekly close for the first time since that ending 20 April; in real-time, the yellow metal still is +70 points above its smooth valuation line (see Market Values); and at Market Trends, Gold’s linreg remains negative, however the “Baby Blues” therein have today lurched to the upside, and the “textbook technicals” have begun turning positive; more on it all of course in tomorrow’s 756th consecutive Saturday edition of the Gold Update. In a day replete with FedSpeak, the Econ Baro concludes its week with May’s UoM Sentiment Survey and April’s Treasury Budget.

09 May 2024 – 08:31 Central Euro Time

At present we’ve the Bond below its Neutral Zone for today, whilst Silver is above same; BEGOS Markets’ volatility by this hour remains quite light, again in a week with little incoming EconData. Looking at Market Rhythms for pure swing consistency, on a 10-test basis our leader is Copper’s 1hr MACD; on a 24-test basis ’tis the Swiss Franc’s 30mn Moneyflow. By Market Trends, when just recently Copper was sporting the only positive linreg, positive too now are those for the Bond, Euro, Swiss Franc and Spoo; ’tis indicative for Fed rate cut expectations. Our best correlation amongst the five primary BEGOS components is positive between the Bond and the Euro. Simply today for the Econ Baro arrives last week’s Initial Jobless Claims.

08 May 2024 – 08:38 Central Euro Time

Both Copper and Oil are at present below today’s Neutral Zones; the other BEGOS Markets are within same, and volatility is again light. The Euro has yet to respond to its positive crossing of the smooth valuation line (see Market Values); still (in real-time), the Euro’s “Baby Blues” are now rising above their 0% axis, (see Market Trends) the linreg having turned positive; Market Profile support for the Euro is 1.07000; too, the Euro’s Best Market Rhythm (see the Euro’s page) is its daily Price Oscillator which appears poised to turn positive: 7 of the past 10 Price Oscillator crossings for the Euro (in either direction) have generated follow-through of at least 0.02000 points ($2,500/cac). Today for the Econ Baro we’ve March’s Wholesale Inventories.

07 May 2024 – 08:35 Central Euro Time

Both the Swiss Franc and Silver are currently below today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is light. We’re minding the Euro, as Friday (by Market Values) the currency confirmed a positive crossover of price above its smooth valuation line: the average follow-through of such crossings from a year ago-to-date is some 0.019 points, which from Friday’s settle at 1.07815 “suggests” the Euro reaching up toward the 1.10s; (the Euro is at present 1.07745); obviously “average” hardly is forward reality, however as “Fed rate cut” expectations are renewing, that has taken some puff out of the Dollar. Late in today’s session the Econ Baro looks to March’s Consumer Credit.

06 May 2024 – 08:24 Central Euro Time

The Swiss Franc is currently below today’s Neutral Zone; above same are the Metals Triumvirate and Oil, and BEGOS Markets volatility is mostly moderate, even as a week with little incoming EconData begins: just five metrics are due through Friday. The Gold Update muses over the “seasonality” of bank failures, noting (per Fitch) that 7% of U.S. banks are “stressed”; otherwise, Gold’s near-term technicals continue to appear negative despite a bit of a price bounce to start the week. Meanwhile, the S&P 500 has unwound its “textbook oversold” condition; and with about 75% of Q1 Earnings Season complete for the S&P, 65% (somewhat below average) have thus far improved their bottom lines from Q1 a year ago; the “live” (futs-adj’d) P/E is 38.2x and the yield 1.417%; the annualized three-month U.S. T-Bill yield is 5.235%.

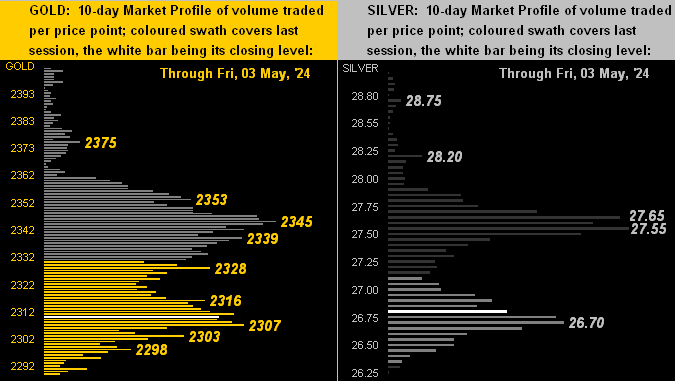

03 May 2024 – 08:18 Central Euro Time

We’ve the Swiss Franc at present above its Neutral Zone for today; the seven other BEGOS Markets are within same, and volatility is again light. Our top three Market Rhythms on 10-test swing basis are the Spoo’s 1hr MACD and daily Parabolics, plus the Swiss Franc’s 15mn Parabolics; on 24-test swing basis they are Gold’s 15mn Moneyflow, Copper’s 8hr Moneyflow, and the Swiss Franc’s daily Parabolics. Looking at Market Values, Gold — which in recent weeks had been better than +200 points above its smooth valuation line — is now (in real-time) “just” +46 points above it; Oil is better than -4 points below same, and the Spoo -101 points by same; the Euro looks poised for the ensuing week to cross above its valuation line, which by rule would be a Long signal. The Econ Baro concludes its week with Aprils’ Payrolls data and the ISM(Svc) Index.

02 May 2024 – 08:19 Central Euro Time

At present we’ve both the Bond and Spoo above today’s Neutral Zones, whilst below same is Silver; BEGOS Markets’ volatility is light. The FOMC’s stance as anticipated was a fairly do-nothing non-event, notably as little has changed on the inflation front, (save for it not really slowing). At Market Trends, the “Baby Blues” of trend consistency are curling upward for the Bond, Euro and Spoo, even as the Fed (subtly or otherwise) is de-emphasizing the word “cut” without specifying “raise” (yet?); ‘course, we’ll continue to mid the math thereto. ‘Tis a busy inflow of metrics today for the Econ Baro, including March’s Trade Deficit and Factory Orders, as well as the initial look at Productivity and Unit Labor Costs for Q1.

01 May 2024 – 08:45 Central Euro Time

Save for the Swiss Franc, at present below today’s Neutral Zone, the seven other BEGOS Markets are within same, and volatility is very light, albeit in the context that some EDTRs (see Market Ranges) have been expanding of late, notably so that for the Spoo which is now measured at 74 points. As anticipated, in real-time the linregs for both Gold and Silver have now rotated to negative, leaving Copper as the only positive linreg BEGOS component. With better than half of S&P 500 companies having thus far reported earnings, the “live” P/E has favourably come off a bit, now 38.3x, but still extremely expensive by any historical earnings yardstick. The Econ Baro looks to April’s ADP Employment Data and ISM(Mfg) Index, plus March’s Construction Spending. 18:00 brings the FOMC’s Policy Statement and then Powell’s Presser.

30 April 2024 – 08:37 Central Euro Time

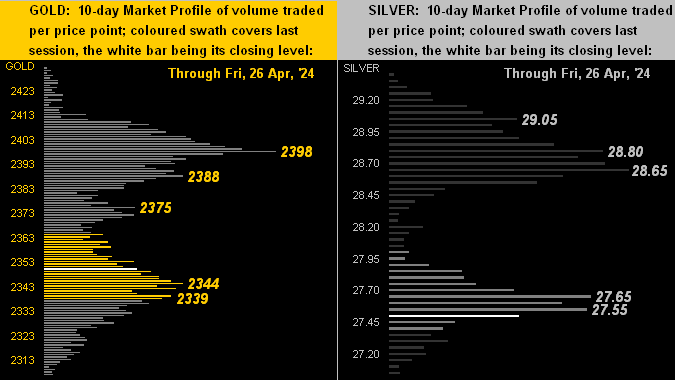

The final day of the year’s first quadrimestris finds early on all eight BEGOS Markets in the red; therein, the elements comprising the EuroCurrencies and Metals Triumvirate are all at present below their respective Neutral Zones for today, (the Bond, Oil and Spoo within same, albeit down). At Market Trends, both Gold and Silver appear within a day or two of their linregs rotating from positive to negative, which would leave Copper as the sole remaining component with a positive linreg; Gold remains above its smooth valuation line (see Market Values) in real-time by +78 points; still thus far today, the yellow metal already has broken below key Market Profile trading support (2342), current price now 2331. For the Econ Baro we’ve April’s Chi PMI and Consumer Confidence, plus Q1’s Employment Cost Index.

29 April 2024 – 08:32 Central Euro Time

A bit of Dollar weakness to begin “Fed Week”, the Euro and Swiss Franc (non-BEGOS Yen too) at present above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is already is moderate-to-robust, the Swiss Franc having traced 108% of its EDTR (see Market Ranges). The Gold Update “apologetically” takes credit for price’s demise last Monday; further downside purely by near-term technicals is anticipated toward structural support in the 2247-2171 zone, (Gold currently is 2342). Thus far in Q1 Earnings Season, 64% of S&P 500 constituents have bettered their bottom lines from a year ago (a decent Earnings Season is at least 70% improvement), but the excessively high level of the Index hasn’t lowered the “live” P/E a wit (45.5x futs-adj’d). Given historical reversion to the P/E mean, the S&P remains, dare we say, dangerously high.

26 April 2024 – 08:37 Central Euro Time

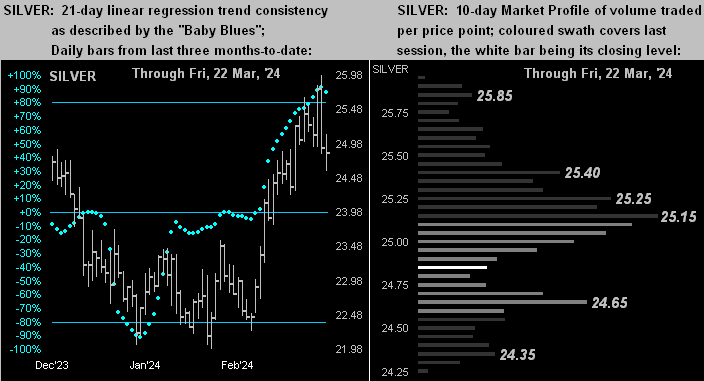

Both the Bond and Copper currently are above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is mostly light. Of note: the change in the Spoo at this time (5127.25, -4.50) belies the change in the S&P itself at the open given a material rise the Spoo after stocks had closed: at that present Spoo level, the S&P would open higher by some +46 points (+0.9%). Cac volume for Silver is moving from May into July: after Monday’s fallout for the precious metals, Gold and Silver have basically been treading water: however by Market Trends, their respective “Baby Blues” of trend consistency continue to drop, our old adage being “Follow the Blues instead of the news, else lose your shoes.” Widely followed today for the Econ Baro are March’s Personal Income/Spending and “Fed-favoured” Core PCE Prices.

25 April 2024 – 08:27 Central Euro Time

The EuroCurrencies (Euro and Swiss Franc) are at present above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is light. Amongst the five primary BEGOS components, the best correlation is negative between the Bond and Gold. As for the five’s Market Values in real-time: the Bond is better than -6 points “low” vis-à-vis its smooth valuation line, the Euro -2.16 points “low”, Gold +96 points “high”, Oil right on its valuation line, and the Spoo -215 points “low”, (the S&P 500 itself now eight days “textbook oversold”, however fundamentally by earnings still catastrophically overvalued, the “live” P/E 43.6x). Incoming metrics for the Econ Baro today include March’s Pending Home Sales plus the first peek at Q1 GDP.

24 April 2024 – 08:22 Central Euro Time

The Bond is at present below its Neutral Zone for today; above same is Copper, the cac volume for which is rolling from May into July, and BEGOS Markets’ volatility is mostly light within the context that Market Ranges have been increasing these last couple of months. Leading our Market Rhythms for consistency is (on a 10-test swing basis) the Euro’s 1hr Parabolics; more broadly (on a 24-test swing basis) the Swiss Franc’s daily Parabolics continue to top that list. At Market Trends, as anticipated, we’ve confirmation of both precious metals’ “Baby Blues” having moved below their respective key +80% axes: thus we should see still lower prices for Gold and Silver near-term. The Econ Baro looks to March’s Durable Orders.

23 April 2024 – 08:15 Central Euro Time

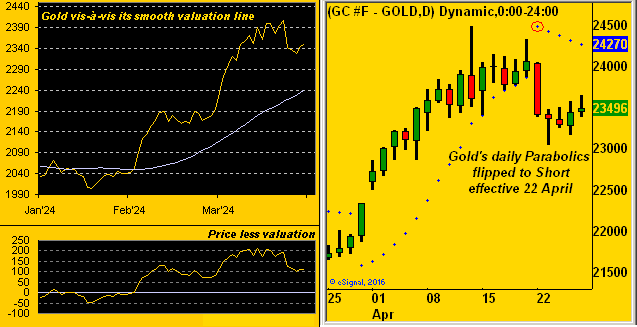

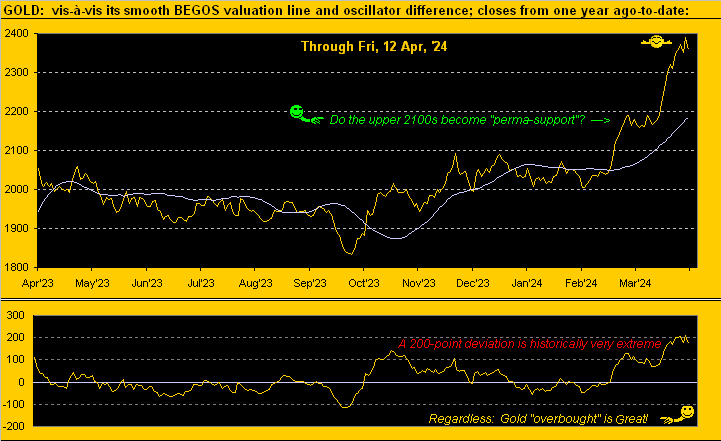

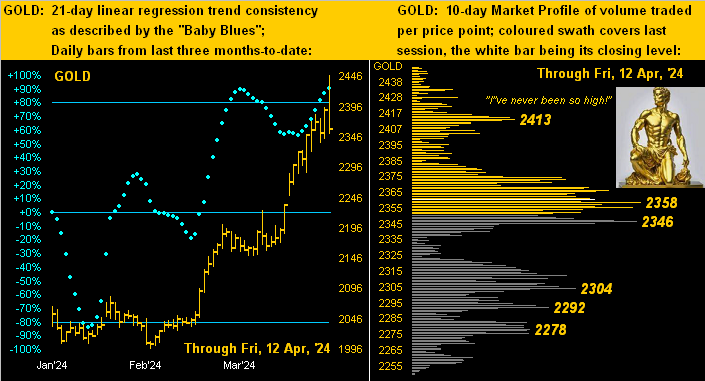

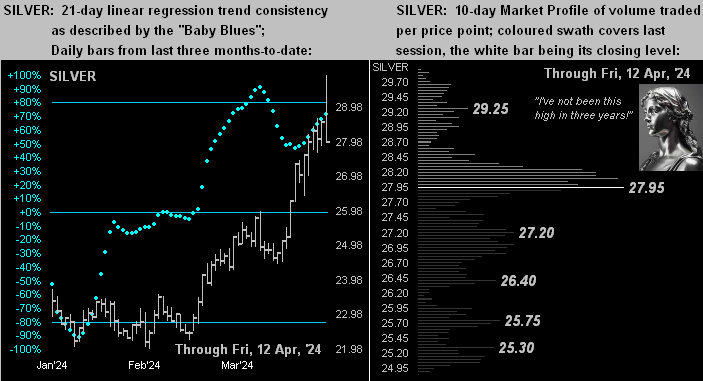

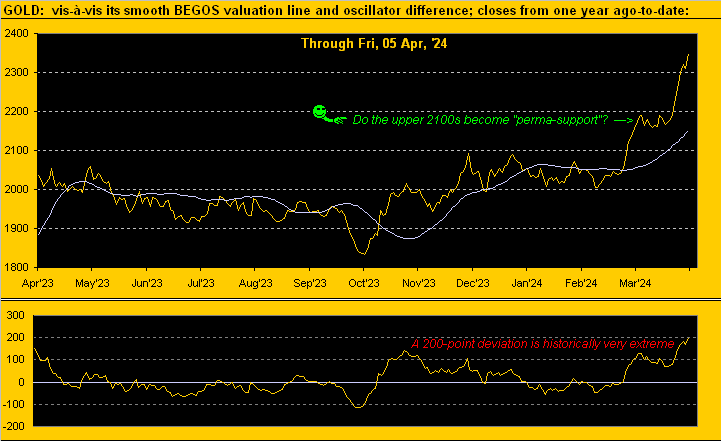

All three elements of the BEGOS Markets’ Metals Triumvirate are at present below today’s Neutral Zones; the other components are within same, and volatility is light-to-moderate. On the heels of the current Gold Update’s near-term negative stance, Gold yesterday suffered its third-worst intraday high-to-low loss (-2.7%) since February a year ago; (’twas Silver’s fourth-worst [-5.7%] across the same 14-month stint). We expect to see lower near-term levels still for both precious metals as (in real-time) their respective “Baby Blues” are crossing below their key +80% axes (see Market Trends). Gold vis-à-vis its smooth Market Values line has essentially halved the recent +200-point gap, but still (in real-time) price is +99 points above valuation. The Econ Baro awaits March’s New Home Sales.

22 April 2024 – 08:29 Central Euro Time

The Bond, Swiss Franc, Gold, Silver and Oil are all at present below their respective Neutral Zones for today; above same is the Spoo, and BEGOS Markets’ volatility runs from light-to-robust, Silver having already traded 101% of its EDTR (see Market Ranges). The Gold Update cites the yellow metal as “fit to pull back a bit”, which on cue ’tis doing: still, our live Market Values shows price +162 points above its smooth valuation line; mind too at Market Trends the level and direction of Gold’s “Baby Blues” of trend consistency. As to the S&P 500, ’tis technically in a “textbook oversold” mode for the first time since late last October; regardless, the Index remain excessively high given its ongoing lack of earnings support: the futs-adj’d “live” P/E at this moment is 43.0x. The volume of incoming Q1 earnings is substantive as the week unfolds.

19 April 2024 – 08:37 Central Euro Time

At present we’ve the Bond, Swiss Franc and Oil above today’s Neutral Zones; the Spoo is below same, and volatility is robust given markets responding to an escalation of conflict in the Middle East; of note, the Metals Triumvirate (Gold/Silver/Copper) along with the Euro are the least volatile (comparatively) of the BEGOS Markets thus far this session. We still sense some near-term retrenchment for Gold, and both it and Silver are nearing negative Market Magnet crossovers. The S&P 500 would appear to be enroute to a sixth consecutive down day, a streak not seen since 05-12 October 2002. The Dollar Index continues to hover above the 106 handle, a level last visited some five months ago. And as noted yesterday, the Econ Baro’s week has already concluded, the net result bringing a downward bent.

18 April 2024 – 08:21 Central Euro Time

Dough is finding its way into the BEGOS Markets: at present the Bond, Swiss Franc, all three components of the Metals Triumvirate and the Spoo are above today’s Neutral Zones; the Euro and Oil are within same, and volatility is pushing toward moderate. On a 10-test basis, these five Market Rhythms are leading the pack for swing consistency: the Bond’s daily Parabolics, Copper’s 12hr Parabolics and 6hr Price Oscillator; the Euro’s 2hr MACD, and the Spoo’s daily Parabolics. More broadly time-wise, the leader on the 24-test swing basis is the Swiss Franc’s daily Parabolics. The Econ Baro completes its week today, incoming metrics including April’s Philly Fed Index, plus March’s Existing Home Sales and Leading (i.e. “lagging”) Indicators.

17 April 2024 – 08:29 Central Euro Time

All eight BEGOS Markets are at present within their respective Neutral Zones for today; session volatility is again light. Going ’round the Market Values horn for the five primary components, as readings are excessive: the Bond is -8 points “low” vis-à-vis its smooth valuation line, the Euro -0.044 points “low”, Gold +189 points “high”, Oil +2.88 points “high”, and the Spoo -216 points “low”. Very early on in Q1 Earnings Season, with 23 S&P 500 constituents having thus far reported, only 13 (57%) have bettered their bottom lines of a year ago. The “live” P/E of the S&P (futs’-adj/d) is 44.7x and the yield 1.420%. No metrics are due today for the Econ Baro.

16 April 2024 – 08:20 Central Euro Time

The Swiss Franc is at present below its Neutral Zone for today; the other seven BEGOS Markets are within same, and volatility is light in context with all EDTRs (see Market Ranges) increasing of late. Speaking of the Swissie, its daily Parabolics are leading our Market Rhythms studies for consistency on a 24-test swing basis. As noted in the current edition of The Gold Update: “…the stock market [is] poised for a downward skate…” even as it has been descending over the past couple of weeks: indeed the Spoo’s daily Price Oscillator study indicated a fresh Short per this morning’s open; there is some arbitrary structural support into the lower 4900s, (depending upon one’s measuring of such); again, the S&P 500 remains a vastly overvalued index relative to earnings, especially in an attractively-positive risk-free interest rate environment. The Econ Baro looks to March’s Housing Starts/Permits and IndProd/CapUtil.

15 April 2024 – 08:44 Central Euro Time

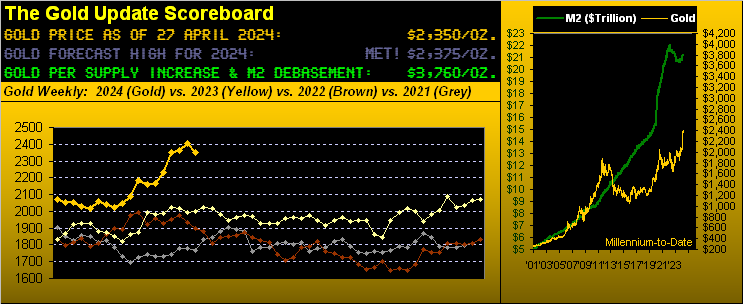

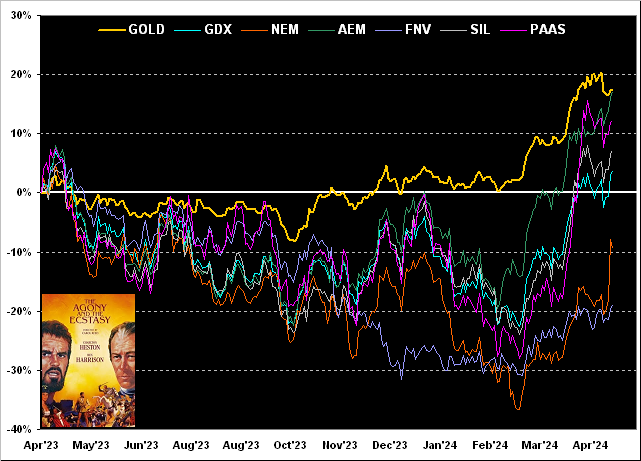

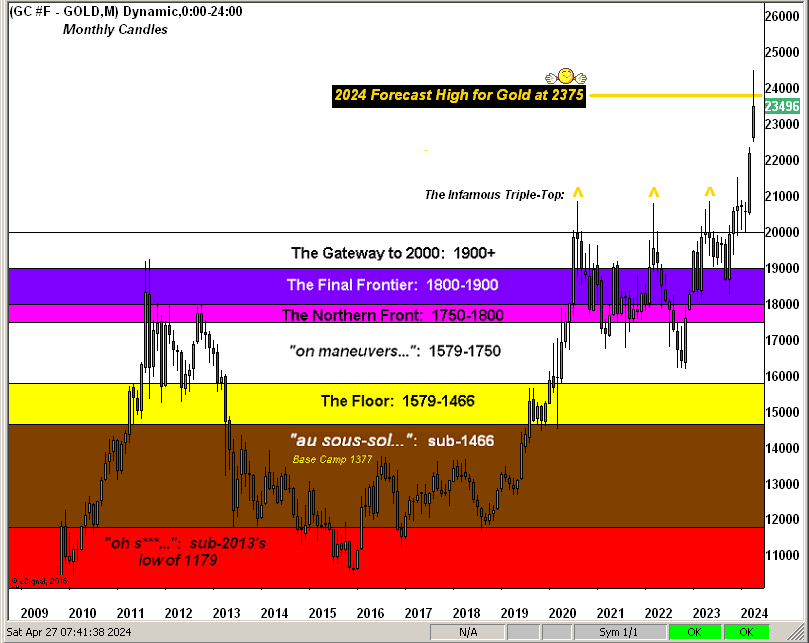

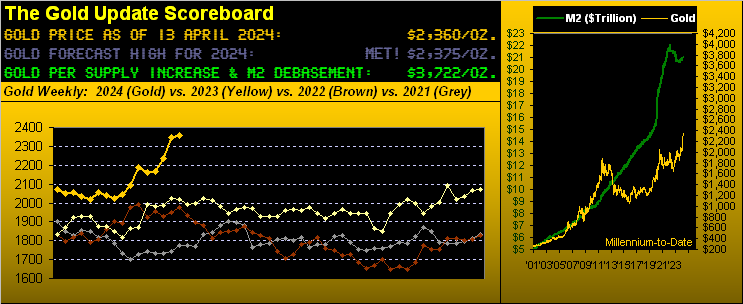

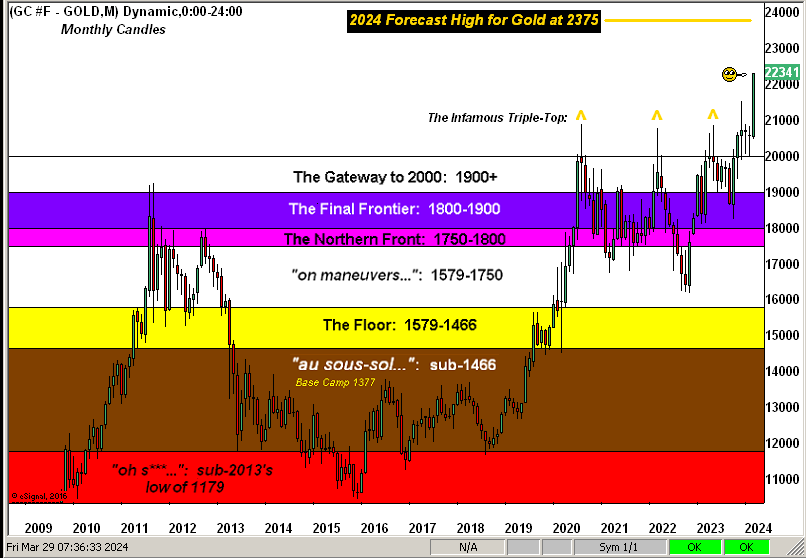

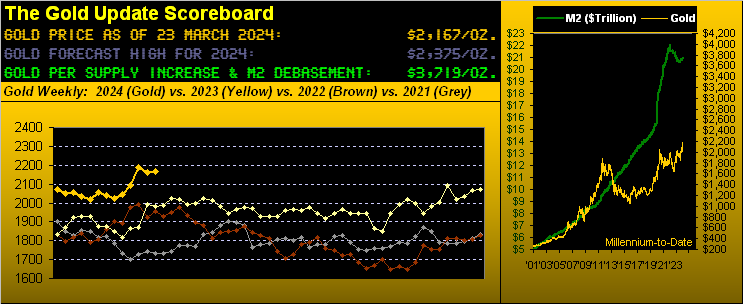

The week begins with the Bond at present below its Neutral Zone; above same are the Euro, Swiss Franc, Gold, Silver and Spoo; and BEGOS Markets’ volatility is moderate-to-robust, notably for both Silver and Copper. The Gold Update cites our 2375 forecast having been achieved (last Tuesday); even so as price remains cheap relative to debasement valuation, Gold on a near-term basis remains excessively “overbought”: currently 2374, the Market Value smooth valuation line is but 2192. Looking at Market Trends for all eight BEGOS components, the 21-day linregs are positive for Gold, Silver, Copper and Oil; such trends are negative for negative for the Bond, Euro, Swiss Franc and Spoo; on balance, a rather an inflationary view, that. The Econ Baro starts a fairly busy week with April’s NY State Empire and NAHB Housing Indices, March’s Retail Sales, and February’s Business Inventories.

12 April 2024 – 08:44 Central Euro Time

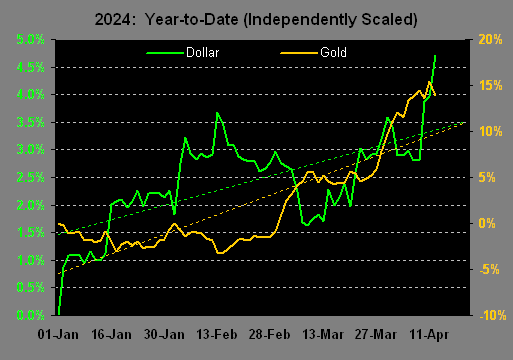

The Bond and the Metals Triumvirate are all at present above today’s Neutral Zones; below same are the EuroCurrencies, and BEGOS Markets’ volatility is pushing toward moderate. Gold has eclipsed the 2400 level (All-Time High now 2413): price (now 2408) is +222 points above its smooth valuation line (see Market Values); more of course in tomorrow’s 752nd consecutive Saturday edition of The Gold Update. And yet, the Dollar also is on the move, trading this week to levels not seen since mid-November, (Gold then nearly -400 lower points than today). The Econ Baro concludes its week with a bit more inflation information as it awaits March’s Ex/Im Prices, plus UofM’s Sentiment Survey. And banks start to report for Q1 Earnings Season.

11 April 2024 – 08:20 Central Euro Time

Similar to this time yesterday, ahead now of StateSide wholesale inflation, all eight BEGOS Markets are within today’s Neutral Zones, and volatility is light. At Market Trends, the Spoo’s “Baby Blues” for trend consistency are looking to cross their 0% axis as the linreg rotates from positive toward negative; technically for the S&P 500 itself, the daily parabolic trend, MACD and Moneyflow standard studies have all taken a negative bent; the Index’s “live” P/E (futs-adj’d) is 45.2x and the yield 1.387%. Gold (not unexpectedly) has mildly come off both its All-Time High (2385) and our year’s forecast high (2375): current price is 2354; Gold’s Market Magnet settled last evening at 2307; and by Market Values, Gold’s smooth valuation line is notably lower at 2179. Again today’s incoming metrics for the Econ Baro include March’s PPI.

10 April 2024 – 08:37 Central Euro Time

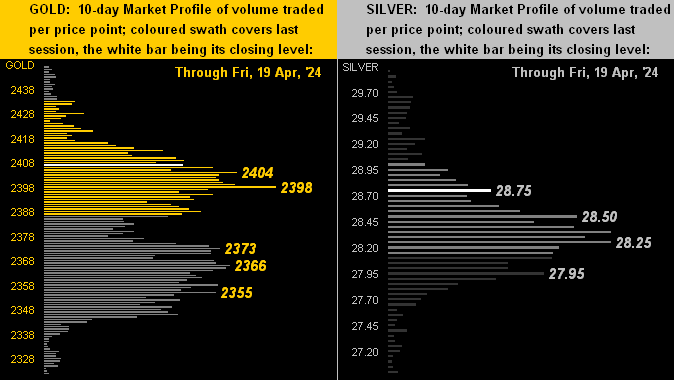

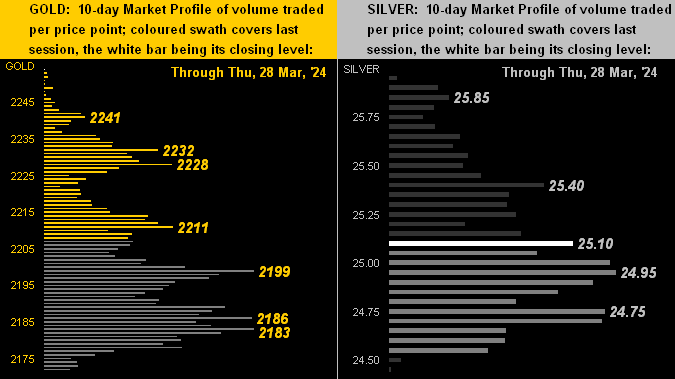

Yesterday (09 April) Gold achieved our forecast high price for this year at 2375; as you readers of the Gold Update know, at the beginning of the year we couched such call as “conservative”, and given some nine months now still remain in 2024, it well could be. Ahead of Stateside retail inflation, all eight BEGOS Markets are at present within their respective Neutral Zones for today, and volatility is very light, the average EDTR (see Market Ranges) tracing just 27% to this point. Looking at Market Profiles, we’ve trading support for the Bond at 117^22, the same for the Spoo at 5254, and for Oil at 85.20; Gold’s most dominantly traded handle of the past two weeks is 2304 and for the Euro ’tis 1.087. As noted, the Econ Baro awaits March’s CPI as well as the month’s Treasury Deficit, plus February’s Wholesale Inventories.

09 April 2024 – 08:45 Central Euro Time

At present, the Bond is above its Neutral Zone whilst below same is Copper; BEGOS Markets’ volatility is light. Leading Market Rhythms for consistency on a swing basis are: (10-test basis) Copper’s 6hr Price Oscillator, the Bond’s daily Parabolics, and Gold’s 15mn MACD; (24-test basis) the Swiss Franc’s daily Parabolics and Copper’s 6hr Parabolics. At Market Values for the Spoo, both price and its smooth valuation line finally have met; the deviation for Gold remains extremely stretched to the upside, in real-time by +198 points; for the other three primary BEGOS components: the Bond is 5 points “low”, the Euro 0.23 points “low” and Oil nearly 6 points “high”. Again, nothing is due today for the Econ Baro ahead of inflation data (CPI, PPI, Ex/Im Prices) through the balance of the week.

08 April 2024 – 08:32 Central Euro Time

The back-loaded EconData week is underway with the Bond, Swiss Franc, Copper and Oil all at present beneath their respective Neutral Zones for today; above same is Silver, and BEGOS Markets’ volatility is already mostly robust, the components of the Metals Triumvirate all well-exceeding their EDTRs (see Market Ranges). The Gold Update again cites (in a positive way) the “extreme” overbought technical near-term stance of price; so far this session, Gold has traded to within 3 points of our forecast high (2375) for this year: mind Gold’s Market Values graphic as to price vis-à-vis its smooth valuation line. As Q1 Earnings Season commences today, the “live” (futs-adj’d) P/E of the S&P is 46.6x, essentially double that since its inception a dozen years ago; the yield is a paltry 1.371% vs. 5.215% annualized on the risk-free US three-month T-Bill.

05 April 2024 – 08:23 Central Euro Time

All three elements of the BEGOS Markets’ Metals Triumvirate are at present below their respective Neutral Zones for today; none of the other components are above same, and volatility runs the gamut from light-to-robust, Silver having already traced 102% of its EDTR (see Market Ranges). Following yesterday’s Commentary on the Spoo seeing its “Baby Blues” (see Market Trends) having slipped below their key +80% axis as well as the S&P 500 being in a historically extreme overbought streak, an inevitable price dump emerged: to the extent it becomes material near-term remains to be seen, the Spoo up a tad this morning. In the day’s balance, the Econ Baro looks to March’s Payrolls data, followed late in the session by February’s Consumer Credit.

04 April 2024 – 08:33 Central Euro Time

Silver — for which the net gain across the past two trading days was +8.3% — is at present below today’s Neutral Zone, as is the Bond; above same is Copper, and volatility for the BEGOS Markets is mostly light. The Spoo’s “Baby Blues” (see Market Trends) confirmed settling beneath their key +80% axis, thus indicative of lower price levels near-term, although two of the past six like downside signals from a year ago-to-date have produced minimal material downside given the S&P 500 having been in “straight-up” mode. Indeed through yesterday, the S&P recorded its 52nd consecutive trading session as “textbook overbought” which ranks fifth for such streaks in better than four decades. With Q1 Earnings Season commencing next week, the “live” (futs-adj’d) P/E is now 46.7x. Today’s incoming Econ Baro metrics include February’s Trade Deficit.

03 April 2024 – 08:26 Central Euro Time

At present we’ve both Silver and Copper above today’s Neutral Zones; below same are both Oil and the Spoo, and BEGOS Markets’ volatility is again mostly light; (both the white and red metals have traced better than 50% of their EDTRs [see Market Ranges]). Looking at Market Values (in real-time): the Bond is nearly -4.5 points “low” vis-à-vis its smooth valuation line, the Euro nearly -0.03 points “low”, Gold +166 points “high”; Oil +4.9 points “high”, and the Spoo now down to just +29 points “high”. Specific to Gold’s “high” deviation, such extremes are rare and have historically led to price pullbacks near-to-medium term; ‘course since Gold is (finally) getting a bid these days, history may not necessarily repeat: rather, the smooth valuation line can instead catch up to price. The Econ Baro looks to March’s ADP Employment data and the ISM(Svc) Index.

02 April 2024 – 08:33 Central Euro Time

Early on we’ve the two EuroCurrencies below today’s Neutral Zones, whilst above same is Silver; BEGOS Markets volatility is mostly light as most ETDRs (see Market Ranges) are narrowing, save for those of the Metals Triumvirate. The Dollar continues getting a bid now to nearly a two-month high as Fed rate cuts fade a bit from FinMedia wishful reporting. Looking at Market Rhythm swing consistencies (on a 10-test basis), we’ve five of note per late night’s data runs: Oil’s 60mn Moneyflow, Copper’s 6hr Price Oscillator, the Spoo’s daily Parabolics, and for the Bond both its 2hr Moneyflow and daily Parabolics. The Econ Baro awaits February’s Factory Orders.

01 April 2024 – 09:26 Central Euro Time

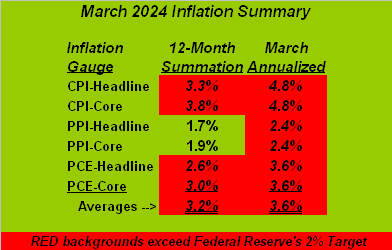

The BEGOS Markets’ Metals Triumvirate are all above today’s Neutral Zones, as is the Spoo; none of the other components are below same, and volatility runs from light-to-robust, Gold already having traced 102% of its EDTR (see Market Ranges). Gold, with its fresh June premium, is now 2281, within 100 points of our forecast high for this year of 2375; The Gold Update remains a bit wary of Gold being technically over-extended near term; too therein, February’s PCE data (reported during Friday’s holiday) confirms a five-month rising trend of inflation by that metric. Regardless, the Spoo at present (5330) is poised such that the S&P 500 would open at a record high. Due for the Econ Baro is March’s ISM(Mfg) Index and February’s Construction Spending.

28 March 2024 – 09:07 Central Euro Time

The week’s final trading day is underway with the Euro, Swiss Franc and Silver all at present below today’s Neutral Zones; the other BEGOS Markets are within same, and volatility is light-to-moderate, the Euro, Gold and Copper already exceeding 50% of their respective EDTRs (see Market Ranges). Per our S&P 500 Moneyflow page, all three time measures (week, month, quarter) are lately indicative of money not flowing from the Index, but neither is inflow increasing; the “live P/E of the S&P (futs’adj’d) is now 47.3x, which as you regular readers know is essentially double that since this measure’s inception a dozen years ago: the S&P thus remains significantly (understatement) expensive. ‘Tis a busy two days for the Econ Baro: today’s incoming metrics include March’s Chi PMI and revision to the UofM Sentiment Survey, February’s Pending Home Sales, and the final revision to Q4 GDP. Tomorrow whilst the markets are closed the Baro nonetheless looks to February’s Personal Income/Spending, plus the “Fed-favoured” PCE data. Joyeuses Pâques à Tous !

27 March 2024 – 09:18 Central Euro Time

Both the Swiss Franc and Oil are at present below today’s Neutral Zones; otherwise the BEGOS Markets are within same, and volatility is light. Looking at Market Rhythms , the most consistent on a 10-test swing basis is the Spoo’s daily Parabolics, whilst on a 24-test swing basis ’tis the Euro’s 15mn Price Oscillator. Market Values’ deviations of note are the Euro as some -0.02 points “low” per its smooth valuation line, Gold as +68 points “high” and the Spoo as +90 points “high”. And as previously noted, at Market Trends Silver’s “Baby Blues” of consistency confirmed dropping below their key +80% axis suggestive of lower price levels near-term. Nothing is due today for the Econ Baro ahead of a data barrage both Thursday and Friday (the markets being shut on the latter).

26 March 2024 – 09:14 Central Euro Time

The Swiss Franc, Silver and Copper are all at present below their respective Neutral Zones for today; the other BEGOS Markets are within same, and volatility is mostly light, save for Copper which has already traced 62% if its EDTR (see Market Ranges). At Market Trends (in real-time), the “Baby Blues” of trend consistency for both Silver and Copper have dropped below their key +80% axes. Gold’s negative technicals (covered in the current Gold Update) have yet to similarly affect price: too, Gold’s cac volume today is rolling from April into that for June, in turn adding +22 points of fresh premium to price. For the Econ Baro today we’ve March’s Consumer Confidence and February’s Durable Orders.

25 March 2024 – 09:18 Central Euro Time

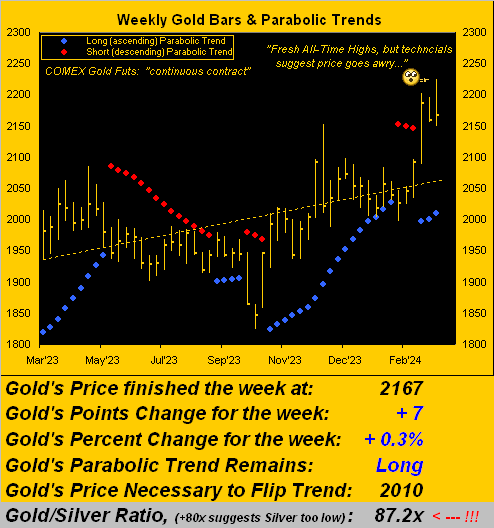

We start the shortened week with Copper at present above its Neutral Zone for today; all the other BEGOS Markets are within same, and volatility is light-to-moderate. The Gold Update graphically lays out the increasing inflation scenario, querying if the Fed has lost its “cred”; too, the Update cites near-term negative technical measures for Gold and that there is little structural support sub-2150 until 2050, (were price to materially let go); of course, the broader weekly parabolic trend remains firmly Long. The S&P 500 is 45 days “textbook overbought”, placing it in the 98th percentile of such overbought conditions since at least the year 1980; the “live” (futs-adj’d) P/E is presently 46.2x. The Econ Baro looks to February’s New Home Sales.

22 March 2024 – 09:25 Central Euro Time

The EuroCurrencies and Metals Triumvirate are all at present below their respective Neutral Zones for today; the balance of the BEGOS Markets are within same, and volatility is firmly moderate. Whilst by Market Ranges most of the EDTRs are on the rise, ’tis not the case for either the Bond nor Oil, (nor to a minor extent, the Euro). Yesterday’s high-to-low plunge in the Swiss Franc of -1.69% was the largest across the day’s range in better than a year (since 15 March ’23) on the heels of the Schweizerische Nationalbank unscheduled reduction of its key interest rate. Looking at Market Rhythms for consistency, our 10-test swing leader is the Spoo’s daily Parabolics, (see too the Yen’s 15mn Moneyflow study); on the 24-test basis ’tis the Swiss Franc’s daily Parabolics. The Econ Baro’s week is complete.

21 March 2024 – 09:07 Central Euro Time

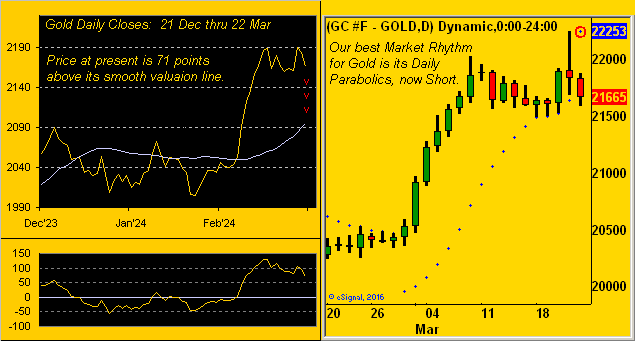

The Swiss Franc, Copper, Spoo and Gold are all at present above today’s Neutral Zones: the yellow metal recorded a new high overnight at 2225; BEGOS Markets volatility is moderate-to-robust, Gold notably having traced 135% of its EDTR (see Market Ranges); and by Market Values (in real-time) price (currently 2209) is +119 points above its smooth valuation line. Per the Fed’s math, even as inflation is increasing, they calculate it as decreasing; more on that in the next Saturday edition of The Gold Update. The Econ Baro wraps its week today, income metrics including Q4’s Current Account Deficit, March’s Philly Fed Index, plus February’s Existing Home Sales and Leading (i.e. “lagging”) Indicators.

20 March 2024 – 09:11 Central Euro Time

Spring starts similarly to Winter’s final day, with (save for the Bond) all the BEGOS Markets at present in the red ahead of the Fed; volatility is mostly light (Copper having already traced 63% of its EDTR — see Market Ranges). ‘Twill be interesting to note (perhaps during Chair Powell’s post-FOMC Policy Statement presser) if a FinMedia member brings up the notion of a rate hike, (all as luridly updated in the current edition of The Gold Update). As for the S&P 500, the “live” (futs-adj’d) P/E is 45.8x and the yield 1.380%; that for the 3-month T-Bill is 5.238% annualized. Nothing is due today for the Econ Baro.

19 March 2024 – 09:36 Central Euro Time

All eight BEGOS Markets are at present in the red; session volatility is mostly moderate; of note, the Yen (not as yet a BEGOS component) has traced 168% of its EDTR (see Market Ranges for those of the BEGOS Markets), as the BOJ ends its era of negative interest rates. Looking at Market Rhythms, our leader for consistency on a pure swing 10-test basis is Gold’s 30mn Price Oscillator, whilst on a 24-test basis ’tis the Swiss Franc’s 6hr Parabolics; indeed by Market Trends, the Swiss Franc is the only component now sporting a negative linreg: were there a “hawkish hint” in the FOMC’s Policy Statement (tomorrow) ‘twould likely add to Dollar strength. The Econ Baro awaits February’s Housing Starts/Permits.

18 March 2024 – 09:07 Central Euro Time

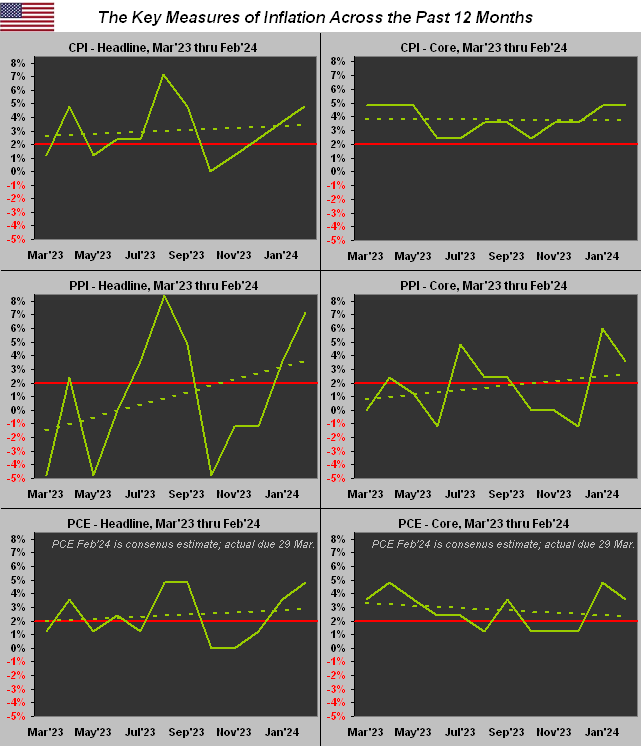

Both Oil and the Spoo are at present above their respective Neutral Zones for today; the balance of the BEGOS Markets are within same, and volatility is light. The Gold Update continues (at the very least) to muse over the notion of the Fed at some point actually having to raise rates: therein, our updated inflation table tells the story. The yellow metal itself as “expected” is coming off the recent All-Time High of 2203 (currently 2155) given the excessive distance of price above its smooth valuation line, that live reading now +79 points (see Market Values). ‘Tis a light week of data for the Econ Baro, beginning today with March’s NAHB Housing Index.