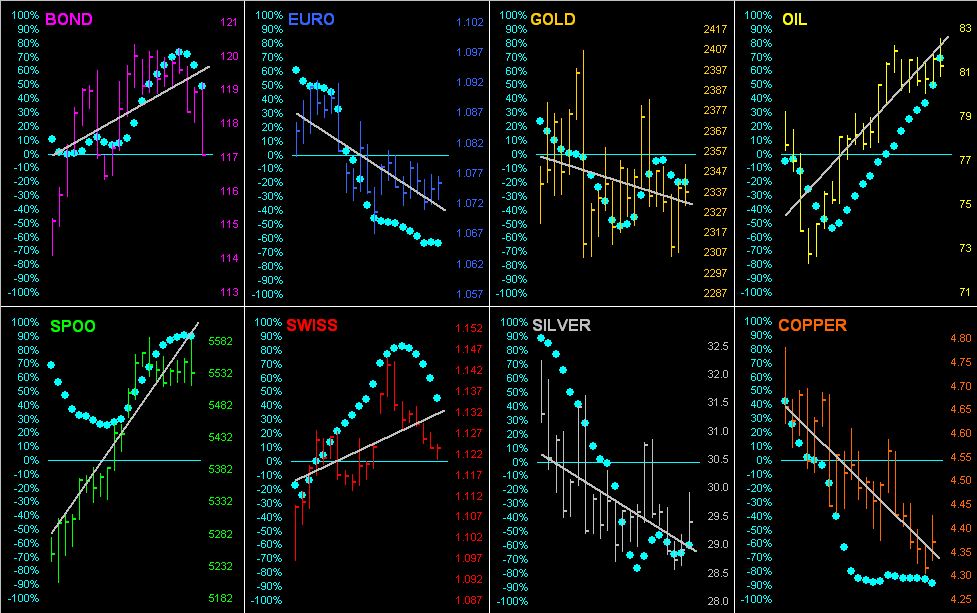

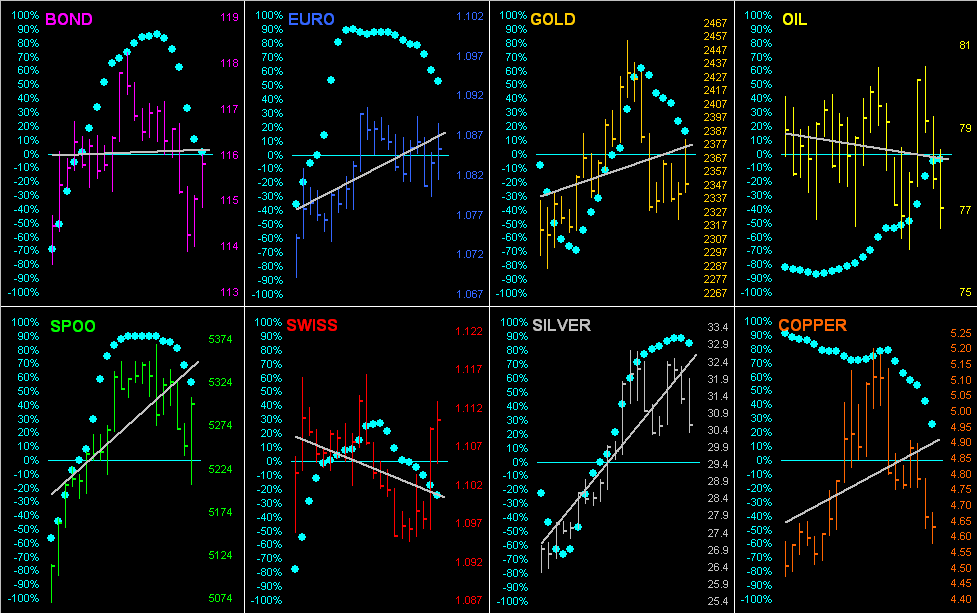

The Euro is at present below its Neutral Zone for today, whilst above same are both Gold and the Spoo; BEGOS Markets’ volatility is light. Yesterday’s -1.4% decline for the S&P 500 was hardly enough to undo the Index’s “textbook overbought” condition as it now enters a 27th straight trading day as such. Going ’round the Market Values horn (in real-time) for the five primary BEGOS components, we’ve both the Bond and Euro priced nearly in sync with their respective smooth valuation lines, where as Gold shows as +87 points “high”, Oil as +3.24 points “high” and the Spoo as +116 points “high”. The Econ Baro concludes its week today with metrics including July’s Philly Fed Index and June’s Leading (i.e. “lagging”) Indicators.

Mark

Mark

17 July 2024 – 08:31 Central Euro Time

Both Silver and the Spoo are at present below today’s Neutral Zones; the balance of he BEGOS Markets are within same, and volatility is moderate. Yesterday the S&P 500 completed a 26th consecutive trading day as “textbook overbought”; the “live” (futs-adj’d) P/E is 43.3x. Oil’s cac volume is rolling from August into that for September; so-called “Black Gold” has been in a comparably narrow trading range year-to-date, regularly spanning from the 70s to the low 80s; Oil’s best pure swing rhythm for consistency on a 24-test basis (dating from 25 April through yesterday) is its 2hr Price Oscillator. For the Econ Baro we’ve June’s Housing Starts/Permits and IndProd/CapUtil.

16 July 2024 – 08:41 Central Euro Time

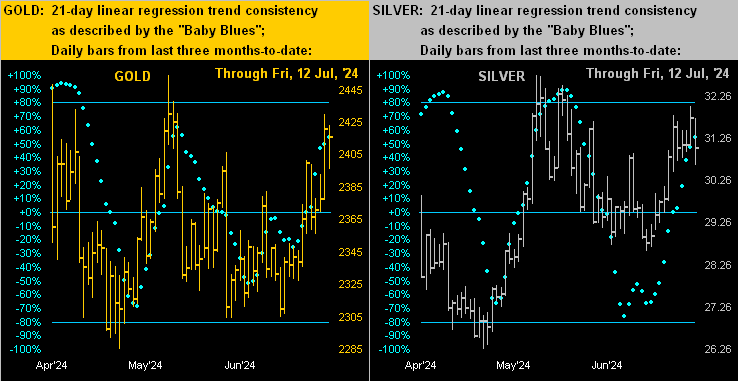

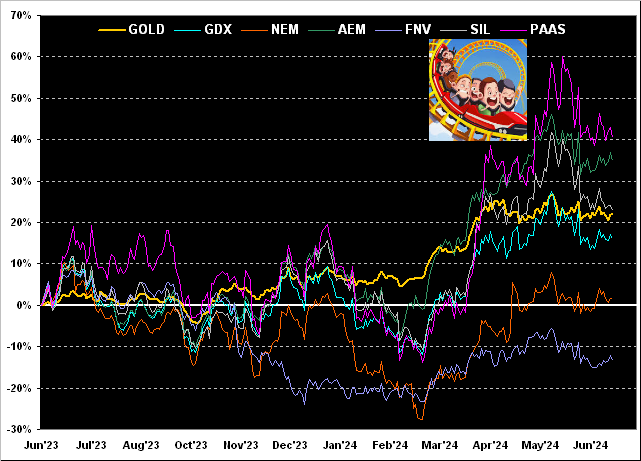

‘Tis a mixed bag at present for the BEGOS Markets with the Bond, Gold and Silver above their respective Neutral Zones for today, whilst below same are the Euro and Oil; session volatility is light. Looking at Market Trends for all eight components, only the Bond and Swiss Franc are in negative linregs. Gold yesterday came within nine points (2445) of its All-Time High (2454); price’s EDTR (see Market ranges) is 33 points such that a fresh high from here (2436) can readily be achieved, even as key weekly technicals still have a negative bent. ‘Tis a busy Econ Baro day with July’s NAHB Housing Index, June’s Retail Sales and Ex/Im pricing, and May’s Business Inventories.

15 July 2024 – 08:25 Central Euro Time

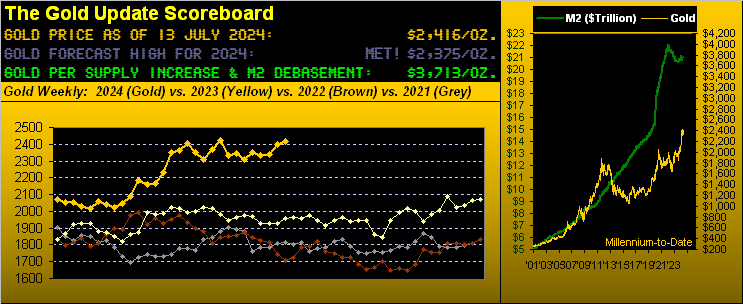

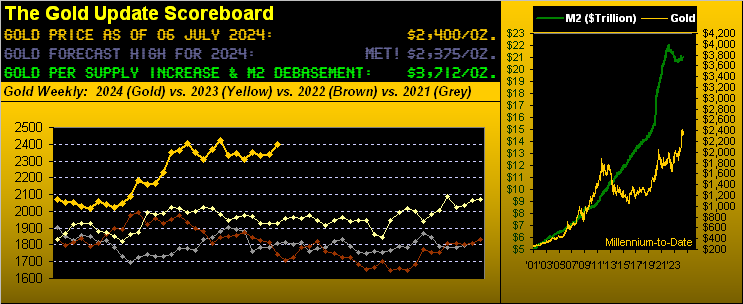

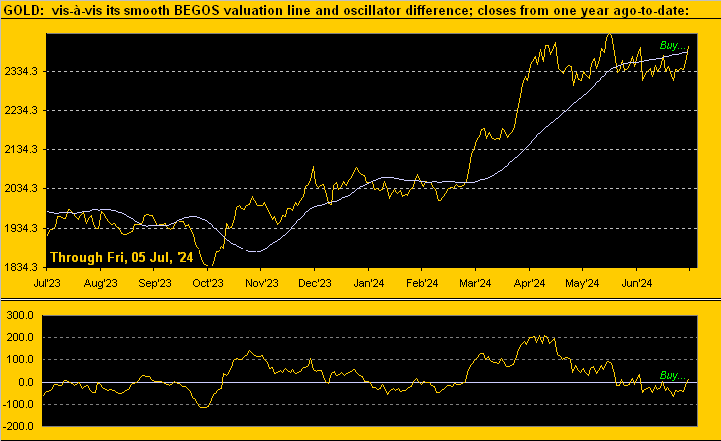

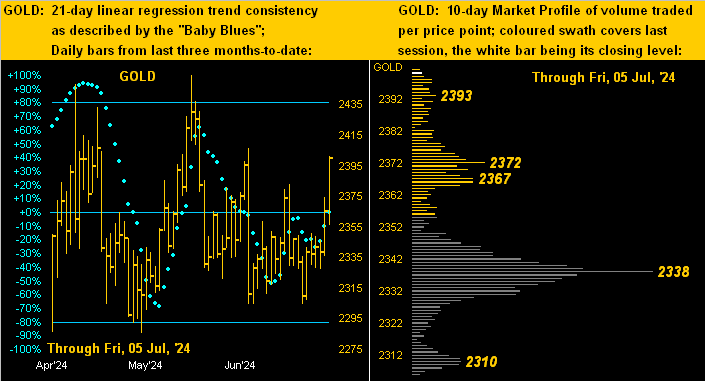

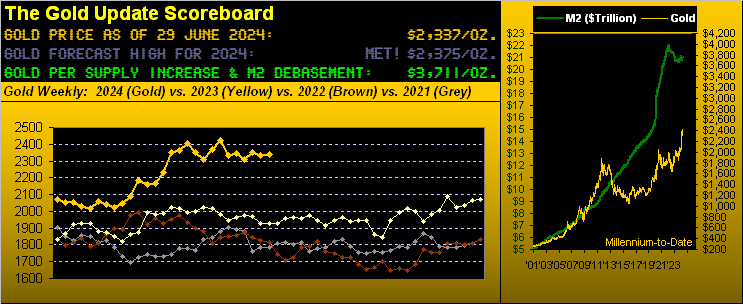

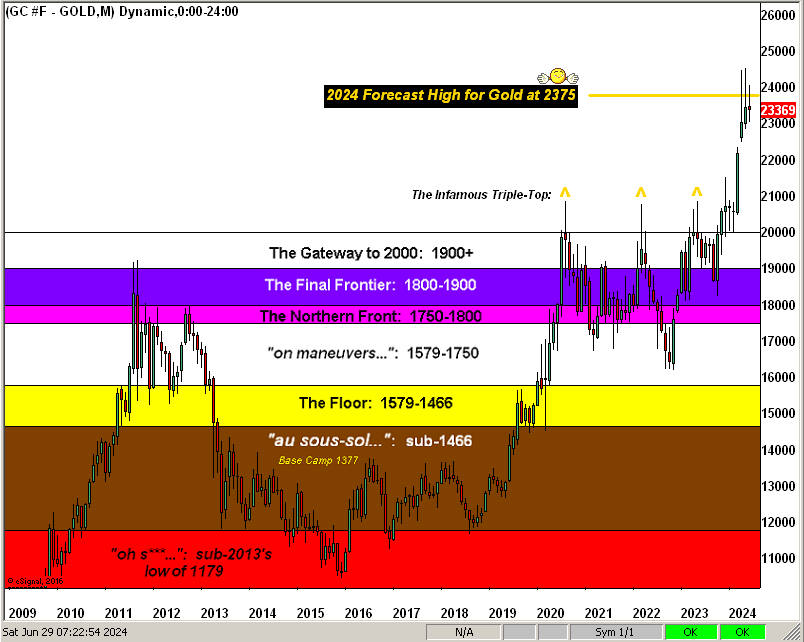

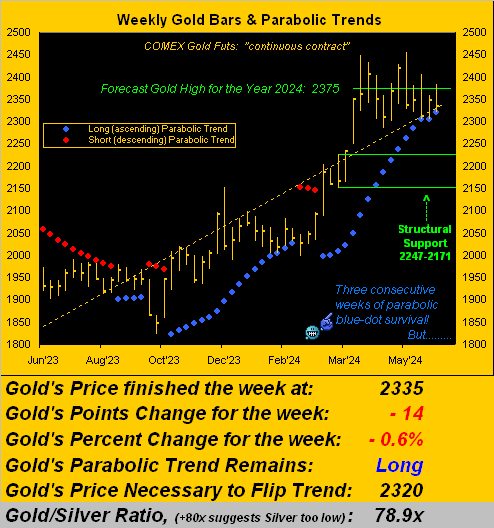

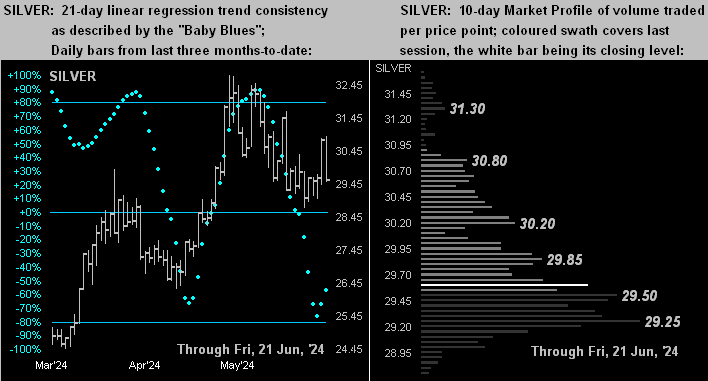

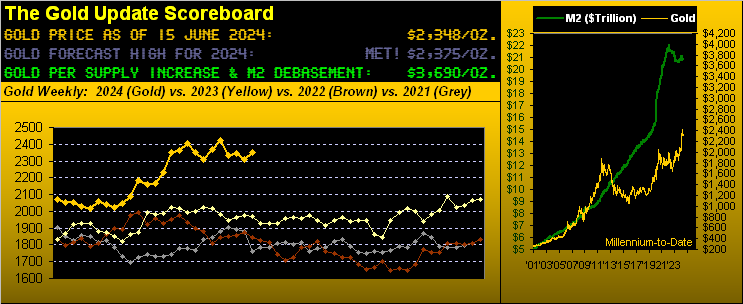

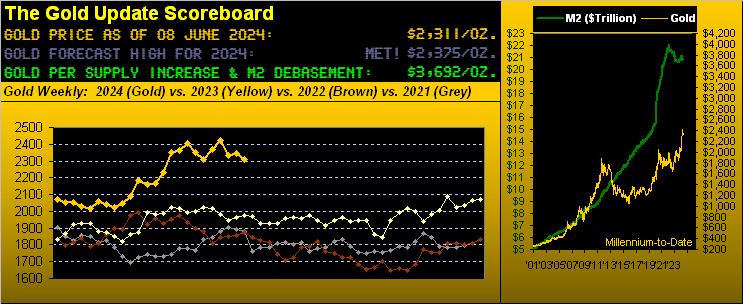

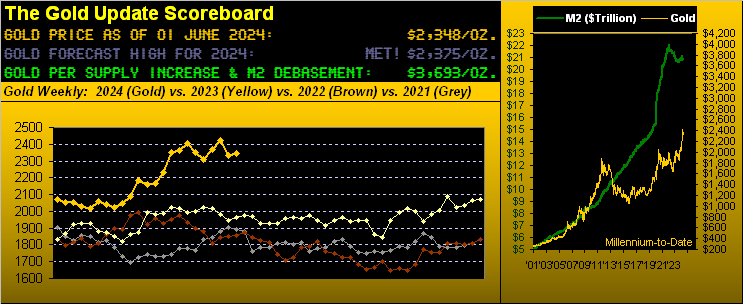

At present we’ve the Bond, Euro, Swiss Franc, Gold and Copper all below today’s Neutral Zones; the other BEGOS Markets are within same, and volatility is pushing toward moderate. The Gold Update takes a more positive near-term stance on the yellow metal without the 2247-2171 structural support zone having (at least yet) been tested, albeit both the weekly Parabolics and MACD have begun this new week still downside positioned. The Spoo by Market Values is (in real-time) +180 points above its smooth valuation line: ’tis been on that side of the ledger from 06 May-to-date, the S&P 500 itself now 24 consecutive trading days “textbook overbought” at a level we deem “extreme” given the daily positionings of the Bollinger Bands, RSI, and Stochastics. The Econ Baro’s busy week of 14 incoming metrics starts today with July’s NY State Empire Index.

12 July 2024 – 08:19 Central Euro Time

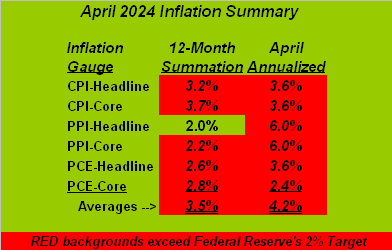

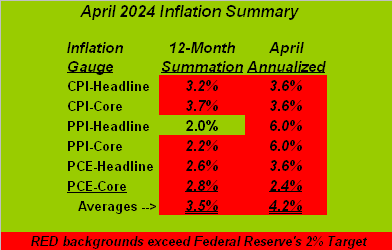

As in a mirror when ’round this time yesterday when all the elements of the Metals Triumvirate were above the day’s Neutral Zones, today all three are below same; the other BEGOS Markets are within their said Zones, and session volatility with wholesale inflation in the balance is moderate. Despite yesterday’s -0.9% decline in the S&P 500, the Index remains “textbook overbought” now into a 24th consecutive trading day. June’s headline CPI was deflationary, furthering the case for the Fed to move with a rate cut come 31 July, such move reinforced by the plummeting Econ Baro, (which we oft think the Fed doesn’t see); further mention on that in tomorrow’s 765th consecutive Saturday edition of The Gold Update. And the Baro completes its week with July’s UofM Sentiment Survey, plus June’s PPI.

11 July 2024 – 08:19 Central Euro Time

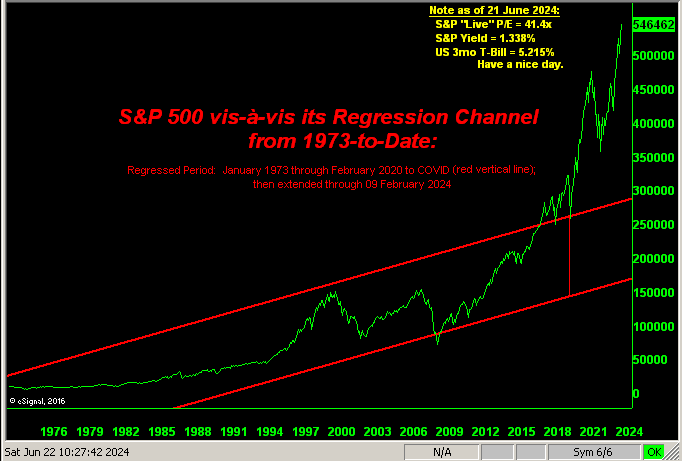

Toward week’s end with much anticipated data on inflation, we’ve all three elements of the Metals Triumvirate above today’s Neutral Zones; none of the other BEGOS Markets are below same, and volatility is again quite light for this hour of the session. The S&P 500 continues to pound out record highs, the mighty Index now 22 days “textbought overbought”, notably the last four days we designate as “extreme”; at our Valuations and Rankings page, amongst the Top Ten largest cap-weighted constituents, just three have P/Es less than 30, and the non-cap-weighted average for those ten is 57.2x. Too, the market-cap of the Index is now $49.3T supported by a liquid U.S. money supply of “only” $21.0T. Today’s incoming Econ Baro metrics include June’s CPI, plus late in the session the month’s Treasury Deficit.

10 July 2024 – 08:10 Central Euro Time

We’ve at present both Copper and Oil below their respective Neutral Zones for today; none of the other BEGOS Markets are outside of same, and volatility is quite light. Looking at Market Rhythms for pure swing consistency: topping the list on a 10-test basis are the Euro’s 2hr MACD, Swiss Franc’s 1hr Moneyflow, Bond’s 8hr Moneyflow, Coppers’ 15mn MACD, and the Spoo’s 8hr MACD; on a 24-test basis ’tis both the Spoo’s 4hr Moneyflow and daily Parabolics. Gold, after having crossed above its smooth valuation line (see Market Values and as highlighted in the current edition of The Gold Update), has since slipped back below same; we’re thus getting price whipsawing in concert with having already written of Gold’s technicals and fundamentals being in conflict with one another. Meanwhile, the Econ Baro looks to May’s Wholesale Inventories.

09 July 2024 – 08:27 Central Euro Time

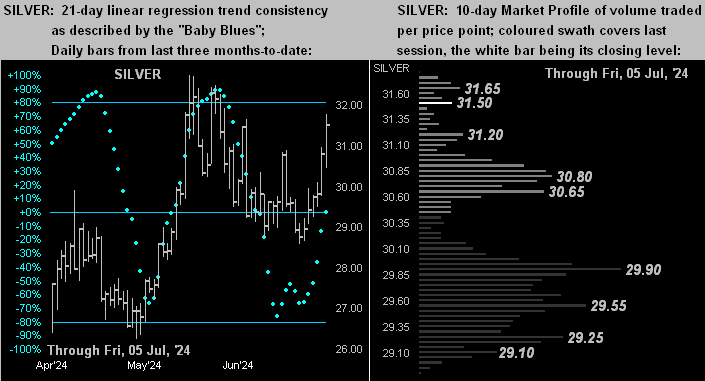

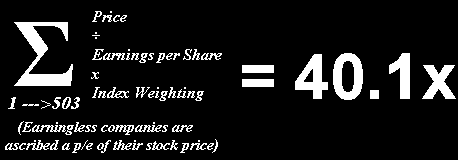

Both Silver and Copper are at present above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is light. Gold took a bit of a hit yesterday, reminding us that key weekly technicals remain negatively in place (MACD and Parabolics); three weeks remain until the next FOMC Policy Statement, wherein — given the diving Econ Baro — an interest rate cut ought be warranted (assuming too that inflation has ceased per May’s data). At Market Values, the Spoo is (in real-time) +197 points above its smooth valuation line; the S&P 500 (futs-adj’d “live” P/E now 43.9x) begins a 21st consecutive session as “textbook overbought”. And as previously noted, Q2 Earnings Season officially is underway, as updated daily on that page.

08 July 2024 – 08:37 Central Euro Time

“Down” describes the state of the BEGOS Markets to start the week: save for the Swiss Franc (+0.1%), the seven other components are in the red with just the Bond and Spoo (albeit lower) at present inside today’s Neutral Zones; session volatility is pushing toward moderate. The Gold Update still confirms the key weekly measures of both MACD and Parabolics as negative, but that the yellow metal is getting a fundamental bid as therein itemized; too of note, Gold on Friday crossed above its smooth valuation line (see Market Values). The Econ Baro (which has been pounded into the ground) begins a fairly light week, today featuring May’s Consumer Credit late in the session; (inflation gauges shall be highlighted come Thursday and Friday). And today also begins Q2 Earnings Season.

05 July 2024 – 08:32 Central Euro Time

The two-day BEGOS Market’s stint continues. At present we’ve the Euro, Swiss Franc, Gold and Copper above their respective Neutral Zones for the session; none of the other BEGOS components are below same, and volatility (given two days of movement) is moderate-to-robust, both the Swiss Franc and Copper having traced in excess of 100% of their EDTRs (see Market Ranges). Gold has regained firmness this week, albeit not enough to change the more near-term negative nature of the weekly technicals; (more on that in tomorrow’s 764th consecutive edition of The Gold Update). The Spoo is up such that the S&P 500 would (at this moment) open at an all-time high of 5540. And the Econ Baro concludes its down week with June’s Payrolls data.

04 July 2024 – 08:16 Central Euro Time

Given the StateSide holiday, the BEGOS Markets are in a two-day session (for Friday Settle) with the Swiss Franc at present above its Neutral Zone whilst Silver is below same; not surprisingly, volatility is light, the Spoo having thus far just traced 13% of its EDTR (see Market Ranges). Looking at Market Rhythms on a purely swing basis, our 10-test group for most consistency is currently the Euro’s 2hr MACD, Oil’s 60mn Parabolics, and Silver’s 15mn Moneyflow; for the 24-test group, we’ve two for the Spoo by its 4hr Moneyflow and daily Parabolics. With the S&P 500 at an all-time closing high (5537), its futs-adj’d “live” P/E is now 43.3x. Tomorrow is a full trading day for US equities, preceded for the “free-fall” Econ Baro by June’s Payrolls data.

03 July 2024 – 08:39 Central Euro Time

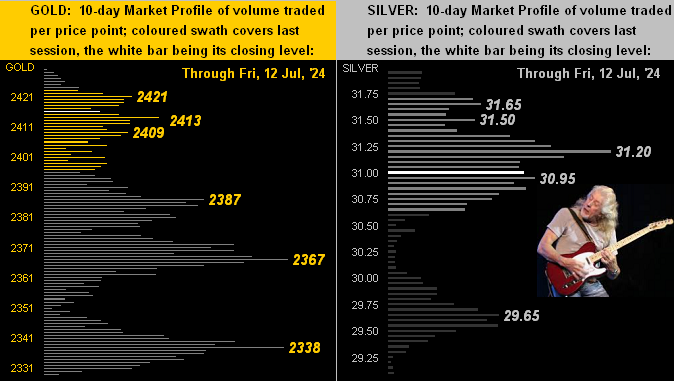

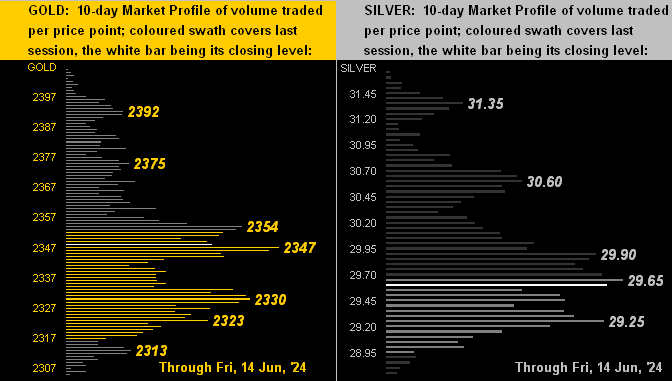

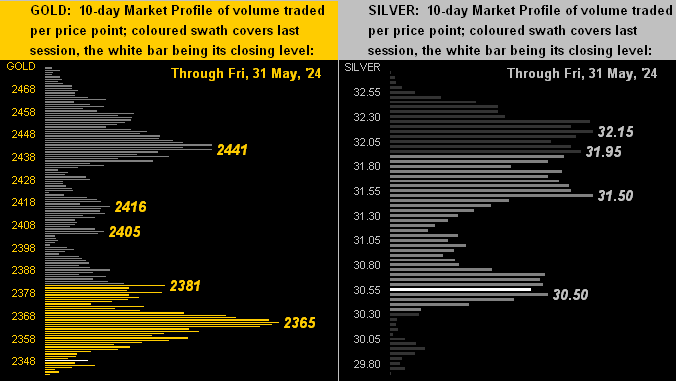

The Swiss Franc is at present below its Neutral Zone for today; above same are both Silver and Copper, and BEGOS Markets’ volatility is mostly light ahead of early closures for the Spoo and S&P 500. The latter settled above 5500 for the first time yesterday, albeit two recent days posted intra-day highs above that level: the “live” (futs-adj’d) P/E of the S&P is 43.0x with Q2 Earnings Season commencing next week; the S&P yields 1.324% versus the US 3mo T-bill’s annualized 5.228% Gold is basically staying buoyed above its key Market Profile support of 2338 even as near-term technicals suggest lower prices. The Econ Baro receives a bevy of metrics today: June’s ADP Employment data and ISM(Svc) Index, May’s Trade Deficit and Factory Orders, and because of tomorrow’s StateSide holiday, last week’s Jobless Claims too are squeezed into the mix.

02 July 2024 – 08:39 Central Euro Time

The Swiss Franc is at present the only BEGOS Market outside (below) its Neutral Zone for today; session volatility is quite light. The firmest correlation amongst the five primary BEGOS components is one which is positive between Gold and Oil, although by Market Trends, the former’s linreg is negative whilst the latter’s is positive; (the correlation benefits from both markets being well up from their lows of a week ago, however we remain more attuned to Gold slipping near-term rather than Oil breaking higher). Still, by Market Values, Gold is (in real-time) -43 points below its smooth valuation line whilst Oil is +5.13 points above same. Nothing is due today for the Econ Baro ahead of a bunching of incoming metrics tomorrow for the shortened equities session ahead of Thursday’s holiday.

01 July 2024 – 08:43 Central Euro Time

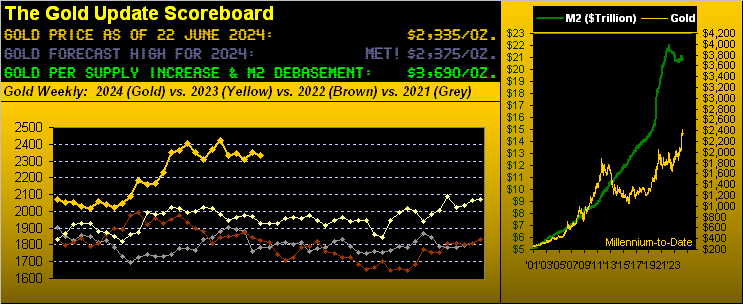

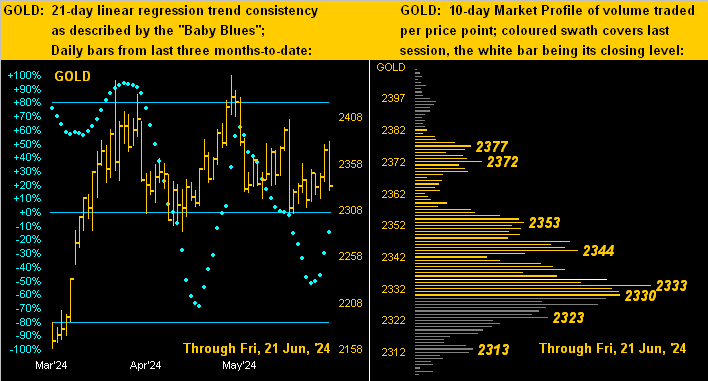

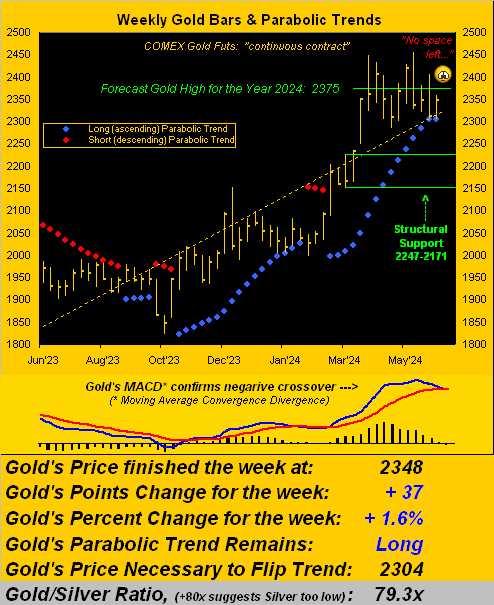

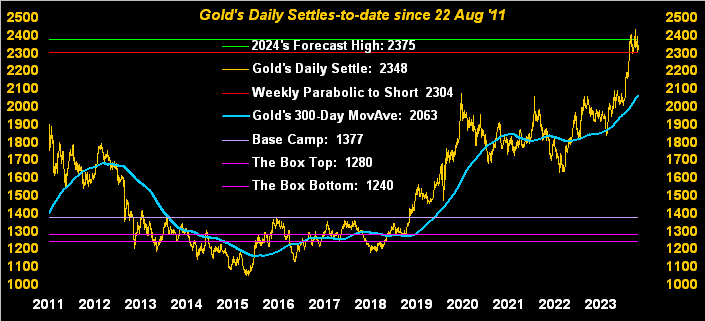

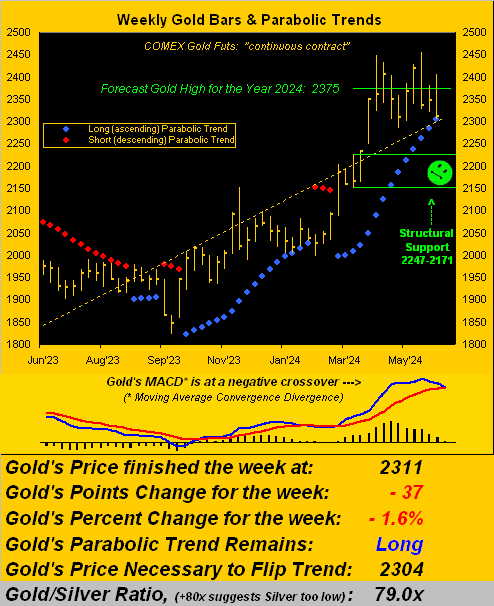

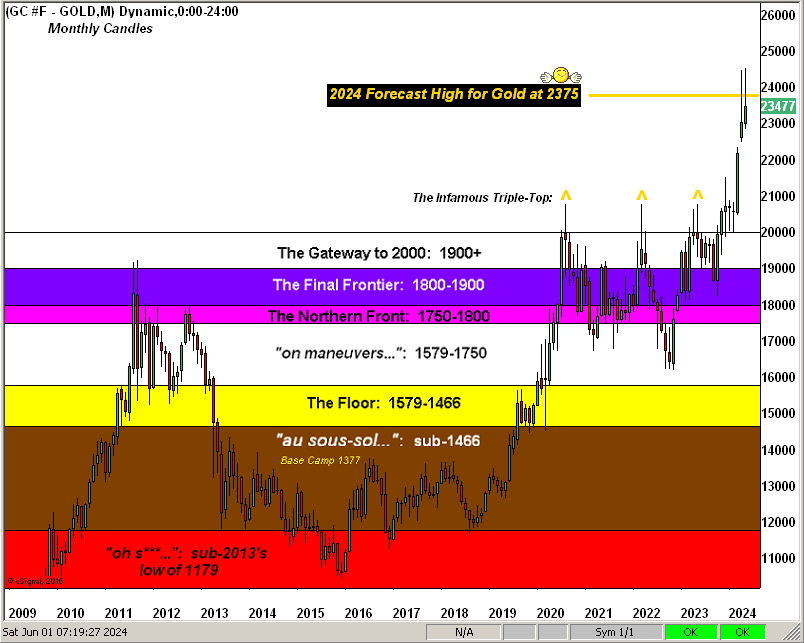

The year’s second half starts with both the Euro and Oil at present above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is moderate within the context that by Market Ranges, EDTRs have been narrowing. The Gold Update cites confirmation of the yellow metal’s weekly parabolic trend having flipped from Long-to-Short, the typical move lower from here (strictly by past average adversity) suggesting a meeting with the 2247-2171 structural support zone; Gold by Market Values is (in real-time) -42 points below its smooth valuation line; but by Market Magnets, price appears poised to eclipse up through its Magnet: thus we don’t sense an imminently stark move lower; still, near-term Gold technicals have a negative bent. For the Econ Baro today we’ve June’s ISM(Mfg) Index and May’s Construction Spending.

28 June 2024 – 08:36 Central Euro Time

Early on in the final trading day (by months) of the year’s first half, we’ve the Bond at present below today’s Neutral Zone; above same are Silver, Copper and Oil, and volatility is pushing toward moderate. Going ’round the Market Values horn for our five primary BEGOS Markets: in real-time we’ve the Bond as +1 point “high” above its smooth valuation line, the Euro -0.018 points “low”, Gold -41 points “low”, Oil +3.82 points “high” and the Spoo +211 points “high”. The S&P 500 is now 14 consecutive days “textbook overbought” and its “live” P/E is 42.7x. The Econ Baro looks to June’s Chi PMI and revision to UofM’s Sentiment Survey, plus May’s Personal Income/Spending and the “Fed-favoured” Core PCE.

27 June 2024 – 08:37 Central Euro Time

The Euro is at present above today’s Neutral Zone, whereas the balance of the BEGOS Markets are within same; volatility is notably light, with 10 metrics incoming for the Econ Baro over the next two sessions. As “X’d” (@deMeadvillePro) yesterday, Gold’s weekly parabolic trend has provisionally flipped from Long to Short, setting up a test for the 2247-2171 structural support zone; (more on that in next Saturday’s 763rd edition of The Gold Update). The Bond yesterday crossed beneath its Market Magnet, whilst today its MACD has provisionally crossed to negative: we thus anticipate some degree of further Bond selling overing the ensuing days, (albeit Friday’s PCE data is the wild card). Reports today for the Econ Baro include May’s Durable Orders and Pending Home Sales, plus the final revision to Q1’s GDP.

26 June 2024 – 08:41 Central Euro Time

At present we’ve the Bond, Euro, Swiss Franc, and Gold all below their respective Neutral Zones for today; above same is Oil, and volatility is again light. Preferential Market Rhythms displaying the best swing consistency through yesterday are (on a 10-test basis) the Euro’s 15mn EMA, and (on a 24-test basis) both the Spoo’s daily Parabolics and 4hr Moneyflow. For the S&P 500 itself (now 12 consecutive trading days as “textbook overbought”), the futs-adj’d “live” P/E is 42.8x and yield 1.323%; the StateSide 3mo annualized T-Bill yield is 5.223%. Silver’s cac volume is rolling from July into that for September. And the Econ Baro looks to May’s New Home Sales.

25 June 2024 – 08:49 Central Euro Time

Gold is the sole BEGOS Market at present outside (below) its Neutral Zone for today; session volatility is light. Going ’round the horn for all eight Market Trends: the Bond, Swiss Franc, Oil and Spoo are in positive linreg; negative is that for the Euro, Gold, Silver, and Copper. Whilst the S&P 500 yesterday was -0.3%, its MoneyFlow (regressed into S&P points) fell -1.9%, the biased constituent therein being NVDA: per the S&P Valuations and Rankings page, amongst the 10 largest cap-weighted constituents, that company’s “live” P/E settled yesterday at 68.4x, second-highest only to that of LLY at 133.0x. As to the S&P itself, yesterday concluded its 11th consecutive session as “textbook overbought”. The Econ Baro awaits June’s Consumer Confidence.

24 June 2024 – 08:14 Central Euro Time

A quiet start to the week as we move toward the mid-point of the trading year: at present, all eight BEGOS Markets are within today’s Neutral Zones, volatility being light. The Gold Update cites the yellow metal’s fundamental grip, albeit the near-term weekly technicals lack strength: penetration of 2320 this week would flip the key weekly parabolic trend from Long to Short. The “live” P/E of the S&P 500 is 41.4x; the Spoo (in real-time) by Market Values is +238 points above its smooth valuation line. Despite much analytical ado about a Bond Market demise, our Bond futs from late April’s lows are nearly +6%, the 21-day linreg firmly positive at Market Trends. Copper’s cac volume is rolling from July into that for September. Nothing is due today for the Econ Baro ahead of 12 incoming metrics for this week, culminating on Friday with the “Fed-favoured” PCE measure of inflaton.

21 June 2024 – 08:10 Central Euro Time

Summer’s first full day begins as the week ends wherein we’ve the Euro as the sole BEGOS Market at present outside (above) today’s Neutral Zone; volatility is quite light. Gold has relinquished its positive correlation with the Spoo and is now better teamed with Oil, both exhibiting uptrends these last couple of weeks, albeit Gold’s weekly technicals continue to suggest lower levels near-term: more on that in tomorrow’s Gold Update (No. 762); regardless, both Gold and Silver have broken above their respective weekly highs of the prior week, (even as by Market Trends their linregs remain negative). The Econ Baro, which has taken a terrific hit this week (indeed across the past two months), looks to May’s Existing Home Sales and Leading (i.e. “lagging”) Indicators, the latter potentially quite negative given the dive in the Baro itself.

20 June 2024 – 08:34 Central Euro Time

The two-day session continues for the BEGOS Markets: now we’ve the Bond below today’s Neutral Zone, whilst above same are Gold, Silver and the Spoo; session volatility expectedly has upshifted to moderate. Given the rise in the Spoo from Tuesday, the S&P 500 is poised to open (at this writing) above 5500 for the first time; its futs-adj’d “live” P/E is 42.1x and the yield 1.337%; (three-month U.S. dough pays 5.235%). By Market Trends, four components are in positive linregs (the Bond, Swiss Franc, Oil and Spoo), the other four being negative (Euro, Gold, Silver and Copper). Included today for incoming Econ Baro metrics are June’s Philly Fed Index, May’s Housing Starts/Permits, and Q1’s Current Account Deficit.

19 June 2024 – 08:43 Central Euro Time

Given the StateSide holiday, we’ve a two-day GLOBEX session in progress: at present, all eight BEGOS Markets are within their respective Neutral Zones for the session, and volatility is very light. Looking at Market Rhythms for pure swing consistency, on a 10-test basis the leader is the Euro’s 1hr MACD, whilst on a 24-test basis ’tis the Bond’s 1hr Moneyflow. The primary BEGOS components with the best recent correlation is one that is positive between Gold and the Spoo; however, by Market Trends, Gold is in a 21-day linreg downtrend whereas the Spoo’s is up; regardless, both markets are directionally higher from their lows of eight sessions ago The one metric due today for the Econ Baro is June’s NAHB Housing Index..

18 June 2024 – 08:44 Central Euro Time

Following another record-high day for the S&P 500 (the “live” fut’s adj’d P/E now 42.1x; and by our MoneyFlow page, dough continues to pour into this vastly overvalued Index), we’ve Oil at present the sole BEGOS Market outside (below) its Neutral zone for today; session volatility is mostly light. At Market Values, the insatiable Spoo is (in real-time) +285 points above its smooth valuation line; the other four primary BEGOS components are not trading excessively far from their respective valuation lines; of note therein, Oil yesterday moved above its valuation line, which by rule is a Long signal, whilst at Market Trends, Oil’s linreg looks poised to rotate from negative to positive. For the Econ Baro we await May’s Retail Sales and IndProd/CapUtil, plus April’s Business Inventories.

17 June 2024 – 08:20 Central Euro Time

As the week commences we’ve all eight BEGOS Markets in the red; six of the eight (save for the Swiss Franc and Spoo) are at present below their respective Neutral Zones for today, and session volatility is mostly light, expect for Copper having thus far traced 64% of its EDTR (see Market Ranges). The Gold Update remains remindful of the yellow metal’s near-term negative stance, the weekly MACD having confirmed a downside crossover at the conclusion of last week, price potentially en route to a test of the 2247-2171 structural support zone, (notably should the 2311 low of two weeks ago go). Cac volume for the Spoo is now on September; by its 10-day Market Profile, the Spoo’s most dominantly-traded handles (basis Sep cac) have been 5502, 5492, 5430, 5365 and 5350. 14 metrics come due this week for the Econ Baro, beginning today with June’s NY State Empire Index.

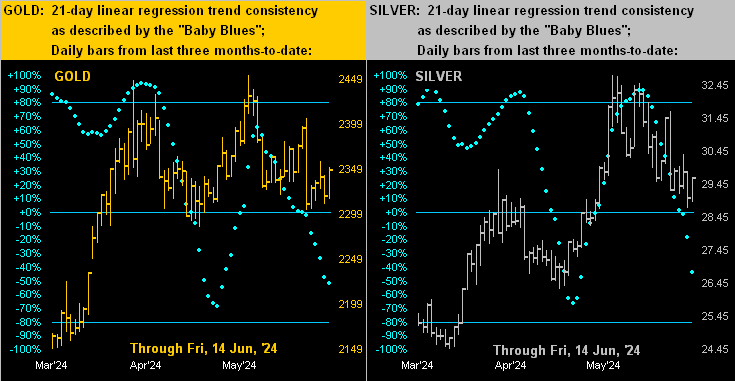

14 June 2024 – 08:37 Central Euro Time

Gold is at present the only BEGOS Market outside (above) its Neutral Zone for today; still, barring a significant up day, Gold shall compete its week with the weekly MACD having confirmed going negative: more in tomorrow’s 761st consecutive Saturday edition of The Gold Update. Session volatility is light; of note however is the Yen (not yet a BEGOS component) having traced 128% of its EDTR (see Market Ranges for those of the other components). Cac volume for the Spoo is beginning to move from June into September with a whopping +65 points of additional price premium: that in turn finds the Sepember cac (in real-time) +259 points above its smooth valuation line (see Market Values). The Econ Baro looks to more inflation information via May’s Ex/Im Prices; too arrives UofM’s Sentiment Survey for June.

13 June 2024 – 08:35 Central Euro Time

Following the somewhat “stubborn-to-cut-Fed” (let alone our year-to-date musings instead about a hike), the Dollar’s furthering a bit of a bid today: at present below their respective Neutral Zones for this session are the Swiss Franc, Gold and Silver; indeed across the board, all eight BEGOS Markets are underwater, and volatility is mostly light, save for Silver having already traced 5% of its EDTR (see Market Ranges). Yesterday’s S&P surge to a record high (5447) without supportive earnings puts the “live” futs-adj’d P/E at 41.2x. Currencies’ cac volumes are beginning their roll from June into September. And at the wholesale inflation level, today’s incoming metrics for the Econ Baro include May’s PPI.

12 June 2024 – 08:34 Central Euro Time

Oil is at present the sole BEGOS Market outside (above) its Neutral Zone for today; session volatility “ahead of the Fed” is very light. At Market Values, Oil is just a point or so below its smooth valuation line, the upside penetration of which by rule is a Long signal; and at Market Trends, whilst Oil’s linreg is negative, the “Baby Blues” of trend consistency are now into their third day of ascent; on a 10-test pure swing basis, Oil’s best Market Rhythm is the 1hr Price Oscillator; and for within swing profit-taking ’tis the 6hr MACD (as graphically detail on our Oil page). Late in the session we’ve both the FOMC’s Policy Statement, Powell presser and Treasury Budget for May, prior to which comes that month’s CPI.

11 June 2024 – 08:39 Central Euro Time

Gold, Silver and Oil are all at present below their respective Neutral Zones for today; the balance of the BEGOS Markets are within same, and volatility again is light. Leading our Market Rhythms for pure swing consistency on a 10-test basis are Silver’s 1hr Price Oscillator, the Spoo’s 8hr MACD, and Copper’s 30mn Price Oscillator; on a 24-test basis the leaders are the Spoo’s daily Parabolics, the Yen’s (not yet an official BEGOS Market) 30mn Moneyflow, and Silver’s 1hr MACD. The best correlation amongst the five primary BEGOS components continues to be positive between the Euro and Gold. The Econ Baro is again quiet today ahead of nine metrics due — including inflation measures at the retail, wholesale and ex/im levels — from Wednesday through Friday. The FOMC’s two-day meeting begins today with their Policy Statement and Powell presser due tomorrow.

10 June 2024 – 08:32 Central Euro Time

The back-loaded EconData week (plus the FOMC’s Policy Statement come Wednesday) at present finds the Bond, Euro and Swiss Franc below today’s Neutral Zones, whilst above same are both Silver and Copper; BEGOS Markets’ volatility is light. The Gold Update maintains its near-term negative price stance: of technical import thereto, Gold’s weekly MACD has now provisionally crossed to negative; (confirmation would arrive at week’s end); downside price follow-throughs of this study average some -90 points, which in this case would place Gold well-within its 2247-2171 structural support zone. The S&P 500 settled its week with the “live” P/E at 40.1x. And by Market Values (in real-time), the Spoo is +136 points above its smooth valuation line.

07 June 2024 – 08:40 Central Euro Time

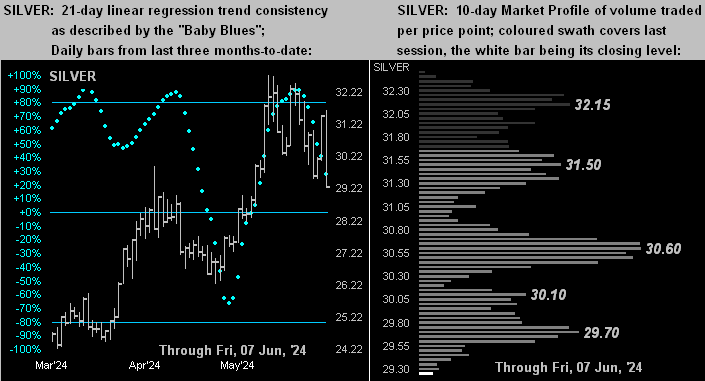

At present we’ve Copper as the only BEGOS Market outside (below) its Neutral Zone for today; session volatility is light with StateSide jobs data in the day’s balance. Curious to note yesterday’s ECB rate reduction despite the Governing Council’s outlook for increasing inflation. Going ’round the Market Trends page (21-day linreg basis and “Baby Blues” consistency): that for the Bond is up and reinforcing; the Euro up but weakening; the Swiss Franc up and reinforcing; Gold barely up and neutral; Silver up but weakening; both Copper and Oil down and worsening; and the Spoo up but weakening. The tumbling Econ Baro completes its busy week with May’s Payrolls data as noted, plus April’s Wholesale Inventories and (late in the session) Consumer Credit.

06 June 2024 – 08:35 Central Euro Time

The Swiss Franc, Gold and Silver all are at present above today’s Neutral Zones; none of the other BEGOS Markets are below same, and volatility is pushing toward moderate. Following yesterday’s record high, the “live” P/E of the S&P 500 is a futs-adj’d 40.5x and the yield 1.352%; three-month annualized U.S. T-Bill dough yields 5.240% without the risk of capital loss. An interesting Market Rhythm to mind is Gold’s 2h MACD: its last nine swings (both Long and Short) from 16 May-to-date have produced at least 12 points of signal follow-through ($1,200/cac); whilst the yellow metal both yesterday and today is having a recovery run, the weekly MACD is nearing a negative cross, in line with our recent writings being wary of near-term price retrenchment. Incoming metrics today for the Econ Baro include April’s Trade Deficit and the revision to Q1’s Productivity and Unit Labor Costs.

05 June 2024 – 08:01 Central Euro Time

The Bond and Swiss Franc are at present below their respective Neutral Zones for today; above same is Gold, and BEGOS Markets’ volatility is light. Gold’s weekly MACD is poised for a negative crossing, the last five of which over three years have led to lower prices of at least -30 points; The Gold Update cites specific lower levels of which to be aware following the “double-top” which formed across the past seven weeks; and price has been flirting with either side of its smooth valuation line (see Market Values). But that same metric, Oil (in real-time) shows as -7.83 points “low” and the Spoo as +123 points “high”, The Econ Baro looks to May’s ADP Employment data and the ISM(Svc) Index.

04 June 2024 – 08:26 Central Euro Time

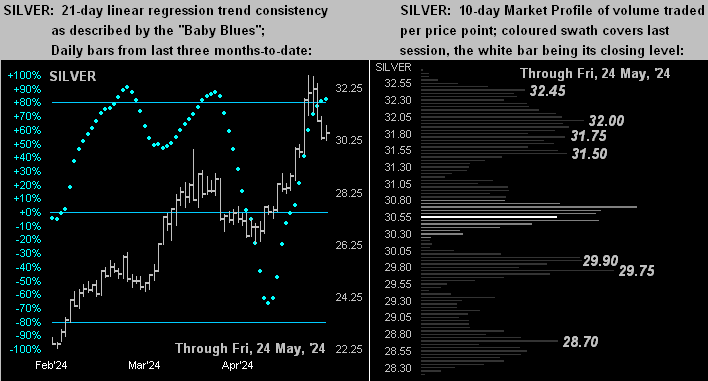

BEGOS Markets’ volatility is lighter than ’round this time yesterday, all eight components having thus far traced less than 50% of their EDTRs (see Market Ranges). The Swiss Franc is at present above today’s Neutral Range, whilst below same is Oil. Yesterday was a sizable up day for the currencies, both the Euro and Swiss Franc moving to nearly two-month highs. At Market Trend’s, Silver’s “Baby Blues” of trend consistency confirmed dropping below their key +80% axis, suggestive of lower prices near-term: should yesterday’s low of 29.940 go, a test of 29.000 (10 May’s high) appears structurally reasonable; Silver’s Market Profile support is 30.650 to 30.500; note as well at on our page for Silver that its EDTR presently exceeds 1.000 (the actual reading being 1.155 points per day). April’s Factory Orders come due for the Econ Baro.

03 June 2024 – 08:36 Central Euro Time

The week begins with the Bond at present above its Neutral Zone for today; below same are Oil, Silver and Gold; volatility is moderate. The Gold Update still is slanted toward lower prices near-term following the yellow metal’s have created a notable “double-top” within the past seven weeks, such pattern generally leading to further downside. The best correlation amongst the five primary BEGOS Markets is positive between the Euro and Gold. Leading our Market Rhythms for pure swing consistency on a 10-test basis is again the Yen’s (not yet a formal BEGOS component) daily Parabolics, and on a 24-test basis ’tis Gold’s 1hr MACD; (as highlighted in The Gold Update, the yellow metal’s 12hr MACD is best for profit taking within swings). The Econ Baro starts a busy week with May’s ISM(Mfg) Index and April’s Construction Spending.

31 May 2024 – 08:16 Central Euro Time

The BEGOS Markets are fairly quiet ahead of “Fed-favoured” inflation data due for April: both the Euro and Swiss Franc are at present a bit below their Neutral Zones for today; otherwise the balance of the components are within same, and volatility is light. The Spoo’s “Baby Blues” (see Market Trends) confirmed closing yesterday below their key +80% axis: year-over-year there’ve been six prior such negative crossovers, price then averaging -96 points of downside within the ensuing 21 trading days (one month); and by Market Values (in real-time), the Spoo still is +81 points above its smooth valuation line; too, this past Wednesday, the Spoo crossed below its Market Magnet, also indicative of further near-term price fallout; there is some structural support for the Spoo in the 5154-5036 zone, (i.e. beginning some -90 points below present price). The Econ Baro looks to May’s Chi PMI, plus April’s Personal Income/Spending and Core PCE Prices.

30 May 2024 – 10:26 Central Euro Time

On the heels of yesterday’s declines across all eight BEGOS Markets, we’ve at present both the Bond and Swiss Franc above their respective Neutral Zones for today, whilst below same are Gold, Silver, Copper, Oil and the Spoo; session volatility is moderate. At Market Trends, save for Silver and Oil, the “Baby Blues” of trend consistency are falling for the balance of the bunch. Looking at Market Rhythms on a profit-taking (rather than pure swing) basis, the best study is the Spoo’s daily Price Oscillator: there have been 10 signals extending as far back as 20 December 2022 for which all 10 produced price follow-through of at least 44 points (i.e. $2,200/cac); the current signal has been Long since 08 May. Metrics for the Econ Baro today include April’s Pending Home Sales and the first revision to Q1 GDP.

29 May 2024 – 08:24 Central Euro Time

Gold picks up +23 points of fresh premium as cac volume moves from June into that for August; however, the yellow metal is lower today, at present below its Neutral Zone as is the Spoo; none of the other BEGOS Markets are above same, and volatility is light. Looking at Market Rhythms for pure swing consistency: on a 10-test basis our best three are the Yen’s (not yet an official BEGOS Market) daily Parabolics, Copper’s 5mn Moneyflow, and the Spoo’s daily Parabolics; on a 24-test basis, the top three are the Yen’s 4hr Moneyflow, Gold’s 2hr Parabolics, and Copper’s 1hr MACD. Our best correlation amongst the five primary BEGOS components is positive between Gold and Oil. No metrics are due today for the Econ Baro.

28 May 2024 – 08:37 Central Euro Time

The BEGOS Markets’ two-day session continues, all three elements of the Metals Triumvirate at present above today’s Neutral Zones, as are Oil, the Euro and Swiss Franc; within same are both the Bond and Spoo; volatility has expectedly widened, now mostly moderate-to-robust, Silver with the largest EDTR (see Market Ranges) tracing at 150%. The Spoo is (in real-time) +192 points above its smooth valuation line (see Market Values); by Market Profiles, the Spoo’s most commonly traded price of the past 10 sessions is 5333. The S&P’s MoneyFlow has been significantly skewed to the upside on further piling into NVDA; otherwise by the page’s quarterly measure, the trend had been in mild decline. The Econ Baro awaits May’s Consumer Confidence.

27 May 2024 – 08:35 Central Euro Time

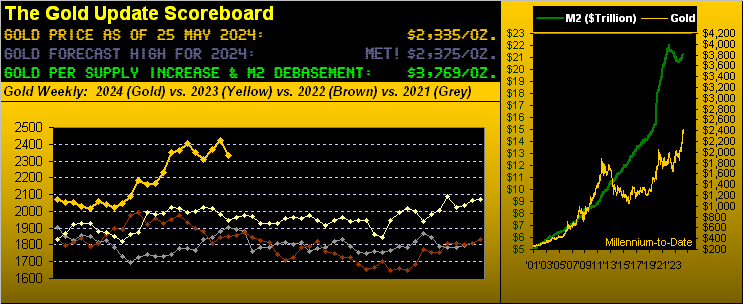

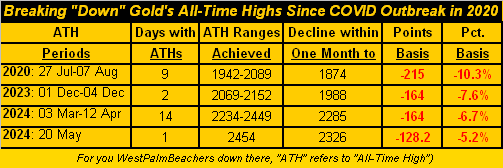

The two-day session for the BEGOS Markets is underway, (for Tuesday settlement given the StateSide holiday). The precious metals are getting the bid, both Gold and Silver at present above today’s Neutral Zones; the other six BEGOS components are within same, and volatility expectedly is quite light: only Silver has thus far traced in excess of 50% (55%) of its EDTR (see Market Ranges). The Gold Update acknowledges the most recent All-Time High (2454) as being at best “marginal” and cites what have become “habitual” moves lower typically following such post-COVID highs. The S&P 500 settled Friday as 13 days “textbook overbought”: the futs-adj’d “live” P/E is 39.7x. The Econ Baro anticipates just nine incoming metrics as the week unfolds, including on Friday the “Fed-favoured” PCE for April.

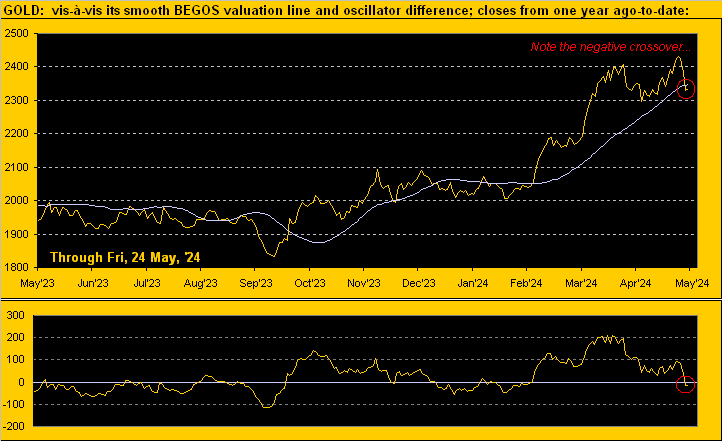

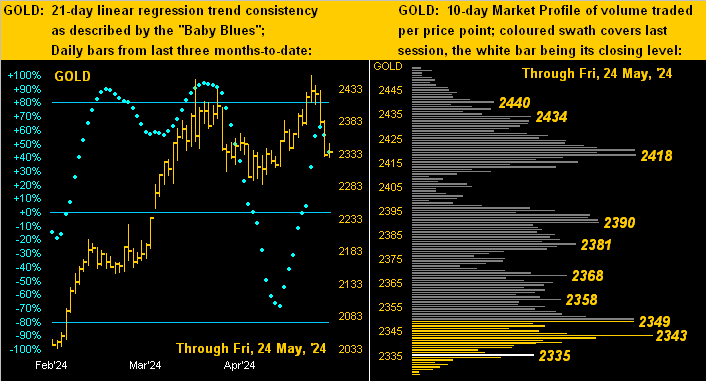

24 May 2024 – 08:28 Central Euro Time

The precious metals are getting a grip, both Gold and Silver at present above their respective Neutral Zones for today; the other six BEGOS Markets are within same, and session volatility is quite light ahead of the StateSide long weekend. In recent years, Gold after recording All-Time Highs has habitually, indeed materially, pulled back somewhat swiftly: more on that in tomorrow’s 758th consecutive Saturday edition of The Gold Update; too, the yellow metal finally has returned to its smooth valuation line (see Market Values) for the first time since 28 February. At Market Trends, the Spoo’s “Baby Blues” of trend consistency have (in real-time) kinked lower (but not so much as to yet penetrate their key +80% axis); still the S&P itself technically remains “textbook overbought” and is overwhelming expensive given its cap-weighted lack of earnings support. The Econ Baro concludes its quiet week with metrics including April’s Durable Orders.

23 May 2024 – 08:34 Central Euro Time

Following what we’d now classify as Gold’s “marginal” All-Time High on Monday (at 2454), the yellow metal has since been in sell mode (at present 2364), and along with Silver (30.545) is below today’s Neutral Zone; the Spoo is above same, and BEGOS Markets’ volatility is light-to-moderate. Such selling has dutifully brought down the Market Value excess we’ve had for Gold for nearly three full months: price (in real-time) is now +20 points above its smooth valuation line; a month ago the deviation was +200 points. “Over-valued” too by such metric is the Spoo (+230 points) whilst “under-valued” we’ve Oil -5.78 points. Specific to our S&P MoneyFlow page, the three-month differential of Flow relative to the Index (per that page’s lower-right panel) has developed a detectably negative bent to it. The Econ Baro’s incoming metrics today include April’s New Home Sales.

22 May 2024 – 08:24 Central Euro Time

At present we’ve both the Bond and Copper below today’s Neutral Zones; the other BEGOS Markets are within same, and volatility is mostly light. Silver has quieted a bit relative to its ranginess into this week: indeed by Market Ranges, the white metal’s EDTR is now 0.99 points, (whereas last September ’twas as low as 0.46 points). The S&P 500 is now 10 consecutive days “textbook overbought”: the “live” (fut’s-adj’d) P/E is 40.4x and the yield 1.369% versus an annualized 5.240% on risk-free U.S. 3-month dough. One wonders for how much longer the investing herd shall continue seeking unrealistic capital gains rather than equities reasonably priced by earnings support: mind our S&P 500 Valuation and Rankings page. The Econ Baro awaits April’s Existing Home Sales; and the Fed releases the 30 Apr-01May FOMC meeting minutes.