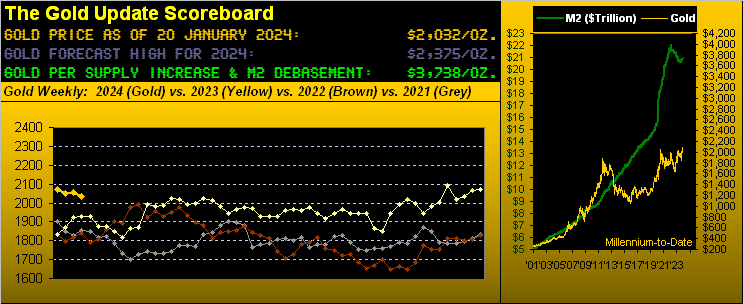

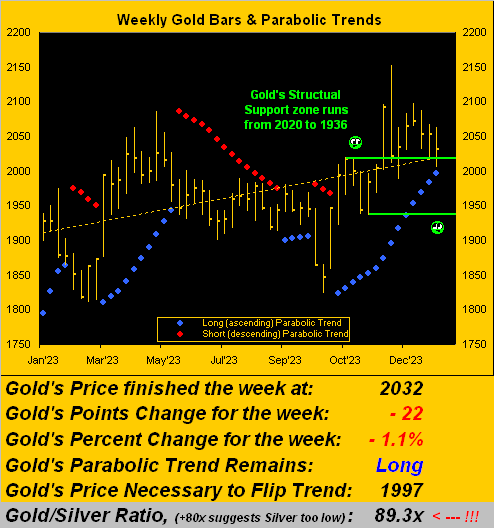

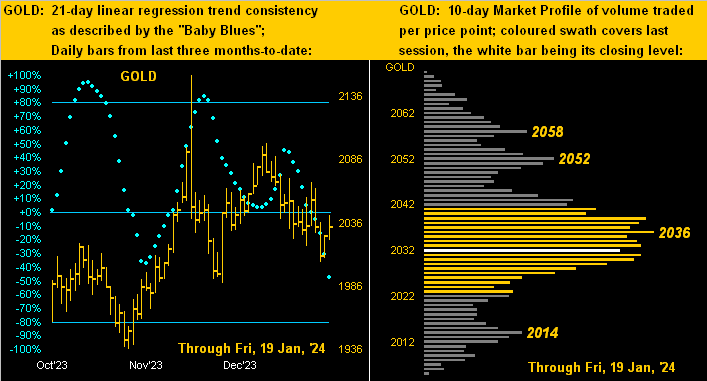

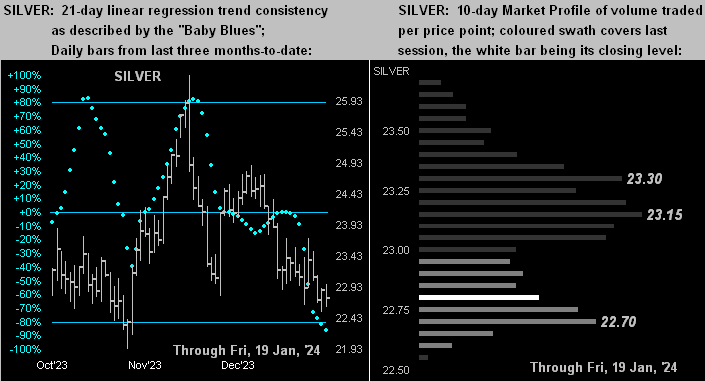

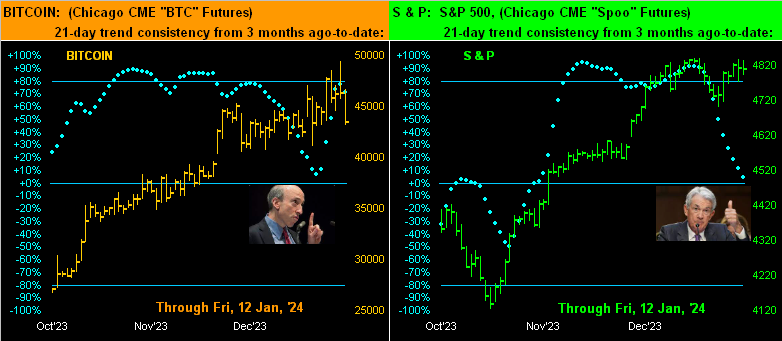

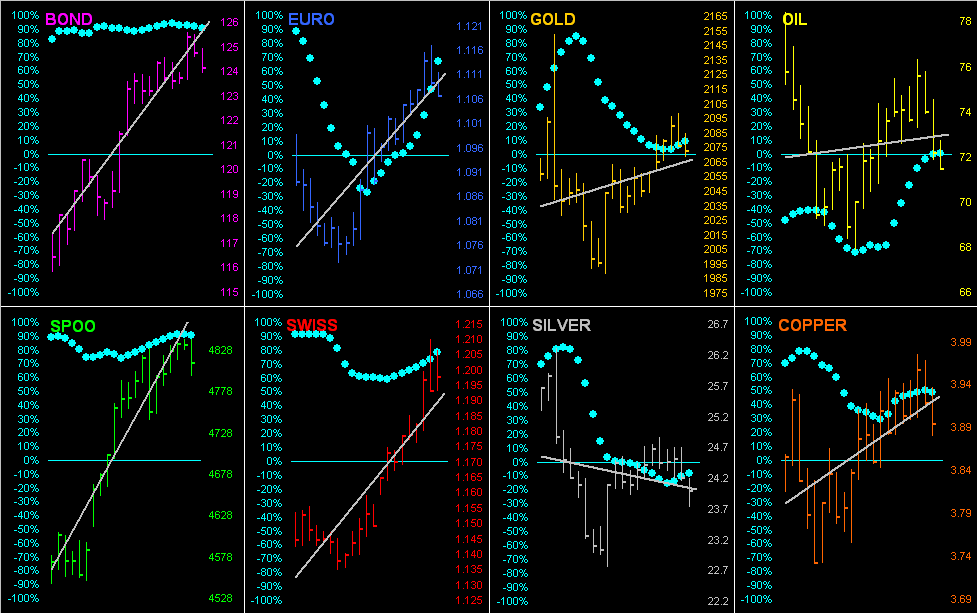

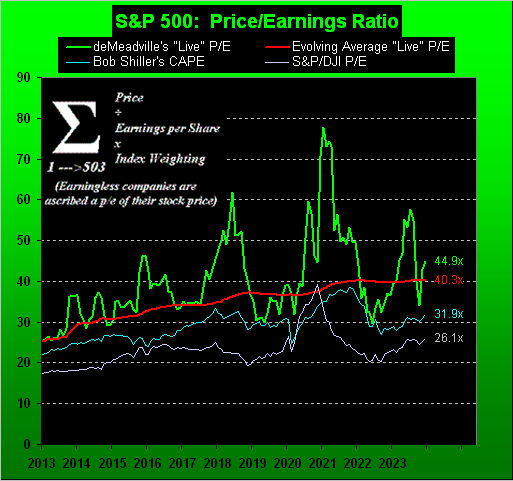

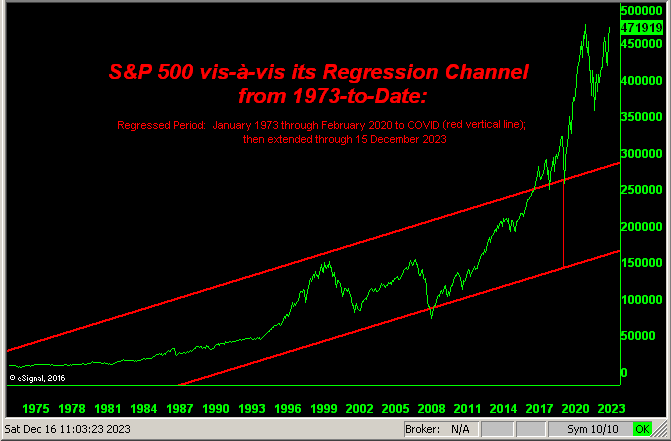

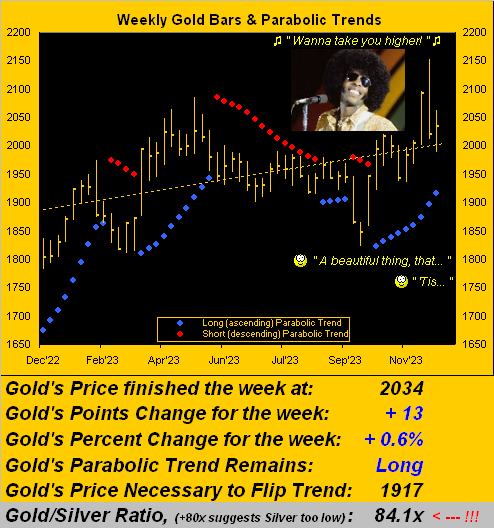

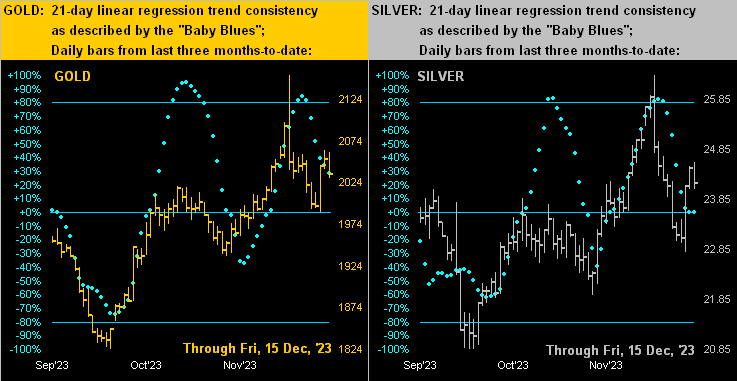

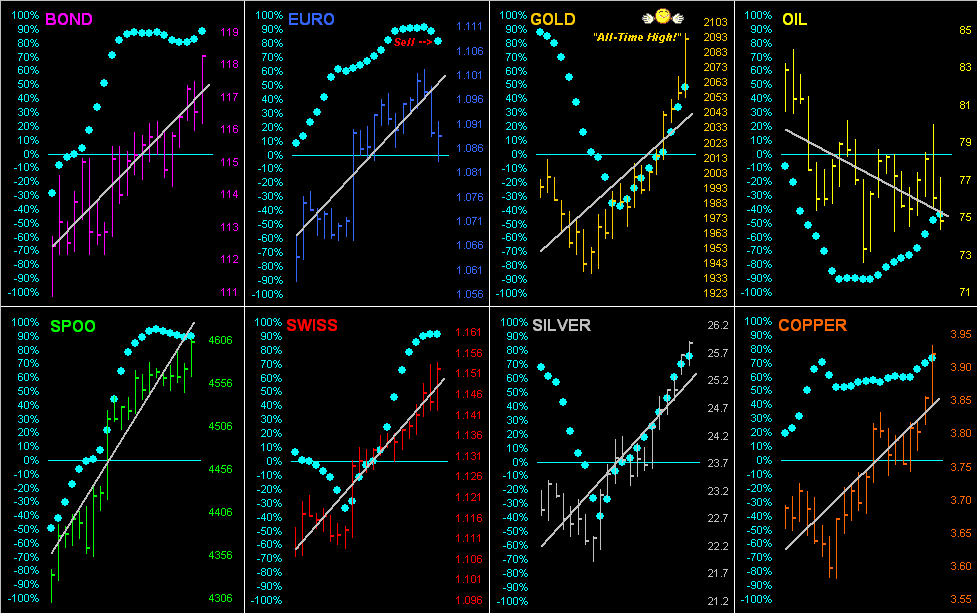

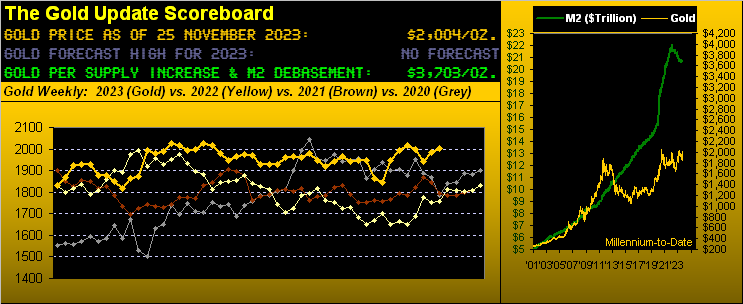

Strength in the Spoo at the moment would have the “live” P/E of the S&P leap to 50.4x at the open, (after settling last week at 49.7x): more on the S&P’s dangerous overvaluation in the current edition of The Gold Update, which also sees near-term weakness for the precious metals. Both Gold and Silver are at present below today’s Neutral Zones. BEGOS Markets’ volatility is pushing toward moderate, and Silver itself has already traced 102% of its EDTR (see Market Ranges). Currently priced 2023, we’ve marked Gold’s underlying support structure as 2020-1936. The record-setting Spoo’s 21-linreg has rotated from negative to positive (see Market Trends). The Econ Baro starts its week with December’s Leading (i.e. “lagging”) indicators.

Mark

Mark

19 January 2024 – 09:19 Central Euro Time

As was the case yesterday at this time, all eight BEGOS Markets are presently within their respective Neutral Zones for today, and volatility thus again is quiet. The amount of money it takes to move the S&P 500 one point is literally but half was it was just back in November, a “warning sign” as to just how frothy the S&P has become; too, with the “live” P/E at 48.5x, the Index remains on very unsteady footing. That noted, the S&P’s MoneyFlow has been on the upside go notably these last two trading days. The Econ Baro concludes its week with January’s UofM Sentiment Survey and December’s Existing Home Sales.

18 January 2024 – 09:16 Central Euro Time

The BEGOS Markets are at present quiet with all eight components inside today’s Neutral Zones; volatility is light. At Market Trends, the Spoo’s 21-day linreg has rotated to negative leaving just the Swiss Franc still (barely) in a positive stance. By Market Rhythms, our most consistent study on a 10-test swing basis is Copper’s 30mn Parabolics, whilst on a 24-test swing basis ’tis the Euro’s 4hr Parabolics. Per Market Values, the most extreme appearance by deviation from its smooth valuation line is Gold which shows (in real-time) as -50 points “low”. The Econ Baro’s incoming metrics for today include January’s Philly Fed Index and December’s Housing Starts/Permits.

17 January 2024 – 09:12 Central Euro Time

Whilst yesterday’s S&P Moneyflow was actually positive (+0.9%), the Index itself fell -0.4%, but by our broadest measure (quarterly) the Flow still is suggestive of lower Index levels. Earnings Season is off to a poor start; however with just 30 companies having reported (of some 2,000 expected), this may not yet be statistically significant: 80% having beaten estimates … but just 40% have improved their bottom lines over Q4 a year ago. At present, Silver, Copper and the Spoo are below their respective Neutral Zones for today; none of the other BEGOS Markets are above same, and volatility is pushing toward moderate. Cac volume for Oil is moving from February into March. And ’tis a big day for the Econ Baro with January’s NAHB Housing Index, December’s Retail Sales, Ex/Im Prices, and IndProd/CapUtil, plus November’s Business Inventories. Too, we receive the Fed’s Tan Tome for January.

16 January 2024 – 09:16 Central Euro Time

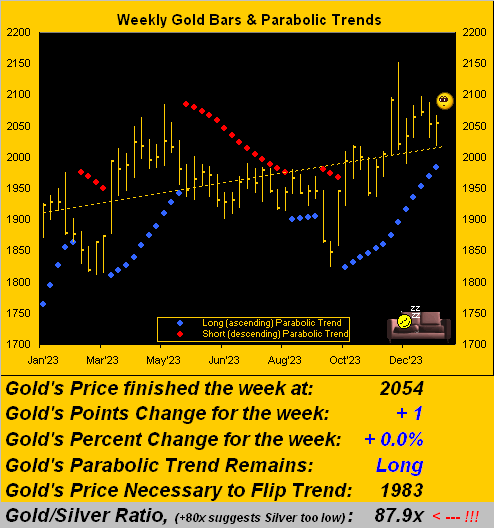

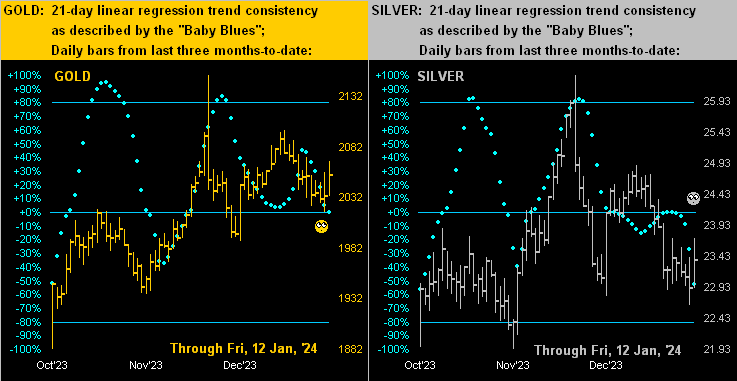

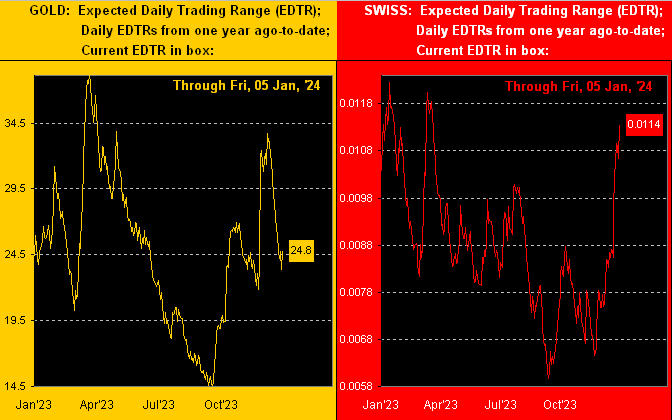

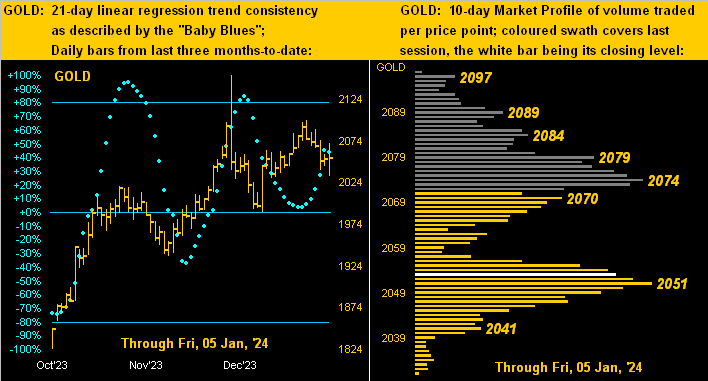

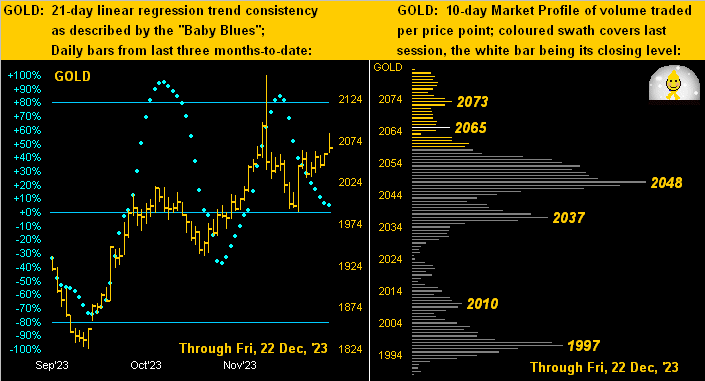

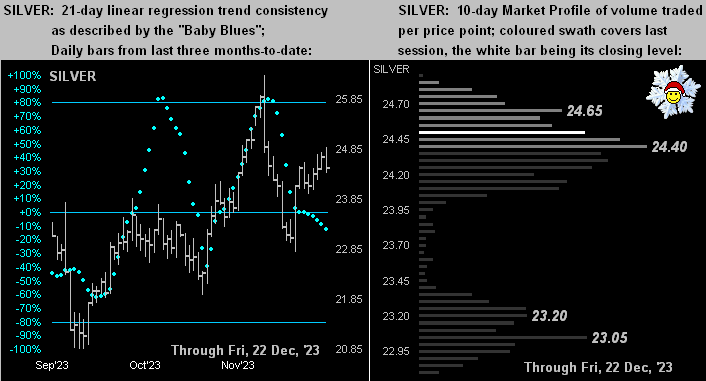

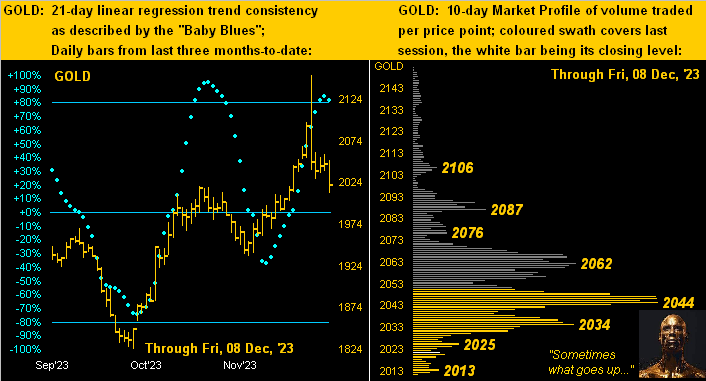

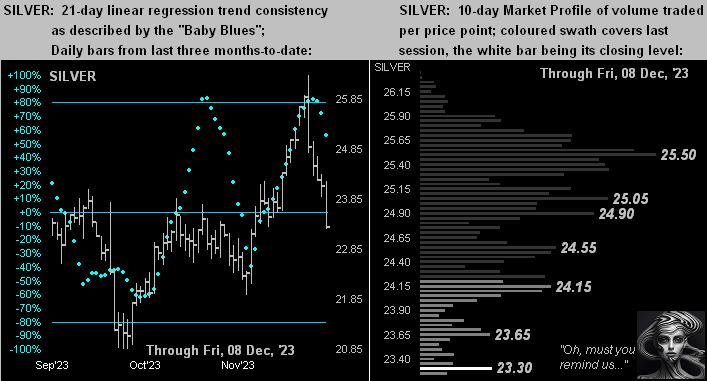

Into the second day of the BEGOS Markets’ two-day session we’ve now the Bond, EuroCurrencies and Spoo all to the weak side; Copper is the sole component at present above its Neutral zone. Volatility is moderate-to-robust given it being a double-session, the Swiss Franc leading the ranginess with a 109% tracing of its EDTR (see Market Ranges). Quietest of the bunch is Gold, thus far with just a 51% tracing: again per the current edition of The Gold Update, the yellow metal is biding its time within a broader rising price environment. At Market Trends the following are now sporting negative 21-day linregs: the Bond, Gold, Silver, Copper and Oil, and it remains that the “Baby Blues” of trend consistency are all in descent. The Econ Baro’s week begins with January’s NY Empire State Index.

15 January 2024 – 09:15 Central Euro Time

Given the StateSide holiday, the BEGOS Markets are into a two-day session (for Tuesday settlement). At present we’ve the Bond below its Neutral Zone for the session, and Copper above same; volatility is expectedly light. The Gold Update cites the December dichotomy between an inflationary CPI and a deflationary PPI, and that Gold on balance is biding its time these days, its broader measures of trend still quite positive. Q4 Earnings Season for 2023 is in the banks’ results phase: of the six having reported this past Friday, four bottom lines were worse than for Q4 of 2022. Still, the S&P 500 remains near its 4819 all-time high, the futs-adj’d opening at this instant for tomorrow being 4787, and the “live” P/E thus 46.6x. The “all-to-risk” S&P now yields 1.465% and the “risk-free” 3-month T-Bill an annualized 5.198%. The Econ Baro awaits a week with 15 incoming metrics.

12 January 2024 – 09:20 Central Euro Time

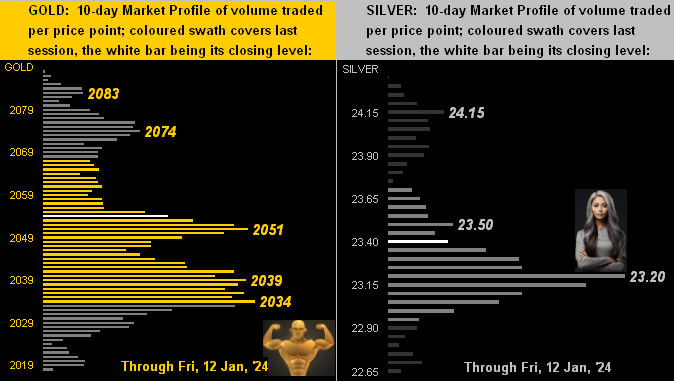

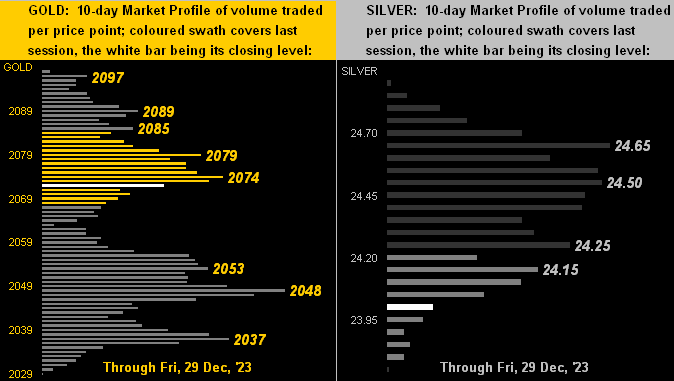

The Metals Triumvirate and Oil are the BEGOS Markets’ winners at present; the other components are within today’s Neutral Zones, and volatility is again mostly light. Last Saturday’s (and still current) edition of The Gold Update introduced the notion that inflation may not be cooling, and we saw evidence of that in yesterday’s CPI data for December; today the Econ Baro looks to the wholesale level of inflation via December’s PPI. Gold (presently 2043) has thus far seen the session’s low at 2034 which is the most dominantly-traded Market Profile price across the past two weeks. Q4 earnings ought get more notice through these next several trading days as financial institutions’ results begin to arrive, (see too the website’s Earnings Season page for the overall picture).

11 January 2024 – 09:09 Central Euro Time

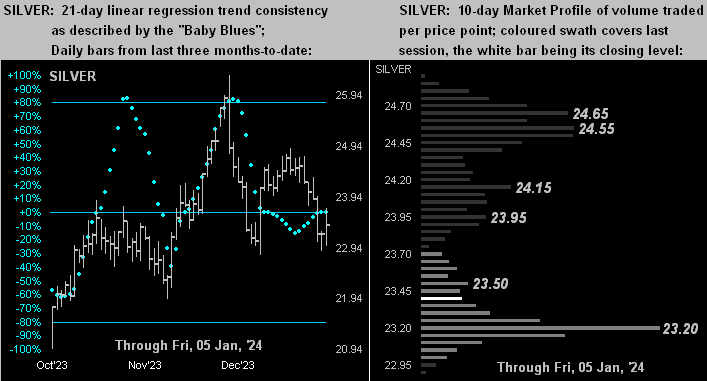

Early on we’ve strength in the Bond, the Metals Triumvirate and the Spoo; none of the other BEGOS Markets are below their Neutral Zone, and volatility is mostly light. At Market Trends, Copper’s linreg has rotated to negative, joining Silver also in that stance; however as noted yesterday, the “Baby Blues” of trend consistency are falling for all eight components. Our best Market Rhythm by swing results (on a 10-test basis) currently is Gold’s 8hr MACD and (on a 24-test basis) the Euro’s 4hr Parabolics. Included in today’s metrics for the Econ Baro are December’s CPI along with the (occasionally elusive) Treasury Deficit.

10 January 2024 – 09:15 Central Euro Time

The BEGOS Markets are at present quiet, all eight components within their respective Neutral Zones for today; volatility is light across the board. The Swiss Franc per our Market Trends page confirmed its “Baby Blues” of trend consistency having fallen below the key +80%, suggestive of lower prices near-term; currently, our favoured Market Rhythm for the Swiss Franc is its 4hr MoneyFlow. Yesterday the S&P got a bit of a MoneyFlow boost; however the tide of the Spoo continues to weaken as its 21-day linreg trend continues to rotate toward turning negative, (again see Market Trends). November’s Wholesale Inventories come due for the Econ Baro.

09 January 2024 – 09:10 Central Euro Time

The precious metals are rebounding this morning, both Gold and Silver at present above today’s Neutral Zones; the other BEGOS Markets are within same, and volatility is mostly light, save for the precious metals having already traced in excess of 50% of their EDTRs (see Market Ranges). At Market Values, all five primary BEGOS components are fairly near their respective smooth valuation lines. Meanwhile at Market Trends, it remains that all the markets are in linreg uptrends save for Silver: however in all eight cases, their “Baby Blues” are in decline, exemplary of the uptrends losing their consistency. For the Econ Baro we’ve November’s Trade Deficit; and Q4 Earnings Season is underway which you can track here at the website.

08 January 2024 – 09:25 Central Euro Time

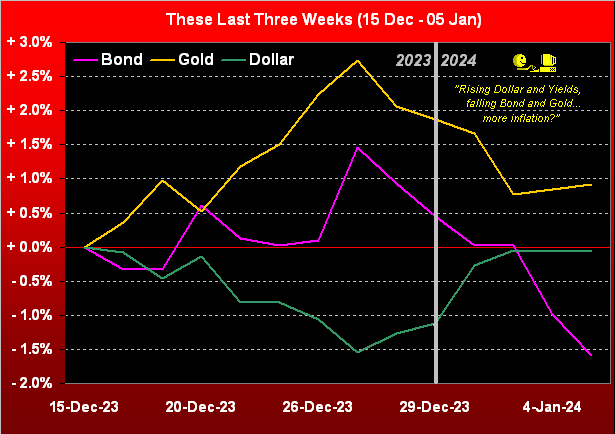

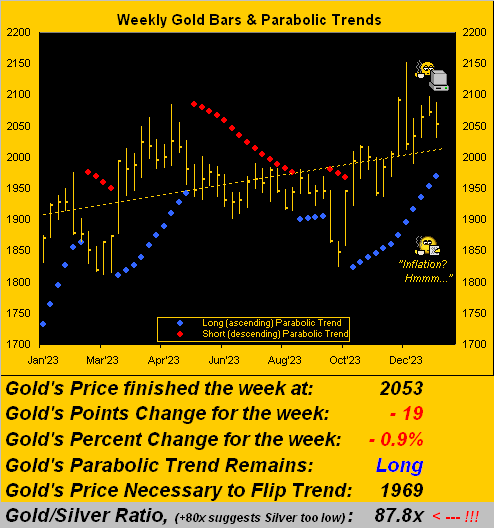

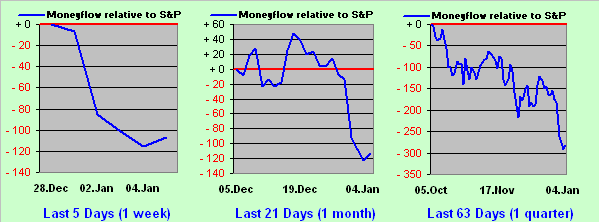

The precious metals and Oil are weak this morning; BEGOS Markets volatility is pushing toward moderate as the year’s first full trading week begins. The Gold Update is somewhat wary of the early-year inflation trading push out of the Bond and into the Dollar, Gold in turn getting the “conventional wisdom” sell. For the S&P 500, the MoneyFlow page is decidedly negative such that lower Index levels ought be in the offing; specific to the Spoo, its “Baby Blues” (see Market Trends) are (in real-time) accelerating their fall, and by Market Values the Spoo looks to a negative crossing below its smooth valuation line, barring a firm rally this week: confirmation of such crossing would, too, suggest lower price levels. Late in the session for the Econ Baro we’ve November’s Consumer Credit.

05 January 2024 – 09:23 Central Euro Time

We’ve weakness this morning in the Bond and EuroCurrencies; the other BEGOS Markets are at present within today’s Neutral Zones, and volatility is again light. As did the Spoo on Wednesday, the Bond has now confirmed its “Baby Blues” (see Market Trends) having crossed below their key +80% axis: currently priced at 122^15, we can see a near-term run down into the 120 handle. The leading MoneyFlow for the S&P 500 continues to deteriorate more swiftly than the downside change in the Index itself, even as the “textbook overbought” condition concluded with a 39-trading-day streak. And for the Econ Baro, ’tis Payrolls day for December, along with the month’s ISM(Svc) Index, plus November’s Factory Orders.

04 January 2024 – 09:09 Central Euro Time

The BEGOS Markets are quiet, at present all eight components within their respective Neutral Zones for today; obviously, volatility is light. Despite the S&P 500 having recorded two down days to commence the year, it nonetheless is entering what would be a 40th consecutive trading day as “textbook overbought”: having settled yesterday at 4704, an up session today would likely maintain that condition, else a down day would finally nix it. Too for the Spoo, its “Baby Blues” (see Market Trends) confirmed settling below their +80% axis yesterday, suggestive of still lower price levels ahead: whilst this is a highly reliable leading near-term indicator, the prior such occurrence failed to produce anything materially to the downside. Today’s Econ Baro metrics include December’s ADP Employment data.

03 January 2024 – 09:02 Central Euro Time

At present we’ve weakness in the Bond and Copper, and strength in the Euro; BEGOS Markets volatility is light. As tweeted [@deMeadvillePro], whilst the S&P dropped -0.6% to start the year, the MoneyFlow regressed into S&P points fell -2.1%: as this is a leading indicator, we look to still lower S&P levels near-term, especially as the Index itself is now 38 consecutive trading days “textbook overbought”. Debt yields and the Dollar rose in beginning 2024, counter to FinMedia expectations of their “Fed pivot”. The Econ Baro awaits December’s ISM(Mfg) Index; too, we’ve the FOMC Minutes from the 12-13 December meeting.

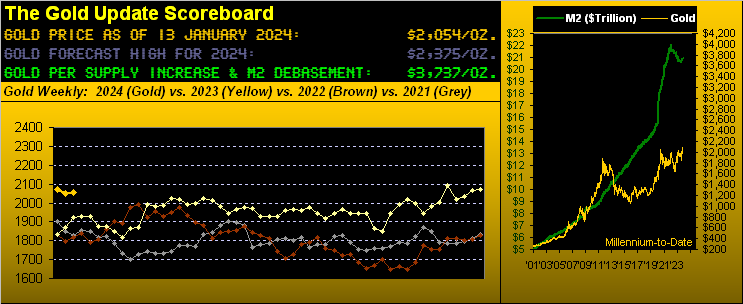

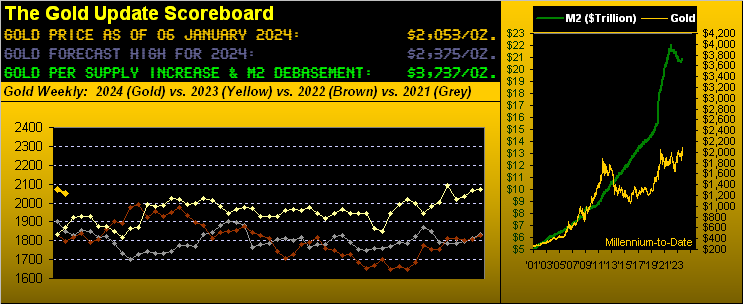

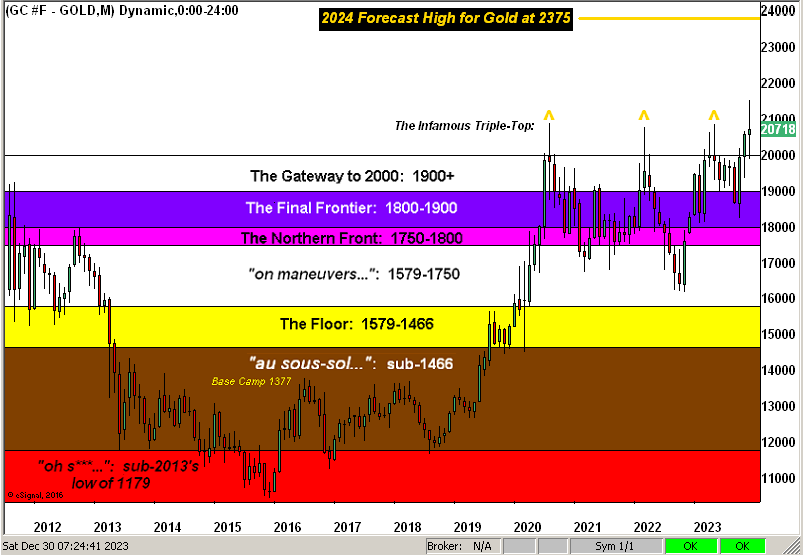

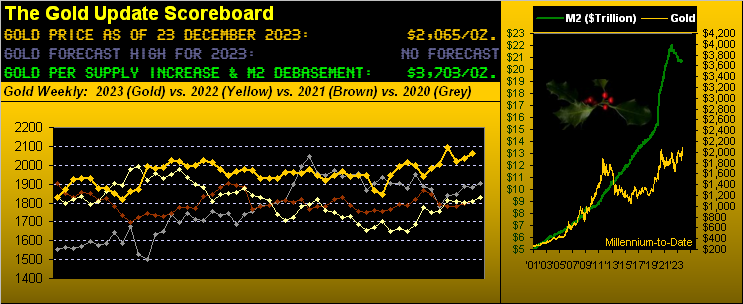

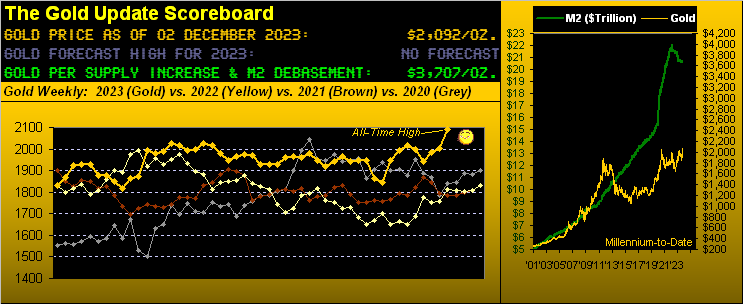

02 January 2024 – 09:14 Central Euro Time

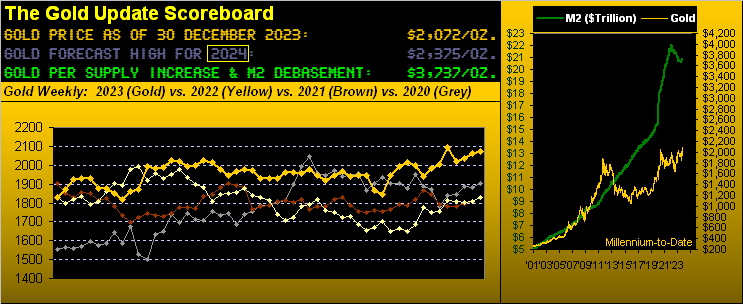

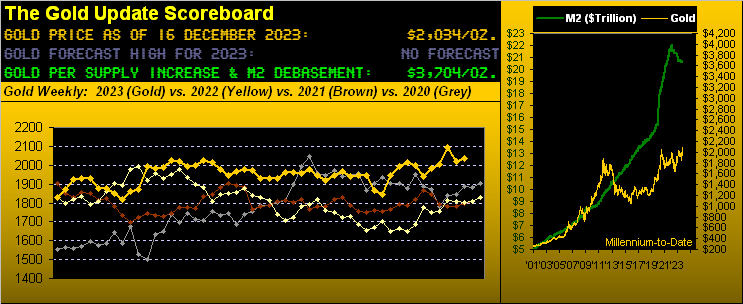

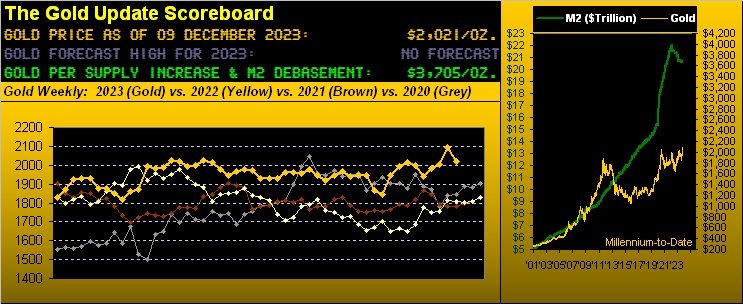

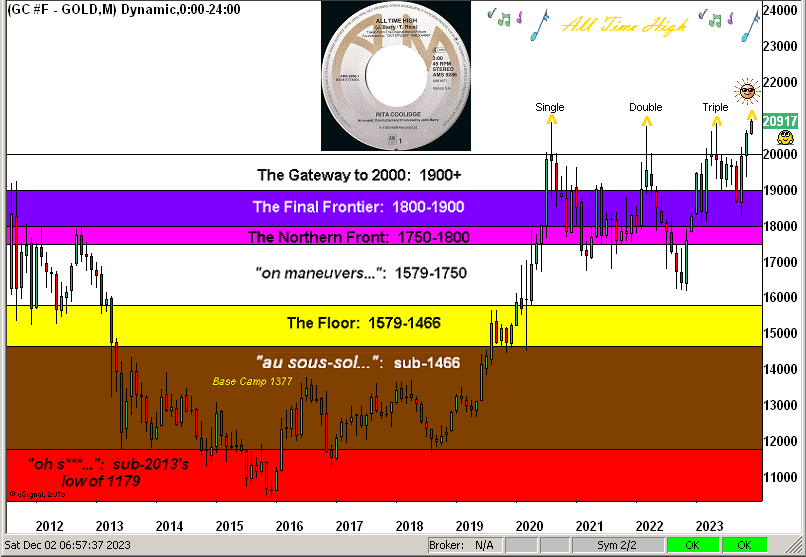

Early on the New Year we’ve weakness in the Bond and EuroCurrencies, and strength in Gold, Silver, Oil and the Spoo. The Gold Update targets a “conservative” high in 2024 for 2375 as detailed in the write-up. The S&P 500’s “textbook overbought” condition ranks in the 97th percentile of all such conditions across the past 44 years, the “live” P/E settling 2023 at 46.3x, an 82% increase from its inception a dozen years ago, purely reflective of earnings not keeping pace with price. In real-time, the Spoo is 193 points above its smooth valuation line (see Market Values). The Econ Baro kicks off the year with 10 incoming metrics this week, including due today November’s Construction Spending.,

29 December 2023 – 09:17 Central Euro Time

Early on in the year’s final session we’ve at present the Swiss Franc, Gold and Copper above their respective Neutral Zones for today, whilst Silver is below same; volatility for the BEGOS Markets is light, with only the Swiss Franc having thus far exceeded 50% (now 56%) of its EDTR (see Market Ranges). By Market Trends, the “Baby Blues” for both the Bond and Spoo remain fairly glued to the ceiling. The S&P 500 (4783) is a day’s range from an all-time high (4819): despite the FinMedia rooting for such high, the Index obviously continues its fundamental trek as extremely overvalued by earnings (the “live” P/E now 46.7x), and the technical track is now 36 days (“textbook overbought”). The Econ Baro concludes its year with December’s Chi PMI. Gold appears firm in the upper 2000 handle: tomorrow’s 737th edition of The Gold Update gives our forecast high price for next year. Indeed: Happy New Year!

28 December 2023 – 09:41 Central Euro Time

The EuroCurrencies and Gold are at present above today’s Neutral Zones, whilst the Bond is below same; BEGOS Markets volatility is mostly light. The Swiss Franc is trading above 1.20 for the first time (save for its brief Euro-decoupling spike in January of 2015) since September of 2011. Gold is again teasing the 2100 level, the session high to this point being 2098: by Market Rhythms on a 10-test basis, various Gold studies populate the top of the consistency stack, notably for the 4hr, 6hr, 8hr and 12hr timeframes; and by Market Values, Gold (in real-time) is +51 points above its smooth valuation line. For the week’s light Econ Baro calendar, today’s metrics include Pending Home Sales for November.

27 December 2023 – 09:23 Central Euro Time

Both the Bond and Copper are at present above today’s Neutral Zones; the other BEGOS Markets all are within same, and volatility is again light. The S&P 500 is -44 points below its 4819 all-time high; the EDTR (see Market Ranges) for the Spoo is coincidentally 44 points; (for the S&P itself ’tis 38 points); the S&P is entering its 35th consecutive “textbook overbought” trading session, and the Spoo (in real-time) is +256 points above its smooth valuation line; (extreme too is the Bond now better than +7 points above same). The “live” P/E of the S&P is 46.3x and the yield 1.468% vs. 5.203% for three-month U.S. dough. By Market Trends, both Silver and Oil remain the only two components in 21-day linreg downtrends, albeit the latter’s “Baby Blues” are swiftly rising. Again the Econ Baro remains quiet until tomorrow.

26 December 2023 – 09:17 Central Euro Time

Into the shortened trading week we go with Gold at present above its Neutral Zone, as too are Silver, Copper and the Spoo; the balance of the BEGOS Markets are within same, and volatility is light. The Gold Update details an historically-based case for Gold to reach 2500 in the ensuing year. The S&P 500 looks to open higher toward entering its 34th consecutive trading day as “textbook oversold”; the “live” P/E adjusted to the futures is presently 45.7x. For tracking the Spoo, currently our best market rhythm for consistency (10-test basis) is the 8hr Moneyflow and (on a 24-test basis) the 15mn Parabolics. The Econ Baro has just three incoming metrics for this week, none due until Thursday.

22 December 2023 – 09:57 Central Euro Time

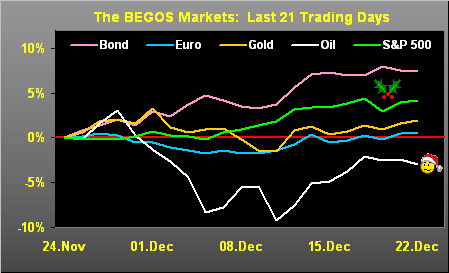

Oil is the only BEGOS Market at present outside (above) its Neutral Zone for today; session volatility is light. By Market Trends, six of the eight components are in 21-day linreg uptrends components, (the two downtrends being for Silver and Oil). Per Market Rhythms, our most consistent on a 10-test is Gold’s 8hr MACD whilst on a 24-test basis ’tis the Yen’s (not yet a BEGOS Market) 2hr MACD. The Econ Baro concludes its busy week with November’s Personal Income/Spending, “Fed-favoured” Core PCE, Durable Orders, New Homes Sales, and revision to December’s UofM Sentiment Survery. Merry Christmas to everyone everywhere!

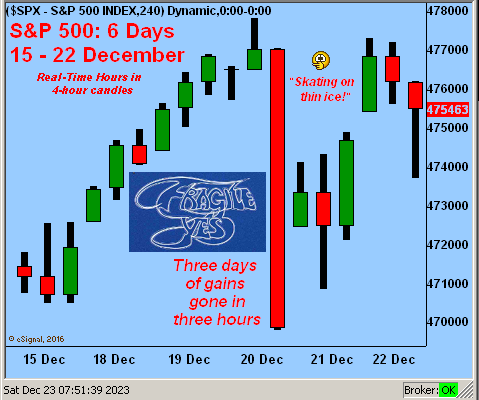

21 December 2023 – 18:04 Central Euro Time

Apologies, we just noted that this morning’s post obviously didn’t “make the trip”. The thrust therein was the S&P 500 yesterday giving up the prior three days’ gains in just three hours. The Index is trying to firm today, but is coming off as we type. Still, save for the Bond and Oil, the balance of the other six BEGOS Markets are higher today. The Econ Baro took a dip today on weakness in Jobless claims, Q3 GDP revision, Philly Fed and Leading Indicataors.

20 December 2023 – 09:10 Central Euro Time

Both the Bond and Copper are at present above today’s Neutral Zones; below same is the Euro, and volatility is quite light, the largest EDTR (see Market Ranges) to this point being that of the Euro at 48%. Going ’round the Market Values horn of the five primary BEGOS Markets (in real-time): the Bond is better than +8 points “high” above its smooth valuation line, the Euro less than +0.01 points “high”, Gold +38 points “high”, Oil -3.24 points “low”, and the Spoo +298 points “high”, the Index itself having recorded its 30th consecutive trading day as “textbook overbought”. For the Econ Baro we’ve December’s Consumer Confidence, November’s Existing Home Sales and Q3’s Current Account Deficit. –> We sadly learned yesterday of the passing of Bob “MeBob” Falk, a fine and well-known trading colleague over many years as far back as the 1990s at Avid Trader. He shall be missed, and we extend our sincere condolences to his entire family.

19 December 2023 – 09:38 Central Euro Time

At present we’ve the Bond, Euro and Copper above today’s Neutral Zones; the other BEGOS Markets are within same, and volatility remains light, (save for non-BEGOS Yen which already has traced 121% of its EDTR [see Market Ranges for the BEGOS components]). At Market Ranges we continue to watch for the Bond’s “Baby Blues” to let go to the downside: however, they’ve remained pasted to the ceiling for better than a full month as price continues to rise. The “live” P/E of the S&P 500 (fut’s-adj’d) is 45.8x and the Index’s “textbook oversold” condition now enters its 30th consecutive trading day. The Econ Baro looks to Novembers’ Housing Starts/Permits.

18 December 2023 – 08:59 Central Euro Time

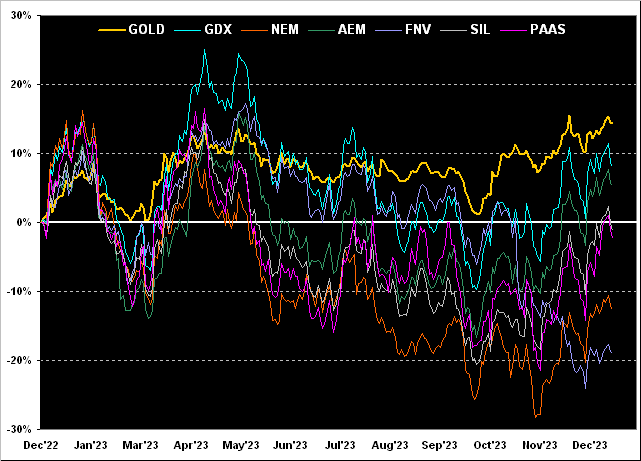

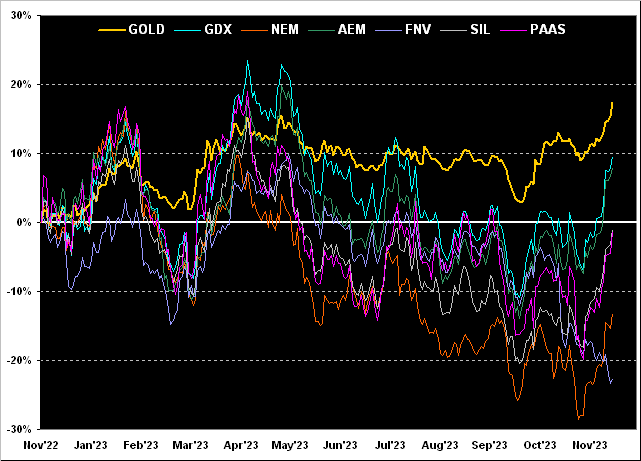

Both the Euro and Spoo are at present above their respective Neutral Zones for today; the balance of the BEGOS Markets are within same, and volatility is again light. The Gold Update emphasizes the dangerously high level of the S&P 500 by a whole host of measures; whereas Gold itself whilst weathering some post All-Time-High pullback nonetheless remains in a more broadly bullish stance. At Market Rhythms, the most consistent on a 10-test basis is Gold’s 8hr MACD, and a 24-test basis the Yen’s (not yet an official BEGOS Market) 2hr MACD. The Econ Baro begins its busy week (17 incoming metrics!) with December’s NAHB Housing Index.

15 December 2023 – 09:29 Central Euro Time

The Euro is at present below today’s Neutral Zone whilst above same are both Copper and the Spoo; BEGOS Markets volatility is mostly light. The S&P 500 looks to open at about 4730, some -90 points below the all-time high (4819); the “live” P/E (fut’s-adj’d) is now 45.0x. ‘Tis volume rollover today from December to March for the EuroCurrencies. Looking at Market Values for the five primary BEGOS components: the Bond shows as nearly 9 points “high” above the smooth valuation line; the Euro is about -0.01 points “low”; Gold is +47 points “high”; Oil is -7 points “low”, and the Spoo is (deep breath) +310 points “high”. The Econ Baro wraps its week with December’s NY State Empire Index along with November’s IndProd/CapUtil.

14 December 2023 – 09:07 Central Euro Time

The Bond, Copper and Spoo are at present above today’s Neutral Zones; the other BEGOS Markets are within same, and volatility is moderate. Yesterday’s S&P 500 rally again did not have full MoneyFlow support (Index +1.4% vs. Flow +1.0%); too the S&P is now quite frothy as the Flow factor to move the S&P by 1 point is notably diminishing. Gold’s firm up push yesterday moved our top three Market Rhythms for consistency (10-test basis) as follows (all for Gold): the 12hr Parabolics, 6hr Price Oscillator and same study for 4hr. Oil’s cac volume is moving from January into that for February. The Econ Baro looks to November’s Retail Sales and Ex/Im Prices, plus October’s Business Inventories.

13 December 2023 – 09:13 Central Euro Time

The Bond at present is above today’s Neutral Zone; both Copper and Oil are below same, and BEGOS Markets volatility is again light with the FOMC’s Policy Statement in the balance. The S&P 500 completed its 25th consecutive trading day as “textbook overbought”; the “live” P/E (futs-adj’d) is 44.5x; at 4644, the Index stands -174 points (-3.8%) below its 4819 all-time high (04 January 2022); the Spoo (including the recent +55 points of fresh March premium) is nonetheless +260 points above its smooth valuation line (see Market Values). Ahead of the Fed comes November’s wholesale inflation per the PPI.

12 December 2023 – 09:03 Central Euro Time

We’ve strength this morning in the Bond and EuroCurrencies, with session volatility notably light, save for the Swiss Franc having already traced 53% of its EDTR (see Market Ranges). Both the Swiss Franc and Gold confirmed their “Baby Blues” (see Market Trends) slipping below their +80% axes, suggestive of still lower prices near-term. Despite yesterday’s +0.4% rise in the S&P 500, its MoneyFlow (regressed into S&P points) fell -0.8%, reflected in the developing negative slant we’re seeing at the MoneyFlow page; too, the Index is now “textbook overbought” through the past 24 trading days. The Econ Baro awaits November’s CPI and Treasury Budget.

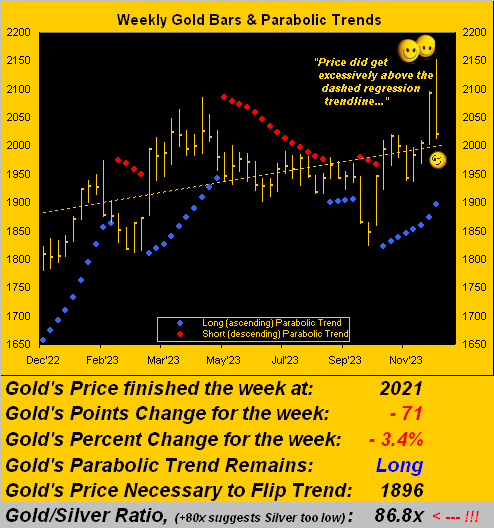

11 December 2023 – 09:08 Central Euro Time

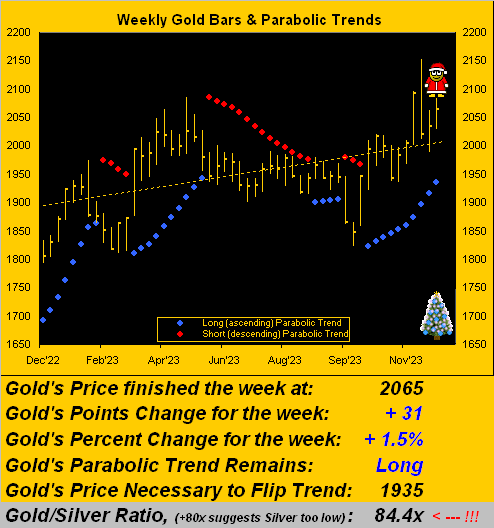

Save for Oil (+0.6% at 71.67), the other seven BEGOS Markets are all at present in the red; session volatility is light. The Gold Update sees safe downside for the yellow metal toward 1975 without causing any concern for the overall uptrend(s); still by Market Trends, Gold’s “Baby Blues” are in real-time dropping below their key +80 axis, warranting a price move sub-2000. Of greater concern is misfortune in the making for the S&P which remains inanely overextended both fundamentally (unsupportive earnings) and technically (beyond “overbought”). Spoo volume today is rolling from the December cac into that for March, with an additional +52 points of fresh premium. The Econ Baro is quiet, albeit with an ample load of metrics as the balance of the week unfolds.

08 December 2023 – 09:12 Central Euro Time

‘Tis StateSide November Payrolls day for the Econ Baro, and at present seven of the eight BEGOS Markets are within their Neutral Zones, the only outlier being Oil above same; the latter appears trying to firm ’round the 70 handle. Session volatility is light, (except again for the non-BEGOS component Yen which has traced 119% of its EDTR as the BOJ interest rate play continues). The S&P 500 is now “textbook overbought” through the past 22 trading days and the “live” P/E is 43.3x; however, the recent MoneyFlow deterioration has (for the moment) righted itself, indicative of money being thrown at a terrifically expensive stock market. In addition to jobs data, the Baro also looks to December’s UofM Sentiment Survey.

07 December 2023 – 09:11 Central Euro Time

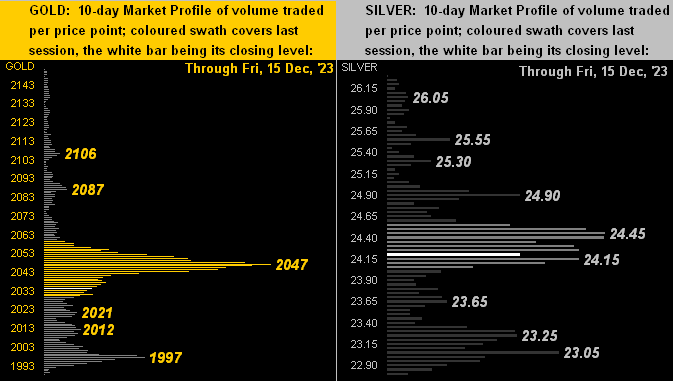

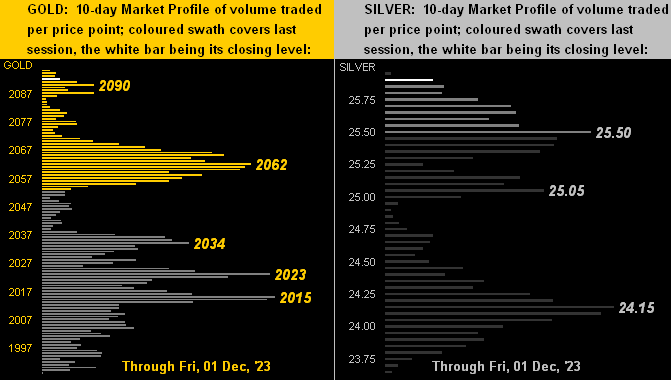

The Bond is at present below its Neutral Zone for today, whilst above same is Copper; BEGOS Markets volatility is again mostly light with the non-BEGOS exception of the Yen which already has traced 145% of its EDTR (see Market Ranges for the standard BEGOS components). Gold has calmed from its wild Monday ride: currently 2047, by the Market Profile we’ve resistance notably in the 2062-2065 zone, with supports right round current price, plus at 2036-2034, 2023 and 2014. A day ahead of Payrolls data for the Econ Baro, today’s metrics include October’s Wholesale Inventories and Consumer Credit.

06 December 2023 – 09:13 Central Euro Time

Gold, Copper and the Spoo are at present above today’s Neutral Zones; the other BEGOS Markets are within same, and volatility is mostly light. Going ’round the horn for the five primary BEGOS components at Market Values, we’ve (in real-time): the Bond +6.5 points “high” above its smooth its smooth valuation line, the Euro “in line”, Gold +57 points “high”, Oil -9.5 points “low” and the Spoo +206 points “high”. The S&P 500 is now “textbook overbought” through the last 20 trading days; the “live” P/E is 42.3x. For the Econ Baro we’ve November’s ADP Employment data, October’s Trade Deficit, and the revision to Q3’s Productivity and Unit Labor Costs.

05 December 2023 – 08:59 Central Euro Time

After achieving an All-Time High yesterday at 2152, Gold’s subsequent -113 intraday points drop ranks 5th-worst century-to-date; however the -5.3% drop ranks just 34th worst intraday. At present, the Euro, Copper and Spoo are below today’s Neutral Zones; none of the other BEGOS Markets are above same, and volatility has returned to mostly light. Our most consistent Market Rhythm at present (10-test swing basis) is Gold’s 4hr Price Oscillator. As anticipated, the Euro’s “Baby Blues” (see Market Trends) confirmed falling below the key +80% axis, indicative of lower prices near-term. And the Econ Baro looks to November’s ISM(Svc) Index.

04 December 2023 – 09:12 Central Euro Time

After setting an All-Time High on Friday (to 2096, settle 2092), Gold spiked overnight some +50 points, only to since return below Friday’s settle. At present ’tis red across the board for all eight BEGOS Markets, and volatility is robust. More details on to where the yellow metal can go near-to-medium term in The Gold Update, (which too outlines the case for an S&P “crash”). Note at the website the S&P 500 Moneyflow differential beginning to weaken, oft a precursor to lower price levels. Due for the Econ Baro is October’s Factory Orders.

01 December 2023 – 09:16 Central Euro Time

All eight BEGOS Markets are at present within their respective Neutral Zones for today, and volatility is light. Gold appears rather hesitant just below record-high territory: FedFuts are 2060; the record high is 2089; but by Market Values, price is (in real-time) +73 points above its smooth valuation line; still by Market Trends, Gold is firmly in an uptrend, the “Baby Blues” therein continuing to climb; again a comprehensive assessment in tomorrow’s Gold Update. The S&P 500 is now “textbook overbought” through 17 consecutive trading sessions: the “live” P/E is a futs-adj’d 43.0x. The Econ Baro concludes its week with November’s ISM(Mfg) Index and October’s Construction Spending.

30 November 2023 – 09:21 Central Euro Time

At present, just Copper is the only BEGOS Market outside (above) its Neutral Zone for today; volatility again is light-to-moderate. As tweeted (@deMeadvillePro) on Tuesday: “Santa clearly is contemplating a new all-time Gold high by Christmas. ‘Twould be 2075 spot a/o 2089 FebFuts. (On verra…)” Price since has reached 2073 (FebFuts); more in this coming Saturday edition of the Gold Update. Looking at Market Rhythms, the most consistent at present are (on a 10-test basis) the Yen’s (not yet an official BEGOS component) 1hr Price Oscillator and 2hr Moneyflow, and Gold’s 4hr Price Oscillator; on a 24-test basis we’ve the Yen’s 15mn MACD along with Gold’s 30mn MACD and 30mn Price Oscillator. ‘Tis a busy day for the Econ Baro, including November’s Chi PMI, plus October’s Pending Home Sales, Personal Income/Spending, and the “Fed-favoured” Core PCE Index.

29 November 2023 – 09:17 Central Euro Time

The Bond is the sole BEGOS Market at present outside (above) its Neutral Zone; session volatility is light-to-moderate. After flipping from Long-to-Short, the Bond’s daily parabolics whip-sawed back to Long: however, we’re minding the Bond’s “Baby Blues” (see Market Trends) for their breaking below the key +80% axis. Going ’round the Market Values horn for the primary BEGOS components, in real-time we’ve the Bond nearly +6 points “high” above the smooth valuation line, the Euro +0.0316 points “high”, Gold +64 points “high”, Oil -7.17 points “low”, and the Spoo a whopping +253 points “high”. The Econ Baro awaits the second peek at Q3 GDP. And late in the session comes the Fed’s Tan Tome.

28 November 2023 – 09:15 Central Euro Time

All eight BEGOS Markets are at present within their respective Neutral Zones for today; session volatility is light. Gold’s cac volume is rolling from December into February, with +20 points of premium; other rollovers in process include Silver, Copper and the Bond, all from December into March. As anticipated, the Bond’s “Baby Blues” (see Market Trends) are teasing their +80% axis: confirmation below that level is suggestive of weaker prices near-term; too, the Bond’s daily Parabolics confirmed flipping from Long to Short effective today’s open. For the Econ Baro we’ve November’s Consumer Confidence.

27 November 2023 – 09:17 Central Euro Time

Both Gold and Silver are at present above today’s Neutral Zones: the white metal, (which has been lagging Gold’s performance), has provisionally flipped its weekly parabolic from Short to Long; confirmation should come at next Friday’s settle. The Spoo is at present below its Neutral Zone. And BEGOS Markets volatility is again moderate. The “textbook overbought” streak of the S&P itself is now through 13 sessions. The Gold Update (brief as planned) is price-bullish, especially given the yellow metal having recorded net gains for the six past Decembers. The Econ Baro starts a week of 12 incoming metrics with October’s New Home Sales.

24 November 2023 – 08:35 Central Euro Time

The second day of the otherwise abbreviated trading session finds the Bond at present below its Neutral Zone; the rest of the BEGOS Markets are within same, and volatility is moderate. The Bond’s “Baby Blues” appear poised to begin their descent in the ensuing week; and by Market Values, the Bond in real-time is nearly +5 points above its smooth valuation line. As for the Spoo, ’tis +265 points above same, and the fut’s-adj’d live P/E of the S&P is 44.2x. We’ve early closures today across all the components and the Econ Baro is complete for the week.

22 November 2023 – 07:13 Central Euro Time

Just brief and early this morning, (our going into motion across the next few days): only Copper is at present outside (below) its Neutral Zone for today; BEGOS Markets volatility is light. Yesterday’s S&P 500’s down move nonetheless maintains a “textbook overbought” rating for the Index, however now “moderate” rather than “extreme”; (such condition can take days, even weeks, to unravel). And metrics to close out the week for the Econ Baro include October’s Durable Orders. Happy T-Day to you StateSiders and fellow USAers ’round the globe.