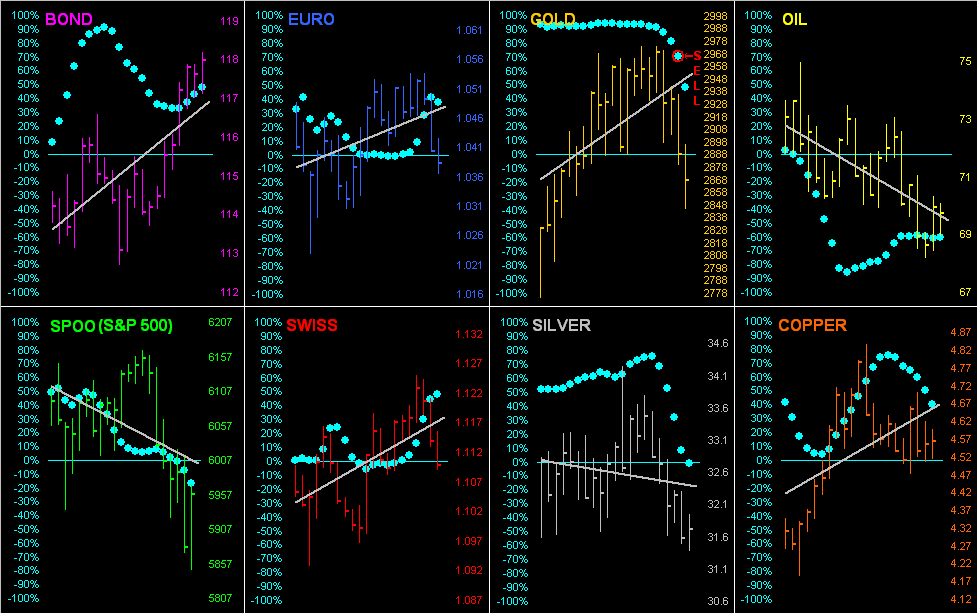

Gold (basis June) has made yet another All-Time High at 3177, albeit price has now pulled back to presently be within today’s Neutral Zone; the only BEGOS Market outside (above) of same is the Bond, and volatility is light-to-moderate. The Bond yesterday pierced up through its Market Magnet, whilst Copper has moved below same; Copper’s “Baby Blues” (see Market Trends) are rolling over such that they many breach below the key +80% by mid-week, then suggestive of still lower price levels. Oil has furthered our anticipation of its rising, now up into the 71s. Q1 kicks off for the Econ Baro with March’s ISM(Mfg) Index and February’s Construction Spending.

Mark

Mark

31 March 2025 – 08:33 Central Euro Time

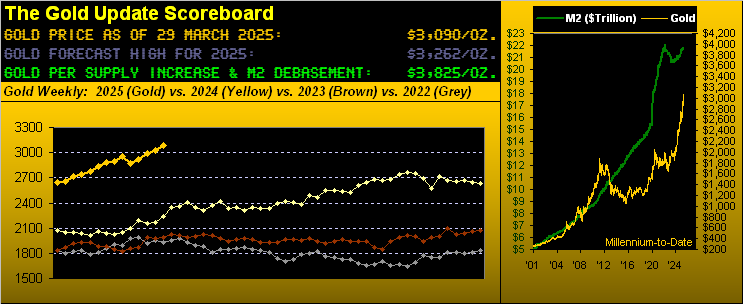

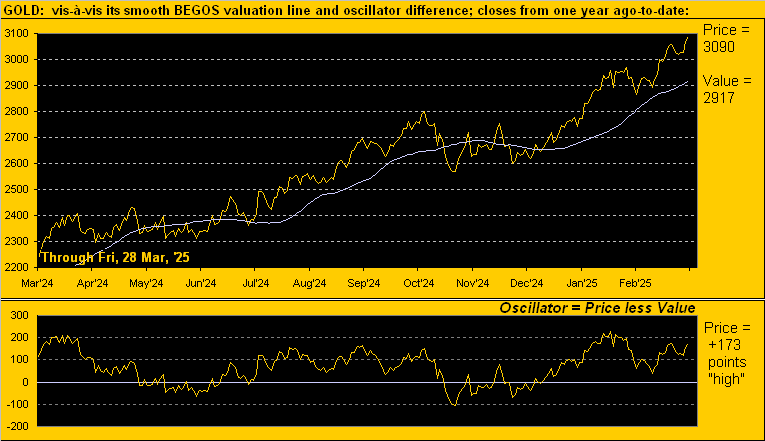

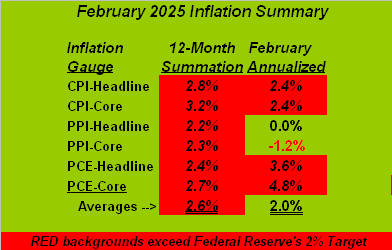

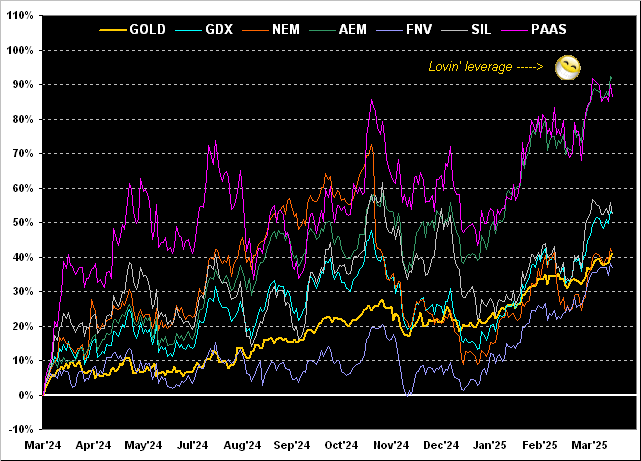

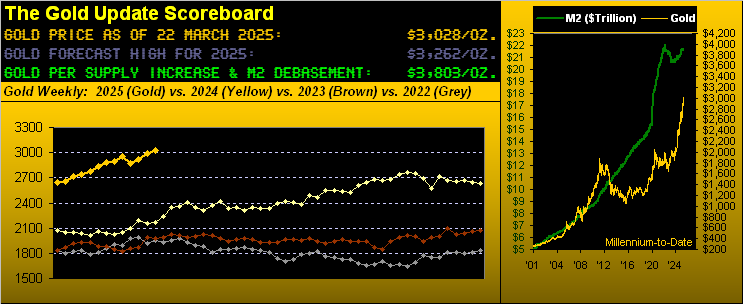

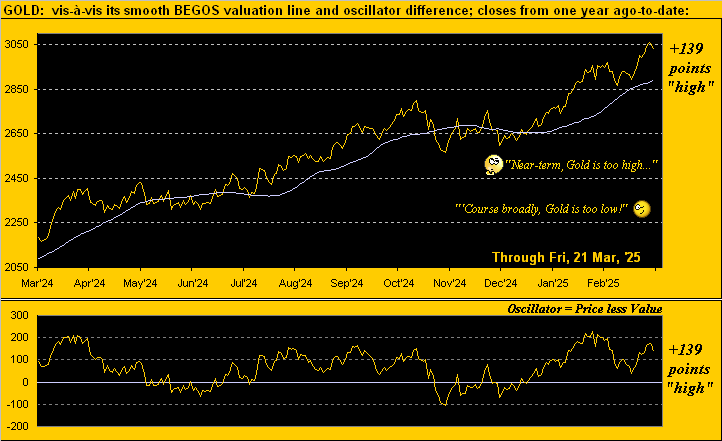

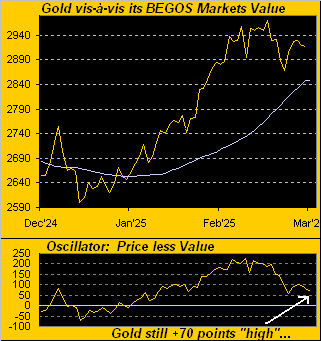

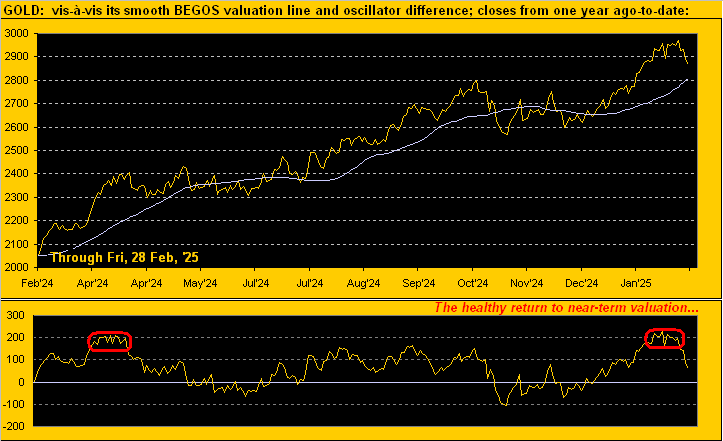

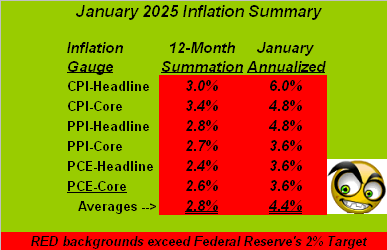

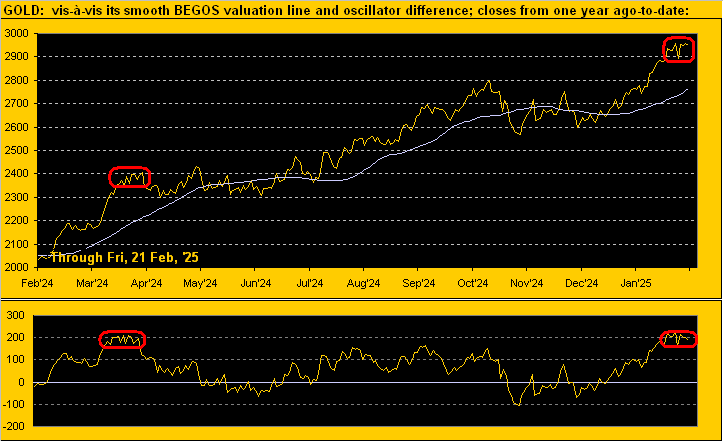

The Bond, Gold, Silver and Oil are all above today’s Neutral Zones, whilst below same is the Spoo; session volatility is moderate-to-robust, Gold notably already having traced 129% of its EDTR (see Market Ranges). The Gold Update underscores the yellow metal’s remarkable rally, yet remains wary for some material degree of pullback to unwind the near-term overbought state of price, which in (real-time) is +228 points above its smooth valuation line (see Market Values); moreover the Update also depicts the inconsistant inflation readings, and sees significantly lower levels for the S&P 500 as the year unfolds, with the 4000s in the offing, (which from its present level is only some -10% lower). For the Econ Baro today we’ve March’s Chi PMI.

28 March 2025 – 08:38 Central Euro Time

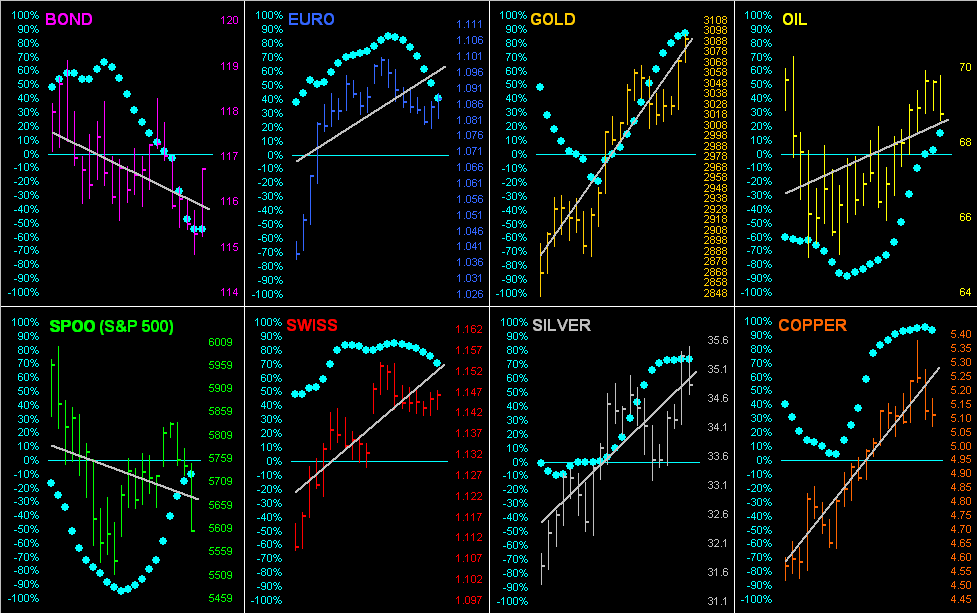

Both the Bond and Gold are at present above their respective Neutral Zones for today; none of the other BEGOS Markets are below same, and session volatility is light-to-moderate. Gold has achieved yet another All-Time High this morning, the June cac thus far trading up to 3124: by Market Values, price is (in real-time) +176 points “high” above its smooth valuation line, a very extreme deviation which can begin to be closed should the “Fed-favoured” inflation of PCE data not be indicative of slowing; ’twill arrive later today for the Econ Baro, and of course, more on it all in tomorrow’s 802nd consecutive Saturday edition of The Gold Update. As for the other primary BEGOS components’ deviations from Market Values, we show both the Bond and Oil as basically right on their valuation lines, the Euro as +0.0312 points “high” and the Spoo as -200 points “low”. As for Copper’s recent robust rally to all-time highs, by Market Trends, the red metal’s “Baby Blues” of trend consistency are depicting the early signs of having run out of puff. EuroSide, we move forward Sunday to summer hours.

27 March 2025 – 08:42 Central Euro Time

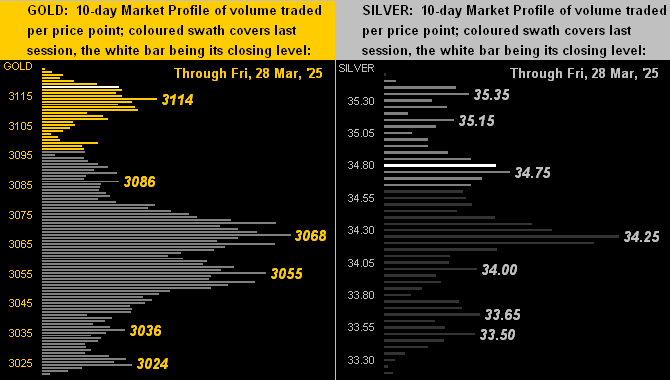

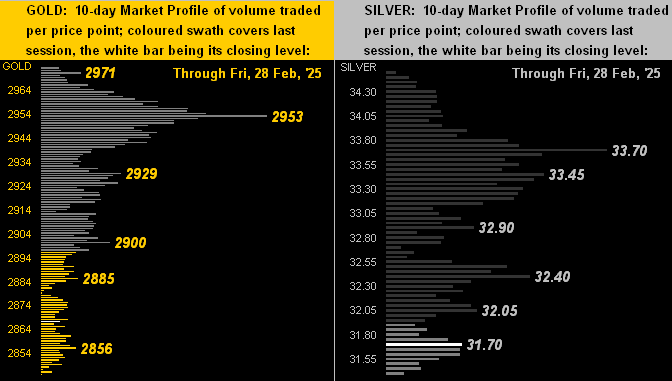

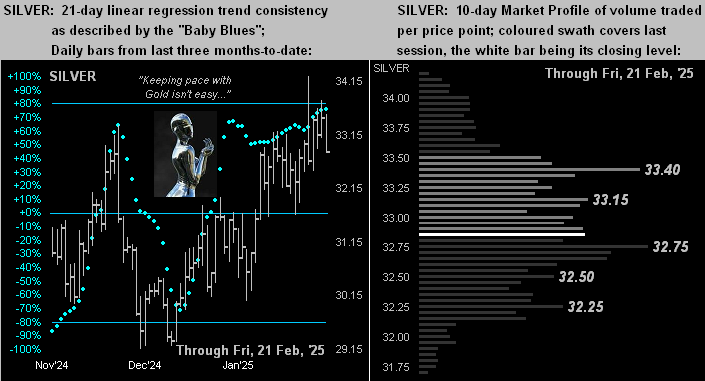

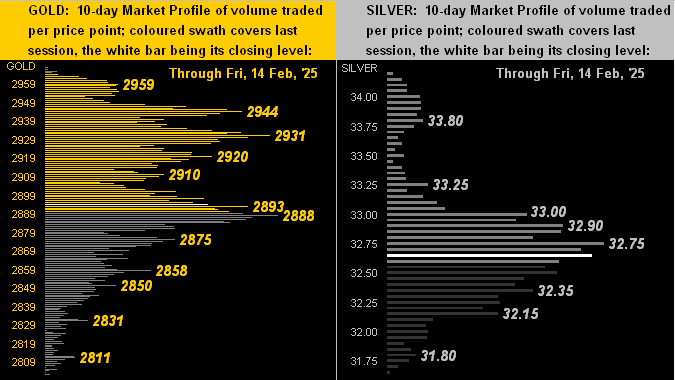

At present we’ve Gold above today’s Neutral Zone, whilst Oil is below same, (but not before having yesterday reached up into our low 70s’ target area); volatility for the BEGOS Markets is moderate. Gold’s cac volume is moving from April into that for June, with +29 points of fresh premium (in turn inducing a “faux” new All-Time High). As anticipated, by Market Trends the Swiss Franc’s “Baby Blues” of linreg trend consistency confirmed falling below the key +80% axis: thus we look for lower price levels near-term. Silver at present is spot-on its most volume-dominant price (34.25) of the past fortnight, (see Market Profiles). And a day ahead of the “Fed-favoured” PCE inflation data, today’s incoming Econ Baro metrics include February’s Pending Home Sales and the final read on Q4 GDP.

26 March 2025 – 08:41 Central Euro Time

As was the same case at this time yesterday, Copper is the only BEGOS Market at present outside (above) its Neutral Zone for today; by Market Ranges, the red metal already has traced 125% its EDTR to an all-time high at 5.3740; overall session volatility is otherwise light. For our Market Rhythms on a 10-test basis, the current standouts are Gold’s 2hr Moneyflow and both the non-BEGOS Yen’s daily price Oscillator and 30mn MACD; on a 24-test basis, our current leaders are again the Yen’s daily price Oscillator along with its daily Parabolics, plus both the Bond’s daily Moneyflow and 15mn Parabolics. We’ve previously mentioned the Euro’s “Baby Blues” (see Market Trends) having broken below the key +80% axis; now provisionally doing the same are those for the Swiss Franc. And for the Econ Baro we await February’s Durable Orders.

25 March 2025 – 08:29 Central Euro Time

At present, the only BEGOS Market outside (above) today’s Neutral Zone is Copper; session volatility is quite light with to this point just an average EDTR (see Market Ranges) tracing of 28%. The Euro yesterday confirmed its “Baby Blues” (see Market Trends) of linreg trend consistency having broken below their key +80% axis, indicative of lower levels to come. The S&P 500, after having been 19 consecutive trading sessions “textbook oversold” finally unwound that condition yesterday; the +1.8% relief rally has now put the “live” (futs-adj’d) P/E up to 42.9x; lurking for April/May is a MACD negative crossover on the S&P’s monthly candles, broadly suggestive of further Index lows as the year unfolds. The Econ Baro gets back into gear today with March’s Consumer Confidence and February’s New Home Sales.

24 March 2025 – 08:10 Central Euro Time

The week starts to find the Bond at present below its Neutral Zone for today, whilst above same are the Euro, Silver, Copper and the Spoo; volatility for the BEGOS Markets is light. The Gold Update applauds the yellow metal’s wonderful uptrend — incorporating yet another All-Time High (3065) this past Thursday — however reiterates our wariness for price to pullback by a few hundred points, typical in the past of similar technical near-term “overvaluations”; (of course fundamentally broad-term, Gold remains well-undervalued). As anticipated, the Spoo is getting a good bid such that the S&P 500 may open nearly a full 1% higher: regardless, the futs-adj’d “live” P/E is 40.0x and the yield (1.347) less than one-third that of the annualized 3mo U.S. T-Bill (4.185%). Too continues Oil’s recent recovery: by its BEGOS Market Value, ‘twould appear price shall move up through its smooth valuation line as the week unfolds towards the anticipated low 70s. ‘Tis a again quiet day for the Econ Baro, the week’s highlight arriving Friday with the “Fed-favoured” PCE reading for February.

21 March 2025 – 08:35 Central Euro Time

When all eight BEGOS Markets are down, we know the Dollar is up; of note across the sea of red, we’ve the Euro, Swiss Franc, Gold and Silver all at present below their respective Neutral Zones for today; session volatility is moderate. Specific to the Spoo, its “Baby Blues” (see Market Trends) of linreg trend consistency confirmed closing above their key -80% axis: this portends (by fib) a run up to at least the 5800s and potentially the 5900s should the February high-March low have a full Golden Ratio retracement; too, the S&P 500 itself remains “textbook oversold” near-term. For Oil, per its “Baby Blues” and Market Magnet, as anticipated, price has moved from the 65s to now being in the 68s with the 69s-low 70s reasonably in the balance. Nothing is due for the Econ Baro until Tuesday, this week’s 16 incoming having flat-lined the economic track rather than see it further weaken; more on it all in tomorrow’s 801st consecutive Saturday edition of The Gold Update.

20 March 2025 – 08:47 Central Euro Time

The Euro at present is below its Neutral Zone for today, whilst above same is the Spoo; session volatility for the BEGOS Markets remains light to this hour. Our best correlation currently amongst the five primary BEGOS components is positive between Oil and the Spoo. The “live” P/E of the S&P 500 has (futs-adj’d) moved back above 40 (now 40.2x); the Index’s yield is 1.353% vs. the risk-free 3-month T-Bill’s 4.190%; technically the S&P is now 17 consecutive trading days “textbook oversold” despite fundamentally remaining dangerously overvalued. The Econ Baro concludes its week today with a busy schedule of incoming metrics which include March’s Philly Fed Index, February’s Existing Home Sales and Leading (i.e. “lagging”) Indicators, and Q4’s Current Account Deficit.

19 March 2025 – 08:43 Central Euro Time

At present, the Euro is below its Neutral Zone for today, whilst above same is Copper; otherwise, BEGOS Markets’ volatility is again light to this time of the session. Oil’s “Baby Blues” (see Market Trends) confirmed crossing above their -80% axis, so as already noted yesterday with respect to its Market Magnet, we anticipate higher Oil levels near-term perhaps up into the low 70s; Oil’s best Market Rhythm for pure swing consistency on a 10-test basis is its 2hr MACD. Elsewhere on that basis, our best currently are the non-BEGOS Yen’s daily Price Oscillator as well as that study for 1hr Silver; on a 24-test basis, we’ve again the Yen’s daily Price Oscillator plus the daily Parabolics, along with the Bond’s daily Moneyflow. Nothing is due today for the Econ Baro. Then at 18:00 GMT comes the “no change” FOMC Policy Statement.

18 March 2025 – 08:50 Central Euro Time

A day ahead of the Fed, the Econ Baro has of late gone into a skid; to the extent the Fed reacts to fresh data is doubtful such that they likely stand pat as their stance of late is “there is no race to lower rates”. For today at present we’ve Gold, Silver and Oil above today’s Neutral Zones, the balance of the BEGOS Markets being within same, and session volatility is again light. Oil’s Market Magnet yesterday confirmed upside penetration by price such that we expect higher levels near-term, albeit there are various structural resistors from 69-73. Too, Oil’s “Baby Blues” (see Market Trends) continue to modestly climb from having been below their-80% axis, so that, too, lends some bullishness to the picture. The 2-day S&P rally has not been kept pace with by the Moneyflow, although the Index remains now 15 days “textbook overbought”; rhus once that unwinds, we may see the next spillover. More February metrics hit the Econ Baro today, specifically Housing Starts/Permits, Ex/Im Prices, and IndProd/CapUtil.

17 March 2025 – 08:28 Central Euro Time

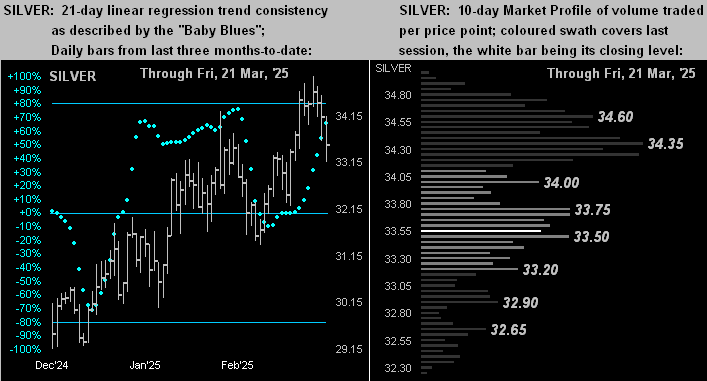

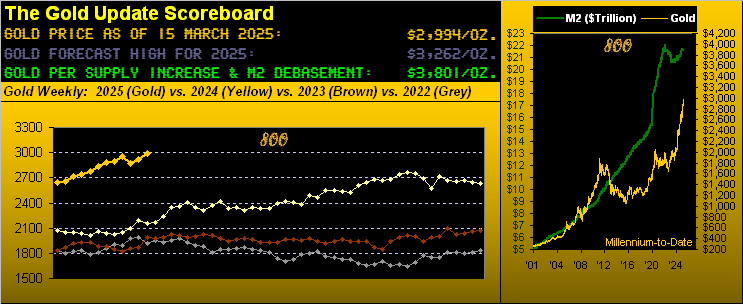

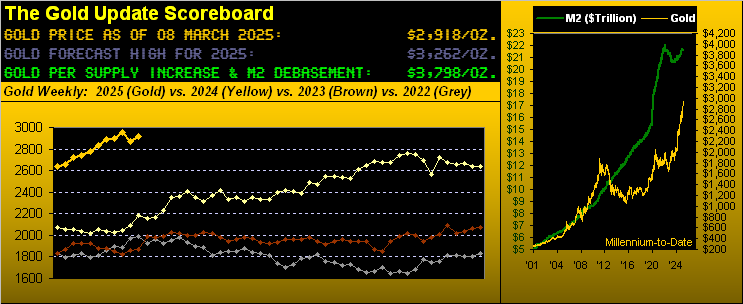

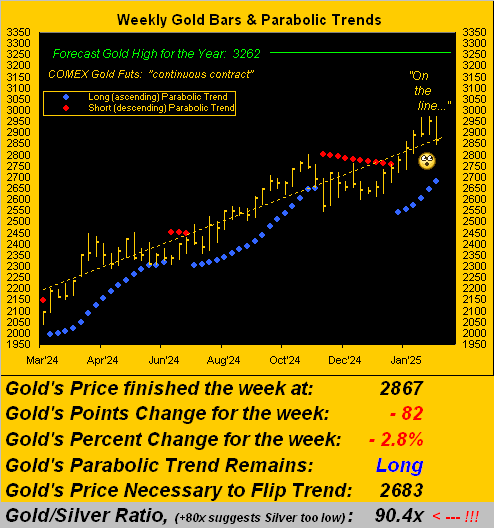

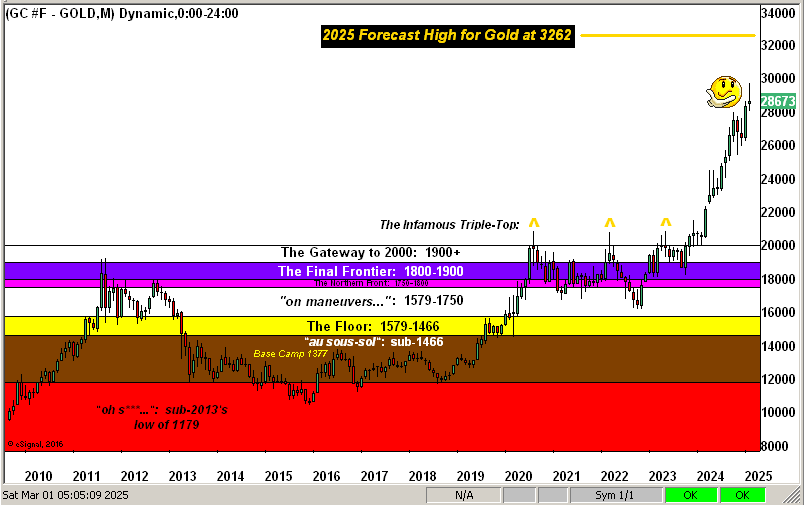

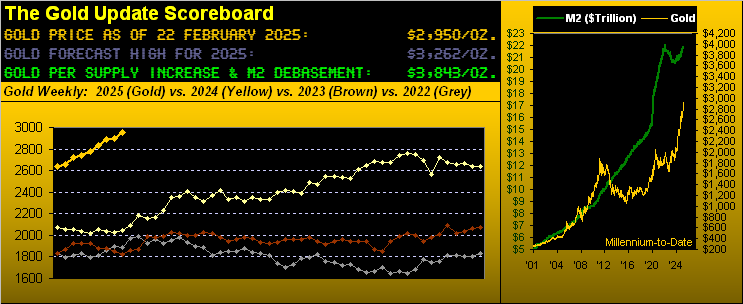

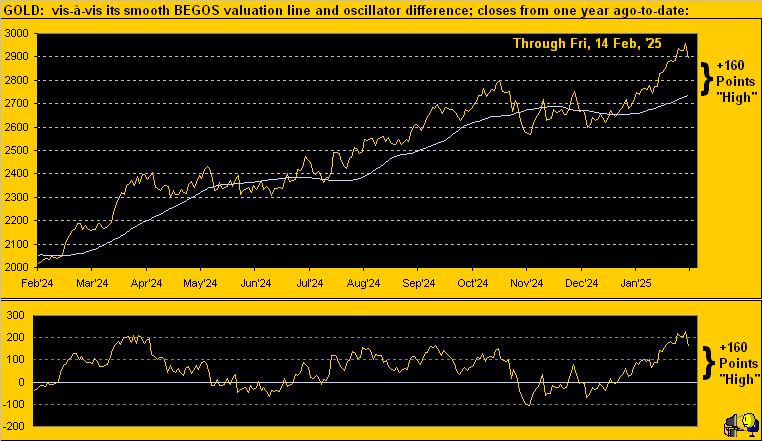

The Spoo is the sole BEGOS Market presently outside (below) its Neutral Zone for today; session volatility is light. The Gold Update celebrates its 800th consecutive Saturday edition, still wary of near-term price pullback even as the weekly parabolic trend remains firmly Long; vis-à-vis its smooth valuation line Gold is (in real-time) +123 points “high” (see Market Values). At Market Trends, only Oil and the Spoo are in negative linreg; specific to their cac volumes, that for Oil is moving from April into May whilst for the Spoo from March into June. ‘Tis a busy week for the Econ Baro (plus Wednesday’s FOMC Policy Statement); 16 metrics come due, those for today including March’s NY State Empire Index and that for NAHB Housing, plus February’s Retail Sales and January’s Business Inventories.

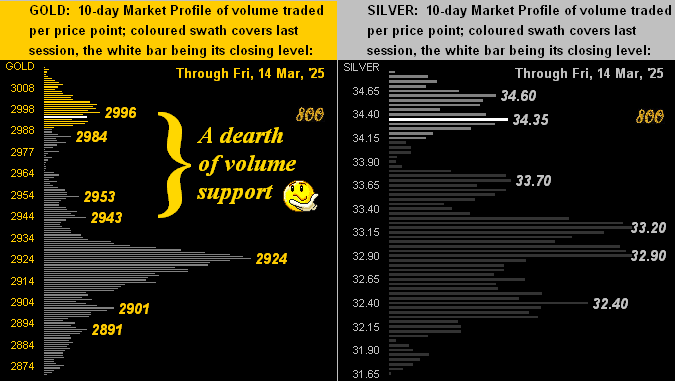

14 March 2025 – 08:32 Central Euro Time

April Gold topped 3000 last evening; spot (currently at a 12-point discount to the futures) has not quite yet made the trip; we’ve expected more of a price pullback which still can materialize; more on it all it tomorrow’s 800th consecutive Saturday edition of The Gold Update. At present, both the Euro and Swiss Franc are below today’s Neutral Zones; the other six BEGOS Markets are within same, and volatility is light. Cac volume in the EuroCurrencies is rolling from March into that for June; come Monday shall be the same for the Spoo. The FinMedia are all aghast that the S&P 500 has just “has entered a correction”, meaning we expect it to now rebound; by deMeadville’s Market Values, the “correction” began three weeks ago (21 February). The Econ Baro wraps its week with March’s UofM Sentiment Survey.

13 March 2025 – 08:44 Central Euro Time

Both the Euro and Silver are at present below today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is mostly light. Looking at Market Rhythms for pure swing consistency, leading our 10-test basis is the Bond’s 2hr Parabolics, whilst on a 24-test basis are both the non-BEGOS Yen’s daily Parabolics and the Euro’s daily MACD. Oil looks poised to move above its Market Magnet: check the website post-close for confirmation thereto, as ‘twould suggest higher price levels near-term after being well down year-to-date; as noted yesterday, Oil is now -4.20 points below its smooth valuation line (see Market Values). Today’s incoming metrics for the Econ Baro include February’s PPI.

12 March 2025 – 08:43 Central Euro Time

The only BEGOS Market at present outside (below) today’s Neutral Zone is the Euro; session volatility is light in the context that EDTRs (see Market Ranges) are substantively up from year-end; notably that for the Spoo — which was 83 points as of 31 December — is for today 116 points, its highest reading since last 07 August. Looking at Market Values for the five primary BEGOS components, we’ve (in real-time) the Bond as as nearly +3 points “high” above its smooth valuation line, the Euro +0.0522 points “high”, Gold +54 points “high”, Oil -5.89 points “low” and the -476 points “low”, the S&P 500 itself now entering a 12th consecutive trading day as “textbook oversold”. The Econ Baro awaits February’s retail inflation, the CPI’s pace by consensus expected to have slowed a pip or two, albeit still above the Fed’s desired annualized rate; too, late in the session (purportedly) comes the month’s Treasury Budget.

11 March 2025 – 08:38 Central Euro Time

The Euro, Gold and Silver are at present above their respective Neutral Zones for today; none of the other five BEGOS Markets are below same, and session volatility is moderate. The S&P’s -2.7% decline yesterday was its worst since the -2.9% fall last 18 December, (prior to which was -3.0% last 05 August); obviously the leading aspects of our deMeadville analytics have been well ahead of the selling, technically by the Spoo’s linreg having already rotated to negative (see Market Trends) and fundamentally of course by the ongoing excessive overvaluation of the S&P given lack of earnings substance; by the Spoo’s Market Profile, overhead volume resistance spans the 5748-5797 zone. All that said, the S&P is now 10 consecutive trading days “textbook oversold”. Again, ’tis a quiet day for the Econ Baro ahead of February’s retail inflation (Wednesday) and wholesale inflation (Thursday).

10 March 2025 – 08:45 Central Euro Time

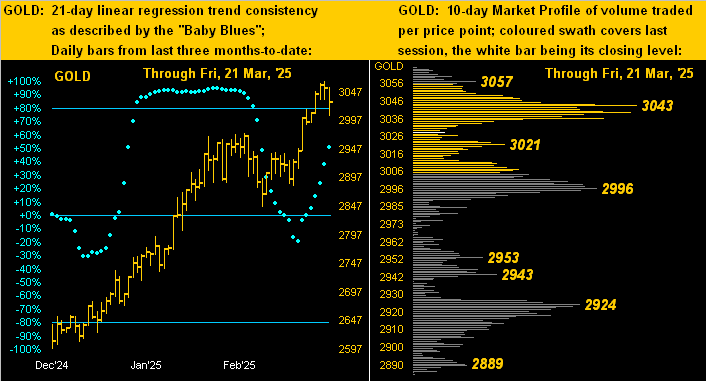

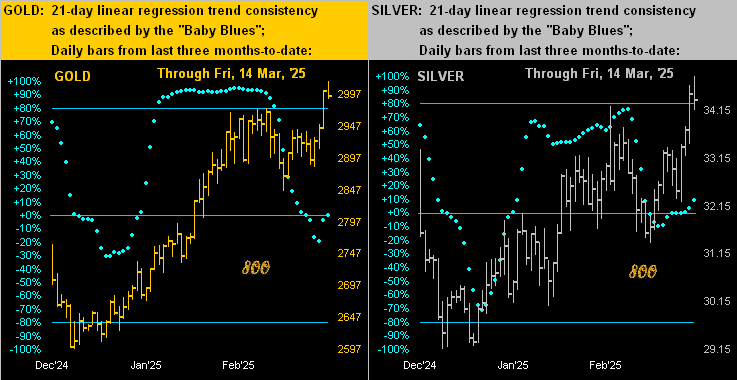

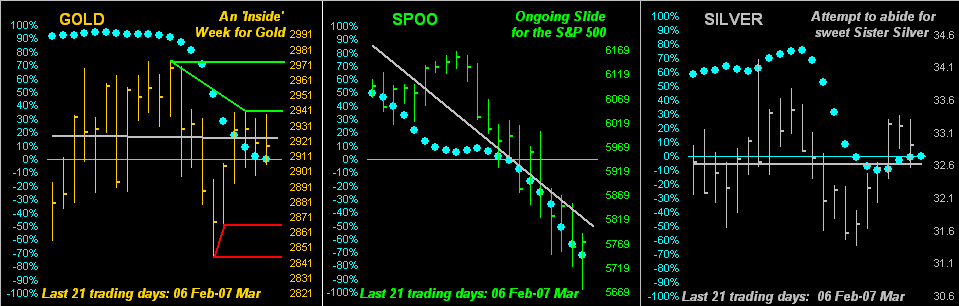

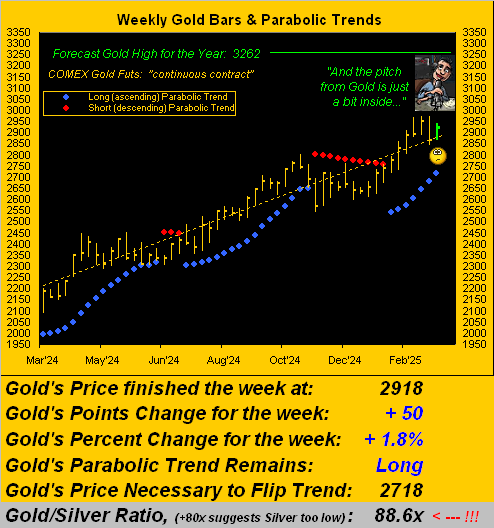

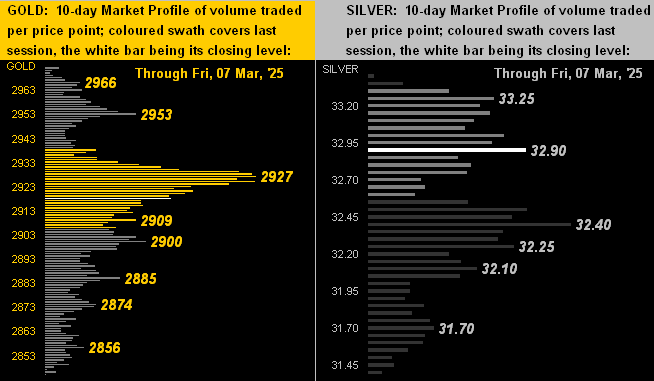

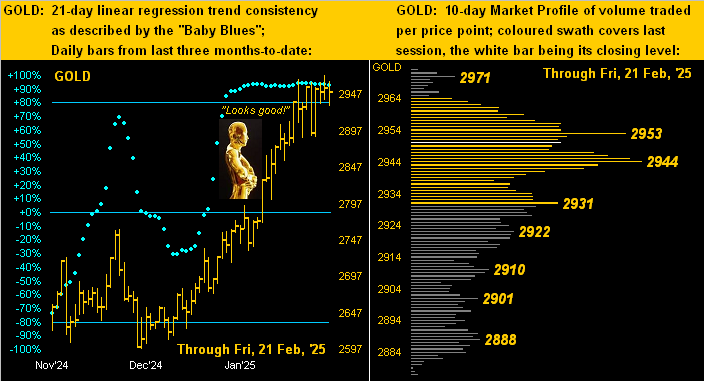

At present we’ve the Swiss Franc and Silver above today’s Neutral Zones; below same is the Spoo, and BEGOS Markets’ volatility is pushing toward moderate. The Gold Update cites the yellow metal having traced its first “inside” week year-to-date: our near-term bias remains for lower levels, and in real-time Gold’s linreg has rotated to negative (see Market Trends), the “Baby Blues” of trend consistency now below their 0% axis; by Market Profiles, Gold’s key line-in-the-sand is the volume-dominant 2927 level; and by Market Values, price in real-time is +66 points “high” above its smooth valuation line. The Econ Baro is quiet both today and tomorrow ahead of February inflation data later in the week. Too, the Spoo, Euro and Swiss Franc are due to see their cac volumes roll from March into June come week’s-end.

07 March 2025 – 08:40 Central Euro Time

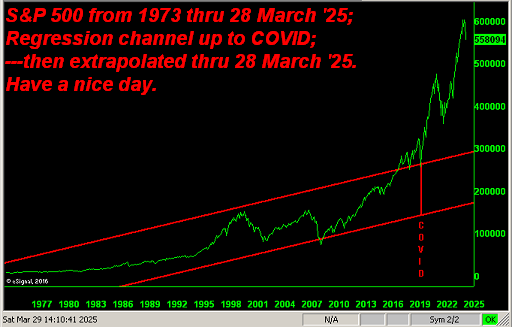

StateSide ’tis February’s Payrolls day for the Econ Baro (and late in the session January’s Consumer Credit). At present we’ve the Bond, Euro, Swiss Franc and Oil all above their respective Neutral Zones for today; volatility for the BEGOS Markets is light. The S&P 500 remains “textbook oversold” such that a so-called “dead cat bounce” may be warranted; however the Index’s broader technical picture is facing a negative crossover on the monthly MACD that seemingly can confirm into April; given the unsustainably high “live” P/E of 40.4x, the S&P ought deservingly suffer rough sledding at least over the near-to-medium term, especially with the short-term U.S. Treasuries yielding better than triple that of the S&P (4.197% vs. 1.343%). ‘Tis to worthy to note that from the S&P’s March 2009 low, the Index has increased by as much as 822%: thus this 7% pullback is essentially noise; indeed were it not for COVID and the monetary creation thereto, the S&P today (5739) would instead be ’round 3000.

06 March 2025 – 08:44 Central Euro Time

Presently we’ve the Bond below its Neutral Zone for today, whilst Oil is above same; the BEGOS Markets’ volatility for this time has calmed to mostly light. Amongst the five primary BEGOS components, we’ve now a positive correlation between the Euro and Gold, which makes sense give the Dollar’s demise notably this week. Copper’s +4.9% net gain yesterday was the largest since 04 November 2022: at Market Trends, Copper’s rally was sufficient to stall the otherwise falling “Baby Blues” of trend consistency. Meanwhile, that measure for the Spoo continues to drop, albeit the S&P 500 itself is now seven days “textbook oversold”; still, the “live” P/E of the S&P (futs-adj’d) is a horribly high 43.1x. Today’s incoming metrics for the Econ Baro include January’s Trade Deficit and Wholesale Inventories, plus the revisions to Q4’s Productivity and Unit Labor Costs.

05 March 2025 – 08:38 Central Euro Time

The Euro, Silver and Copper are all at present above today’s Neutral Zones; the other five BEGOS Markets are within same, and session volatility is moderate-to-robust, Copper notably having traced 170% of its EDTR (see Market Ranges). As has oft been the case of late, we’ve no notable correlations amongst the five primary BEGOS components. In looking at Market Rhythms for pure swing consistency, our 10-test basis cites the Swiss Franc’s 1hr Parabolics as best, whilst on a 24-test basis we show both the non-BEGOS Yen’s daily Parabolics and the Euro’s daily MACD. The Dollar Index has thus far traded today down to its lowest level (105.280) since 11 November, Gold getting a bit of a bid in the balance, albeit to the extent ’tis geo-politically driven, we look for Gold to resume working lower (as detailed in the current edition of The Gold Update). The Econ Baro awaits February’s ADP Employment data and ISM(Svc) Index, plus January’s Factory Orders. Then late in the session brings the Fed’s Tan Tome.

04 March 2025 – 08:41 Central Euro Time

Both the Bond and Swiss Franc are at present above today’s Neutral Zones, whilst below same are Copper and Oil; session volatility for the BEGOS Market’s is moderate, (which you may be noting is the case ’round this time more frequently of late). Yesterday’s whirl back down in the S&P 500 ought not be too much of an eyeopener given the Spoo’s 21-day linreg trend having last week rotated from positive to negative, as presently is the stance as well for both Silver and of course Oil over recent weeks; by Market Trends, those for the other five BEGOS components are positive; however Gold’s “Baby Blues” of trend consistency are in freefall as are those for Copper. Too for the S&P per our Moneyflow page, all three time bases (weekly, monthly, quarterly) point to still lower levels ahead for the Index. Nothing is due today for the Econ Baro with then 13 incoming metrics remaining from tomorrow through the week’s balance.

03 March 2025 – 08:29 Central Euro Time

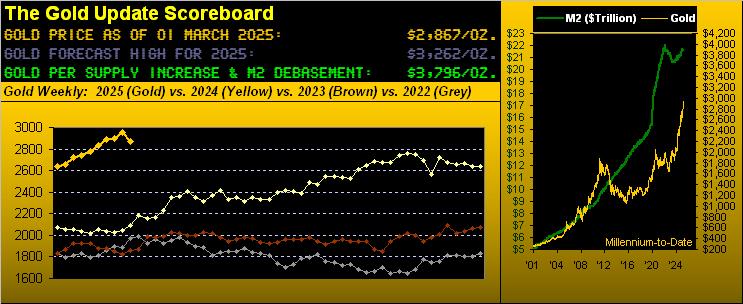

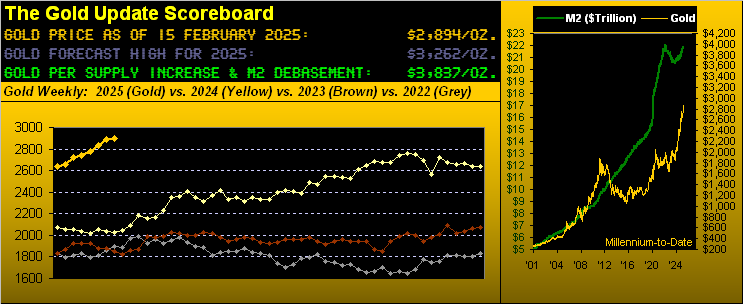

At present the Bond is below its Neutral Zone for today, whilst above same is the Euro; the BEGOS Markets’ volatility is mostly moderate. The Gold Update cites the anticipated fall having commenced for the yellow metal; as written: “…should the present selling become more substantive … ‘twould be reasonable to find price reach down into the 2703-2641 zone…” By Market Values, Gold — after having been better than +200 points “high” above its some valuation line — is now +56 points “high”. Notably too by that same metric, the Bond remains nearly +4 points “high”, the Euro basically in line, Oil -4.55 points “low” and the Spoo -104 points “low”. Despite the S&P 500’s +1.6% Friday rally, the Index is actually mildly “textbook oversold”; more meaningfully however, the overall weak level of earnings doesn’t support the “live” P/E of 44.0x. Q4 Earnings Season is complete with 69% of the S&P’s constituents bettering their bottom lines from Q4 a year ago, an above-average showing over 66% for the past eight years. The Econ Baro begins its week of 15 incoming metrics with February’s ISM(Mfg) Index and January’s Construction Spending.

28 February 2025 – 08:42 Central Euro Time

Gold’s “Baby Blues” (see Market Trends) confirmed falling below their key +80% axis, indicative of still lower prices; more tomorrow in the 798th consecutive Saturday edition of The Gold Update. Along with the yellow metal at present, Copper, Oil and the Swiss Franc are all below today’s Neutral Zones; above same is the Bond, and BEGOS Markets’ volatility is firmly moderate. The Moneyflow of the S&P 500 continues to be weaker than the down move in the Index itself: yesterday’s change in the S&P was -1.6%, however the Money suggested a change of -3.1%: as this is a leading indicator, we look for further selling in the S&P; mind our S&P Moneyflow page. ‘Tis the final day of Q4 Earnings Season. And the Econ Baro wraps its week, indeed the month, with February’s Chi PMI plus January’s Personal Income/Spending and “Fed-favoured” Core PCE.

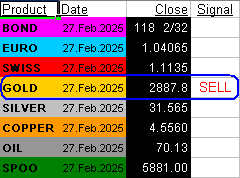

27 February 2025 – 08:45 Central Euro Time

Both the Swiss Franc and Gold are below today’s Neutral Zones; the other six BEGOS Markets are within same, and volatility is again moderate, although like yesterday ’round this time, Oil has traced but 18% of its EDTR (see Market Ranges). At Market Trends, Gold’s “Baby Blues” of trend consistency are provisionally (in real-time) dropping below their key +80% axis, indicative (upon confirmation) of lower prices near-term: recent missives of The Gold Update have been anticipative of a run down; looking at Market Values in real-time, Gold is +107 points “high” above its smooth valuation line. By that metric for the other four primary BEGOS components: the Bond shows as nearly +4 points “high”, the Euro as essentially in line, Oil as -6.25 points “low” and the Spoo now as -76 points “low”. The week’s selling in the S&P 500 has actually pushed it down into “textbook oversold” territory, however the Index remains dangerously high by its “live” (futs-adj’d) P/E of 44.6x. Included in today’s incoming metrics for the Econ Baro are January’s Durable Orders and Pending Home Sales, plus the first revision to Q4 GDP.

26 February 2025 – 08:40 Central Euro Time

The Bond and the EuroCurrencies are at present below their respective Neutral Zones for today; the balance of the BEGOS Markets are within same, and volatility is moderate, save for Oil which has traced just 15% of its EDTR (see Market Ranges). For the S&P 500, similar to that from Monday, on Tuesday whilst the Index fell -0.5%, the Moneyflow was instead suggestive of a -1.6% fall, again indicative of further selling still to come (see our S&P Moneyflow page). The Spoo’s 21-day linreg trend confirmed rotating to negative, the “Baby Blues” of trend consistency now having moved below their 0% axis (see Market Trends); should the selling turn more substantive, we’d look in due course for the S&P 5400s. The Bond’s cac volume is rolling from March into June, whilst that for Silver from March into May. And the Econ Baro awaits January’s New Home Sales.

25 February 2025 – 08:35 Central Euro Time

The Bond is above its Neutral Zone for today, whilst below same are Gold and Copper; session volatility for the BEGOS Markets is light. As anticipated, in real-time the Spoo’s 21-day linreg trend line has rotated to negative (see Market Trends) as has been that for Oil for the past few weeks; such trend for the other six BEGOS components is positive, albeit with weakening “Baby Blues” (which depict trend consistency) in decline for the Bond and all three elements of the Metals Triumvirate. The MoneyFlow of the S&P 500 was notably more negative yesterday (-1.2%) than that of the Index itself (-0.5%), suggestive of lower price levels near-term. The Econ Baro looks to February’s Consumer Confidence.

24 February 2025 – 08:41 Central Euro Time

Into the new week we’ve presently both the Euro and Spoo above today’s Neutral Zones; none of the other BEGOS Markets are below same, and volatility is mostly moderate. The Gold Update (as was the case a week ago) gives a near-term bearish bias strictly by technicals and the deMeadville proprietary measures (see Gold under BEGOS Markets): an affective metric this week shall be Friday’s release of PCE inflation data; either way, Gold completed an eighth consecutive up week for just the fifth time (mutually-exclusive basis) this century and currently priced at 2954 is -46 points below “Golden Goal Two” of “milestone 3000”. Nothing is due today for the Econ Baro. And, barring laggards, this is the final week of Q4 Earnings Season: with 402 S&P 500 constituents thus far having reported, 69% have improved their bottom lines from Q4 of 2023, a somewhat better-than-average improvement pace; problematic remains the extreme 45.2x P/E ratio.

21 February 2025 – 08:35 Central Euro Time

Copper is the sole BEGOS Market at present outside (below) its Neutral range for today; however, session volatility is pushing toward moderate. Gold indeed made another marginal All-Time High yesterday in reaching 2973 (from the prior 2968); as you well know, the yellow metal — whilst still significantly undervalued vis-à-vis Dollar debasement — is extremely near-term overbought: more in tomorrow’s 797th consecutive Saturday edition of The Gold Update. The Spoo’s EDTR (see Market Ranges) has been narrowing since a recent peak at 93 points on 07 January: through yesterday, ’tis now 64 points; again, we’re minding the Spoo’s 21-day linreg trend (see Market Trends) for its rotating from positive to negative. The Econ Baro wraps its week with metrics which include January’s Existing Home Sales.

20 February 2025 – 08:31 Central Euro Time

The Swiss Franc, Gold and Silver are all at present above their respective Neutral Zones for today; none of the other BEGOS Markets are below same, and volatility is light, (save for the non-BEGOS Yen which has traced 103% of its EDTR, which for the BEGOS components can be seen at Market Ranges). Correlations amongst the five primary BEGOS components have been messy of late with no notably directional pairings therein. Gold appears poised to set another All-Time High (above 2968) as the day unfolds: the high thus far this session is 2967. The S&P 500 is entering its 21st consecutive trading day as “textbook overbought”; the Spoo’s “Baby Blues” look to slip into negative territory within the next few sessions as the linreg trend rotates to negative, (barring a firm rally). And amongst the metrics due for the Econ Baro are February’s Philly Fed Index and January’s Leading (i.e. “lagging” given the Baro) Indicators.

19 February 2025 – 08:33 Central Euro Time

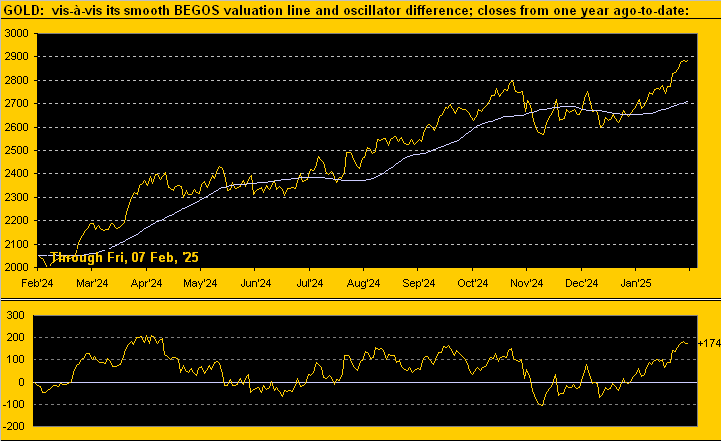

At present, only Oil is outside (above) today’s Neutral Zone; session volatility for the BEGOS Markets is quite light. Looking at Market Rhythms for pure swing consistency, on a 10-test basis the best currently are the Bond’s daily Moneyflow, Copper’s 30mn Price Oscillator as well as the red metal’s 2hr Parabolics; on a 24-test basis our leaders are (as oft has been the case) the non-BEGOS Yen’s daily Price Oscillator and daily Parabolics, plus the Euro’s 4hr MACD. The flow into Gold is being maintained, price (2950) in real-time +203 points above its smooth valuation line; today marks the 22nd consecutive trading session for Gold with its “Baby Blues” (see Market Trends) above their key +80%, a stretch which for any BEGOS Market is remarkable. The Econ Baro looks to January’s Housing Starts/Permits; and late in the session come the Minutes from the FOMC’s 28/29 meeting.

18 February 2025 – 08:48 Central Euro Time

Into the session’s second day, as expected the BEGOS Markets have increased their range traveled: at present below their Neutral Zones are the Bond, Euro, Swiss Franc and Copper, whilst above same are Gold, Silver, Oil and the Spoo, with overall volatility firmly moderate, leaning toward robust as the day develops. Were the S&P 500 to open at this instant, ‘twould be at an all-time high of 6140 (vs. the actual-to-date of 6128). Going ’round the Market Values horn for the five primary BEGOS components (in real-time), we show both the Bond and Euro as nearly on their smooth valuation lines, Gold as +185 points “high” above same, Oil -4.35 points “low” and the Spoo as +94 points “high”. With Gold at 2925, the volume-dominant overhead Market Profile resistors are 2931 and 2944. The Econ Baro awaits February’s NY Empire State and NAHB Housing Indices.

17 February 2025 – 08:42 Central Euro Time

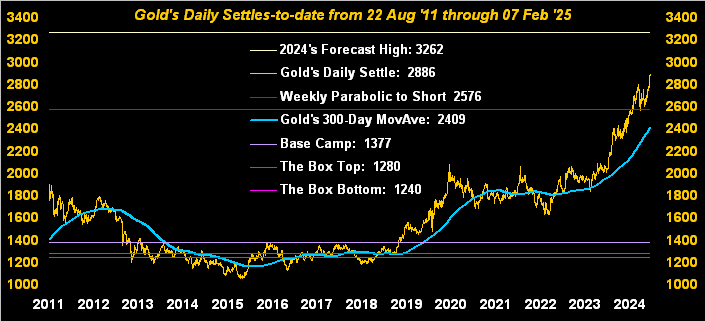

The BEGOS Markets begin the week with a two-day session (for Tuesday settlement); at present, we’ve the Bond below today’s Neutral Zone, whilst above same is Gold; session volatility already is pushing toward moderate and likely by this time tomorrow shall be mostly robust. The Gold Update graphically depicts last week’s price spike to the new All-Time High of 2968; still, we are cautious of Gold’s near-term extensive stance, seven consecutive up weeks now recorded; price is “textbook overbought” for the last 25 trading days, and (in real-time) ’tis +171 points above it smooth valuation line (see Market Values). Too, the inflation scare has us once again musing of the Fed potentially having to revert to raising rates. To this point in Q4 Earnings Season, 361 S&P 500 constituents have reported, of which 70% have bettered their bottom lines from Q4 of 2024: again, that is an above-average rate of improvement, albeit the Index itself remains catastrophically high with the “live” (futs-adj’d) P/E at this instant 47.8x.

14 February 2025 – 08:25 Central Euro Time

We’ve both Silver and Copper at present above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is mostly light, save for Silver which already has traced 110% of its EDTR (see Market ranges). Barring January being an outlier, the pace of inflation is increasing away for the Fed’s +2.0% preference; more tomorrow in the 796th consecutive Saturday edition of The Gold Update; to that end, Gold thus far today has traded up to 2064, just 4 points shy of its 2068 All-Time High achieved this past Tuesday; as a caution, Gold in real-time is +226 points “high” above its smooth valuation line (see Market Values). Too in real-time, Oil’s “Baby Blues” have provisionally moved above their -80%; as previously noted, confirmation of that condition typical brings higher prices near-term. And ’tis a busy day to end the week for the Econ Baro, scheduled metrics being January’s Retail Sales, Ex/Im Prices and IndProd/CapUtil, plus December’s Business Inventories.

13 February 2025 – 08:25 Central Euro Time

The Euro, Swiss Franc, Gold and Copper are all at present above today’s Neutral Zones; none of the other BEGOS Markets are below same, and volatility is mostly moderate. The Bond’s “Baby Blues” (see Market Trends) confirmed settling below their +80% axis: price already has moved lower into structural support of the 113s; were that to crack, a re-test of January’s lows in the 110s would be in order, especially should inflation be re-accelerating. By that same study, Oil’s “Baby Blues” are mildly curling back upward (-81% in real-time): a settle above -80% would suggest higher price levels; too, Oil’s cac volume is rolling from March into April. And the Econ Baro awaits January’s wholesale inflation data via January’s PPI.

12 February 2025 – 08:35 Central Euro Time

At present, all eight BEGOS Markets are within their respective Neutral Zones for today, and session volatility is light with January’s retail inflation metrics in the balance. Going ’round the Market Rhythms horn for pure swing consistency, currently the leaders (on a 10-test basis) are the Bond’s daily Moneyflow, the Euro’s 30mn Parabolics, Copper’s 15mn Price Oscillator, and the non-BEGOS Yen’s daily Parabolics; too, (on a 24-test basis) is again the Yen’s daily Parabolics as well as its daily Price Oscillator, plus the Euro’s 4hr MACD. And at Market Trends, despite the Spoo’s being in a 21-day linreg uptrend, its “Baby Blues” of the trend consistency are dropping for the fourth consecutive session. As noted, the Econ Baro awaits January’s CPI, plus (purportedly) late in the session the Treasury’s Budget. And per Humphrey-Hawkins, FedChair Powell, having testified yesterday before The Senate, concludes today with The House.

11 February 2025 – 08:47 Central Euro Time

Both Silver and Copper are at present below today’s Neutral Zones; the six other BEGOS Markets are within same, and session volatility is light-to-moderate. The S&P 500 is now “textbook overbought” through the past 14 consecutive trading days: there were significantly longer overbought stints during 2024, but ’tis something of which to be aware, especially given the “live” (futs-adj’d) P/E now at 48.8x and a yield of 1.243% less than a third of that for the 3mo US T-Bill of 4.228% annualized. At Market Trends we’re minding the Bond’s “Baby Blues” of trend consistency which are just starting to roll over to the downside with inflation data due both tomorrow and Thursday. And at Market Values the most extreme deviation is Gold’s being (in real-time) +216 points “high” above its smooth valuation line, pricing reaching another All-Time High earlier today at 2968. Again, ’tis a quiet session for the Econ Baro.

10 February 2025 – 08:34 Central Euro Time

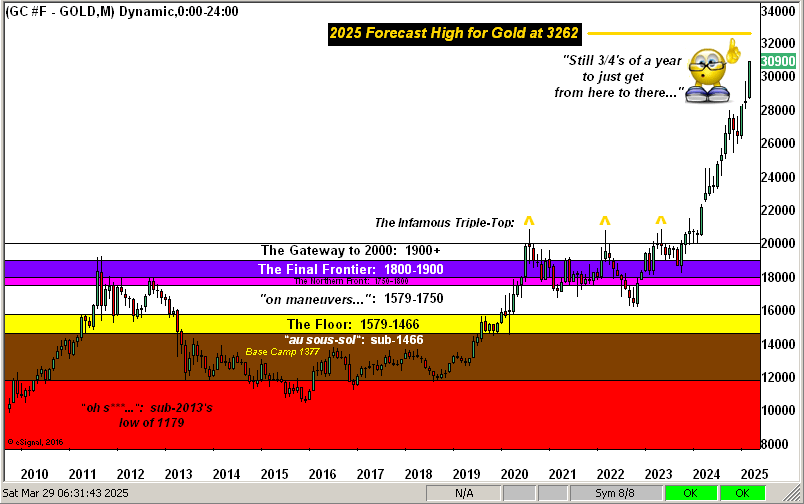

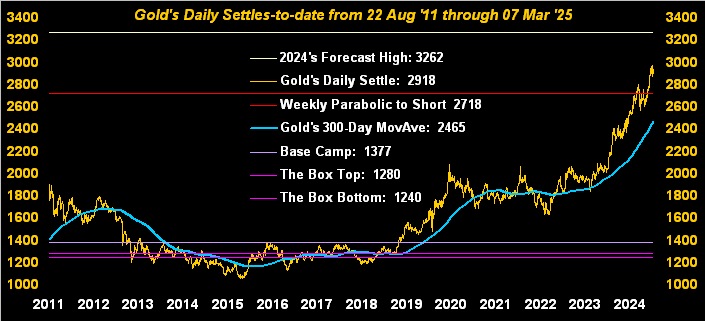

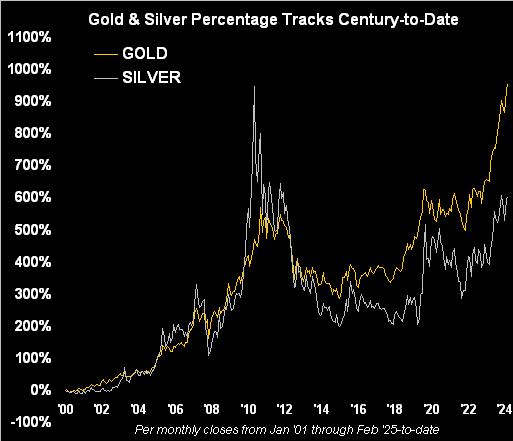

The week starts finding at present the Swiss Franc below today’s Neutral Zone, whilst above same are both Gold and Silver; BEGOS Markets’ volatility is moderate. The Gold Update muses the 3000 level as within reasonable distance by month’s end, however cautions that price has risen for six consecutive weeks (which historically is a bit of an outlier); still, the weekly parabolic trend is Long and we maintain our forecast high for this year at 3262; more immediately, Gold (in real-time) is +200 points “high” above its smooth valuation line (see Market Values); too, price is quite stretched above its 300-day moving average, (nearly +20%). Q4 Earnings Season continues to run at an above average pace for S&P 500 constituents bettering their bottom lines from Q4 a year ago: 71% of the 286 reports thus far have so done; ‘course it remains very problematic that the overall level of S&P 500 earnings is too low to support the extremely high Index itself, (the “live” futs-adj’d P/E at this instant 48.4x). ‘Tis a back-loaded week for the Econ Baro with 13 metrics due beginning on Wednesday.

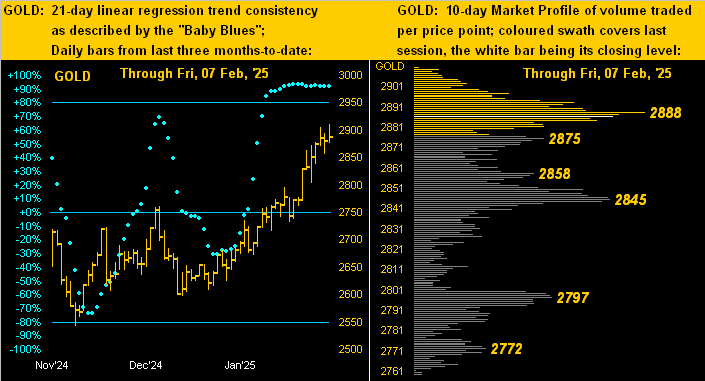

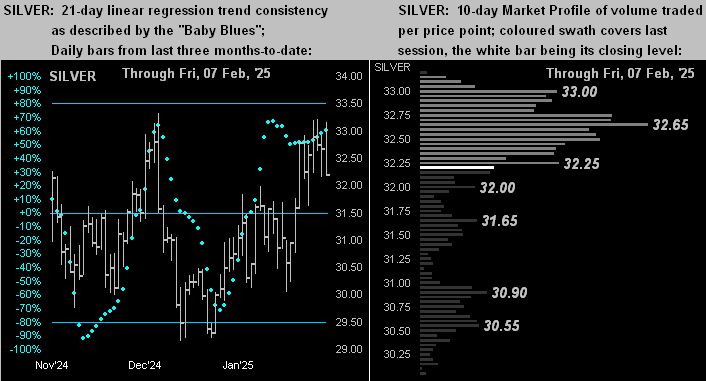

07 February 2025 – 08:45 Central Euro Time

As was the same situation ’round this time yesterday, the Swiss Franc is presently below its Neutral Zone whilst above same is Copper; session volatility for the BEGOS Markets is light. The futs-adj’d “live” P/E of the S&P 500 is 49.6x: ’twill be interesting to see if (i.e. “when”) 50x is reached, the Index as a whole remaining extraordinarily expensive if not outright dangerous. As it ought be a rangy day for the Spoo with January’s Payrolls due, key apices in the Market Profile are 6099, 6086, 6076, 6065, 6047 and 6025. Gold’s remarkable resilience continues: more on that in tomorrow’s 795th consecutive Saturday edition of The Gold Update. And for the Econ Baro in addition to the jobs data for January, we’ve also February’s UofM Sentiment Survey, and for December both Wholesale Inventories and Consumer Credit.

06 February 2025 – 08:39 Central Euro Time

The Swiss Franc is at present below its Neutral Zone for today, whilst above same is Copper; BEGOS Markets’ volatility is mostly light. Currently we find no compelling correlations amongst the five primary BEGOS components. Still, we can go ’round the horn by their Market Values as follows (in real-time): the Bond is 1^09 points “high” above its smooth valuation line (recall our year-end comment above a potential run up into the 116s, price currently 116^02); the Euro is -0.012 points “low”; Gold — which yesterday cleared the 2900 level for the first time — is +174 points “high” and in a sixth consecutive up week; Oil is -3.34 points “low”; and the Spoo is just +32 points “high”. Incoming metrics for the Econ Baro include Q4’s Productivity and Unit Labor Costs.

05 February 2025 – 08:40 Central Euro Time

We’ve at present the Euro, Swiss Franc and Gold above today’s Neutral Zones; below same is the Spoo, and BEGOS Markets’ volatility is mostly moderate. Looking at Market Ranges, most of the components’ EDTRs are around the mid-point of where they’ve been from a year ago at this time; those for Gold and the Euro are a bit above their mid-points. At Market Trends, all save for Oil are in 21-day linreg uptrends, including the Spoo even as it is struggling of late to stay upright. And for Market Rhythms on a pure swing basis for consistency, our top four (10-test basis) are currently the non-BEGOS Yen’s daily Parabolics (see too yesterday’s comment), the Bond’s daily Moneyflow, Gold’s 30mn Moneyflow, and the Spoo’s 2hr Parabolics. The Econ Baro awaits January’s ADP Employment data and ISM(Svc) Index, plus December’s Trade Deficit.

04 February 2025 – 08:32 Central Euro Time

For the second consecutive week the Spoo on Monday has gapped considerably lower, yet by week’s end (in this case just after this morning’s open) come all the way back up to “fill the gap”. Regardless, the Spoo is back on the skids, at present below its Neutral Zone for today, as too are the Euro, Swiss Franc and Gold; the other BEGOS Markets are within their respective Neutral Zones, and session volatility is moderate. The non-BEGOS Yen’s daily Parabolics flipped to Short effective today’s opening price (0.0064910); we mention this as ’tis been a leading study for pure swing consistency in our Market Rhythms going back better than a year. The Econ Baro looks to December’s Factory Orders.

03 February 2025 – 08:47 Central Euro Time

The Dollar is getting a very health bid, such that — save for the Bond (at present above today’s Neutral Zone) and Oil — the six other BEGOS Markets are in the red and all below said Neutral Zones; volatility is mostly robust. The Gold Update celebrates the yellow metal’s new All-Time High (furthered today up to 2862 basis the April cac) whilst again warning of the extreme overvaluation and fragility of the S&P 500; at this instant (per the Spoo and adjusting for Fair Value) were the stock market to open, the S&P would gap down -1.8% to 5931 from Friday’s 6041 settle. Our best Spoo Market Rhythm for pure swing consistency (10-test basis) is currently the 6hr MACD. And the Econ Baro commences its week with January’s ISM(Mfg) Index and December’s Construction Spending.