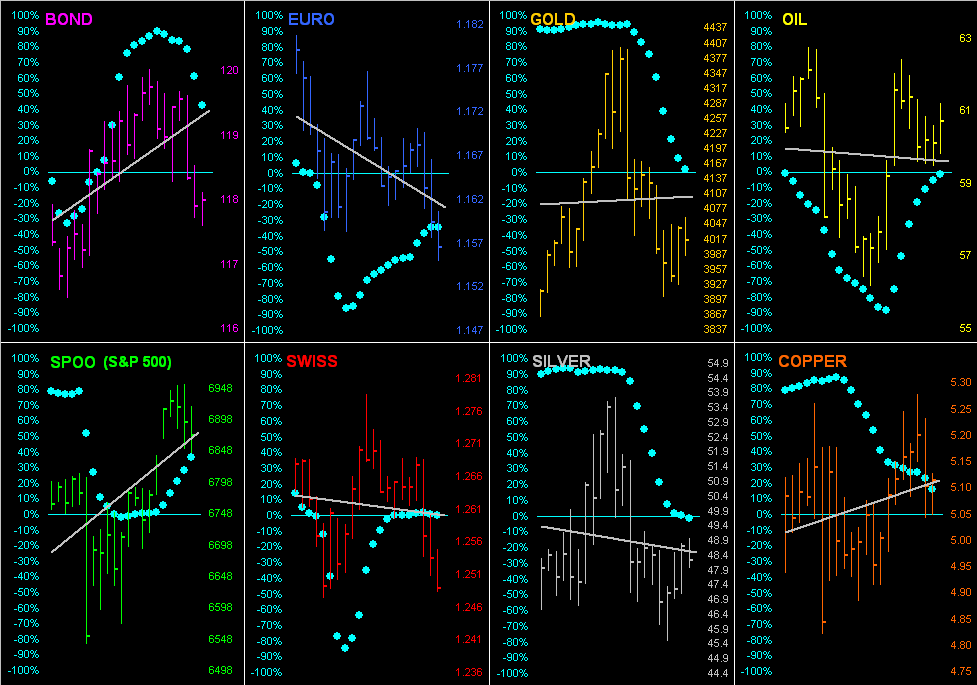

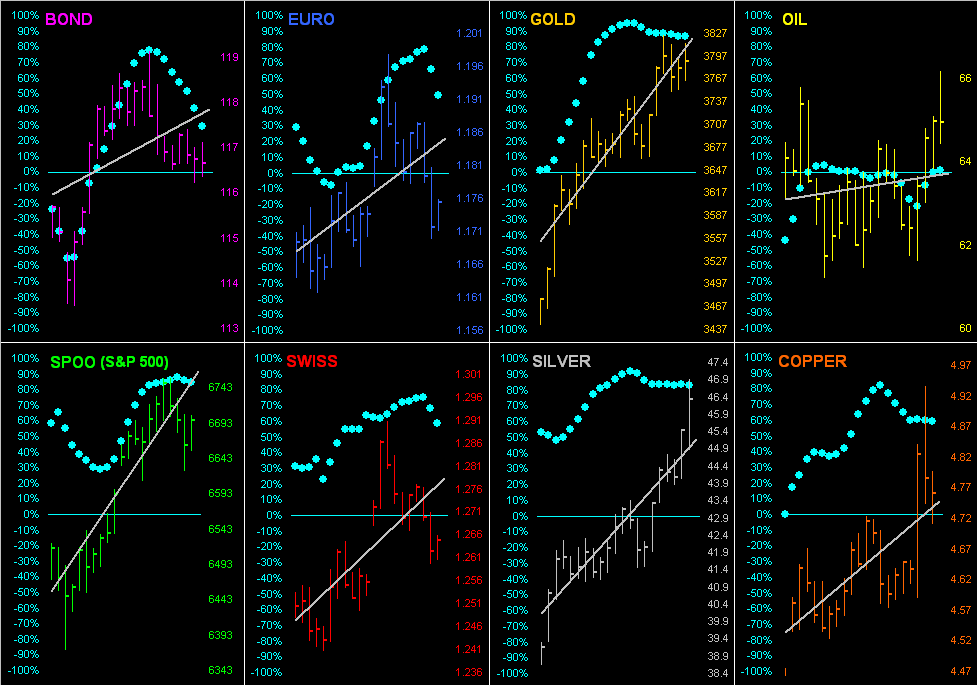

The Euro plus the three element of the Metals Triumvirate are presently above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is light. By Market Trends, linregs are positive for Copper, Oil and the Spoo, and negative for the Bond, Euro, Swiss Franc, Gold and Silver. That noted, yesterday Gold crossed back above its Market Value and Silver back above its Market Magnet; the yellow metal’s best Market Rhythm for pure swing consistency currently is the 4hr Price Oscillator, whilst for the white metal ’tis the 15mn Moneyflow. And the Bond yesterday moved below its most volume-dominant Market Profile support (117^14, price now 116^17). As the StateSide “shutdown” continues, the following metrics due today for the Econ Baro shall go missing: Q3’s Productivity and Unit Labor Costs, September’s Wholesale Inventories, and the prior week’s Initial Jobless Claims.

Mark

Mark

05 November 2025 – 08:39 Central Euro Time

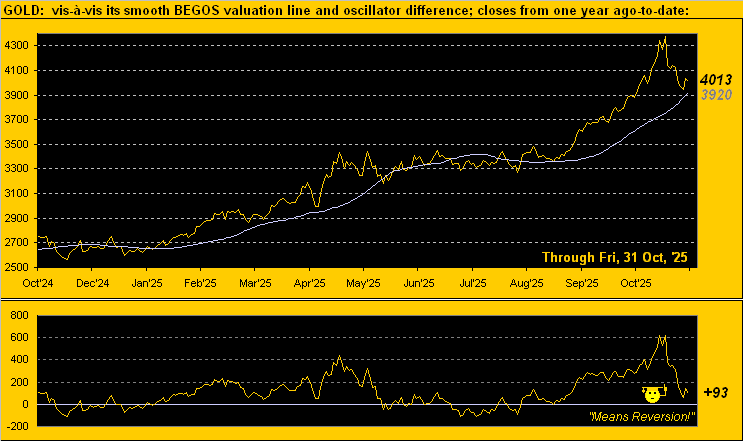

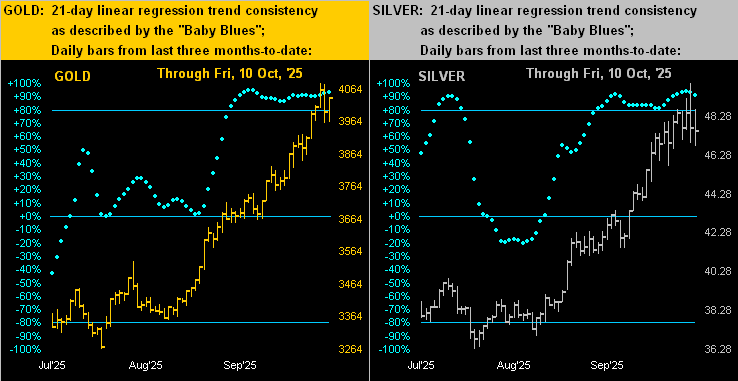

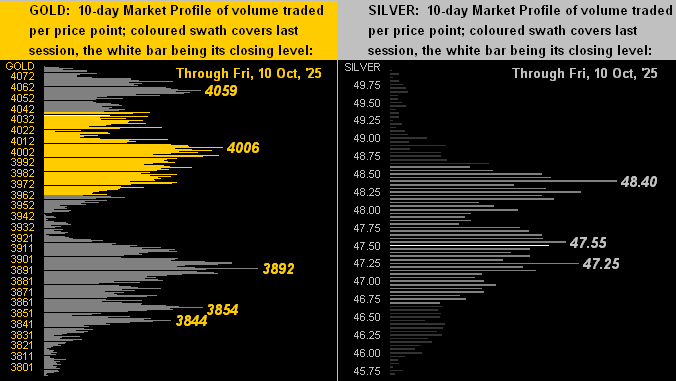

Both Gold and Silver are at present above today’s Neutral Zones, whilst below same is the Spoo; session volatility for the BEGOS Markets is moderate. Whilst higher today, the precious metals’ “Baby Blues” of linreg consistency continue to cascade (see Market Trends). Notably by Market Values, Gold finally has fully reverted to its smooth valuation line after having been above it for 53 consecutive trading days (since 20 August); by its Market Profile, Gold’s most volume-dominant zone of overhead resistance spans from 3990-to-4039; similarly for Silver ’tis from 47.75-to-48.60. The Dollar Index at this instant is precisely 100.000 after basically having been below that level for the past three months. And the Econ Baro does receive two non-government metrics today: October’s ADP Employment and the ISM(Svc) Index, (the StateSide shutdown continuing following a 14th-failed Senate vote last evening).

04 November 2025 – 08:48 Central Euro Time

The Bond is currently above its Neutral Zone for today, whilst below same are Silver, Copper, Oil and the Spoo; BEGOS Markets’ volatility is firmly moderate. By Market Trends, Gold’s 21-day linreg has rotated to negative; with 3975 thus far today’s low, again, should 3901 be penetrated by week’s end, the weekly parabolic Long trend shall flip to Short. The Spoo today has closed its up gap from the opening back on 27 October; too, the daily MACD is approaching a negative crossover, and the daily Moneyflow study has dropped below the key mid-point level of 50. Today’s Econ Baro metrics that shan’t be received (give the StateSide “shutdown”) are September’s Trade Deficit and Factory Orders.

03 November 2025 – 08:32 Central Euro Time

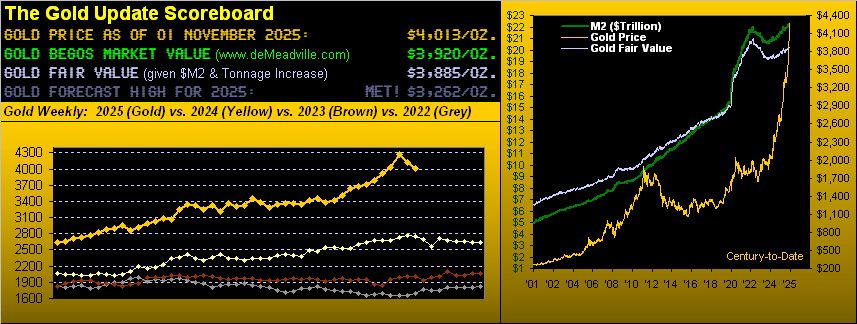

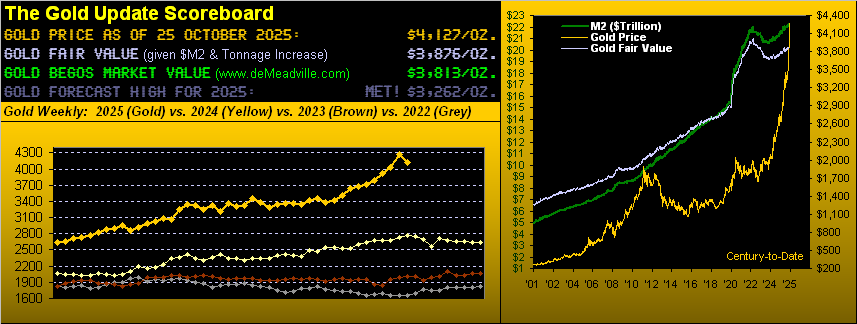

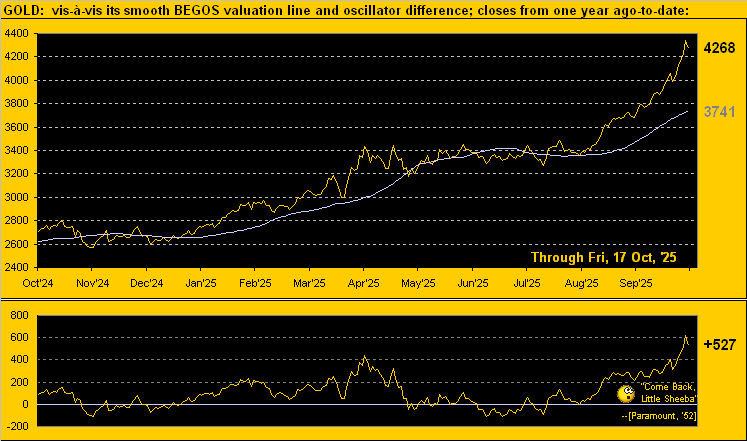

‘Tis a fairly quiet start to November for the BEGOS Markets; presently the Bond is below today’s Neutral Zone, whilst above same is Oil; session volatility is light. The Gold Update confirms our expectations for price having had a second consecutive down week; however year-to-date, there’ve yet to be three negative weeks in-a-row; Gold’s “expect weekly trading range” (172 points) brings the weekly parabolic Long trend into jeopardy should 3901 (last week’s low) be tested as ’tis “within range”. Looking at Market Values for the five primary BEGOS components, in real-time we’ve the Bond as not quite a full point “low” below its smooth valuation line, the Euro -0.025 points “low”, Gold +89 points “high”, Oil -1.04 points “low” and the Spoo +126 points “high”. Given the ongoing StateSide “shutdown”, for the second consecutive month there shan’t be the otherwise due Construction Spending for September, making for a 35th missing Econ Baro metric; however October’s ISM(Mfg) shall be reported.

31 October 2025 – 08:47 Central Euro Time

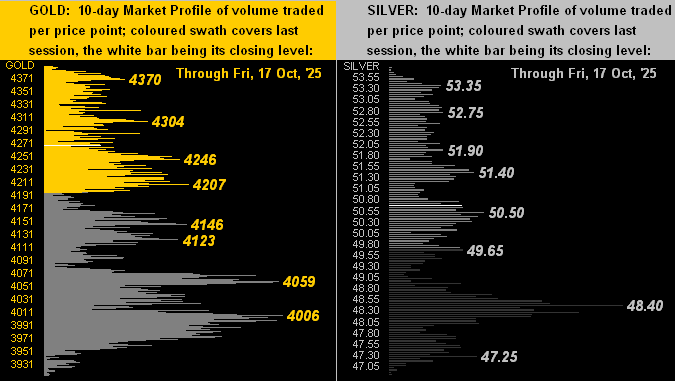

All eight BEGOS Markets are currently within their respective Neutral Zones for today; session volatility is light. It remains the case amongst the five primary BEGOS components that’ve we’ve no notable correlations therein. Tomorrow’s 833rd consecutive Saturday edition of The Gold Update shall cite price’s return back down into the 3000s (as anticipated), albeit ’tis presently 4031 and By Market Values still +110 points “high” above the smooth valuation line; similarly, the Spoo is +156 points above same. Silver had a firm day yesterday in climbing back up through 47.75-48.15 resistance zone (see Market Profiles). We await October’s Chi PMI for the Econ Baro; however, today’s missing reports due to the StateSide “shutdown” are Q3’s Employment Cost Index plus September’s Personal Income/Spending and “Fed-favoured” Core PCE Index.

30 October 2025 – 08:45 Central Euro Time

Presently, Gold is above its Neutral Zone for today, whilst below same is Oil; BEGOS Market’s volatility is firmly moderate. Unsurprisingly, the FOMC with little data upon which to decide nonetheless reduced the FedFunds interest rate 25bps to a 3.75%-4.00% target range. Despite yesterday’s “unch” session, the S&P 500 is (yet again) extremely “textbook overbought”, buoyed almost solely by NVDA and to an extent AAPL; breadth yesterday was poor (25%/75%); the Spoo by Market Values shows (in real-time) as +180 points “high” above its smooth valuation line. For the Econ Baro today, given the ongoing StateSide government “shutdown”, the Bureau of Economic Analysis shan’t be furnishing the first peek at Q3 GDP, nor the Bureau of Labor Statistics the prior week’s Initial Jobless Claims. Q3 Earnings Season has reached the midway mark: for the S&P 500, 72% have bettered their bottom lines from a year ago, an above-average pace; of course, the overall level of S&P earnings remains far too low to maintain the current Index levels, especially with a risk-full yield of just 1.126% vs. a risk-less 3.730% on a 3mo. T-Bill.

29 October 2025 – 08:42 Central Euro Time

Both EuroCurrencies are at present below today’s Neutral Zones, as is Oil, whilst above same are the Metals Triumvirate and Spoo, session volatility for the BEGOS Markets is moderate. Gold yesterday traded down to as low as 3901, which as posted on “X” (@deMeadvillePro) was down through the first of three potential “fib” levels, followed then by 3857 and 3729; both precious metals today, however, are higher, even as their “Baby Blues” (see Market Trends) continue to drop. Our best Market Rhythms for pure swing consistency are currently (on a 10-test basis) Silver’s 30mn Moneyflow, Oil’s 4hr MACD and Gold’s 30mn Parabolics, plus (on a 24-test basis) the non-BEGOS Yen’s 2hr Moneyflow, Silver’s 15mn Moneyflow, and Gold’s 60mn Parabolics. For the Econ Baro we await September’s Pending Home Sales. And late in the session comes the FOMC’s Policy Statement for a -0.25% FedFunds interest rate cut.

28 October 2025 – 08:41 Central Euro Time

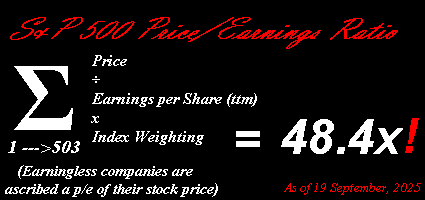

All three elements of the Metals Triumvirate, plus Oil, are at present below today’s Neutral Zones; the balance of the BEGOS Markets are within same, and session volatility is mostly moderate. As anticipated in The Gold Update, Gold and Silver continue to correct, the “Baby Blues” of linreg consistency (see Market Trends) furthering their falls in real-time; indeed we may see Silver’s trend having rotated from positive to negative by tomorrow or Thursday; mind as well the widened Market Ranges for both precious metals (Gold’s EDTR for today is 129 points whilst that for Silver is 2.42 points). The P/E of the S&P 500 has further skyrocketed to in excess of 60x due in large part to INTC’s “ttm” earnings now but $0.01: the P/E of INTC is now 2,822.5x (see S&P 500, Valuations and Rankings). Despite the StateSide “shutdown”, the Econ Baro will take in some actually data today: October’s Consumer Confidence.

27 October 2025 – 08:42 Central Euro Time

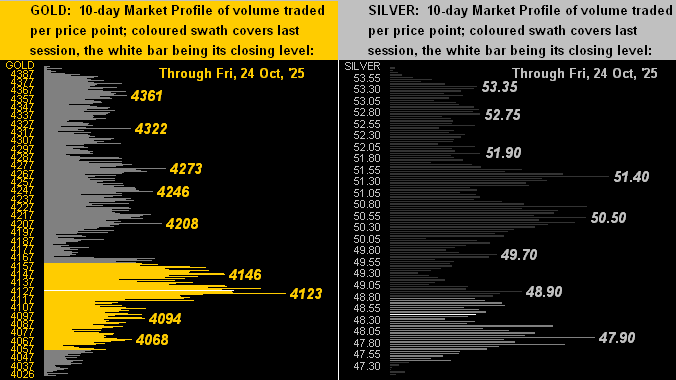

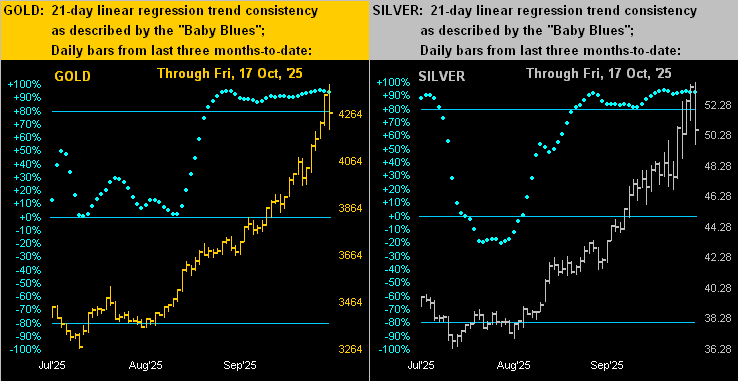

(Note: Europe is now on winter hours). The week gets underway presently finding the Bond, Swiss Franc and Gold below today’s Neutral Zones, whilst above same are Copper and the Spoo; BEGOS Markets’ volatility is moving toward moderate. The Gold Update sees further near-term downside for price as the “Baby Blues” of linreg consistency (see Market Trends) accelerate lower; indeed Gold today has moved below a shelf of support (see Market Profiles) spanning from 4132-4123, (price now 4083); and in real-time Gold is +250 points above its smooth valuation line (see Market Values). Were the S&P 500 to open at this instant (+0.9%), its P/E would be 50.9x. The week’s highlight comes Wednesday via the Policy Statement from the FOMC. And due today (but unlikely to be reported given the “shutdown”) are Durable Orders for September.

24 October 2025 – 08:24 Central Euro Time

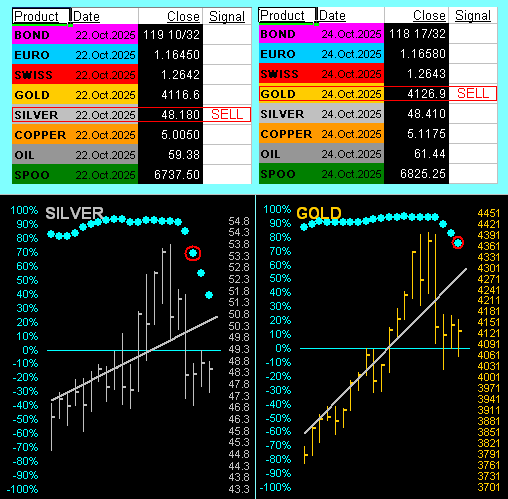

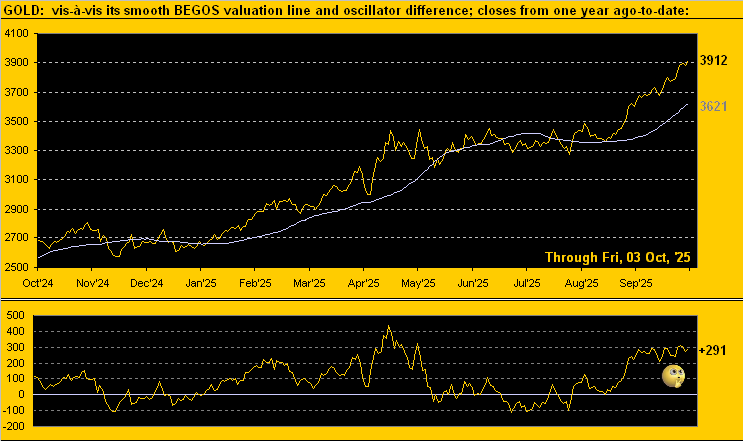

The Euro, Swiss Franc, Gold and Silver are all below today’s Neutral Zones; above same are Copper and the Spoo, and session volatility for the BEGOS Markets is light. Gold’s “Baby Blues”(see Market Trends) of linreg consistency have provisionally dropped below their key +80% axis such as (upon day’s-end confirmation) to then expect lower prices near-term; vis-à-vis its smooth valuation line (see Market Values), Gold in real-time shows as +289 points “high”; more on the yellow metal in tomorrow’s 832nd consecutive Saturday edition of The Gold Update. Oil’s “Baby Blues” yesterday confirmed crossing above their -80% axis: given price in real-time is about -2 points below its own valuation line, near-term we’d expect Oil to visit the mid-63s from the current mid-61s. Due (but likely not arriving) today for the Econ Baro are September’s CPI (<– update, yes CPI reported) and New Home Sales; however, the non-governmental UofM Sentiment Survey for October ought make the trip.

23 October 2025 – 08:49 Central Euro Time

The Bond, Euro and Swiss Franc are at present below their respective Neutral Zones for today, whilst above same is Oil; session volatility for the BEGOS Markets is moving toward moderate. At Market Trends, Gold’s “Baby Blues” of linreg consistency are dropping, but have yet to move below their key +80% (as did Silver’s so confirm yesterday); thus far today, both precious metals are stabilizing to this point; however by Market Values, Gold in real-time is +335 points above its smooth valuation line; further of note today for Gold, it has been trading either side of its most volume-dominant price of the past fortnight which by the Market Profile is 4123. Given the scattered nature of late amongst the five primary BEGOS components, we find no reasonable correlation — neither positive nor negative — therein. The Econ Baro awaits September’s Existing Home Sales; but with yet another Senate vote such that the StateSide government remains closed, this shall be the fourth consecutive week of missing Initial Jobless Claims.

22 October 2025 – 08:43 Central Euro Time

The Swiss Franc, Gold, Copper and Oil are presently above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is moderate, albeit Gold already has traced 115% of its EDTR (see Market Ranges). As stated yesterday on “X” (@deMeadvillePro), Gold recorded its largest intraday loss by points in history: -300 from 4393 to 4093; (on a percentage basis, the -6.8% intraday drop ranked 33rd worst). Regardless, by Market Values, Gold in real-time (4159) is still +380 points above its smooth valuation line (3779). As for Silver, her intraday drop of -8.7% was enough to pull her “Baby Blues” of regression trend consistency in real-time today below the key +80% level; we thus expect still-lower prices for Sister Silver near-term, and thus likely for Gold as well. Again ’tis a nothing-due day for the Econ Baro (irrespective of the StateSide government “shutdown”). And Q3 Earnings Season is going well for the S&P 500 with 80% of reported constituents beating their like earnings of Q3 a year ago; problematic of course is that earnings continue to run too low to support the level of the S&P, its futs-adj’d “live” P/E 49.5x at the moment.

21 October 2025 – 08:37 Central Euro Time

None of the BEGOS Markets are presently above today’s Neutral Zones; below same are the Euro and the three elements of the Metals Triumvirate; session volatility is mostly moderate. Gold as a “meme stock” has moved excessively above its key valuation levels: currently 4340, Fair Value is 3873 and BEGOS Market Value is 3765; a reversion to the latter’s mean at this point would be -576 points. Too by Market Values, Oil is currently -6.40 points below its smooth valuation line: currently 57.07, Oil is just above its most volume-dominant supporter of 57.00, with near-by resistance spanning from 57.90 to 58.40. The Gold/Silver ratio in real-time is 86.0x as Silver today (-1.9%) is selling off at a faster pace than is Gold (-0.8%). Nothing is scheduled today nor tomorrow for the Econ Baro; the StateSide Senate voted last evening such that the “shutdown” continues.

20 October 2025 – 08:31 Central Euro Time

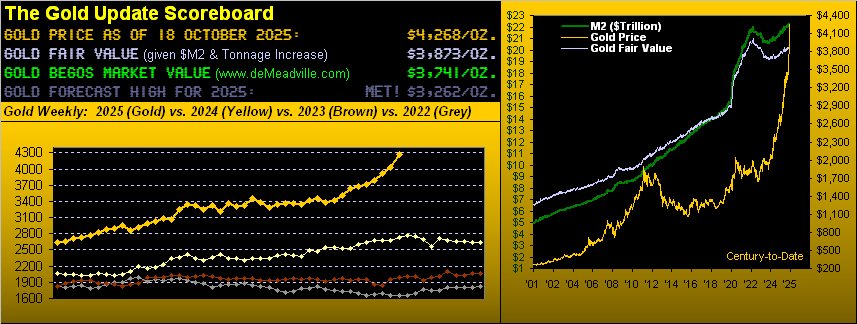

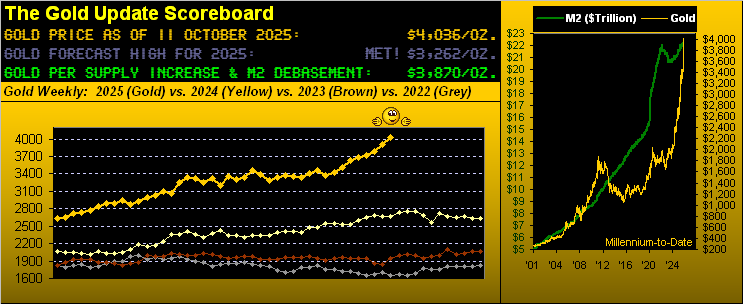

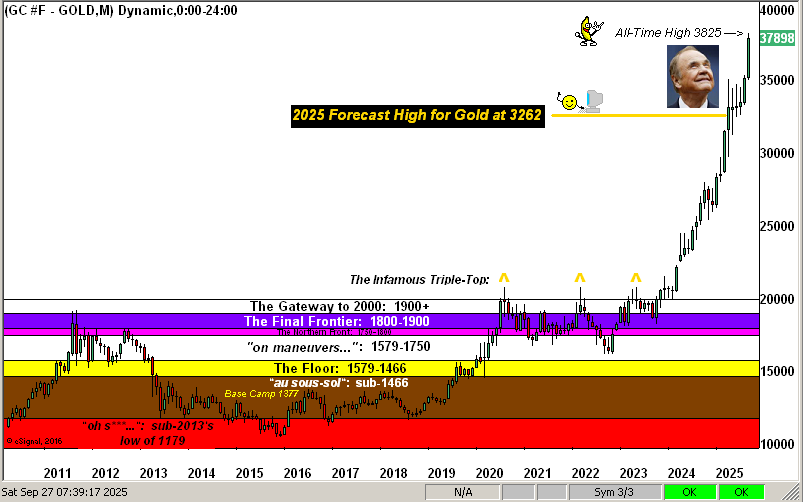

Copper is presently above its Neutral Zone for today, whilst Oil is below same; session volatility for the BEGOS Markets is mostly light. The Gold Update likens the yellow metal to trading as a “meme” stock; Gold had similar runs in both 2007/2007 and again in 2011, both of which led to corrections respectively of -34% and -45%; not that we’ll again witness same, however price is better than +300 points above its Fair Value and nearly +500 points above its smooth valuation line (see Market Values). As to the S&P 500, its “risk-full” yield is but 1.170% vs. 3.832% annualized for the “risk-less” 3mo T-Bill; the “live” (futs-adj’d) P/E of the S&P is 49.1x at this moment. Given the ongoing StateSide government “shutdown”, incoming data for the Econ Baro may continue to be scant, however due today is the Conference Board’s Leading (i.e. “lagging”) Indicators for September. <– “Delayed” due to lack of data. And Q3 Earnings Season picks up its pace as the week unfolds.

17 October 2025 – 08:45 Central Euro Time

The Bond, Euro, Swiss Franc and Gold are all at present above their respective Neutral Zones for today; below same are Silver, Copper and the Spoo, (only Oil is within same), and session volatility for the BEGOS Markets is moderate-to-robust. The fragility of the S&P 500 continues, the Spoo notably having lost -132 points in just the last 16 hours; again we point to the leading characteristic of the S&P MoneyFlow page. At close last evening, the Euro by its “Baby Blues” of linreg consistency (see Market Trends) triggered a Long signal, whilst for Copper a Short signal too was confirmed. Q3 Earnings Season is off to a good start for the S&P as 78% thus far having beaten the prior year’s like quarter; of course, problematic remains the overall level of earning is too low to support the S&P given its “live” P/E (futs-adj’d) of 48.3x at this instant. As the StateSide “shutdown” continues, none of the six metrics due for the Econ Baro today are likely to be released, (including for September Housing/Permits, Ex/Im Prices, IndProd/CapUtil).

16 October 2025 – 08:41 Central Euro Time

The Euro, Swiss Franc and Spoo are all presently above today’s Neutral Zones; below same is Silver, and BEGOS Markets’ volatility is light-to-moderate. In a microcosm of last Friday’s S&P plunge, yesterday saw 18 hours worth of Spoo gains then fully evaporate in just four hours: the S&P 500 sellers are quite quick to exit each time the Index runs out of puff; again, mind the S&P MoneyFlow page. Gold is becoming ever-more overbought both by Fair Value and BEGOS Value: the latter measure (in real-time) finds the yellow metal +506 points above its smooth valuation line (see Market Values). The StateSide government shutdown continues: due today for the Econ Baro are nine metrics, albeit we’ll likely only receive three: October’s Philly Fed Index and NABH Housing Index, plus September’s Treasury Budget, look to be the only arrivés, whilst left on the shelf shall be data points for September’s wholesale inflation and Retail Sales, August’s Business Inventories, and the prior week’s Jobless Claims.

15 October 2025 – 08:44 Central Euro Time

Save for Oil, all seven other BEGOS Markets are presently above their respective Neutral Zone for today, (Oil being within same), and session volatility is moderate. Concern lies with the S&P’s MoneyFlow (see our page thereto) as despite the Index having come off Friday’s low, the Flow is net negative, certainly so on our five-day measure. By Market Rhythms for pure swing consistency, our Top Three are (on a 10-test basis) the non-BEGOS Yen’s 2hr Moneyflow, the same measure for Gold, and the Bond’s 15mn parabolics; too, (on a 24-test basis) we’ve again Gold’s 2hr Moneyflow, Copper’s 15mn MACD and Silver’s 15mn Moneyflow; (note: our S&P MoneyFlow calculation is comprehensively different from the “canned” study we use for the futures markets). Whilst the StateSide Senate could not receive enough votes last evening to end the “shutdown”, the Econ Baro still looks today to October’s NY State Empire Index, (which of course is Fed-generated rather than by a government entity). Then late in the session comes the Fed’s Tan Tome.

14 October 2025 – 08:35 Central Euro Time

Gold is the only BEGOS Market at present inside of today’s Neutral Zone; above same are the Bond, Euro and Swiss Franc, with the balance below same; session volatility is mostly robust. Gold earlier this morning touched another All-Time High at 4191, but has since given back the sessions. The Spoo’s “Baby Blues” (see Market Trends) are dropping so swiftly (following Friday’s technical damage) that the 21-day linreg trend looks to rotate from positive to negative within the next few days; by its Market Profile, the Spoo’s more volume-dominant resistors are 6671, 6695, 6708 and 6737; there is a wee bit of volume support at 6595; indeed the current volatility for the S&P is creating fragility, and we still sense lower levels in the offing; the Spoo’s EDTR (see Market Ranges) is 74 points. Again nothing is scheduled today for the Econ Baro, (the StateSide government “shutdown” notwithstanding); and financials begin populating Q3 Earnings Season.

13 October 2025 – 08:31 Central Euro Time

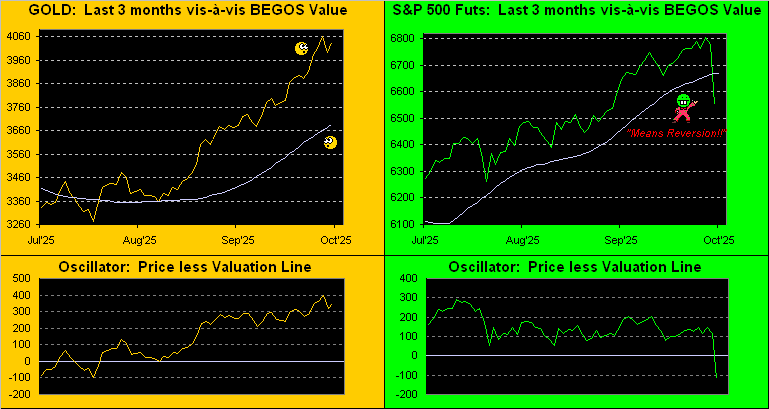

Gold has tapped yet another All-Time High this morning at 4097; The Gold Update cites price as continuing to look good going forward, but that more immediately ’tis extremely high above its smooth valuation line (in real-time now +391 points “high”; see Market Values); Silver has not followed with an all-time high thus far today. Too, the missive supports a firm case for a significant correction in the S&P 500, which in six hours on Friday gave back a full month’s worth of gains; however, the Spoo is very strong this morning such that the S&P (at this moment) would open +81 points higher (+1.2%), fears over the “Trump n’ China” tariffs concern be somewhat allayed. Presently, all three elements of the Metal Triumvirate are above today’s Neutral Zones, as too are Oil and the Spoo; below same are the Bond and Swiss Franc, and volatility for the BEGOS Markets is moderate-to-robust. Nothing is due until Wednesday for the Econ Baro, which to date in October is missing 11 of the 16 metrics thus far due as the StateSide “shutdown” continues. Q3 earnings Season picks up its pace this week, notably with financial entities reporting.

10 October 2025 – 08:38 Central Euro Time

Presently we’ve Copper below its Neutral Zone for today, whilst above same is the Spoo; session volatility for the BEGOS Markets is light-to-moderate. Spot Silver has briefly traded above 50, however by CME GLOBEX, yesterday’s December cac high was 49.97 — regardless, an all-time high — and the high thus far today lower however at 47.915. Gold high-to-low yesterday dropped -120 points (-2.9%) its eight-worst intra-day loss by points century-to-date: we’ve of late regularly been citing Gold’s excessively high price vis-à-vis its BEGOS Market Value, so ’tis no surprise (indeed expected) seeing price retreat; even at that, Gold in real-time is still +299 points above its smooth valuation line; more on it all in tomorrow’s 830th consecutive Saturday edition of The Gold Update. The P/E of the S&P 500 may exceed 50x as the day unfolds; (marked by fair value to the futs, ’tis 49.9x at the moment). For the Econ Baro we’ve the UofM Sentiment Survey for October, and purportedly late in the session September’s Treasury Budget, (the Treasury Department does operate under “shutdown” conditions).

09 October 2025 – 08:18 Central Euro Time

Copper is presently the only BEGOS Market outside (above) its Neutral Zone for today; session volatility is again moderate. Silver yesterday traded above 49 for the first time in better than 14 years; currently ’tis 48.63; Gold traded yesterday to an All-Time High at 4081. Too, the S&P 500 reached a record high 6756, the Spoo itself attaining the 6808 level. By Market Trends: Gold, Silver, Copper and the Spoo are all in 21-day linreg uptrends; the balance of the Bond, Euro, Swiss Franc and Oil are in like downtrends. Gold is now +382 points above its smooth valuation line (see Market Values) and the Spoo is +141 points above same, both markets severely stretched to the upside. Oil’s cac volume is rolling from November into that for December. And the two unlikely-to-be-reported metrics due for the Econ Baro are the prior week’s Jobless Claims and August’s Wholesale Inventories as the StateSide gov’t shutdown continues.

08 October 2025 – 08:46 Central Euro Time

Gold, having yesterday achieved 4000, has since risen today to as high as 4059; Silver however has not kept pace, “stuck” to a degree in the 47s and 48s, the Gold/Silver ratio in turn having risen from the 81s to nearly the 84s (its current real-time reading 83.7x). All three elements of the Metal Triumvirate are presently above today’s Neutral Zones (even as the Dollar strengthens, reminding us that “Gold plays no currency favourites”), and the two EuroCurrencies are below their Neutral Zones; BEGOS Market’s volatility is moderate. The Spoo’s “Baby Blues” (see Market Trends) have marginally been slipping below their key +80% axis since Friday, and price seemingly is losing its rampant upward push: the “live” P/E of the S&P (futs-adj’d) is 49.1x, and the Index is now 21 trading days (one full month) “textbook overbought”. Nothing is due today for the Econ Baro; late in the session come the Minutes from the FOMC’s 16/17 meeting.

07 October 2025 – 08:45 Central Euro Time

Gold (by its December “front month” contract) at 00:28 this morning touched 4000 for the first time. Price has since come off and is now inside of today’s Neutral Zone (3999-3970), as too are the Bond, Silver Oil and the Spoo; Copper is above its Neutral Zone, and below same are both the Euro and Swiss Franc; session volatility for the BEGOS Markets is light. Gold’s best Market Rhythm for pure swing consistency is its 2hr Moneyflow, whilst for a profit-target basis/swing (per the Market Rhythms page) is its 12hr Moneyflow, (wherein a minimum of 29 points have been gained through the last 10 swings inclusive). Cautionarily, the yellow metal settled last evening +131 points above its Market Magnet, and is (in real-time) +337 points above its smooth valuation line (see Market Values). Due today for the Econ Baro — but unlikely to be reported given the ongoing StateSide gov’t closure — is August’s Trade Deficit; then late in the session we’ve August’s Consumer Credit. Q3 Earnings Season has commenced with just one report (STZ) … which beat estimates … but its earnings were less than a year ago, (same old Wall Street game). Mind our Earnings Season page throughout the ensuing days and weeks.

06 October 2025 – 08:39 Central Euro Time

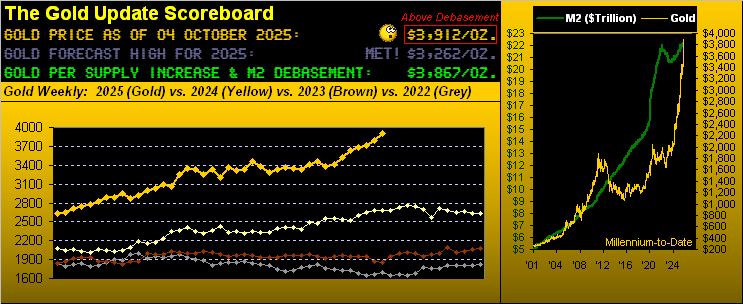

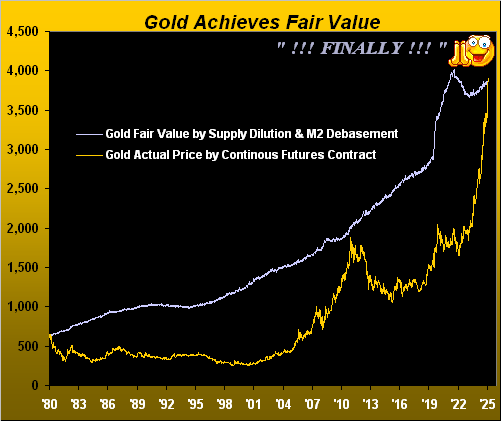

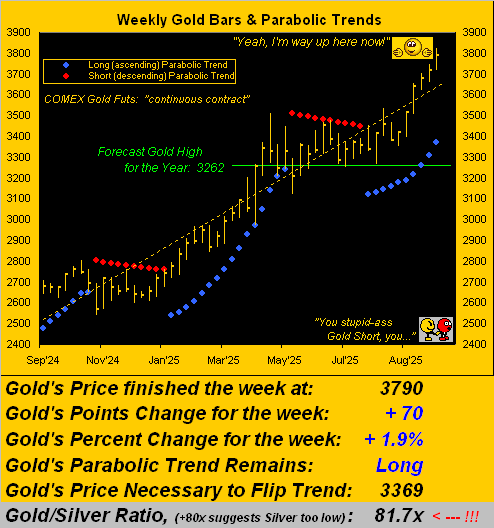

The Gold Update officially recognizes the yellow metal as having achieved, indeed surpassed, our measure of its Fair Value: congrats to Gold! Presently, both Gold and Silver are higher today, above their Neutral Zones as are Oil and the Spoo; below same are the Bond and EuroCurrencies, and BEGOS Markets volatility is session moderate-to-robust. By Market Values in real-time, Gold shows as +315 points above its smooth valuation line, whilst the Spoo too is +140 points above same, both markets currently in extreme, technically overbought states. ‘Tis a very light data week for the Econ Baro given just six metrics being due: with the ongoing StateSide government shutdown, actual reports may be less, (none are scheduled for today). And Q3 Earnings Season gets underway.

03 October 2025 – 08:36 Central Euro Time

Both Silver and the Spoo are presently above today’s Neutral Zones; the balance of the BEGOS Markets are within same, and session volatility is light. Amongst the correlations of our five primary BEGOS components, the best currently is negative between Oil and the Spoo. The S&P 500 continues its streak of being “textbook overbought” now through the past 18 trading sessions; (‘twould be of note to see the “live” P/E surpass the 50x level: futs-adj’d, ’tis 49.5x at the moment). The Spoo (currently 6784) shows Market Profile support at the volume-dominant levels of 6765, 6752, 6737, 6722, and most notably across the past fortnight at 6710. As the StateSide government remains shutdown, we don’t expect September’s Payrolls to arrive today for the Econ Baro; however due, too, is the ISM(Svc) Index.

02 October 2025 – 08:41 Central Euro Time

Copper is at present the only BEGOS Market outside (above) its Neutral Zone for today; session volatility is not quite yet moderate. The “live” (futs-adj’d) P/E of the S&P 500 is 49.8x, the Index recording yet another record high. Gold yesterday found its way also to another All-Time High at 3923. By Market Rhythms for pure swing consistency, our current Top Three on a 10-test basis are the Swiss Franc’s 2hr MACD, the Euro’s 4hr Parabolics, and Copper’s 2hr Moneyflow; on a 24-test basis we’ve Silver’s 4hr MACD, Gold’s 2hr Moneyflow, and the non-BEGOS Yen’s 14mn Price Oscillator. Metrics due today for the Econ Baro include August’s Factory Orders, however given the StateSide gov’t shutdown, such report likely shan’t be released.

01 October 2025 – 08:33 Central Euro Time

The Bond, Copper and Spoo are presently below today’s Neutral Zones; above same are the Euro and Swiss Franc, and BEGOS Markets’ session volatility is moderate. Gold has again set an All-Time High at 3904, and Silver has reached up to 47.83 so far this session. The Spoo’s “Baby Blues” (see Market Trends) have dropped (in real-time) to their key +80% axis: a settle below that border regularly dictates lower prices near-term; the S&P 500 itself saw its P/E settle yesterday at 49.0x, albeit with the Spoo trading lower this morning, the “live” futs-adj’d P/E at the moment is 48.7x; the S&P is now 16 consecutive sessions “textbook overbought” and the yield a wee 1.164%, (that for “risk-free” three-month annualized T-Bill yield is 3.845%). The Econ Baro looks to September’s ADP Employment data and ISM(Mfg) Index, plus August’s Construction Spending (not reported due to U.S. government shutdown).

30 September 2025 – 08:28 Central Euro Time

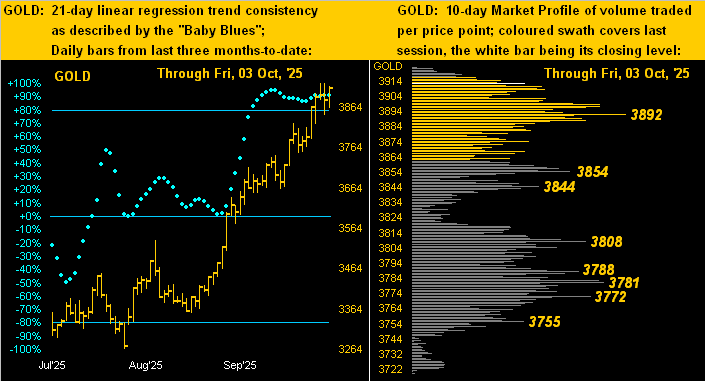

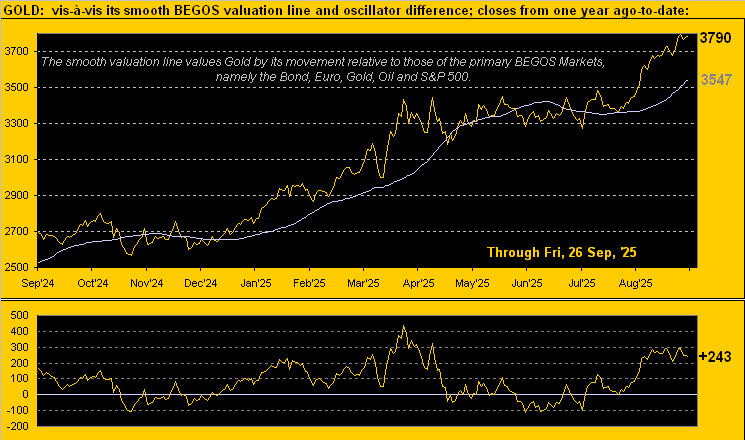

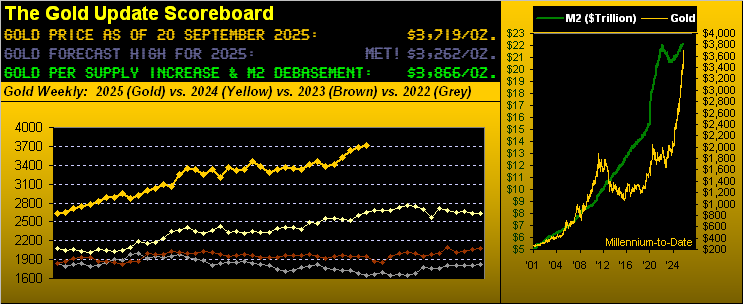

Gold at 00:05 GMT this morning reached its Dollar debasement value of 3865, moving further up to (thus far) as high as 3899; this is the first time since 2011 that price has (as graphically portrayed each Saturday in The Gold Update’s Scoreboard) exceeded its Dollar debasement value; the yellow metal is at present the only BEGOS Market outside (above, obviously) its Neutral Zone for today, and volatility for the BEGOS Markets otherwise is light. In real-time, Gold (3892) by Market Values is +314 points above its smooth valuation line; by its Market Profile, Gold’s nearest volume-dominant support price area is 3856-3854. Go Gold! albeit as we’ve written of late, price is very extended to the upside, and now certainly so in exceeding its Dollar debasement value; to be sure, geopolitical sensitivity is for the moment supporting price. For the Econ Baro today we’ve September’s Chi PMI and Consumer Confidence.

29 September 2025 – 08:38 Central Euro Time

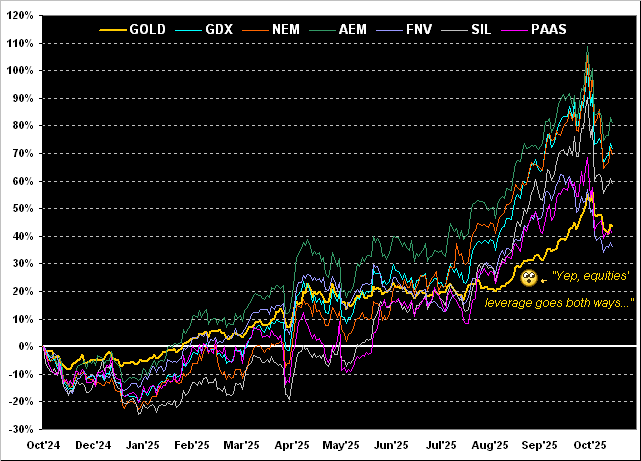

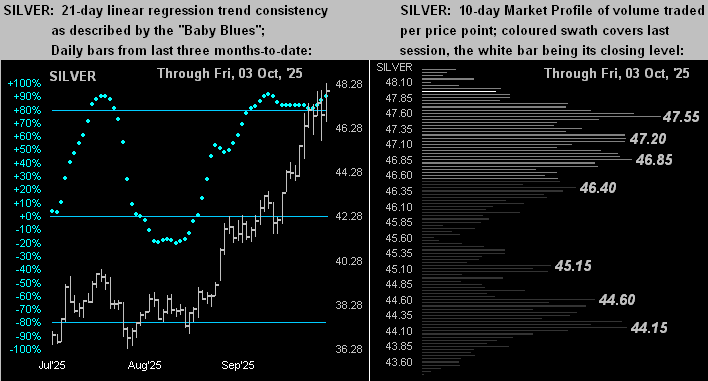

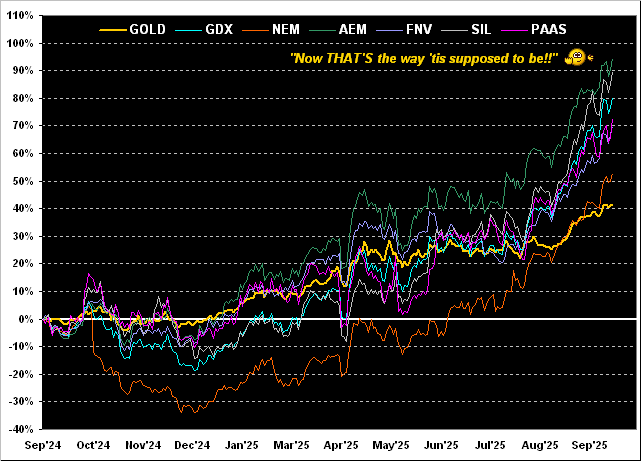

The week begins finding Gold trading ever closer (its high thus far today 3849) to its Dollar debasement value (3865). At present, every BEGOS Market is higher, with seven of the eight (save for Oil) above their respective Neutral Zones for today; session volatility is moderate-to-robust. The Gold Update notably finds Silver leading the BEGOS Markets Standings, price +58.3% year-to-date, and even more so as of today by the white metal having moved up into the 47s; (Silver’s all-time high was back on 25 April 2011 at 49.82); too, we’re a bit concerned over Gold becoming excessively stretched to the upside, in real-time now +281 points above its smooth valuation line (see Market Values). The Spoo is higher such that were the S&P 500 to open at this instant, ‘twould so do +0.4%. 13 Econ Baro metrics are due this week, starting today with August’s Pending Home Sales.

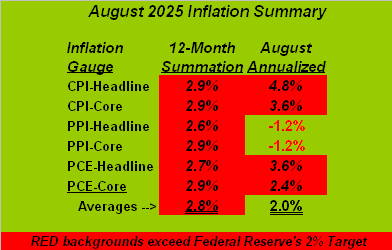

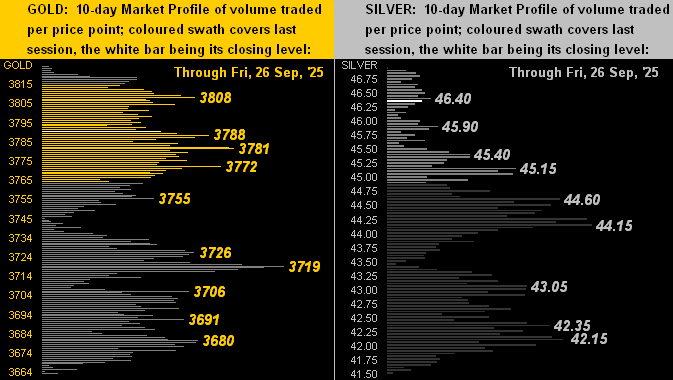

26 September 2025 – 08:32 Central Euro Time

Silver presently is the only BEGOS Market outside (below) its Neutral Zone for today; session volatility is again light with August’s “Fed-favoured” PCE inflation gauge in the balance. Silver traded yesterday to as high as 45.50, a better than 14-year high: the white metal now easily leads the BEGOS components year-to-date standings as we’ll present in tomorrow’s 828th consecutive Saturday edition of The Gold Update. Stocks took a bit of a jolt yesterday on an unusually strong revision to finalize Q2’s GDP — perhaps putting into question another Fed rate cut — the S&P 500 nonetheless coming well off its intraday low (6569) in settling at 6605. Looking at correlations for our five primary BEGOS components, the best currently is positive between the Bond and the Euro. In addition to the PCE, other Econ Baro metrics today of course include August’s Personal Income/Spending.

25 September 2025 – 08:32 Central Euro Time

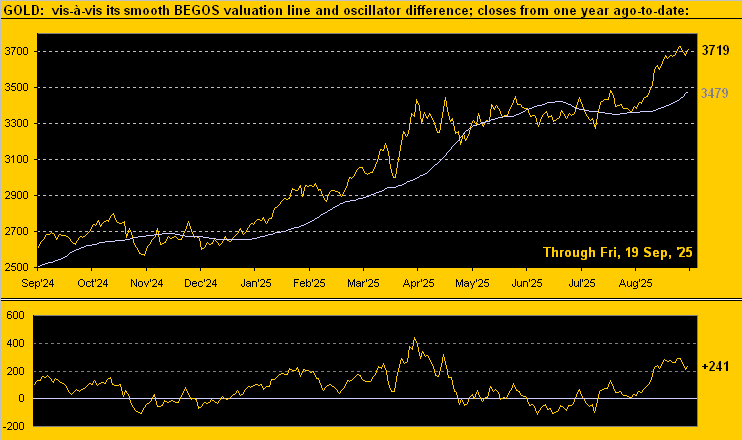

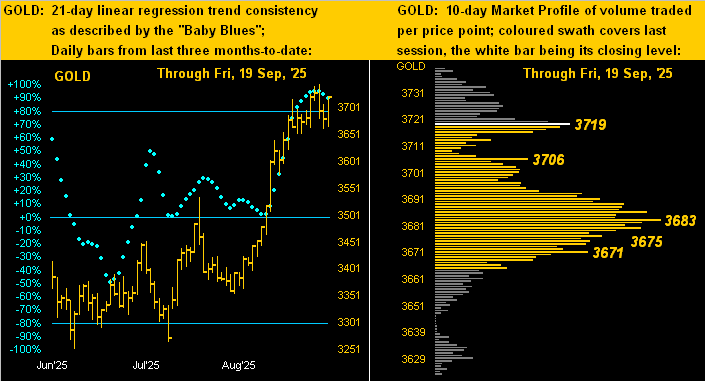

Copper, for which yesterday’s +4.0% net gain ranked fourth-best year-to-date, is higher again this morning and is the only BEGOS Market presently outside of its Neutral Zone; overall session volatility is again light. The pricing for the Spoo may be quite contained from now to tomorrow’s “Fed-favoured” PCE data for August; nonetheless, the S&P 500 itself remains “textbook overbought” and the futs-adj’d P/E 48.6x. Both Precious Metals have cooled a bit from their highs of Tuesday; still, Gold notably in real-time is +244 points above its smooth valuation line (see Market Values); and by its Market Profile, Gold shows its most dominant volume support at 3719. Incoming metrics for the Econ Baro include August’s Durable Orders and Existing Home Sales, along with the final read for Q2 GDP.

24 September 2025 – 08:26 Central Euro Time

Our two EuroCurrencies are the only BEGOS Markets presently outside (both below) today’s Neutral Zones; session volatility continues light, and by Market Ranges, save for the two precious metals, EDTRs remain relatively subdued. Our Top Three Market Rhythms for pure swing consistency are on a 10-test basis the Euro’s 1hr Moneyflow, the Spoo’s 4hr Parabolics, and the Swiss Franc’s 2hr MACD; on a 24-test basis they are Silver’s 4hr MACD, the Swiss Franc’s 1hr Parabolics, and Gold’s 2hr Moneyflow. The Swiss Franc (1.2739) is by its Market Profile in real-time on its most volume-dominant price of the past fortnight: overhead resistance by same is 1.2840 and support 1.2700. Despite yesterday’s -0.6% S&P 500 pullback, the breadth was positive (55%/44%), indicative of the largest mkt cap constituents driving the downside bus. The Econ Baro awaits August’s New Home Sales.

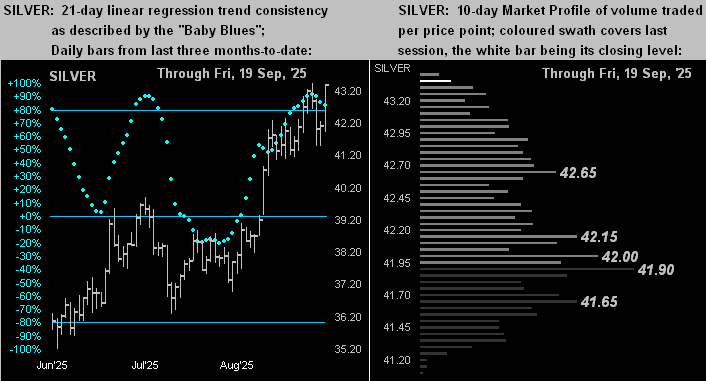

23 September 2025 – 08:50 Central Euro Time

New highs continue to be recorded for both Gold (3795 thus far today) and the S&P 500 (6699 yesterday). At present, Copper is the sole BEGOS Market outside (below) its Neutral Zone for today, and session volatility to this hour is again light. Silver has today reached thus far up to 44.42, a level last traded on 03 May 2011; yet, the white metal still remains attractive vis-à-vis the level of the yellow metal given the Gold/Silver ratio of 85.8x bein well above its century-to-date average of 69.3x; Silver’s volume-dominant Market Profile support ranges from 42.65 down to 41.65; but by its Market Magnet, Silver’s settle last evening (44.32) finds it quite stretched at +1.85 points above that metric (see our Silver page). The Econ Baro starts its week today with Q2’s Current Account Deficit.

22 September 2025 – 08:42 Central Euro Time

Gold, Silver and Oil all are presently above today’s Neutral Zones; the other BEGOS Markets are within same, and session volatility is light. The Gold Update highlights both the yellow metal and S&P 500 making record highs, albeit prices are quite stretched near-term for Gold and broadly so for the S&P; the P/E of the latter in real-time (adjusted for the futs) is 48.6x. At Market Trends, only Oil is in negative linreg; however the “Baby Blues for the seven other BEGOS components are rolling over to the downside, (save barely those for the Spoo, but look poised to so do). Regardless, Gold just printed a fresh All-Time High as we type at 3748, (the previous being 3744 this past Wednesday). Nothing is due today for the Econ Baro ahead of a moderate load of incoming metrics as the week unfolds, the highlight being Friday’s release for August of the “Fed-favoured” PCE data.

19 September 2025 – 08:39 Central Euro Time

The S&P 500 is at an all-time closing high (6632) following yesterday’s all-time intraday high (6657). The Spoo however is weaker this morning (6687) and presently below its Neutral Zone for today, as are the Bond, Swiss Franc and Oil; above same is Silver, and session volatility for the BEGOS Markets is moderate. Amongst the five primary BEGOS components, the best current correlation is positive between Gold and Oil. Gold, after reaching another All-Time High this past Wednesday (3744) is by its daily technicals showing the earliest signs of perhaps some price pullback: more on that in tomorrow’s 827th consecutive Saturday edition of The Gold Update. And Copper’s “Baby Blues” (see Market Trends) just confirmed a sell signal last evening, the level of the Blues having settled below the key +80% level. The Econ Baro is quiet today following a rather choppy week of 14 incoming metrics.

18 September 2025 – 08:41 Central Euro Time

Moving on from the Fed’s “non-event” -25bp Funds rate reduction, we’ve at present both the Bond and Spoo above today’s Neutral Zones, whilst all six of the other BEGOS Markets are below same; session volatility is firmly moderate. Specific to the positioning of the five primary BEGOS components vis-à-vis their Market Values in real-time: the Bond is 1^15 points “high” above its smooth valuation line, the Euro basically in sync with its valuation line, Gold +208 points “high”, Oil -1.17 points “low, and the Spoo +165 points “high”. Yesterday the S&P 500 posted a second consecutive down day for just the second time across the past 18 trading sessions, the “live” futs-adj’d P/E now 47.5x. And the Econ Baro concludes its week today with metrics that include September’s Philly Fed index and August’s Leading (i.e. “lagging”) Indicators.

17 September 2025 – 08:37 Central Euro Time

The Swiss Franc and all three elements of the Metals Triumvirate are presently below today’s Neutral Zones; the rest of the BEGOS Markets are within same, and volatility is mostly light. Looking at Market Rhythms for pure swing consistency, on a 10-test basis the Top Three are all for the Spoo as follows: 4hr Parabolics, 30mn Moneyflow, and 15mn Parabolics; for the 24-test basis we’ve again the Spoo’s 30mn Moneyflow, the non-BEGOS Yen’s 30mn MACD, and Silver’s 4hr MACD. Gold yesterday registered another All-Time High at 3740, but as noted, the metals are coming off so far today. The S&P 500 remains “textbook overbought”. The Econ Baro awaits August’s Housing Starts/Permits. Then at 18:00 GMT we’ve the Policy Statement from the FOMC incorporating a -25bp reduction in the Funds rate.

16 September 2025 – 08:43 Central Euro Time

The EuroCurrencies and the Spoo are presently above their respective Neutral Zones for today, whilst below same is Copper; volatility is light-to-moderate. To be sure, the Spoo’s “Baby Blues” (see Market Trends) are now in a fifth trading day of ascent after having declined (as herein written) the six prior sessions which (save for 02 September) essentially found price on the rise: ’tis unusual, that, which is why our deMeadville analytics ought always be judged in context with one’s own financial assessments of trend, etc.; indeed the 21-day linreg trend of the Spoo has been positive from 29 April-to-date. The S&P 500 itself now sports a “live” (futs-adj’d) P/E of 47.3x, the Index as well characterized as “extremely textbook overbought”. Oil’s cac volume is rolling from October into that for both November and December. And ’tis a busy day for the Econ Baro with September’s NAHB Housing Index, August’s Retail Sales, Ex/Im Prices, and IndProd/CapUtil, plus July’s Business Inventories.

15 September 2025 – 08:42 Central Euro Time

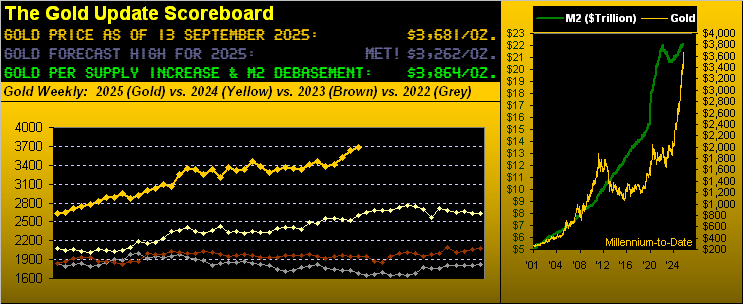

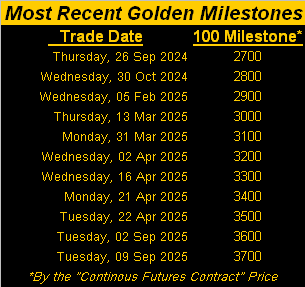

The Bond begins the week at present below its Neutral Zone for today; Oil is above same, and BEGOS Markets’ volatility is light. The Gold Update details the yellow metal having achieved a run in less than one year of ten +100-point milestones, the most recent of course being 3700 this past Tuesday; too is stressed the massive overvaluation of the S&P 500 and the notion of it perhaps nearing a crash as Gold gets the cash. That stated, the S&P 500’s MoneyFlow (per our page) is very supportive of the Index’s ascent, even as the “live” (futs-adj’d) P/E in real-time is 46.7x. Cac volume for the Spoo is rolling from September into December. ‘Tis a busy week for the Econ Baro with 14 incoming metrics scheduled, beginning today with September’s NY State Empire Index. Wednesday is the week’s centerpiece of the FOMC vote to reduce the Funds rate by -25bp, an event which already has been “priced-in” to the S&P time and again.

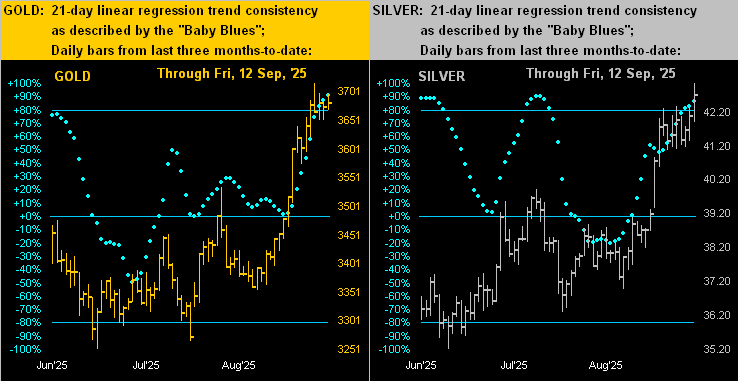

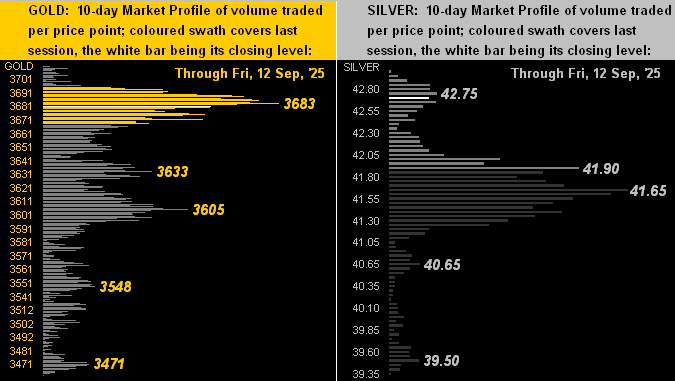

12 September 2025 – 08:43 Central Euro Time

Record highs were recorded yesterday for both the Spoo (6600) and the S&P 500 itself (6593), even as retail inflation via headline CPI doubled its pace from from July’s +0.2% to now +0.4% for August; the month’s core pace was maintained at +0.3%, still ahead of the Fed’s desired 2% annualized target. Although September is notoriously known for being the year’s poorest S&P month, through its eight trading days-to-date ’tis +2.0%. This morning presently finds all three elements of the Metals Triumvirate above today’s respective Neutral Zones, whilst below same is Oil; session volatility for the BEGOS Markets is mostly moderate. Amongst the five primary BEGOS components, our best correlation currently is negative between the Euro and Oil. Currencies’ cac volume is rolling today from September into that for December. The Econ Baro finishes its somewhat negative week with September’s UofM Sentiment Survey. And tomorrow’s 826th consecutive Saturday edition of The Gold Update shall of course feature price having tapped the 3700 level.

11 September 2025 – 08:45 Central Euro Time

The Bond is at present the only BEGOS Market outside (below) its Neutral Zone for today; session volatility is again light. Yesterday’s +0.3% gain in the S&P 500 was (by moneyflow regressed into S&P points) solely due to one stock, ORCL, which gained 36%; otherwise, the S&P’s breadth was negative (201 up, 301 down, 1 unch). Came too a deflationary PPI read for August (-0.1%) albeit as volatile as is that series, a better read ought be by today’s CPI report. Market Values’ excesses of note include (in real-time) the Bond as +2 points “high” above its smooth valuation line, Gold as +259 points “high” and the Spoo as +104 points “high”; obviously by our “textbook technicals”, the S&P is “overbought”. In addition to retail inflation for the Econ Baro, included late in the session is August’s Treasury Budget.

10 September 2025 – 08:45 Central Euro Time

Gold, after achieving yet another All-Time High yesterday (3715) is at present (3681) above its Neutral Zone for today, as is Oil; the balance of the BEGOS Markets are within same, and volatility is light with key inflation data pending these next two days. The S&P 500, whilst not exceeding its all-time intraday high (6533 last Friday), settled yesterday at an all-time closing high of 6513. For the Spoo, its “Baby Blues” (see Market Trends) having in real-time stopped their descent; however that doesn’t preclude significant market downside it being September and the S&P “priced to perfection” incorporating a Fed rate cut. Still as noted, the final two pieces in the Fed’s inflation puzzle come today via August’s PPI which spiked in July, and tomorrow for the CPI which may well be upwardly affected by the July PPI as it leads the CPI by a month. Mind the Econ Baro.