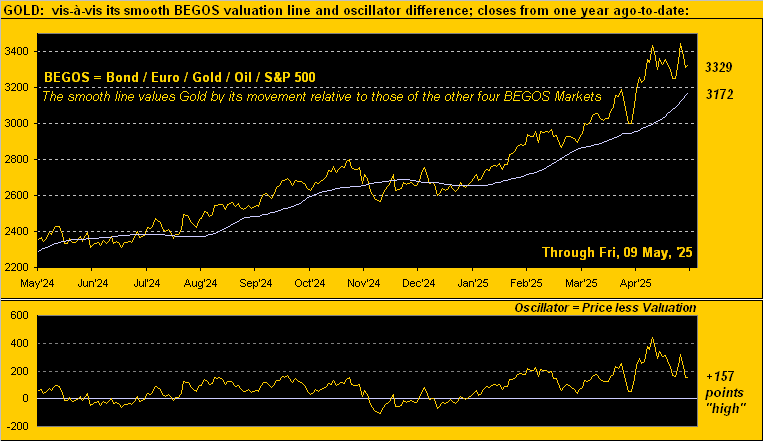

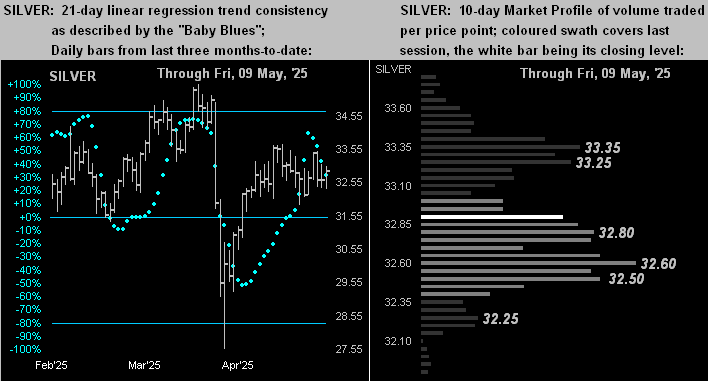

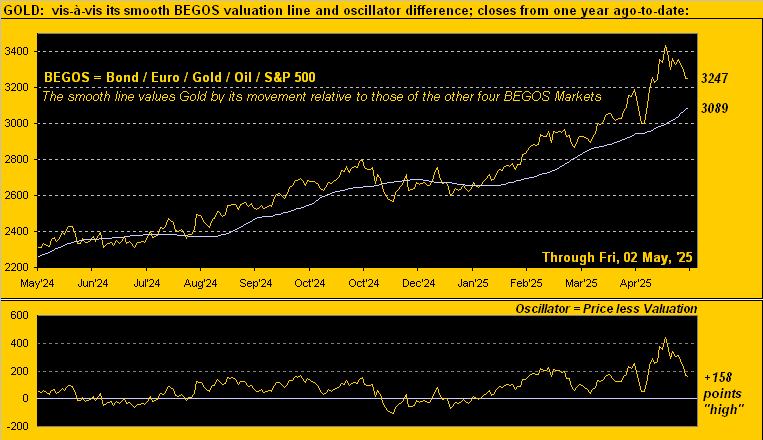

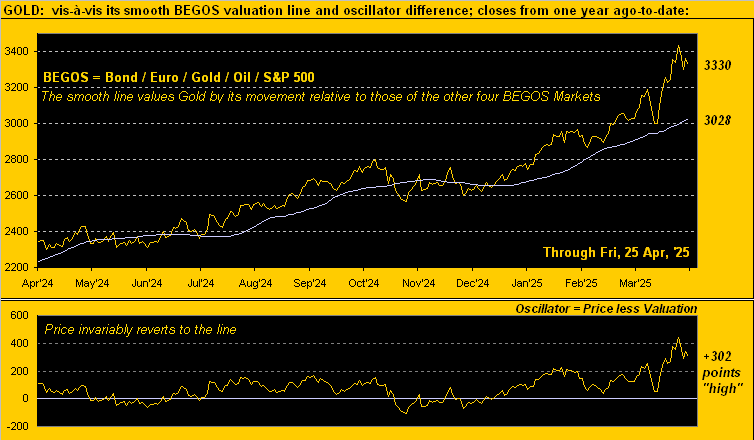

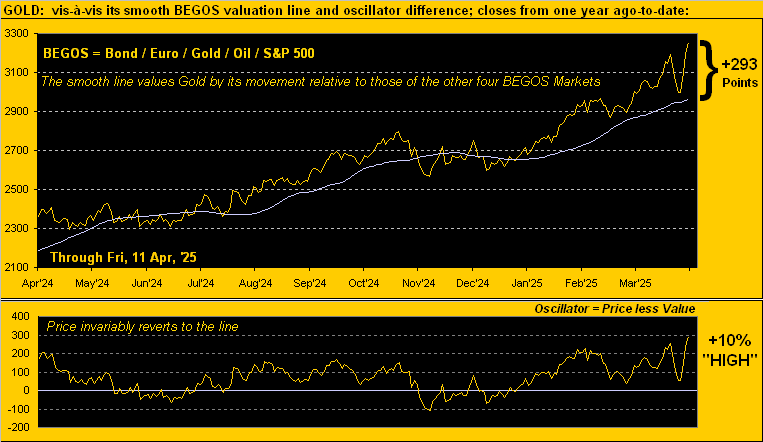

Both Gold and Silver are at present below today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility is quite light. Gold has nearly closed the long-running deviation above its smooth valuation line (see Market Values): in real-time, price is now just +10 points over the line, after having been as much (on a closing basis) as +440 points “high” back on 21 April; (and as previously noted, Gold’s weekly parabolic trend provisionally has flipped from Long-to-Short). Gold’s best Market Rhythm for pure swing consistency on a 10-test basis is currently the 6hr MACD; on a 24-test basis ’tis the 4hr parabolics. Nothing is due today for the Econ Baro ahead of a barrage featuring 16 incoming metrics from tomorrow into Friday; of note per yesterday’s CPI data, inflation’s pace increased during April.

Mark

Mark

13 May 2025 – 08:34 Central Euro Time

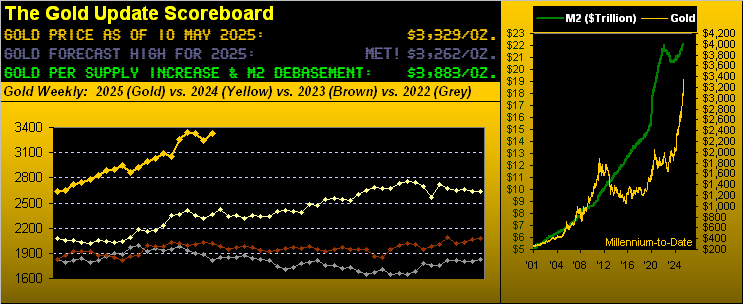

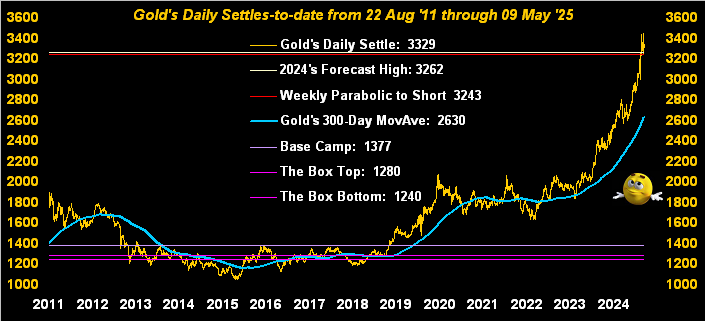

As posted yesterday on ‘X’, Gold’s weekly parabolic trend has provisionally flipped from Long-to-Short; barring Gold improbably making an All-Time High this week (above 3510), the new Short trend shall confirm upon Friday’s settle. At present, both Gold and Silver, along with the Euro and Swiss Franc are above their respective Neutral Zones for today, whilst below same is the Spoo; session volatility is light. Yesterday’s gap-up open for the S&P 500 was by points the largest in its 68-year history; the Index through the past 11 days is “textbook overbought” and the Spoo (in real-time) is +384 points above its smooth valuation line (see Market Values); the futs-adj’d “live” P/E for the Index is 44.3x. The Econ Baro looks to the first report of April’s inflation via the CPI.

12 May 2025 – 08:39 Central Euro Time

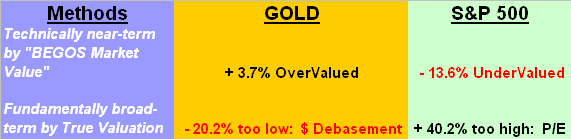

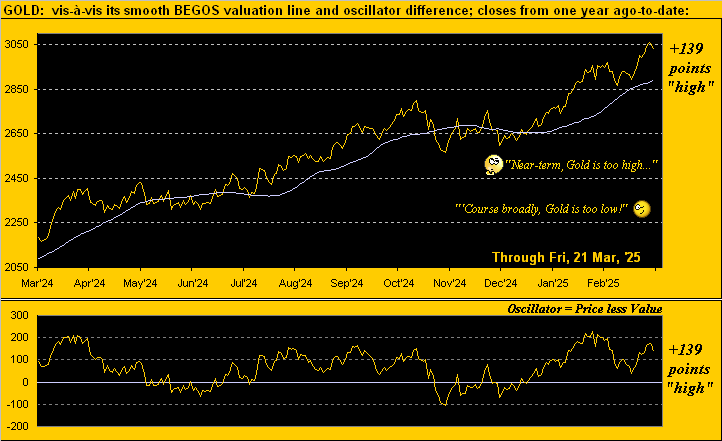

Copper is the sole BEGOS Market at present within its Neutral Zone for today; below same are the Bond, Euro, Swiss Franc, and Gold, whilst above same are Silver, Oil and the Spoo; volatility is mostly moderate. The Gold Update gives evidence to the yellow metal’s great rally potentially having run out of puff: purported progress of tariff resolution issues is drawing money from the safe havens into equities and the Dollar. Were the S&P 500 to open at this instant, the Spoo as adjusted for fair value places the Index +1.5%, (and the “live” P/E at 43.6x); the Spoo in real-time is +297 points above its smooth valuation line, see Market Values). The Econ Baro begins it busy week of 19 incoming metrics with April’s Treasury Budget due late in the session. And this is the final week of Q1 Earnings Season.

09 May 2025 – 08:42 Central Euro Time

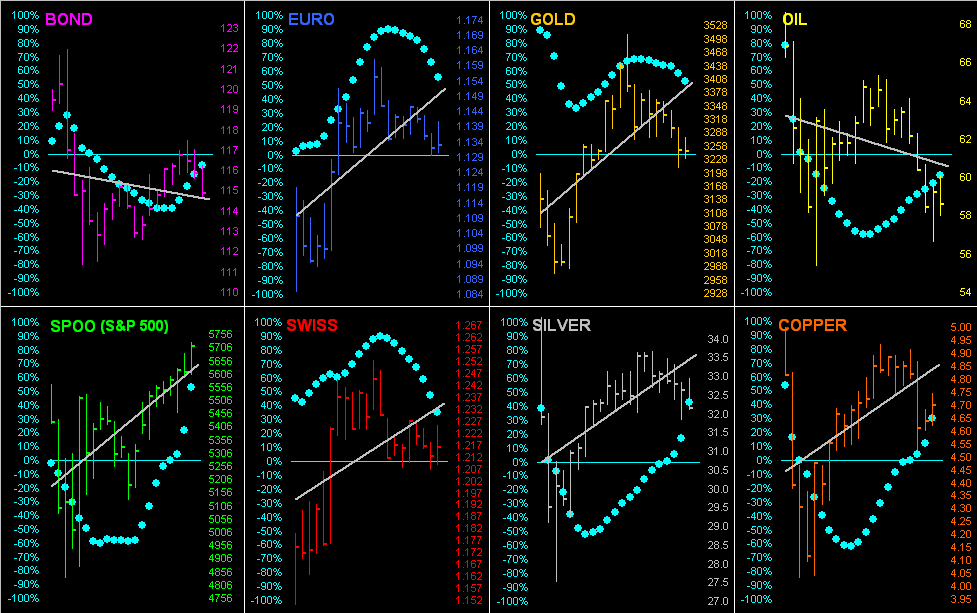

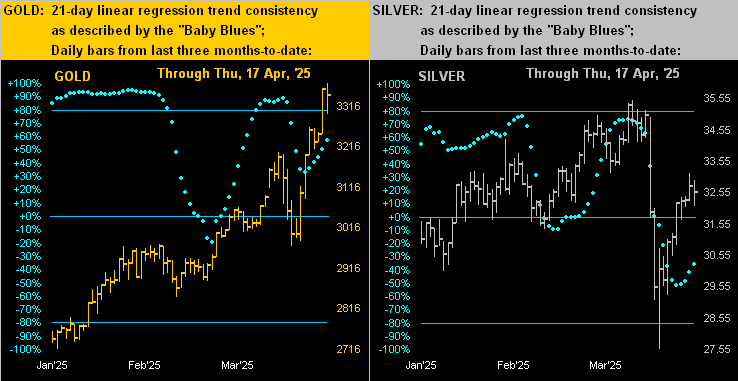

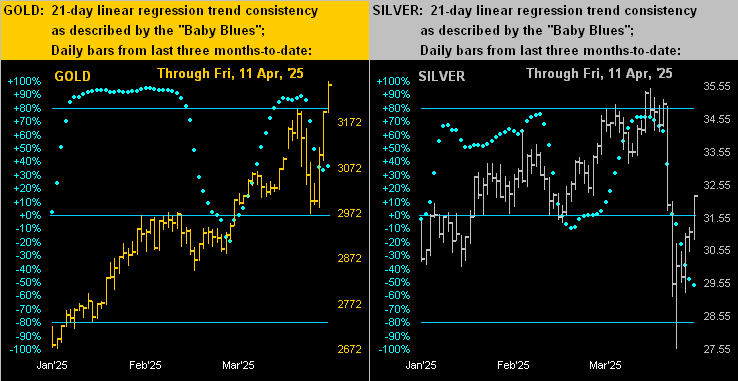

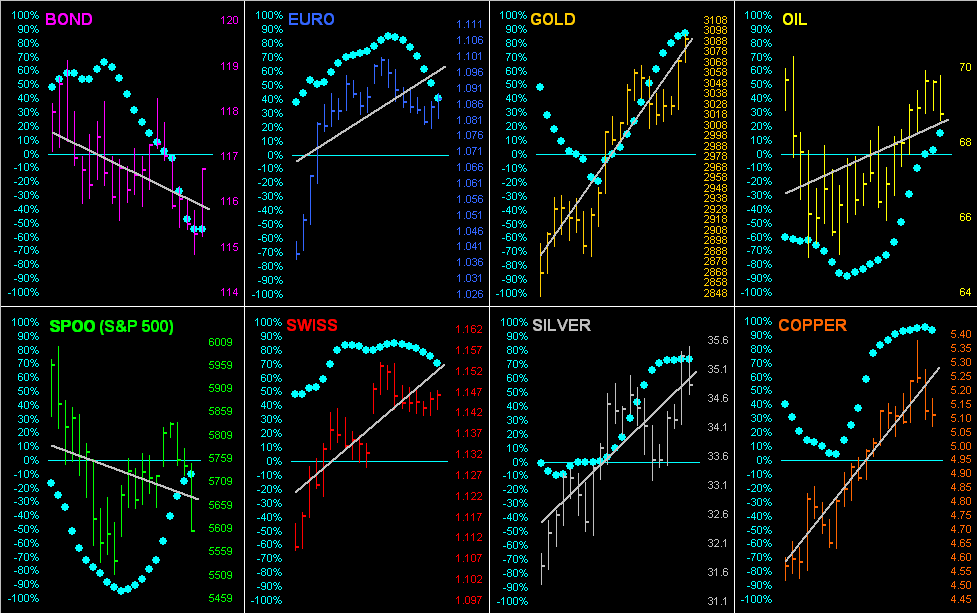

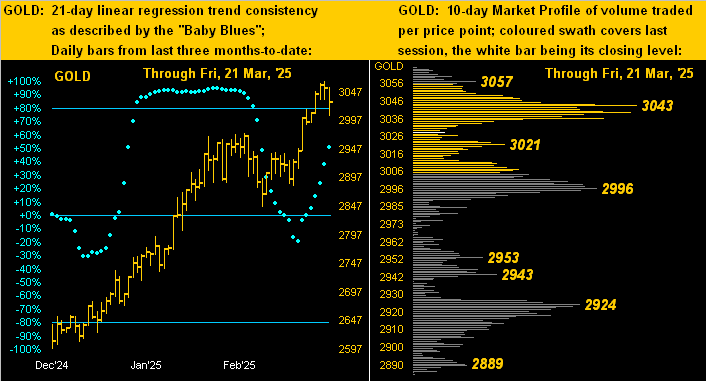

Into week’s end we’ve at present Gold above its Neutral Zone for today and Copper below same; session volatility for the BEGOS Markets is pushing toward moderate. At Market Trends, our “Baby Blues” of linreg consistency are falling for all eight BEGOS components, albeit the only two currently with actual declining trends are the Swiss Franc and Oil. By Market Values for the five primary entities in real-time time: the Bond is 2^09 points “low” vis-à-vis its smooth valuation line, the Euro just 0.001 points “high”, Gold +155 points “high”, Oil -4.77 points “low” and the Spoo +220 points “high”. The S&P 500 is now textbook overbought through the past nine trading days. With one week still to run for Q1 Earnings Season, 427 S&P 500 constituents have reported of which 66% (282) have beaten their EPS of their like quarter a year ago. Nothing is due for the Econ Baro, it having concluded its week yesterday. Tomorrow brings our 808th consecutive Saturday edition of The Gold Update.

08 May 2025 – 08:20 Central Euro Time

The Swiss Franc is at present below its Neutral Zone for today, whilst above same are Silver, Copper, Oil and the Spoo; BEGOS Markets’ volatility is light-to-moderate. Amongst correlations of the five primary BEGOS components, that for Gold is notably positive with the Euro, however negatively so with the Spoo. Oil’s 12hr MACD embarked on a flip from Short-to-Long effective yesterday at12:00 (CET): year-to-date this has been a very respectable Market Rhythm, and in real-time by Market Values, Oil is -6.92 points below its smooth valuation line. The Econ Baro rounds out its week today, incoming metrics including March’s Wholesale Inventories and Q1’s initial read of Productivity and Unit Labor Costs.

07 May 2025 – 08:26 Central Euro Time

The Swiss Franc, Gold and Copper are all presently below today’s Neutral Zones, whilst above same are both Oil and the Spoo; session volatility for the BEGOS Markets to this hour continues as moderate. Looking at Market Rhythms at those currently displaying the best pure swing consistency: on a 10-test basis we’ve the Spoo’s 12hr Parabolics as well as its 4hr Moneyflow, plus the non-BEGOS Yen’s daily Price Oscillator; on a 24-test basis ’tis again the same for the Yen, along with Gold’s 2hr Parabolics. At Market Magnets, both the Euro and Silver yesterday confirmed positive crossings of price above Magnet, suggestive of higher levels near-term. Late in the session, the Econ Baro looks to March’s Consumer Credit, preceded an hour earlier by the week’s highlight of the FOMC’s Policy Statement, the consensus for which is no change in the Bank’s Funds rate.

06 May 2025 – 08:43 Central Euro Time

Both the Bond and Swiss Franc are at present below their Neutral Zones for today; above same are Gold, Silver and Oil, and BEGOS Markets’ volatility is yet again moderate to this point of the session. Gold has gained some +130 points since our querying (at 3247) about its great run being done: presently 3371, price is “only” -139 points below the 3510 All-Time High; by its Market Profile, Gold’s most dominant volume support price is 3324; and the yellow metal’s best Market Rhythm for pure swing consistency (10-test basis) is its 6hr MACD, in which hindsight vacuum $57k/cac has been generated since late February, and which swung from Short to Long yesterday at 12:00 (CET). The Econ Baro awaits March’s Trade Deficit.

05 May 2025 – 08:38 Central Euro Time

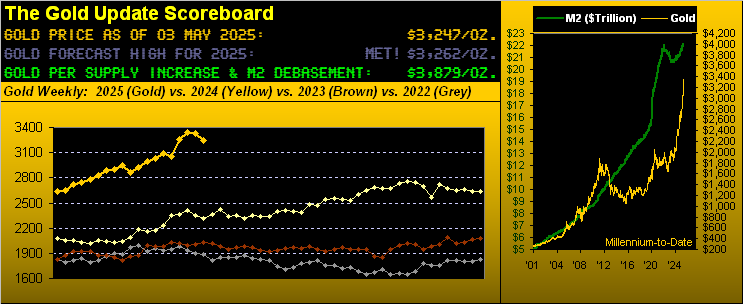

The Euro, Gold and Silver are all at present above today’s Neutral Zones; below same is the Spoo, and volatility for the BEGOS Markets is again moderate. The Gold Update queries as to the yellow metal’s great run being done (for now): price is within a day’s range of flipping the weekly parabolic trend from Long to Short (effective 3209); Gold’s EDTR (see Market Ranges) is 83 points.; and by Market Values (in real-time) Gold remains +164 points above its smooth valuation line. Q4 Earnings Season still has some two weeks to run: with 337 S&P 500 constituents having reported, 220 have bettered their bottom lines from Q1 a year ago; such 65% rate of improvement is a bit below the typical 66% pace. The Econ Baro begins a light week with April’s ISM(Apr) Index. And Wednesday brings the FOMC’s next policy statement for which consensus sees no change in.

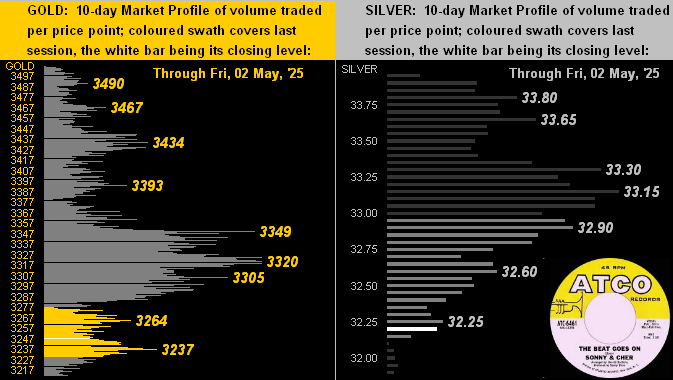

02 May 2025 – 08:38 Central Euro Time

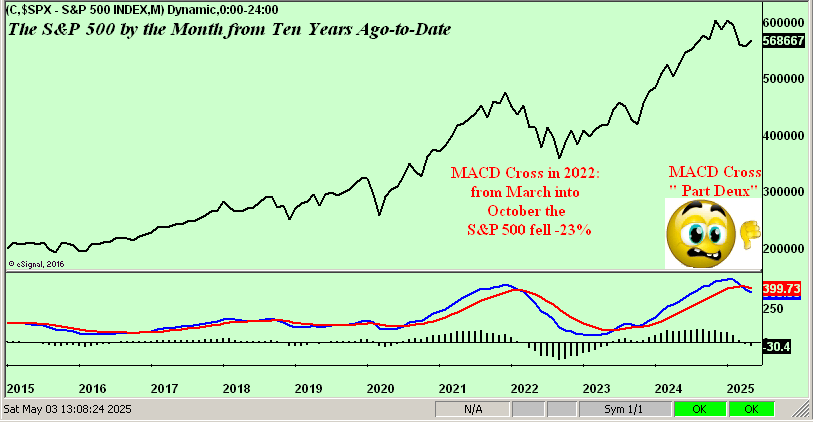

Save for the Bond which at present is inside its Neutral Zone for today, the seven other BEGOS Markets are above same; session volatility is moderate. Going ’round the Market Values horn in real-time for the five primary BEGOS components: the Bond shows as essentially on its smooth valuation line, the Euro as +0.0393 points “high”, Gold as +180 points “high”, Oil as -6.56 points “low” and the Spoo as +160 points “high”. The S&P 500 itself week-to-date remains “textbook overbought” and the futs-adj’d “live” p/e is 43.0x; on the S&P’s monthly chart, its MACD confirmed a negative crossing as May got underway: the last such negative crossover occurred in April 2022 leading to a more than -1,000 points (-14.5%) decline into November. ‘Tis April’s Payrolls day for the Econ Baro, along with March’s Factory Orders.

01 May 2025 – 08:42 Central Euro Time

The Euro, Gold and Silver are all at present below their respective Neutral Zones for today; above same is Copper, and session volatility for the BEGOS Markets is light-to-moderate. Indeed, the Euro’s “Baby Blues” (see Market Trends) of trend consistency confirmed crossing below the +80%; we’re anticipating the low 1.12s from here, perhaps even the upper 1.11s as the Dollar is showing a bit of resilience with a positive MACD swing on the Buck’s daily chart. Gold continues to work toward closing the gap down to its smooth valuation line (see Market Values), price in real-time however still +167 points “high”. For correlation amongst the five primary BEGOS components, the current best is positive between Gold and the Euro. And included in today’s incoming metrics for the Econ Baro are April’s ISM(Mfg) Index and March’s Construction Spending.

30 April 2025 – 08:12 Central Euro Time

The year’s first quadrimester concludes with significant input for the Econ Baro: nine metrics come due, amongst which are April’s ADP Employment data and the Chi PMI, March’s “Fed-favoured” PCE report along with Personal Income/Spending and Pending Home Sales, plus the first peek at Q1’s GDP along with the Employment Cost Index. Ahead of it all at present we’ve Copper as the sole BEGOS Market outside (below) today’s Neutral Zone, and session volatility is very light, again within the context of EDTRs (see Market Ranges) having widened considerably this month. At Market Trends, the Euro’s “Baby Blues” of trend consistency are in real-time moving below their key +80% axis such that we look for lower prices near-term; too by Market Values, the Euro is (in real-time) +0.046 points above its smooth valuation line; a run from here in the 1.14s down into the 1.12s wouldn’t be untoward over the ensuing days/week or two.

29 April 2025 – 08:38 Central Euro Time

The Euro, Swiss Franc and Gold are all at present below today’s Neutral Zones; the other five BEGOS Markets are within same, and volatility is light. The S&P 500 (5529) has returned to being “textbook overbought” for the first time since 20 February (then 6118); indeed the Spoo — which had been below its smooth valuation line (see Market Values) for some two months — has finally (in real-time) reverted back up to it such that still higher price levels ought be expected; however, the S&P’s “live” P/E (futs-adj’d) is at this moment an ever so expensive 42.5x, and the yield a wee 1.394% vs. the 3-month US T-Bill’s 4.193% annualized. Meanwhile Gold, by its smooth valuation line remains excessively “high”, in real-time +278 points above said line. The Econ Baro gets its week going today with April’s Consumer Confidence.

28 April 2025 – 08:37 Central Euro Time

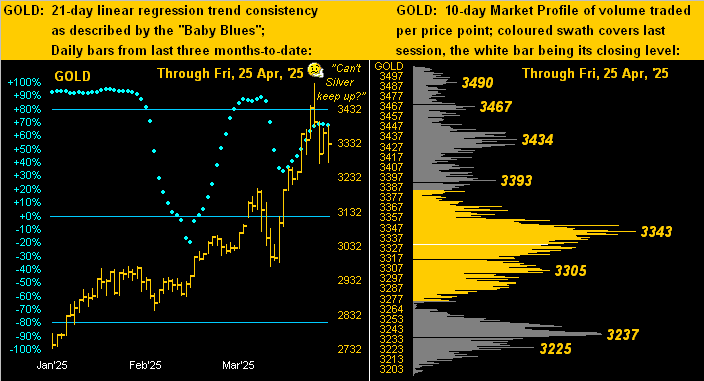

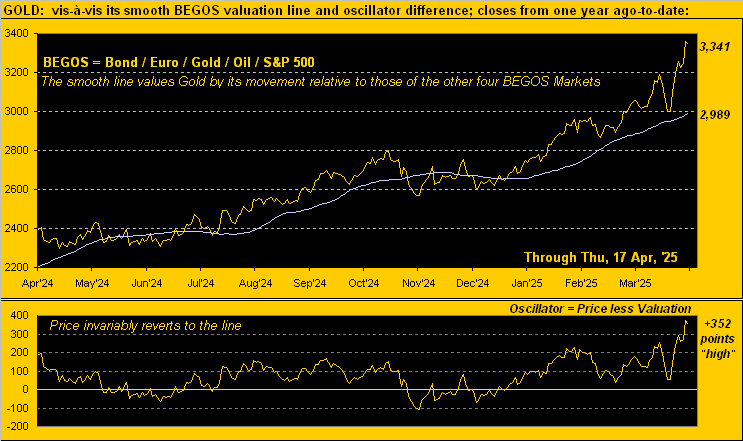

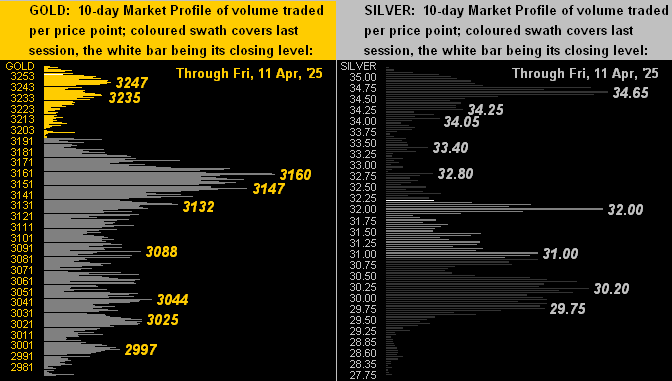

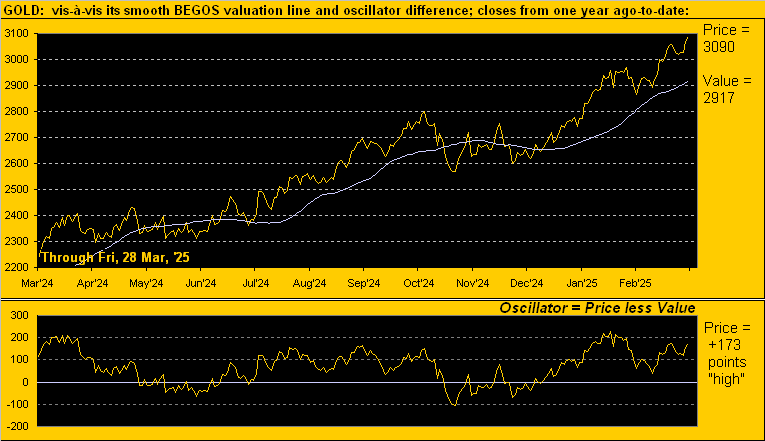

At present, the Swiss Franc plus all three elements of the Metals Triumvirate are below today’s Neutral Zones; the balance of the BEGOS Markets are within same, and volatility to begin the week is mostly light. The Gold Update continues to cite price’s near-term over-valuation; however with Gold down today, by Market Values, price — which on a closing basis had been as much as +440 “high” above its smooth valuation line — is now (in real-time) +262 points “high” above completing reversion to said “mean”; by its Market Profile, Gold’s most volume-dominant resistor is 3343, the like supporter being 3238; and Gold’s EDTR (see Market Ranges) is now 92 points. ‘Tis a very busy week for the Econ Baro: whilst nothing is due for today, the rest of the week has 18 incoming scheduled metrics, including on Wednesday the “Fed-favoured” PCE Index for March’s inflation.

25 April 2025 – 08:31 Central Euro Time

The elements of the EuroCurrencies and Metals Triumvirate all are at present below today’s Neutral Zones; above same is the Bond, and BEGOS Markets’ volatility is light-to-moderate. Our current leaders of Market Rhythms for pure swing consistency are on a 10-test basis: the Spoo’s 4hr Moneyflow and 12hr Parabolics, Gold’s 2hr Parabolics, the Swiss Franc’s 30mn Parabolics along with the 30mn Moneyflow, and the non-BEGOS Yen’s daily Price Oscillator; on a 24-test basis ’tis same for the Yen plus its daily Parabolics. Gold — which by Market Values remains severely near-term overbought — is returning down into the 3200s: more on that in tomorrow’s 806th consecutive Saturday edition of The Gold Update. Copper’s cac volume is rolling from May into that for July. The Econ Baro looks to April’s UofM Sentiment revision. And Q1 Earnings Season for the S&P 500 — which had a robust start — is fading as more companies report, 150 having thus far so done.

24 April 2025 – 08:28 Central Euro Time

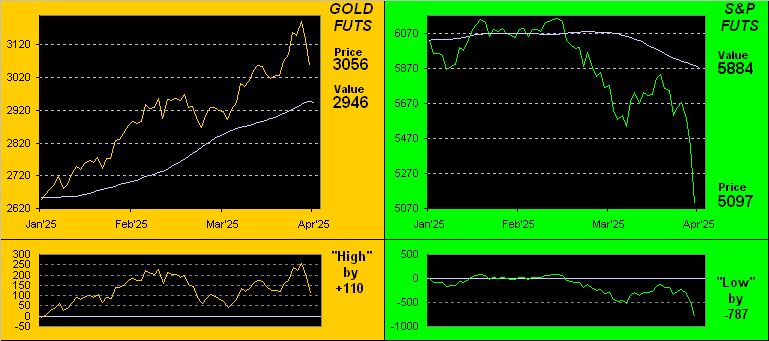

Gold high-to-low this week has thus far dropped -239 points (-6.8%), albeit in real-time (now at 3328) ’tis still priced +307 points above its smooth valuation line (see Market Values). As for the BEGOS Markets at large, we’ve at present Gold along with the Euro and Swiss Franc above their respective Neutral Zones for today, whilst the balance of the bunch are within same; volatility is light in the context of the extremely expanded EDTRs (see Market Ranges): indeed that today for Gold is 90 points and for the Spoo 212 points. Amongst correlations for the five primary BEGOS components, the best currently is negative between the Euro and Spoo, (the hedge thus being both Long or both Short). Yesterday’s rally in the S&P 500 was sufficient to see the “live” P/E settle all the way back up at 40.0x; futs-adj’d in real-time ’tis 39.9x. Incoming metrics today for the Econ Baro include March’s Durable Orders and Existing Home Sales.

23 April 2025 – 08:34 Central Euro Time

Gold, after having made another All-Time High yesterday at 3510, has since dropped as much as -194 points in essentially 24 hours to 3316; current price is 3333, which is below today’s Neutral Zone as are both the Euro and Swiss Franc; above same are the Bond, Copper, Oil and Spoo; BEGOS Markets’ volatility is moderate. Going ’round the Market Values horn for the five primary BEGOS components in real-time we’ve: the Bond as nearly -3 points “low” vis-à-vis its smooth valuation line, the Euro +0.0549 points “high”, Gold +320 points “high”, Oil -2.59 points “low” and the Spoo -237 points “low”. By Market Rhythms, the Euro appears poised for a negative 12hr MACD crossover come 12:00 CET/10:00 GMT: follow-through of the prior eight swings has been at minimum 0.012 points (i.e. $1,500/cac). The Econ Baro looks to March’s New Home Sales. And late in the session comes the Fed’s Tan Tome.

22 April 2025 – 08:21 Central Euro Time

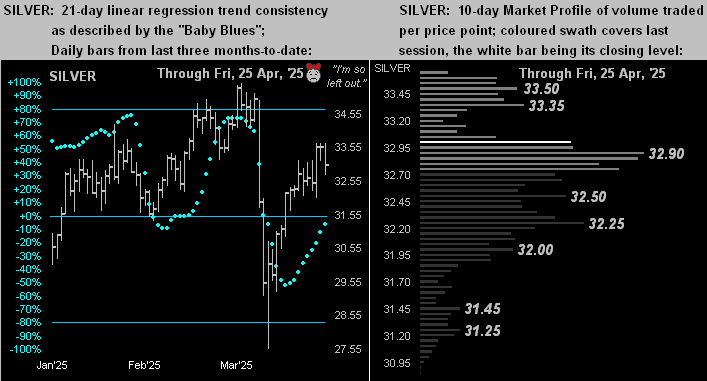

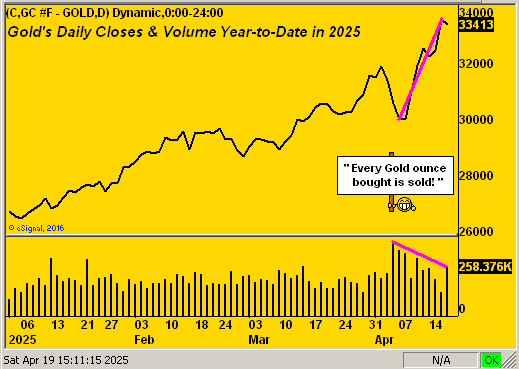

Another day, another century mark for Gold, price having eclipsed the 3500 level: by Market Values, the yellow metal in real-time is +501 points above its smooth BEGOS valuation line. Copper, too is above today’s Neutral Zone, whereas the balance of the BEGOS Markets are within same; volatility is mostly light, save for Gold having already traced 102% of its EDTR (see Market Ranges). Silver continues not to participate in Gold’s rally, the “live” Gold/Silver ratio now 106.8x. Yesterday’s -2.4% drop in the S&P 500 may be mollified by the MoneyFlow being more indicative of a -1.5% drop; the Spoo at present is -453 points below its smooth BEGOS valuation line. Nothing is due today for the Econ Baro. And Q1 Earnings Season thus for for the S&P shows 42 constituents having reported, of which 71% have bettered their like quarter of a year ago; the S&P’s “live” (futs-adj’d) P/E is 38.1x.

21 April 2025 – 08:46 Central Euro Time

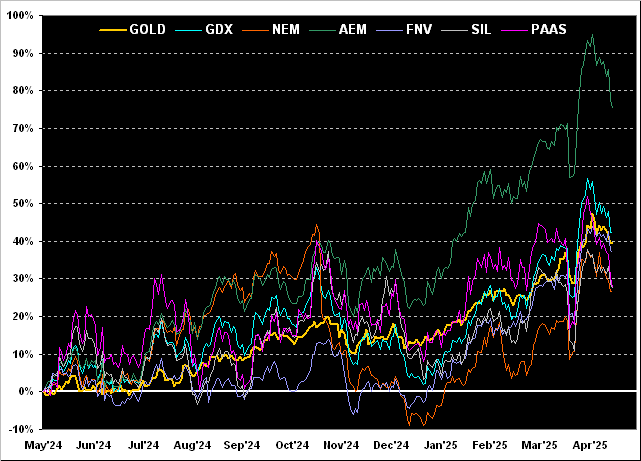

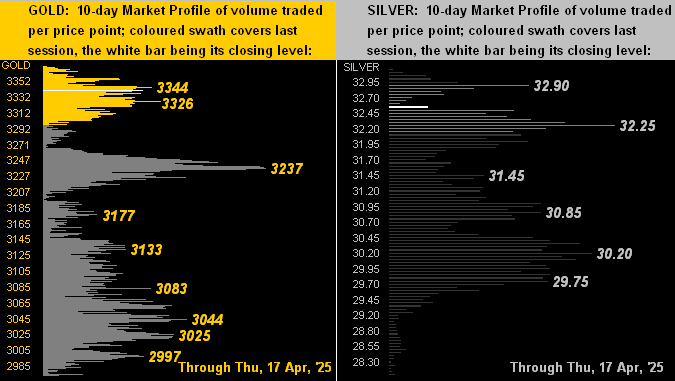

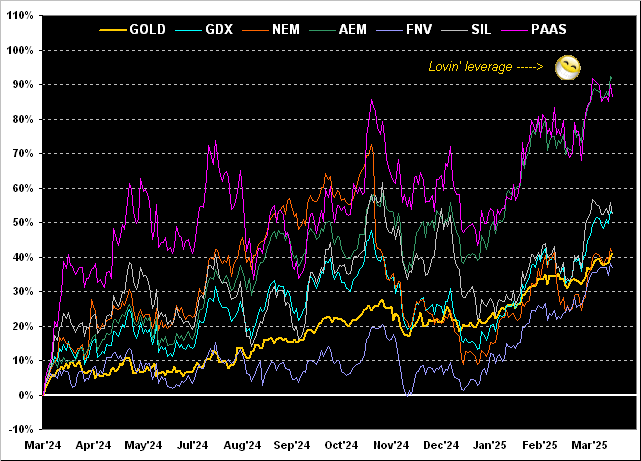

EuroSide the long weekend continues, however StateSide ’tis back to business as usual with the BEGOS Markets on the move: at present above today’s Neutral Zones are the EuroCurrencies and Metals Triumvirate whilst below same are both the Bond and Spoo; session volatility is firmly moderate. Indeed Gold is soaring this morning, currently +61 points at 3402, even as The Gold Update continues to cite the near-term technically overbought state of the yellow metal; in real-time, price is now +408 points above its smooth valuation line; by Market Profiles, Gold’s “nearby” volume supports are 3344, 3326, and then nothing of substance until 3237. Silver is not participating to Gold’s upside extent, the Gold/Silver ratio now 103.7x. ‘Tis a fairly light week for the Econ Baro, beginning today with March’s Leading (i.e. “lagging”) Indicators.

18 April 2025 – 08:49 Central Euro Time

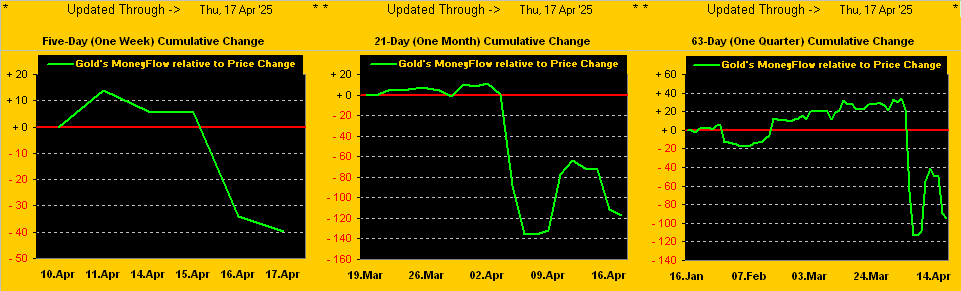

The BEGOS Markets and many global exchanges are closed as the long weekend begins. Just a few notes: the S&P 500 now at 5283 is now -14.1% below its all-time high of 6147, and is “textbook oversold” through the past 11 trading days; the P/E however remains perilously high at 39.2x, even as Q1 Earnings Season is running at an above-average pace for year-over-year improvement; still, the Spoo settled its week -371 points below its smooth valuation line (see Market Values). On the other hand, Gold — whist still fundamentally undervalued — is +352 points above its smooth valuation line and is “textbook overbought” these past five sessions. More tomorrow in our 805th consecutive Saturday edition of the Gold Update. StateSide bourses resume trading on Monday, however those for Europe not until Tuesday. Bonne Fête de Pâques à Tous!

17 April 2025 – 08:44 Central Euro Time

This week’s final trading day finds at present the Euro, Swiss Franc, Gold and Copper below the day’s Neutral Zones, whilst above same is the Spoo; BEGOS Markets’ volatility is light-to-moderate. Gold has recorded yet another All-Time High, thus far today reaching up to 3372: price in real-time is currently +356 points above its smooth valuation line (see Market Values). Looking at correlations amongst the five primary BEGOS components, our best at present is positive between Oil and the Spoo, (the hedge notion thus being Long one and Short the other one). The Euro by its Market Profile is on its second most heavily-traded apex of the past fortnight at 1.1400, (the most heavily-traded being 1.1080). And the Econ Baro rounds out its week with metrics including April’s Philly Fed Index and March’ Housing Starts/Permits.

16 April 2025 – 08:44 Central Euro Time

Gold is significantly higher this morning in having made another All-Time High at 3312: price is +1.8% whereas that for Silver is but +0.7%, Copper weighing there -1.2%. Only the Bond and Silver are at present within today’s Neutral Zones; above same are the Euro, Swiss Franc and Gold, whilst below same are Copper, Oil and the Spoo; session volatility for the BEGOS Markets is mostly moderate. By Market Rhythms, our two best on a 24-test basis currently are (per usual) the non-BEGOS Yen’s both daily Price Oscillator and Parabolics; on the 10-test basis, the present best are the Spoo’s 4hr Moneyflow and again the Yen’s daily Price Oscillator. For the Econ Baro today we’ve April’s NAHB Housing Index, plus March’s Retail Sales and IndProd/CapUtil, along with February’s Business Inventories.

15 April 2025 – 08:40 Central Euro Time

Gold is the sole BEGOS Market at present outside (above) its Neutral Zone; session volatility is very light to this time, although again, EDTRs (see Market Ranges) remain extremely wide: for example, that for the Spoo today is 245 points, (and yes, brokers have been broadcasting full initial margin requirements during recent sessions). Looking at Market Trends, the Euro, Swiss Franc, and Gold are in ascent, the other five BEGOS components in descent. The Spoo by Market Values is -295 points “low” vis-à-a its smooth valuation line; the S&P 500 itself is for eight consecutive sessions “textbook oversold”, albeit fundamentally the Index continues as vastly overvalued, the futs-adj’d “live” P/E 39.8x at this instant; its yield is 1.421% vs. 4.195% annualized on the 3mo U.S. T-Bill. The Econ Baro awaits April’s NY State Empire Index, plus March’s Ex/Im Prices.

14 April 2025 – 08:51 Central Euro Time

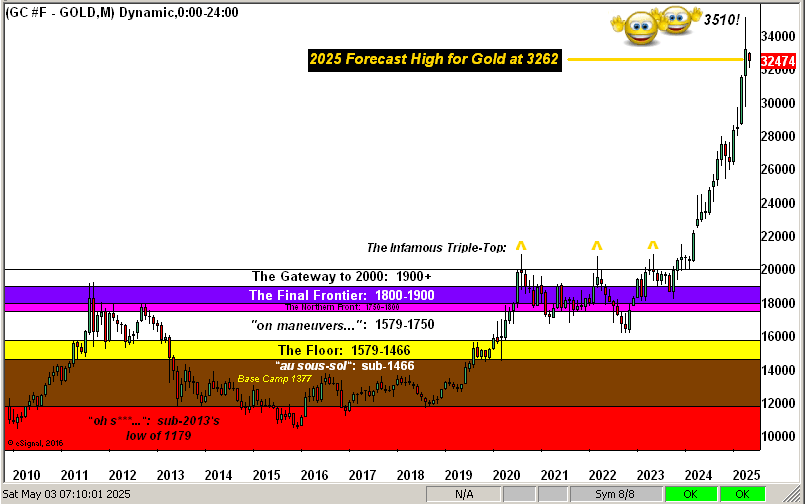

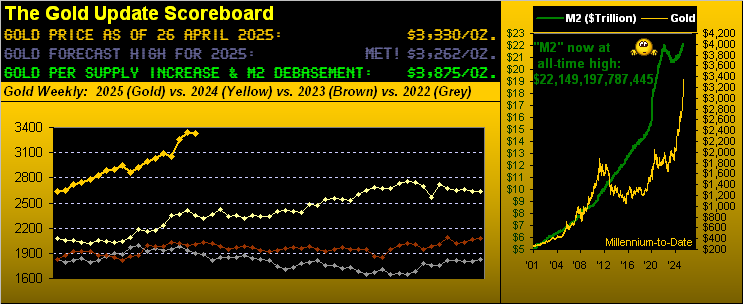

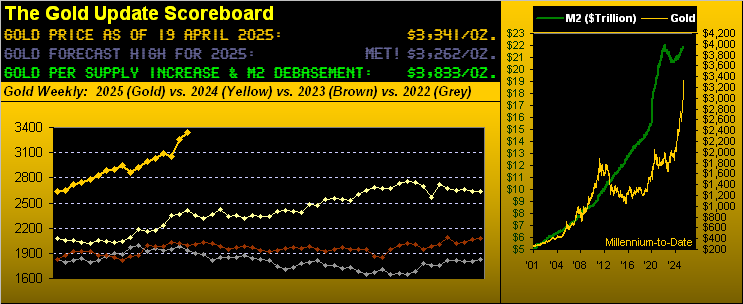

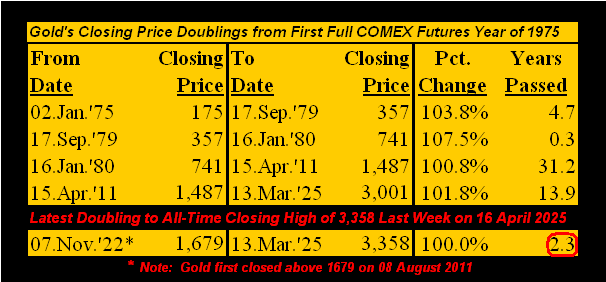

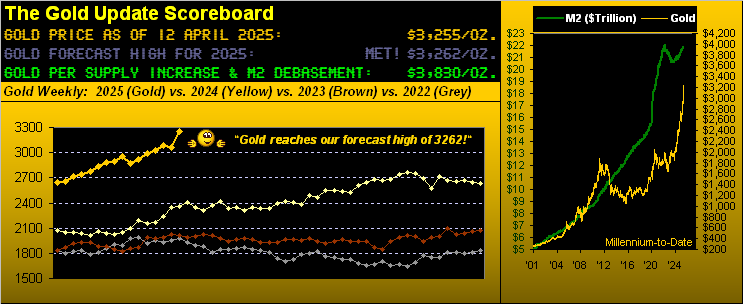

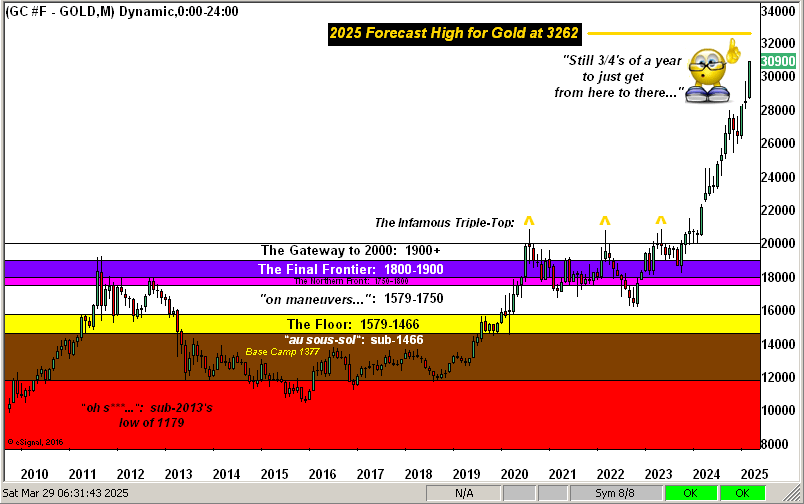

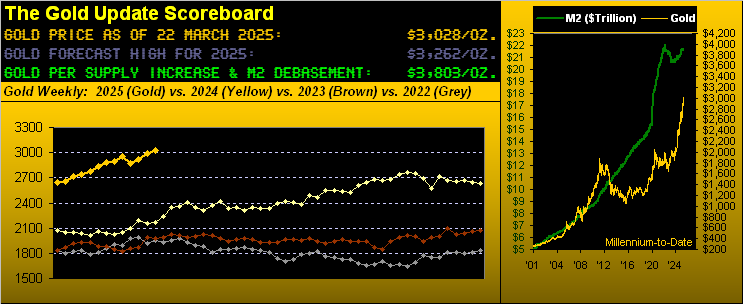

Gold on Friday tapped our forecast high for this year of 3262 indeed reaching a point higher to the now new All-Time High of 3263, all as detailed in The Gold Update. The abbreviated trading week at present finds both the Euro and Spoo above their respective Neutral Zones for today; the other six BEGOS Markets are within same, and session volatility is light-to-moderate. Gold vis-à-vis its BEGOS Market Value shows (in real-time) as +277 points “high”; the yellow metal’s largest volume support price is 3160 (see Market Profiles). The Dollar Index since Friday has been trading below 100, that round number having previously proven as support during the second half of last September. Oil’s cac volume these next two days is moving from May into that for June. Nothing is due today for the Econ Baro, albeit 13 metrics are scheduled across the next three days. And Q1 Earnings Season picks up its pace a bit as the week unfolds.

11 April 2025 – 08:43 Central Euro Time

Gold has come quite near to our 3262 forecast high for this year, trading this morning up to 3242 before pulling back; our “high if an up day” for Gold today is 3257, thus 3262 is plausible were there an ensuing price push. Gold is, as is the Euro, at present above its Neutral Zone for today; the balance of the other six BEGOS Markets are within same, and volatility is firmly moderate, the Euro notably having already traced 138% of its EDTR (see Market Ranges). By Market Values, extreme deviations remain for the five primary BEGOS components: in real-time the Bond shows as -3^19 points below its smooth valuation line, the Euro as +0.055 points above same, Gold as +260 points above same, Oil as -7.52 below same and the Spoo as -422 points below same. The Swiss Franc (1.2233) is essentially at a 14-year high. ‘Tis March wholesale inflation day for the Econ Baro via the PPI, plus the initial April Sentiment read from UofM.

10 April 2025 – 08:51 Central Euro Time

Yesterday sported the fourth largest percentage low-to-high run since at least 1980 for the S&P 500: +10.8%. More on “Wacky Wednesday” in next Saturday’s 804th edition of The Gold Update. At present, only Gold is above today’s Neutral Zone whilst below same are both Copper and Oil; BEGOS Markets’ volatility is moderate, again within the context that EDTRs (see Market Ranges) have been blown out. We’ve gone on quite a bit in recent weeks about the Spoo being too low vis-à-vis its smooth valuation line (see Market Values), Tuesday’s differential being -839 points: a substantive portion of that was reduced yesterday such that now in real-time ’tis -340 points. Looking at correlations amongst the five primary BEGOS components, the best currently is negative between the Euro and the Spoo, (the hedge notion thus to be simultaneously Long or Short both of them). Metrics for the Econ Baro today include retail inflation for March via the CPI, and late in the session the month’s Treasury Budget.

09 April 2025 – 08:50 Central Euro Time

At present, only Oil is within today’s Neutral Zone; above same are the EuroCurrencies and Metals Triumvirate, whilst below same are the Bond and Spoo; BEGOS Markets’ volatility is moderate-to-robust. By Market Rhythms our best are currently (10-test basis) the non-BEGOS Yen’s daily Price Oscillator and Gold’s 2hr parabolics; again (on a 24-test basis) we’ve the Yen’s daily Price Oscillator and the Bond’s daily Moneyflow. At Market Trends, save for the EuroCurrencies, the “Baby Blues” of trend consistency are falling for the six other BEGOS components. Our internally-measured MoneyFlow for the S&P 500 is inconsistent across its three key timeframes: the one-week measure suggests the Index ought be +50 points higher than ’tis; the one-month measure +136 points higher; but the one-quarter measure -919 points lower: the take-away is near-term higher, then broad-term lower, which too is the near-term technical stances per by the Spoo’s Market Values, but broad-term the fundamental reality of the very high P/E (“live” now 35.0x futs-adj’d). The Econ Baro awaits February’s Wholesale Inventories. Then late in the session come the FOMC Minutes from the 18-19 March meeting.

08 April 2025 – 08:52 Central Euro Time

The BEGOS Markets at present find the Euro, Swiss Franc, Gold, Oil and the Spoo above their respective Neutral Zones for today; none of the other three components are below same, and volatility is moderate, albeit in the context that EDTRs (see Market Ranges) have substantively widened in recent sessions: for example, a year ago today the Spoo’s EDTR was 51 points (price then 5257) whereas for today (price currently 5174) ’tis 165 points. Gold’s “Baby Blues” (see Market Trends) of trend consistency yesterday broke below the key +80% axis, making us anticipative of still lower price levels: by Market Values in real-time, Gold still is +79 points above its smooth valuation line; the Spoo however is -681 points below same, even as the S&P 500 itself fundamentally remains quite overvalued give its “live” (futs-adj’d) P/E at 37.1x. Nothing is due today for the Econ Baro, however as previously noted, Q1 Earnings Season has commenced, which you can follow day-by-day on that page.

07 April 2025 – 08:45 Central Euro Time

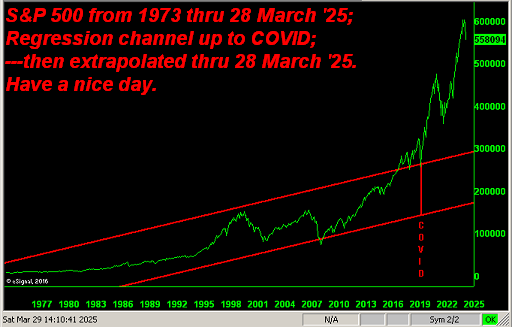

Selling of equities looks to continue: adjusting the Spoo at present to Fair Value, the S&P 500 (were the StateSide market to open at this instant) would trade sub-5000 for the first time since 25 April a year ago. ‘Tis worth noting with the Spoo -4.4%, the -7% “lock limit” would apply at 4740. At present along with the Spoo below their respective Neutral Zones are both Gold and Oil; above same are the Bond, Euro, Swiss Franc and Silver; volatility for the BEGOS Markets is again firmly moderate and then some: both Silver and Copper (the latter at present back inside today’s Neutral Zone) have traced in excess of 200% of their EDTRs (see Market Ranges). The Gold Update cites the yellow metal still as being technically overbought near-term but fundamentally undervalued broad-term, whilst ’tis the opposite cases for the S&P 500, (technically oversold, fundamentally overvalued). The Econ Baro looks late in the session to February’s Consumer Credit. And Q1 Earnings Season gets underway.

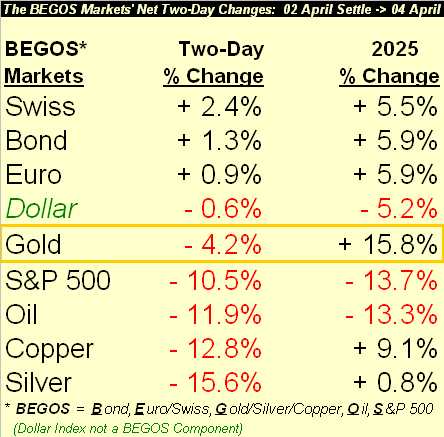

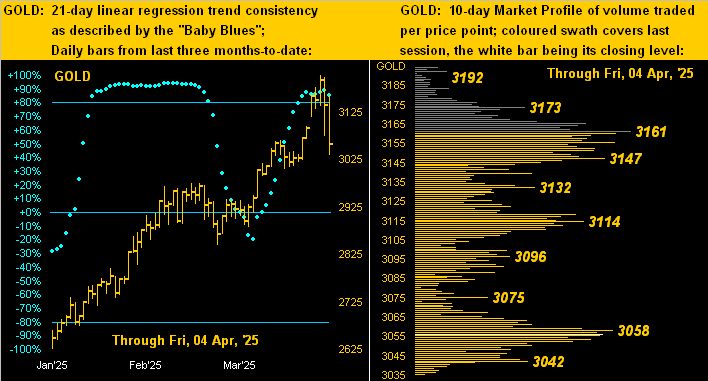

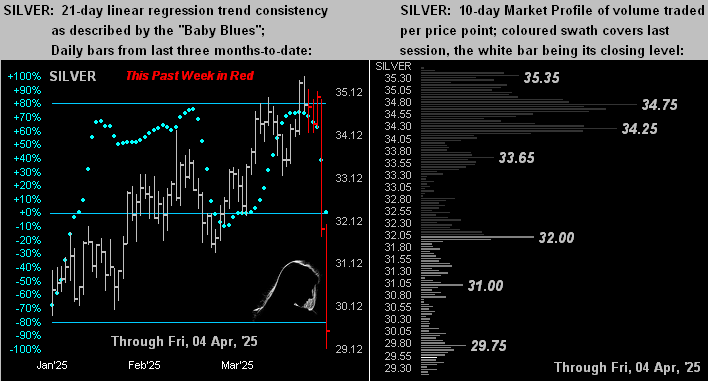

04 April 2025 – 08:50 Central Euro Time

Sister Silver suffered the worst yesterday amongst the BEGOS Markets: her -8.8% net loss was the white metal’s worst since 11 August 2020; more on the metals and markets in tomorrow’s 803rd consecutive Saturday edition of The Gold Update. Following yesterday’s beat-down, (save for the Bond and EuroCurrencies), we’ve at present both the Bond and Swiss Franc above today’s Neutral Zones, whilst below same are again the Metals Triumvirate and Oil; (the Spoo is within same); session volatility is firmly moderate, the Swiss Franc notably having traced 110% of its EDTR (see Market Ranges). Given yesterday’s material moves, the five primary BEGOS components are positioned (in real-time) as follows vis-à-vis their respective smooth valuation lines (see Market Values): the Bond is just over +3 points “high”, the Euro +0.039 points “high”, Gold (despite its being sold) +170 points “high”, Oil -2.95 points “low”, and the Spoo deeply oversold by this metric at -471 points “low”; of course, for the S&P 500 itself, its “live” P/E (futs-adj’d) still remains up in the silly zone at 37.1x; thus there’s rightly still a long way to fall. The Econ Baro closes its weeks with March’s Payrolls.

03 April 2025 – 08:35 Central Euro Time

The Spoo is presently positioned such that were the S&P 500 to open at this instant, ‘twould immediately fall -3.0%; the last time the S&P completed a session down by at least that much was on 13 September 2022 (-4.3%). The Dollar Index is down to its lowest level (102.425) since 09 October. The Bond and EuroCurrencies are currently above today’s Neutral Zones, whilst below same are the Metals Triumvirate, Oil, and Spoo; session volatility is robust with five of the eight BEGOS Markets tracing in excess of 100% of their EDTRs (see Market Ranges). Silver is getting notably sold, -4.8%, in turn pushing the Gold/Silver ratio up to 94.2x; Gold itself is -1.5% and by its Market Value is (in real-time) nonetheless +197 points “high” above its smooth valuation line. Amongst today’s incoming metrics for the Econ Baro are March’s ISM(Svc) Index and February’s Trade Deficit.

02 April 2025 – 08:44 Central Euro Time

The Bond is at present the sole BEGOS Market outside (below) its Neutral Zone for today; session volatility is light. Looking at Market Rhythms for pure swing consistency, on a 10-test basis our best are the non-BEGOS Yen’s daily Price Oscillator, both Silver’s 8hr Parabolics and 2hr Price Oscillator, plus Copper’s 8hr Price Oscillator; on a 24-test basis we’ve again the Yen’s daily Price Oscillator plus its daily Parabolics and 15mn MACD, along with the Bond’s daily Moneyflow and the Swiss Franc’s 2hr Moneyflow. As anticipated, Copper’s “Baby Blues” (see Market Trends) have in real-time provisionally crossed under their +80% axis suggestive of still lower prices near-term. The Econ Baro awaits March’s ADP Employment data plus February’s Factory Orders. And 20:00 GMT brings the StateSide tariffs address.

01 April 2025 – 08:38 Central Euro Time

Gold (basis June) has made yet another All-Time High at 3177, albeit price has now pulled back to presently be within today’s Neutral Zone; the only BEGOS Market outside (above) of same is the Bond, and volatility is light-to-moderate. The Bond yesterday pierced up through its Market Magnet, whilst Copper has moved below same; Copper’s “Baby Blues” (see Market Trends) are rolling over such that they many breach below the key +80% by mid-week, then suggestive of still lower price levels. Oil has furthered our anticipation of its rising, now up into the 71s. Q1 kicks off for the Econ Baro with March’s ISM(Mfg) Index and February’s Construction Spending.

31 March 2025 – 08:33 Central Euro Time

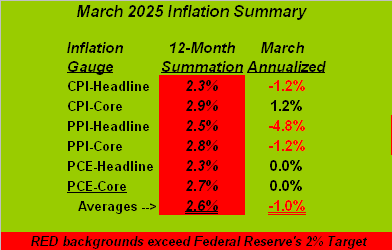

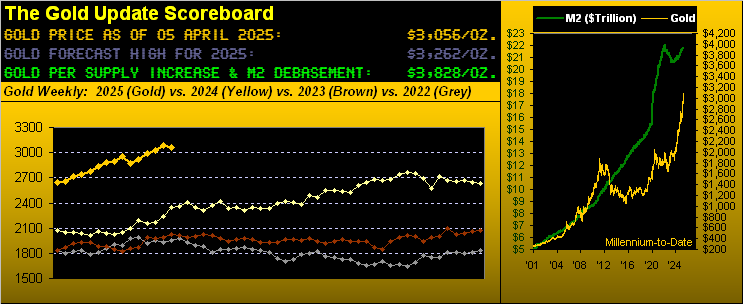

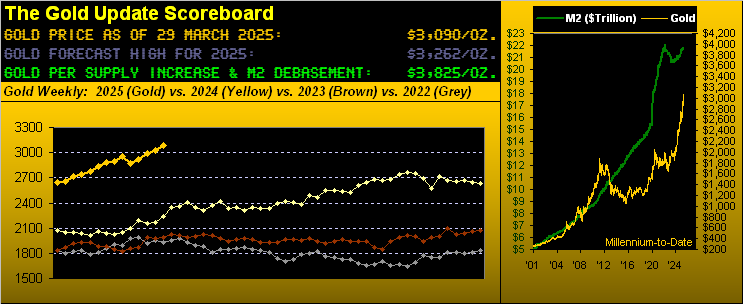

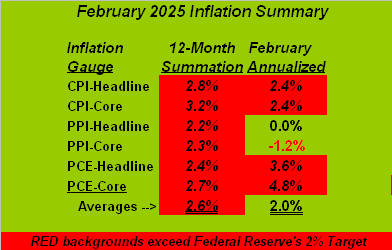

The Bond, Gold, Silver and Oil are all above today’s Neutral Zones, whilst below same is the Spoo; session volatility is moderate-to-robust, Gold notably already having traced 129% of its EDTR (see Market Ranges). The Gold Update underscores the yellow metal’s remarkable rally, yet remains wary for some material degree of pullback to unwind the near-term overbought state of price, which in (real-time) is +228 points above its smooth valuation line (see Market Values); moreover the Update also depicts the inconsistant inflation readings, and sees significantly lower levels for the S&P 500 as the year unfolds, with the 4000s in the offing, (which from its present level is only some -10% lower). For the Econ Baro today we’ve March’s Chi PMI.

28 March 2025 – 08:38 Central Euro Time

Both the Bond and Gold are at present above their respective Neutral Zones for today; none of the other BEGOS Markets are below same, and session volatility is light-to-moderate. Gold has achieved yet another All-Time High this morning, the June cac thus far trading up to 3124: by Market Values, price is (in real-time) +176 points “high” above its smooth valuation line, a very extreme deviation which can begin to be closed should the “Fed-favoured” inflation of PCE data not be indicative of slowing; ’twill arrive later today for the Econ Baro, and of course, more on it all in tomorrow’s 802nd consecutive Saturday edition of The Gold Update. As for the other primary BEGOS components’ deviations from Market Values, we show both the Bond and Oil as basically right on their valuation lines, the Euro as +0.0312 points “high” and the Spoo as -200 points “low”. As for Copper’s recent robust rally to all-time highs, by Market Trends, the red metal’s “Baby Blues” of trend consistency are depicting the early signs of having run out of puff. EuroSide, we move forward Sunday to summer hours.

27 March 2025 – 08:42 Central Euro Time

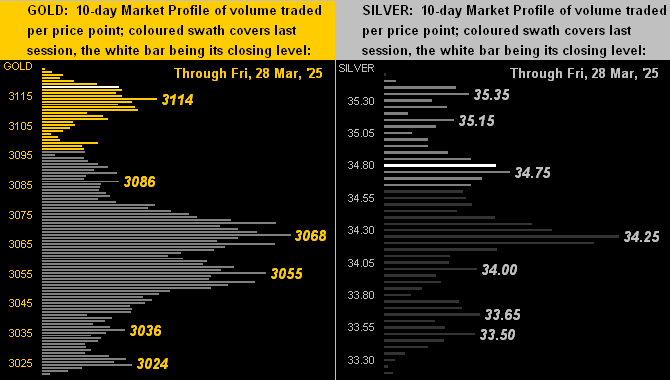

At present we’ve Gold above today’s Neutral Zone, whilst Oil is below same, (but not before having yesterday reached up into our low 70s’ target area); volatility for the BEGOS Markets is moderate. Gold’s cac volume is moving from April into that for June, with +29 points of fresh premium (in turn inducing a “faux” new All-Time High). As anticipated, by Market Trends the Swiss Franc’s “Baby Blues” of linreg trend consistency confirmed falling below the key +80% axis: thus we look for lower price levels near-term. Silver at present is spot-on its most volume-dominant price (34.25) of the past fortnight, (see Market Profiles). And a day ahead of the “Fed-favoured” PCE inflation data, today’s incoming Econ Baro metrics include February’s Pending Home Sales and the final read on Q4 GDP.

26 March 2025 – 08:41 Central Euro Time

As was the same case at this time yesterday, Copper is the only BEGOS Market at present outside (above) its Neutral Zone for today; by Market Ranges, the red metal already has traced 125% its EDTR to an all-time high at 5.3740; overall session volatility is otherwise light. For our Market Rhythms on a 10-test basis, the current standouts are Gold’s 2hr Moneyflow and both the non-BEGOS Yen’s daily price Oscillator and 30mn MACD; on a 24-test basis, our current leaders are again the Yen’s daily price Oscillator along with its daily Parabolics, plus both the Bond’s daily Moneyflow and 15mn Parabolics. We’ve previously mentioned the Euro’s “Baby Blues” (see Market Trends) having broken below the key +80% axis; now provisionally doing the same are those for the Swiss Franc. And for the Econ Baro we await February’s Durable Orders.

25 March 2025 – 08:29 Central Euro Time

At present, the only BEGOS Market outside (above) today’s Neutral Zone is Copper; session volatility is quite light with to this point just an average EDTR (see Market Ranges) tracing of 28%. The Euro yesterday confirmed its “Baby Blues” (see Market Trends) of linreg trend consistency having broken below their key +80% axis, indicative of lower levels to come. The S&P 500, after having been 19 consecutive trading sessions “textbook oversold” finally unwound that condition yesterday; the +1.8% relief rally has now put the “live” (futs-adj’d) P/E up to 42.9x; lurking for April/May is a MACD negative crossover on the S&P’s monthly candles, broadly suggestive of further Index lows as the year unfolds. The Econ Baro gets back into gear today with March’s Consumer Confidence and February’s New Home Sales.

24 March 2025 – 08:10 Central Euro Time

The week starts to find the Bond at present below its Neutral Zone for today, whilst above same are the Euro, Silver, Copper and the Spoo; volatility for the BEGOS Markets is light. The Gold Update applauds the yellow metal’s wonderful uptrend — incorporating yet another All-Time High (3065) this past Thursday — however reiterates our wariness for price to pullback by a few hundred points, typical in the past of similar technical near-term “overvaluations”; (of course fundamentally broad-term, Gold remains well-undervalued). As anticipated, the Spoo is getting a good bid such that the S&P 500 may open nearly a full 1% higher: regardless, the futs-adj’d “live” P/E is 40.0x and the yield (1.347) less than one-third that of the annualized 3mo U.S. T-Bill (4.185%). Too continues Oil’s recent recovery: by its BEGOS Market Value, ‘twould appear price shall move up through its smooth valuation line as the week unfolds towards the anticipated low 70s. ‘Tis a again quiet day for the Econ Baro, the week’s highlight arriving Friday with the “Fed-favoured” PCE reading for February.

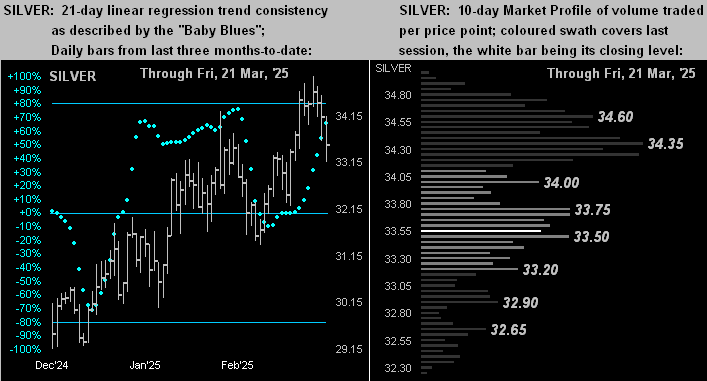

21 March 2025 – 08:35 Central Euro Time

When all eight BEGOS Markets are down, we know the Dollar is up; of note across the sea of red, we’ve the Euro, Swiss Franc, Gold and Silver all at present below their respective Neutral Zones for today; session volatility is moderate. Specific to the Spoo, its “Baby Blues” (see Market Trends) of linreg trend consistency confirmed closing above their key -80% axis: this portends (by fib) a run up to at least the 5800s and potentially the 5900s should the February high-March low have a full Golden Ratio retracement; too, the S&P 500 itself remains “textbook oversold” near-term. For Oil, per its “Baby Blues” and Market Magnet, as anticipated, price has moved from the 65s to now being in the 68s with the 69s-low 70s reasonably in the balance. Nothing is due for the Econ Baro until Tuesday, this week’s 16 incoming having flat-lined the economic track rather than see it further weaken; more on it all in tomorrow’s 801st consecutive Saturday edition of The Gold Update.

20 March 2025 – 08:47 Central Euro Time

The Euro at present is below its Neutral Zone for today, whilst above same is the Spoo; session volatility for the BEGOS Markets remains light to this hour. Our best correlation currently amongst the five primary BEGOS components is positive between Oil and the Spoo. The “live” P/E of the S&P 500 has (futs-adj’d) moved back above 40 (now 40.2x); the Index’s yield is 1.353% vs. the risk-free 3-month T-Bill’s 4.190%; technically the S&P is now 17 consecutive trading days “textbook oversold” despite fundamentally remaining dangerously overvalued. The Econ Baro concludes its week today with a busy schedule of incoming metrics which include March’s Philly Fed Index, February’s Existing Home Sales and Leading (i.e. “lagging”) Indicators, and Q4’s Current Account Deficit.

19 March 2025 – 08:43 Central Euro Time

At present, the Euro is below its Neutral Zone for today, whilst above same is Copper; otherwise, BEGOS Markets’ volatility is again light to this time of the session. Oil’s “Baby Blues” (see Market Trends) confirmed crossing above their -80% axis, so as already noted yesterday with respect to its Market Magnet, we anticipate higher Oil levels near-term perhaps up into the low 70s; Oil’s best Market Rhythm for pure swing consistency on a 10-test basis is its 2hr MACD. Elsewhere on that basis, our best currently are the non-BEGOS Yen’s daily Price Oscillator as well as that study for 1hr Silver; on a 24-test basis, we’ve again the Yen’s daily Price Oscillator plus the daily Parabolics, along with the Bond’s daily Moneyflow. Nothing is due today for the Econ Baro. Then at 18:00 GMT comes the “no change” FOMC Policy Statement.

18 March 2025 – 08:50 Central Euro Time

A day ahead of the Fed, the Econ Baro has of late gone into a skid; to the extent the Fed reacts to fresh data is doubtful such that they likely stand pat as their stance of late is “there is no race to lower rates”. For today at present we’ve Gold, Silver and Oil above today’s Neutral Zones, the balance of the BEGOS Markets being within same, and session volatility is again light. Oil’s Market Magnet yesterday confirmed upside penetration by price such that we expect higher levels near-term, albeit there are various structural resistors from 69-73. Too, Oil’s “Baby Blues” (see Market Trends) continue to modestly climb from having been below their-80% axis, so that, too, lends some bullishness to the picture. The 2-day S&P rally has not been kept pace with by the Moneyflow, although the Index remains now 15 days “textbook overbought”; rhus once that unwinds, we may see the next spillover. More February metrics hit the Econ Baro today, specifically Housing Starts/Permits, Ex/Im Prices, and IndProd/CapUtil.