Gold’s cac volume is rolling from February into that for April with an additional +39 points of premium, and — with or without — a fresh All-Time High has been reached thus far today at 5318 (April) or 5279 (February). Presently for the BEGOS Markets we’ve the Bond, Gold, Silver and the Spoo above their respective Neutral Zones for today, whilst below same are the two EuroCurrencies; session volatility is moderate-to-robust, Gold having traced 115% of its EDTR. Gold by Market Values is +803 points above its smooth valuation line; and dominant Market Profile support for the yellow metal (basis April) is 5121. Of note the current 5312 price is -234 points (-4.2%) below our forecast high for this year of 5546. The Spoo is positioned such that the S&P 500 (were it to open at this instant) would trade above 7000 for the first time. And much ado shall be FinMedia-made about “The Dow” approaching the 50,000 milestone. Nothing is due today for the Econ Baro. And we look for no change in the FedFunds rate come the FOMC’s Policy Statement at 19:00 GMT.

Mark

Mark

27 January 2026 – 08:46 Central Euro Time

Silver’s late-in-the-session drop yesterday of -12% prompted us to query on “X” (@deMeadvillePro) as to if the high was in place. However this morning, Silver is back above its Neutral Zone for today as are Gold, Copper and the Spoo; Oil is below same, and BEGOS Markets’ volatility is moderate, save for Silver which already has traced 141% of its EDT (see Market Ranges). Silver’s high yesterday was 117.70 whereas present price is 112.44 (+8.3% on the session). For the S&P 500, earnings improvements have driven the P/E down to 47.3x — still a dangerously high ratio — but at least well off it having been above 64x in the prior week. Thus far in Q4 Earnings Season, 52 constituents have reported of which 38 (73%) have bettered their bottom lines from Q4 a year ago, which is an above average pace. For the Econ Baro today we’ve the January read of Consumer Confidence.

26 January 2026 – 08:41 Central Euro Time

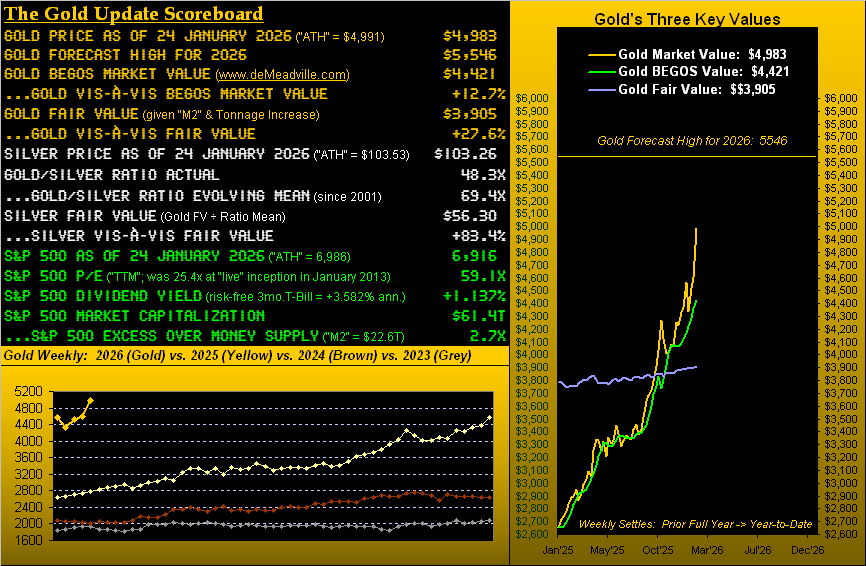

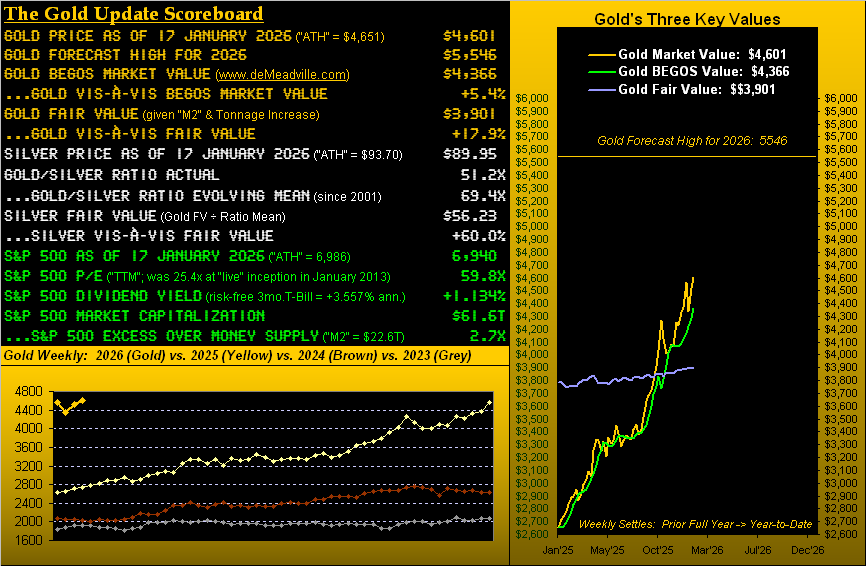

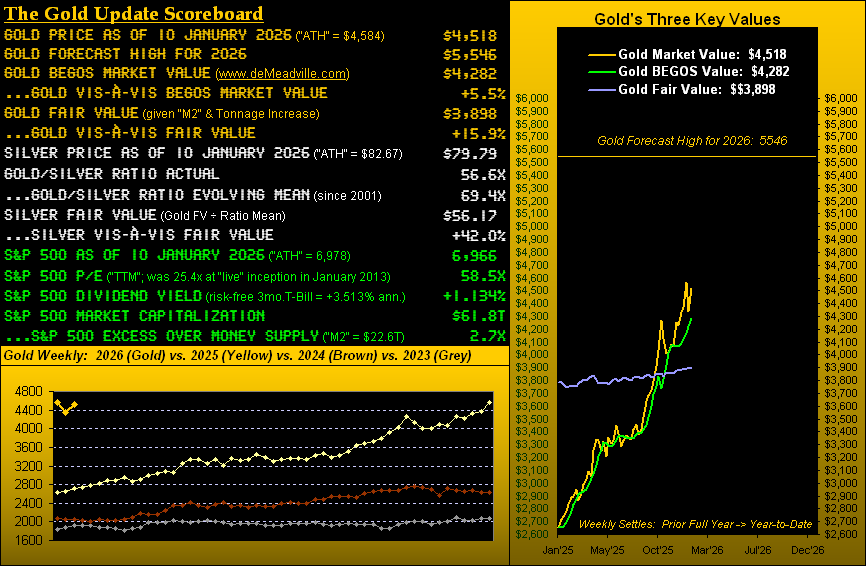

Gold, having settled Friday at 4983, gapped higher to begin the week in opening at 5013 and since has traded to as high as 5108; Silver has reached 109.32. The Gold Update underscores the overvaluation fundamentally and technically for the precious metals, whilst nonetheless maintaining our Gold target for this year of 5546. Presently, the Bond, Euro, Swiss Franc, Gold and Silver all are above today’s Neutral Zones; within same are Copper, Oil and the Spoo; session volatility for the BEGOS Markets is moderate-to-robust. Going ’round the Market Values horn for the five primary BEGOS components in real-time: the Bond is -1^17 points below its smooth valuation line, the Euro -0.005 points below same, Gold +653 points above, Oil +2.83 points above, and the Spoo -71 points below valuation. In “shutdown” arrears for the Econ Baro we’ve November’s Durable Orders.

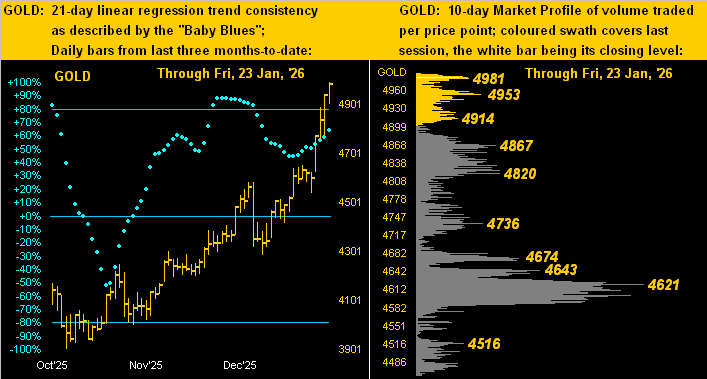

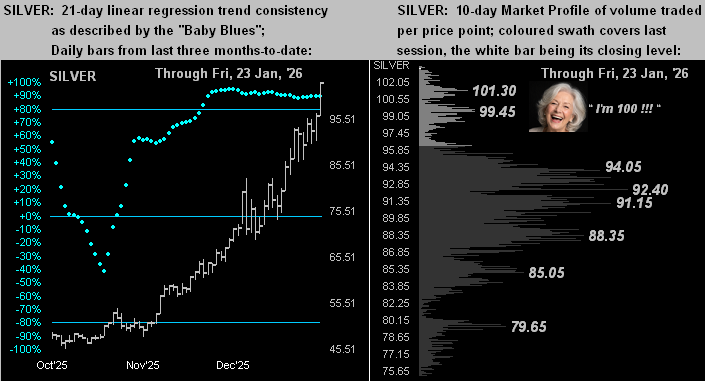

23 January 2026 – 08:45 Central Euro Time

Presently we’ve the Euro and Swiss Franc below their respective Neutral Zones for today, whilst above same are Gold, Silver and the Spoo; BEGOS Market’s volatility is again light-to-moderate. Milestones on tap: Gold 5000 (record high this morning 4970) and Silver 100 (record high this morning 99.40). The S&P 500’s “live” P/E (futs-adj’d) is 64.4x. Tomorrow’s 845th consecutive edition of The Gold Update (milestones made or not) shall nonetheless continue to celebrate the amazing run of the precious metals, albeit we’ll again caution valuation as having become quite upside extreme, (although certainly not as much as is the S&P). Too, we’ll make mention of December inflation as some metrics (CPI) in “shutdown” arrears have finally been reported. The Econ Baro concludes the week with the revised look at the UofM Sentiment Survey. And with some 10% of S&P constituents having thus far reported earnings for Q4, some 76% of those have bettered their bottom line of Q4 a year ago; but by the aforementioned P/E, the overall level of earnings remains tellingly weak relative to the price of the Index.

22 January 2026 – 08:34 Central Euro Time

Silver is the sole BEGOS Market at present outside (above) its Neutral Zone for today; session volatility has slowed a bit from recent days, thus far looking light-to-moderate. Looking at Market Rhythms for pure swing consistency, our Top Three through yesterday are — on a 10-test basis — Gold’s 12hr Parabolics, the Swiss Franc’s 4hr Price Oscillator, and Silver’s 4hr Parabolics; on a 24-test basis ’tis the Swiss Franc across the board by the 2hr Price Oscillator, 4hr Moneyflow and 4hr MACD. The P/E of the S&P 500 settled last evening at a whopping 63.7x; the yield is 1.156%; (the 3mo T-Bill annualized is 3.588%). The Econ Baro looks in “shutdown” arrears to Personal Income/Spending along with the attendant “Fed-favoured” PCE data; too, in arrears, shall be what is being termed a “revision” to Q3 GDP and its Chain Deflator.

21 January 2026 – 08:43 Central Euro Time

Gold records yet another All-Time High this morning at 4891 and is above its Neutral Zone for today as are both the Bond and Spoo; the Swiss Franc is below same, and session volatility for the BEGOS Markets is mostly moderate, Gold being the exception with a 142% tracing of its EDTR (see Market Ranges). Yesterday, both Gold and Silver, along with the Euro and Swiss Franc, moved and settled above their most volume-dominant Market Profile levels. Gold in real-time at 4845 is +446 points “high” above its smooth valuation like (see Market Values), of note, Silver at present is just mildly lower today at 94.45, whereas Gold is +1.7%. Scheduled for the Econ Baro are December’s Housing Starts/Permits, plus purportedly in “shutdown” arrears Construction Spending for both September and October.

20 January 2026 – 08:40 Central Euro Time

The BEGOS Markets’ two-day session continues with further record highs for both Gold (4727) and for Silver (94.75); both at present are above their Neutral Zones for this session, as too are Copper, the Euro and Swiss Franc; below same are the Bond and Spoo, and volatility (it being a double-day) is mostly robust, although Silver (despite its new high), Copper and Oil have traced no more than 70% of their EDTRs (see Market Ranges). Looking at Market Values (in real-time) for the five primary BEGOS components: the Bond is -2^15 points “low” vis-à-vis its smooth valuation line, the Euro -0.016 points “low”, Gold +342 points “high”, Oil +1.14 points “high” and the Spoo -76 points “low” having in this session crossed beneath its valuation line that portends still lower prices near-term. The Dollar Index — which had a firm start to the year — has given back more than that which was gained. Again, there is no Econ Data due until tomorrow. And mind our Earnings Season page as Q4 reporting picks up its pace this week.

19 January 2026 – 08:46 Central Euro Time

Given the StateSide holiday, ’tis a two-day session (for Tuesday settlement) for the BEGOS Markets. Therein at present we’ve both the Bond and Spoo below the session’s Neutral Zones, whilst above same are the Euro, Swiss Franc, Gold and Silver; volatility is moderate-to-robust, the two EuroCurrencies both having already exceeded 100% of today’s EDTR tracings (see Market Ranges). The Gold Update in maintaining our 5546 price forecast for this year nonetheless continues to cite the current overvaluation of Gold and Silver in this “Metals’ Mania Mayhem!”, noting that intra-week selling increased over that prior, even as prices further rose, and indeed are into higher record territory today (Gold thus far to 4698 and Silver to 94.37). The S&P 500 remains beyond any imaginable level of overvaluation, the futs-adj’d “live” P/E at this moment 59.2x. The reporting pace of Q4 earnings increases as the week unfolds. And nothing is scheduled for the Econ Baro until Wednesday.

16 January 2026 – 08:45 Central Euro Time

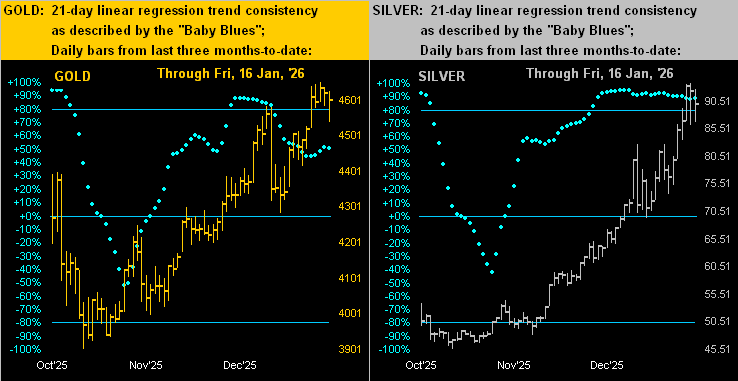

Both Silver and Copper are below their respective Neutral Zones for today, whilst above same is the Spoo, (“live” fut’s-adj’d S&P 500 P/E now 60.7x); BEGOS Markets’ session volatility ranges from light (Bond and Euro EDTR tracings of 26%) to robust (Copper’s 102%); EDTRs are updated daily on the Market Range page. Gold has dipped below its most volume-dominant Market Profiles support of 4621, price currently 4612; however the precious metals remain extremely high vis-à-via their Fair Value as we’ll depict in tomorrow’s 844th consecutive Saturday edition of The Gold Update; obviously too, given lack of earnings support, the S&P remains overvalued by a massive margin; the riskless 3mo T-Bill yield (3.565%) is 3.1x that of the S&P’s dividend yield (1.131%). The Econ Baro wraps its busy week of 20 incoming metrics with January’s NAHB Housing Index and December’s IndProd/CapUtil.

15 January 2026 – 08:43 Central Euro Time

The “live” P/E of the S&P 500 settled yesterday at 60.2x. Meanwhile, we’ve presently the EuroCurrencies, Metals Triumvirate and Oil all below today’s Neutral Zones; within same are the Bond and Spoo, and session volatility for the BEGOS Markets is moderate-to-robust, with both Silver and Copper already having traced in excess of 100% of their respective EDTRs for today (see Market Ranges). All-time high metals’ readings recorded yesterday were: Gold 4651, Silver 93.56, and Copper 6.154. Through the first nine trading days of 2026, the Dollar Index has recorded a net daily gain six times. Our S&P leading MoneyFlow continues to thin with a bit of a negative bent, (see S&P 500: MoneyFlow). And the Econ Baro awaits January’s Philly Fed and NY State Empire Indices, plus in “shutdown arrears”, November’s Ex/Im Prices.

14 January 2026 – 08:38 Central Euro Time

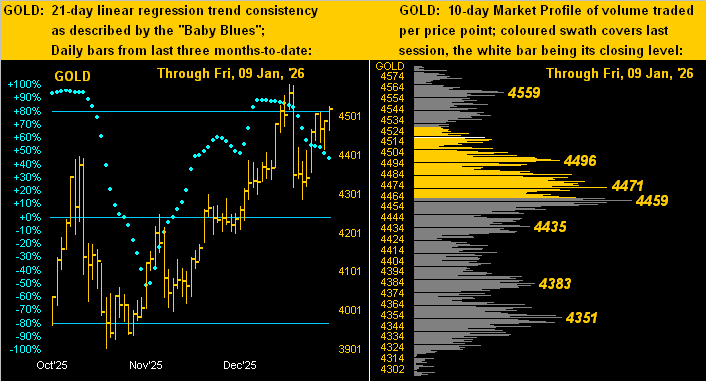

Record highs continue for Gold, Silver (91.37!), Copper and the Spoo/S&P 500. Per last evening’s post on “X” (@deMeadvillePro) the S&P settled yesterday with a “live” P/E of 59.9x. This morning, all three elements of the Metals Triumvirate are at present above today’s Neutral Zones; the rest of the BEGOS Markets are within same, and session volatility is pushing toward moderate. Gold (4643) is in real-time +312 points above its smooth valuation line (see Market Values); Market Profile support is 4621, followed by 4603; (the most volume-dominant support is still 4459); and by its Market Trend, Gold’s “Baby Blues” of linreg trend consistency have ceased their recent fall. The Econ Baro looks to in “shutdown” arrears November’s Retail Sales, PPI, and purportedly October’s Business Inventories, plus Q3’s Current Account. And late in the session comes the Fed’s “Tan Tome”.

13 January 2026 – 08:46 Central Euro Time

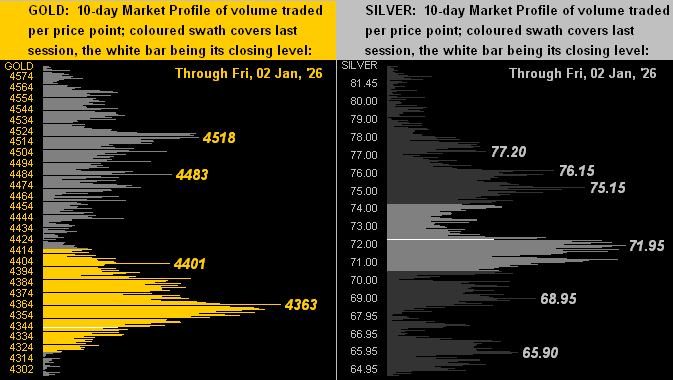

On the heels of record highs yesterday for Gold, Silver and the S&P 500, we’ve at present both the Bond and Gold below today’s Neutral Zones; the balance of the BEGOS Markets are within same, and session volatility is light-to-moderate, except for the non-BEGOS Yen which has traced 118% of its EDTR (see Market Ranges for those of the BEGOS Markets). By Market Trends, all are linreg positive, save for the two EuroCurrencies. Looking at Market Profiles, volume-dominant supports are as follows: Bond 115^16, Gold 4459, Silver 75.90, Copper 5.8650, Oil 58.00, and the Spoo 6953; volume-dominant resistance for the Euro is 1.172 and for the Swiss Franc 1.271. Oil’s cac volume is rolling from February into that for March. And for the Econ Baro we’ve December’s CPI and Treasury Budget, plus purportedly in “shutdown” arrears, September’s New Home Sales.

12 January 2026 – 08:39 Central Euro Time

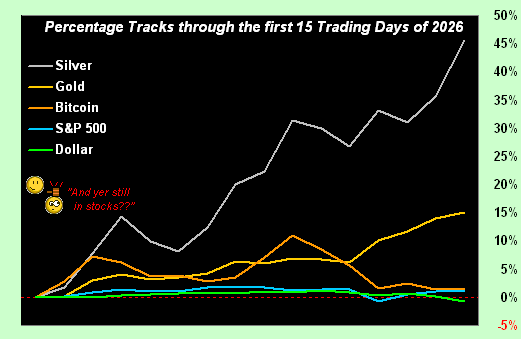

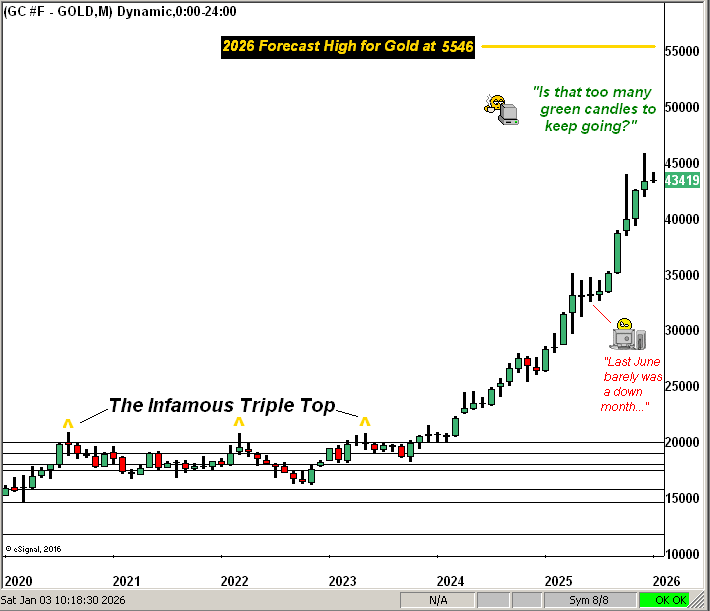

The BEGOS Markets finally appear to be waking up to the new year. The Gold Update cites sovereign invasions, currency concerns, and now we read of Chairman Powell facing an investigative issue. At present, both the Bond and Spoo are below today’s Neutral Zones, whilst the two EuroCurrencies and Metals Triumvirate are above same; only Oil at the moment is inside its Neutral Zone; session volatility is mostly robust. Too, The Gold Update points to the yellow metal’s year-to-date growth pace as sufficiently steep such that our forecast high for this year — 5546 — could be reached as swiftly as by February’s end, albeit this highly is unlikely as markets do not move in a straight line. ‘Tis a very busy week for the Econ Baro, although nothing for today is scheduled. And Q4 Earnings — which has had quite a weak start with just 43% of 23 reporting companies having beaten their Q4s of a year ago — looks later in the week to the major financial entities.

09 January 2026 – 08:36 Central Euro Time

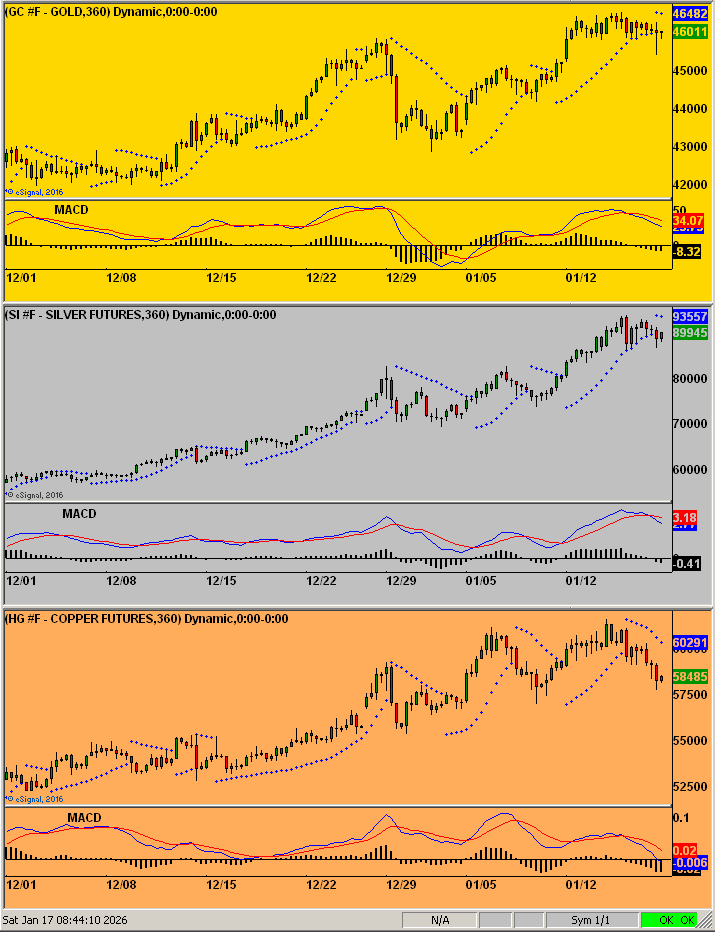

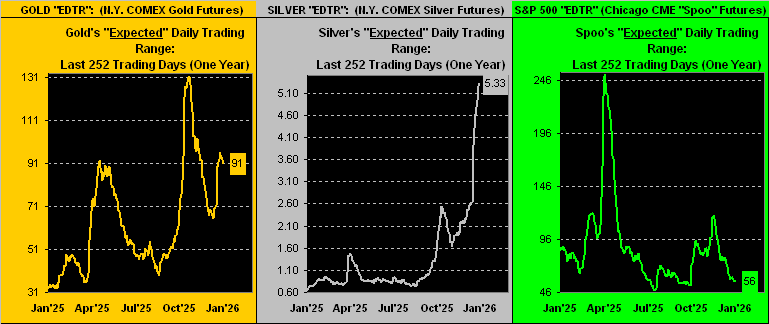

Toward rounding out the first full trading week of 2026 , we’ve at present the Euro, Swiss Franc and Spoo below their respective Neutral Zones for today, whilst Copper is above same; BEGOS Markets’ volatility is moving toward moderate. Save for the Metals Triumvirate, EDTRs (see Market Ranges) are near or even below where they were at this time a year ago. The 30mn MACD for both Oil and the Spoo has been their best Market Rhythm on pure swing basis. By their Market Profiles, Oil finds volume-dominant support at 58.00 and the Spoo at 6953. At Market Trends, the Euro’s linreg (in real-time) has rotated from positive to negative, the Dollar Index continuing to get the currency bid thus far into the new year. The Econ Baro looks to January’s UofM Sentiment Survey, December’s Payrolls data, and in “shutdown” arrears, Housing Starts/Permits for perhaps both September and October. And tomorrow brings the 843rd consecutive Saturday edition of The Gold Update.

08 January 2026 – 08:36 Central Euro Time

The Spoo as a “continuous contract” topped 7000 yesterday for the first time; intraday, the S&P 500 made an all-time high (6966) and settled with a “live” P/E of 57.2x, more than double from its inception 13 years ago: that means earnings have since grown at less than half the rate of the S&P itself. At present, we’ve Gold, Silver and the Spoo all below their respective Neutral Zones for today; the balance of the BEGOS Markets are within same, and session volatility is mostly moderate. The Euro yesterday settled below its smooth valuation line (see Market Values) for the first time since 25 November, a portent of still lower prices near-term; at Market Trends, the Euro’s “Baby Blues” of trend consistency are accelerating lower as, too, are those for the Swiss Franc, and to an extent for Gold. The Econ Baro looks to some catch-up metrics today from the “shutdown”: included are November’s Consumer Credit, October’s Trade Deficit and Wholesale Inventories, and Q3’s initial read of Productivity and Unit Labor Costs.

07 January 2026 – 08:41 Central Euro Time

The Bond is at present above its Neutral Zone for today, whilst below same are Oil and all three elements of the Metals Triumvirate; session volatility for the BEGOS Markets is mostly moderate, save for the Spoo which thus far has traced just a wee 18% of its EDTR (see Market Ranges). Oil is now the only BEGOS component in negative linreg, albeit as noted yesterday, the “Baby Blues” of trend consistency continue to ascend, even as price is lower today; broadly, Oil’s best Market Rhythm — in hindsight with a profit target of 2.70 points per swing — has been its daily EMA, having reached that target the last 10 of 10 times; (too as noted yesterday, Oil’s best Market Rhythm on a pure swing basis has been the 4hr Moneyflow). Scheduled today for the Econ Baro are December’s ADP Employment data and ISM(Svc) Index, along with (purportedly for November) Factory Orders and Business Inventories.

06 January 2026 – 08:41 Central Euro Time

At present, we’ve the Bond below its Neutral Zone for today, whilst above same are both Silver and Copper; BEGOS Markets’ volatility is moderate across-the-board. Oil yesterday settled above (and currently is on) Market Profile support at 58.00: on a pure swing basis, Oil’s best Market Rhythm has been the 4hr Moneyflow; and by its Market Trend, although Oil’s linreg remains negatively sloped, but its “Baby Blues” of trend consistency are rising for the sixth-consecutive session. The Spoo at 6955 is -39 points below is continuous contract all-time high of 6994 (26 December ‘2025): the futs-adj’d “live” P/E of the S&P 500 is 55.7x and the yield 1.138% vs. the “risk-free” 3mo T-Bill annualized yield of 3.515%. Nothing is scheduled for the Econ Baro today; and as noted, Q4 Earnings Season is underway.

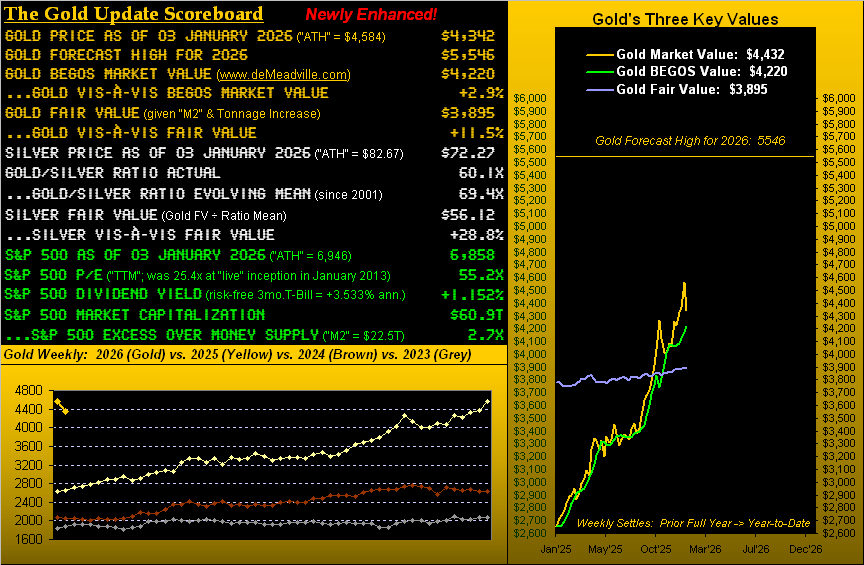

05 January 2026 – 08:43 Central Euro Time

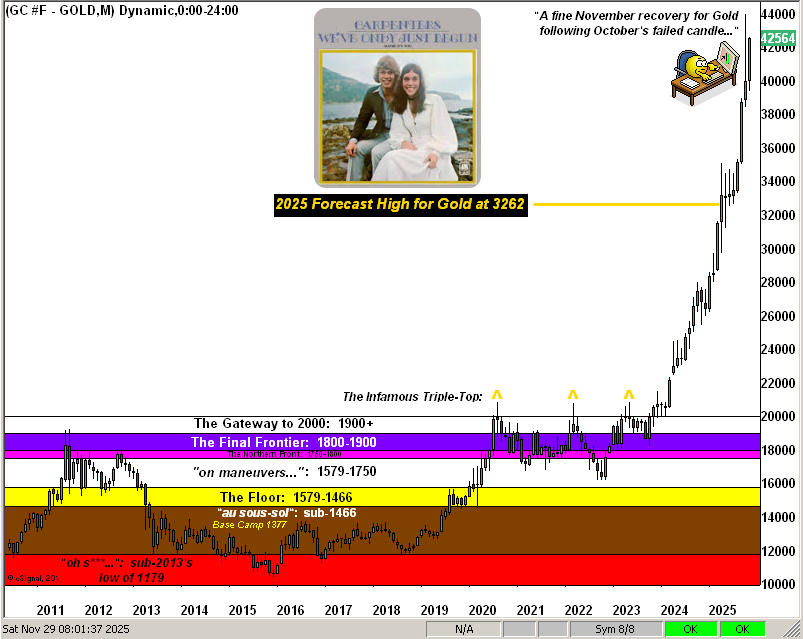

Not surprisingly, the precious metals are getting a geo-political boost, both Gold and Silver, as well as Copper, at present above today’s Neutral Zones; below same are the EuroCurrencies and Oil, whilst quietly within are the Bond and Spoo; session volatility for the BEGOS Markets spans from light for the Spoo to robust for Copper. The Gold Update has selected 5546 as the yellow metal’s forecast high for this year, even as price is currently overvalued both by its Fair and BEGOS Market Values. Going ’round the Market Values horn in real-time for the five primary BEGOS components: the Bond is -2^03 points “low” vis-à-vis its smooth valuation line, the Euro is essentially in sync with same, Gold is +200 points “high”, Oil -2.35 points “low” and the Spoo +60 points “high”. The Econ Baro looks to December’s ISM(Mfg) Index. And Q4 Earnings Season gets underway.

02 January 2026 – 08:41 Central Euro Time

Whereas the final trading day of 2025 saw all eight BEGOS Markets record a down day, this start to 2026 finds five of the eight to the upside: the Metals Triumvirate, Oil and Spoo all at present are above today’s Neutral Zones; below same are the Bond and Swiss Franc, (only the Euro is currently within its Neutral Zone); session volatility is moderate across the board. Tomorrow’s 842nd consecutive Saturday edition of The Gold Update — with its newly enhanced Scoreboard — shall also of course feature the final 2025 Standings of the BEGOS components, as well as our annual forecasted price for Gold’s high. As for “the now”, by Market Trends, Gold’s “Baby Blues” of linreg consistency continue to drop, as do those for the EuroCurrencies, and to a degree, for the Spoo, too. The Econ Baro awaits Construction Spending: because of the recent StateSide “shutdown”, there is source conflict as this being the report for October or November. On verra… Let the year commence.

31 December 2025 – 08:46 Central Euro Time

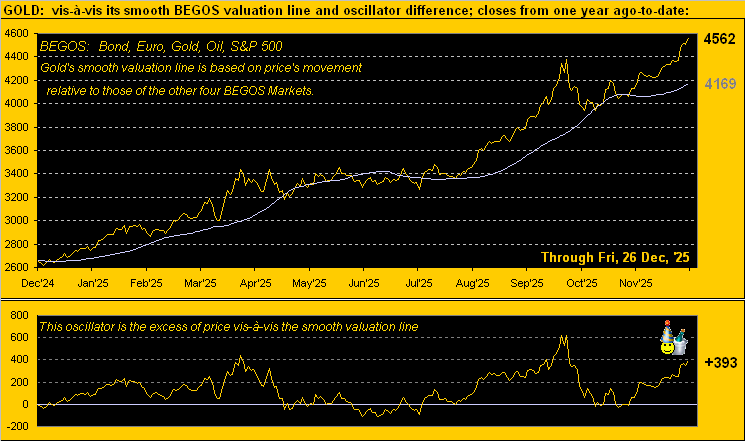

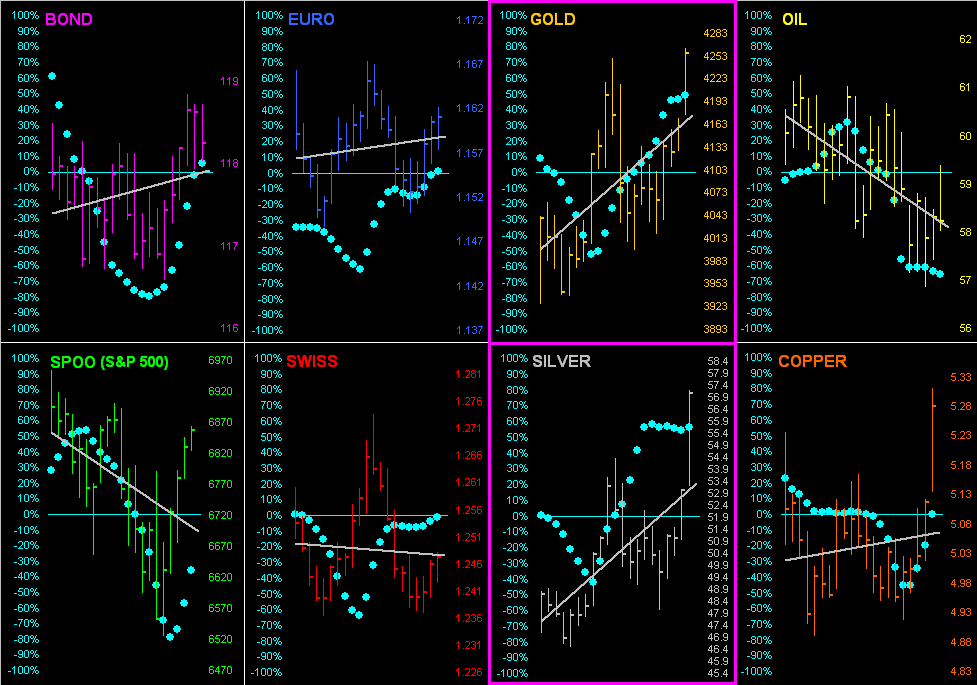

The final trading day of 2025 is a full session for the BEGOS Markets. At present, we’ve the Euro, Swiss Franc, Silver, Copper and Spoo all below their respective Neutral Zones for the session; the other BEGOS components (Bond, Gold and Oil) are within same, and volatility is mostly moderate-to-robust, the precious metals again to this hour already having traded in excess of 100% of their EDTRs (see Market Ranges); the EDTR for Gold is 90 points and for Silver ’tis 4.30 points; for pure swing trading, Gold’s best Market Rhythm is its 12hr Parabolics, whereas for Silver ’tis her 30mn Parabolics. As anticipated, Gold’s “Baby Blues” of linreg consistency (see Market Trends) have confirmed falling beneath the key +80% axis: structural support spans the 4200s, (which today already have been tapped per the session low thus far at 4283). The S&P 500 — which a year ago closed with its “live” P/E at 46.1x — now finds it at 55.1x. The Econ Baro (its 36 missing “shutdown” metrics notwithstanding) concludes the year with last week’s Initial Jobless Claims. Back Friday for the full session. A Safe and Happy New Year to All!

30 December 2025 – 08:36 Central Euro Time

Yesterday’s substantive selling in the precious metals found Gold’s intraday high-to-low drop of -5.8% ranking 19th-worst century-to-date, whilst that for Silver of -15.1% ranked 6th-worst. At present, both metals above above their Neutral Zones for today, as too are both Copper and Oil; the balance of the BEGOS Markets are within same, and session volatility is light-to-moderate, save for the two precious metals already having traced in excess of 100% of their EDTRs (see Market Ranges). Gold’s “Baby Blues” of linreg consistency (see Market Trends) have dropped (in real-time) below the key +80% axis, confirmation of which likely leads to lower prices near-term. Yesterday’s -0.3% fall in the S&P 500 was internally weaker, the MoneyFlow regressed into S&P points having been -0.7%. The Econ Baro looks to December’s Chi PMI. And the FOMC’s 09-10 December meeting Minutes shall be released late in the session.

29 December 2025 – 08:39 Central Euro Time

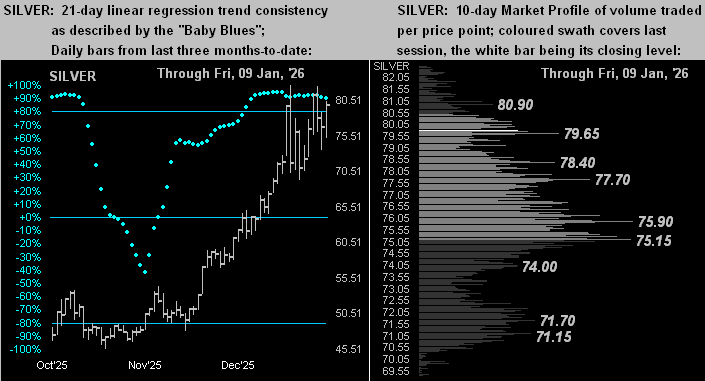

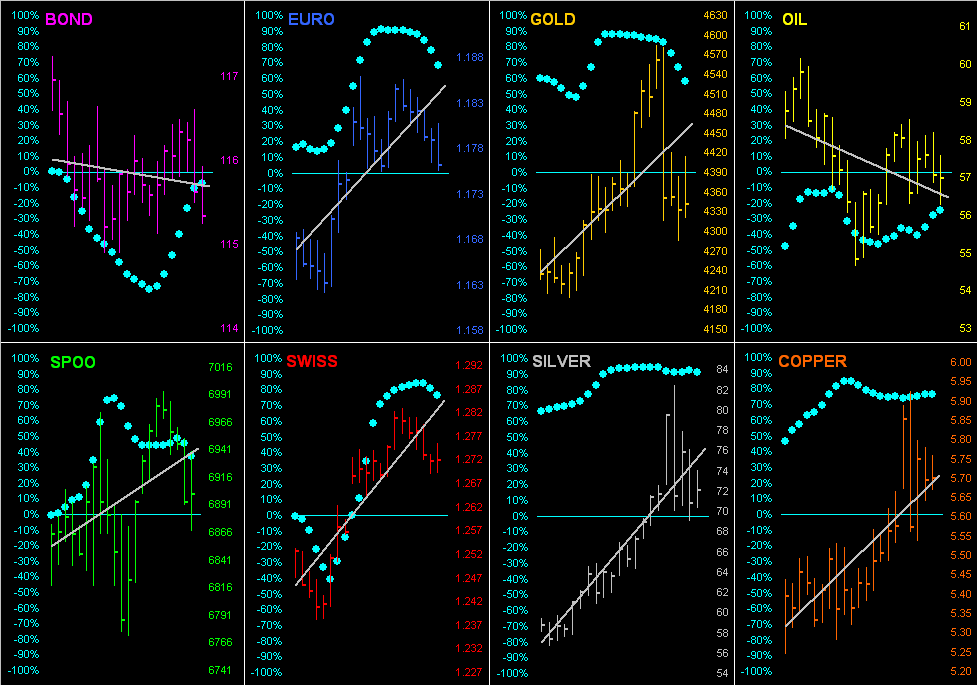

On the heels of the current edition of the Gold Update entitled “Yes, Gold REALLY Is Getting Ahead of Itself”, the precious metals are taking a bit of a pounding this morning: with all three elements of the Metals Triumvirate presently below today’s Neutral Zones, Silver — which began the session north of 80 in trading to a record high of 82.67, is now 75.52 , -5.2% having traded 266% of its EDTR (see Market Ranges), and Gold is 4491 with a 165% EDTR tracing. The Bond is at present above its Neutral Zone, and session volatility for the BEGOS Markets is mostly robust as skewed by the metals; notably quiet is the Spoo with just a 27% EDTR tracing. By Market Values (in real-time) for the five primary BEGOS components: the Bond is -1^27 points “low” vis-à-vis its smooth valuation line, the Euro +0.012 points “high”, Gold +314 points “high” in spite of today’s selling, Oil -2.20 points “low”, and the Spoo +135 points “high”. Due for the Econ Baro is November’s Pending Home Sales.

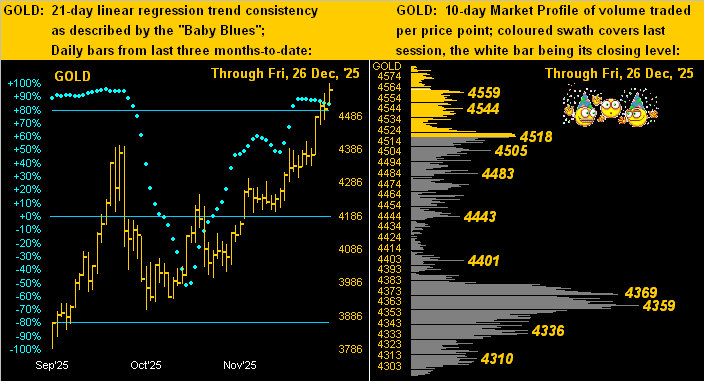

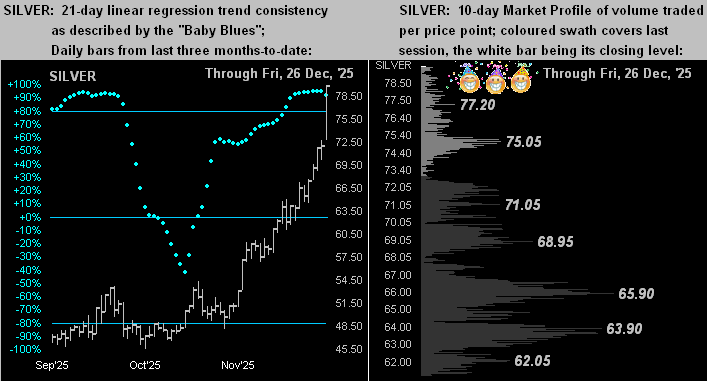

26 December 2025 – 08:43 Central Euro Time

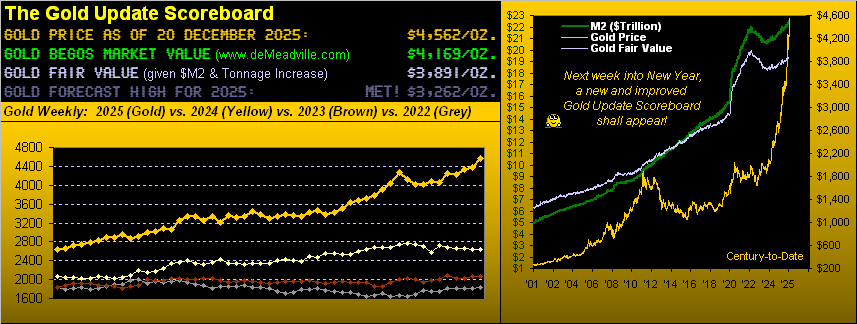

Today’s full session for the BEGOS Markets presently finds the Bond and Swiss Franc below their respective Neutral Zones, whilst above same are all three elements of the Metals Triumvirate, both Gold and Silver having again recorded new highs at 4562 and 75.50. Session volatility is moderate, noting therein that Silver has traced 105% of its EDTR (see Market ranges). Tomorrow’s 841st consecutive Saturday Edition shall give an estimate of how much the Money Supply (“M2”) need increase to catch up in matching these otherwise overvalued levels of the precious metals. Meanwhile, Gold by its BEGOS Market Value is (in real-time) +371 points above its smooth valuation line; the Spoo is currently +147 points above same. Nearby volume-dominant Market Profile support for Gold is 4518 whilst for the Spoo ’tis 6960. Nothing is due for the Econ Baro, (albeit 36 metrics remaining missing).

24 December 2025 – 08:33 Central Euro Time

We’ve furtherance of record highs this morning for the precious metals, Gold having tapped 4555 and Silver 72.75. At present above today’s Neutral Zones are both Silver and Copper; the balance of the BEGOS Markets are within same, and volatility for the abbreviated session is pushing toward moderate; (session closures range today from 18:00 GMT for stocks to 18:15 GMT and 18:45 GMT for the various BEGOS components). The S&P 500 yesterday settled at an all-time high (6910), albeit did not achieve its record intra-day high (6920 on 29 October); by Fair Value (+50 points) to the futures, the S&P at this instant would open lower by -6 points. And per Market Values, the Spoo in real-time is +134 points above its smooth valuation line; Gold is +364 points above same as price continues to break further above Fair Value (3896). Due for the Econ Baro are last week’s Initial Jobless Claims. Back on Friday for a full session, and thus a most Merry Christmas to one and all!

23 December 2025 – 08:33 Central Euro Time

Gold has cleared the 4500 handle in trading thus far to as high as 4531, whilst Silver has cleared its 70 handle in thus far reaching up to 70.16: whilst we welcome such lofty prices, a word to the wise is sufficient: Gold is at present +16% above Fair Value and Silver +24% above same. Too, the yellow metal is currently above today’s Neutral Zone, as are the Bond and Swiss Franc, a phenomena not unusual as we glide toward year-end. Session volatility for the BEGOS Markets is mostly moderate. Copper’s “Baby Blues” of linreg consistency (see Market Trends) continue to inch below the key +80%, albeit price has yet to respond in kind. They may be quite an array of data arriving today for the Econ Baro: problematic thereto is much conflict between our reporting sources as to what shall or shall not be issued, either timely or in arrears; we’ll have it all updated later in the session; also there is “talk” of another StateSide “shutdown” come late January.

22 December 2025 – 08:47 Central Euro Time

The current edition of The Gold Update entitled “Merry Metals!” is being well-vindicated this morning with record highs for both Gold (4453) and Silver (69.53); both are presently above today’s Neutral Zones as are Copper, Oil and the Spoo; below same is the Bond, and BEGOS Markets’ volatility is moderate, duly noting that Gold has traced 130% of its EDTR (see Market Ranges). Too, The Gold Update graphically summarizes the precious metals’ best pure swing Market Rhythms as currently Gold’s 12-hour Parabolics and Silver’s six-hour Moneyflow. The Spoo has regained the 6900s: currently 6910, the all-time high is 6975 (12 December); the futs-adj’d “live” P/E of the S&P 500 is 56.0x; the amount of money to move the S&P one point is the thinnest ’tis been since 15 October, (i.e. mind the froth). Nothing is scheduled today for the Econ Baro.

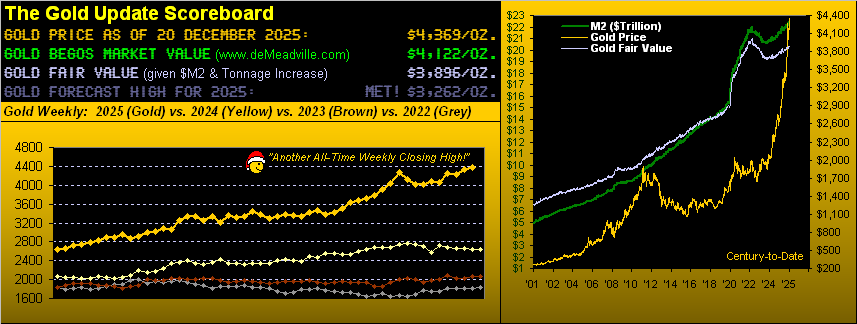

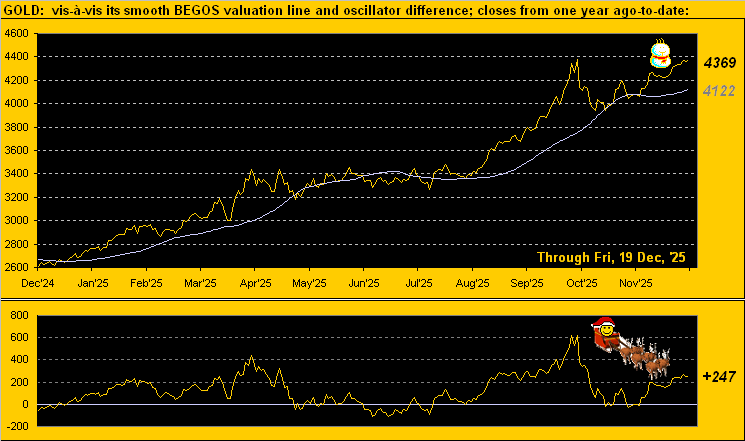

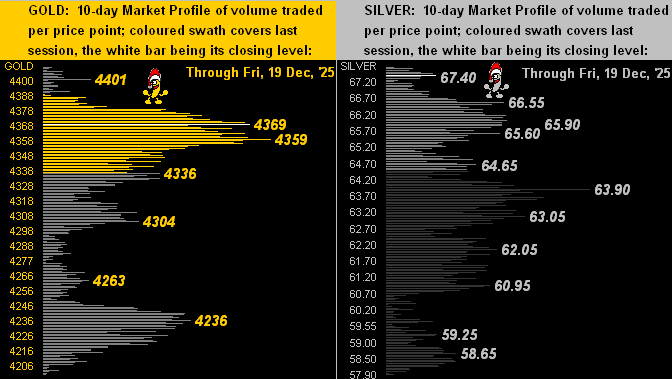

19 December 2025 – 08:43 Central Euro Time

Gold yesterday by its “continuous contract” reached another All-Time High at 4410; (the “front month” currently is February, which itself had reached 4433 on 20 October but with a lot of forward “premium” at that time when ’twas not yet the “front month”). Either way, more on having achieved 4410 in tomorrow’s 840th consecutive Saturday edition of The Gold Update. For the present, with session volatility for the BEGOS Markets moving toward moderate, we’ve the Bond and Swiss Franc below today’s Neutral Zones, whilst above same are Silver and Copper. Of note, Copper’s “Baby Blues” for linreg consistency (see Market Trends) yesterday dropped below their key+80% axis indicative of lower prices near-term; Copper’s best Market Rhythm of late is its daily MACD. The Econ Baro looks to December’s revision to the UofM Sentiment Survey and November’s Existing Home Sales; due too are that month’s Personal Income/Spending and “fed-favoured” Core PCE Index: instead however may come the still unreported data for October, given the “shutdown”.

18 December 2025 – 08:40 Central Euro Time

Another record high for Silver yesterday in trading up to 67.18 at which level year-to-date the white metal was up +129%; Silver currently is 66.61 and at present inside her Neutral Zone for today, as are all the BEGOS Markets, save for Oil’s being below same; session volatility is light. The NASDAQ 100 finished yesterday on a “Hobson Close” in settling on the low of the session, which by market lore is indicative of an up opening; indeed the Spoo is presently positioned for an opening S&P 500 gain of +22 points, placing the “live” futs-adj’d P/E at 54.2x. Too, the Spoo yesterday settled having crossed below its BEGOS Market Value, typically indicative of still lower prices near-term; the Spoo’s linreg trend remains up, but ’tis weakening (see Market Trends). Amongst the metrics expected today for the Econ Baro are December’s Philly Fed Index and November’s CPI; the Conference Board’s Leading (i.e. “lagging”) Indicators are “scheduled” but are not likely to be reported as the wake of the “shutdown” keeps the full view of the economy somewhat in question.

17 December 2025 – 08:40 Central Euro Time

We’ve record highs for Silver this morning, up to as much as 66.65; and even as the Dollar Index is up a firm +0.5%, all three elements of the Metals Triumvirate are at present above their respective Neutral Zones for today, as is Oil; below same are the Bond, Euro and Swiss Franc, and session volatility for the BEGOS Markets is moderate-to-robust, Silver having thus far traced 119% of its EDTR (see Market Ranges). Looking at Market Values for the five primary BEGOS components: the Bond is -2^08 points “low” vis-à-vis its smooth valuation line, the Euro +0.013 points “high”, Gold +250 points “high”, Oil -3.72 points “low” and the Spoo +62 points “high”. Incoming data for the Econ Baro remains sporadic as “scheduled” reports in arrears are not necessarily being released; there are three metrics “due” for today (including November’s Retail Sales and October’s Business Inventories), but already they are indicated as likely not to arrive; either way, data that is being released has continued to move the Baro lower month-to-date.

16 December 2025 – 08:49 Central Euro Time

Presently we’ve the Metals Triumvirate and Spoo all below today’s Neutral Zones; the other BEGOS Markets are within same, and volatility thus far again is moderate. Save for Silver and Copper, EDTRs (see Market Ranges) of late have been narrowing. And by Market Trends, save for the Bond and Oil, the six other BEGOS components are in 21-day linreg uptrends. The Spoo’s moving from its December cac into that for March has added +59 points of premium to price; the March Spoo yesterday meekly moved up through significant Market Profile resistance before being swiftly sold back down; currently 6839, such resistance is 6908 up to 6926; the Spoo’s EDTR is 78 points. There are 11 metrics “scheduled” today for the Econ Baro, some in arrears and some timely; they notably include: November’s Payrolls data (to fold in as able some of that for October which was not reported), IndProd/CapUtil, October’s Retail Sales, plus September’s Housing Starts/Permits and Business Inventories.

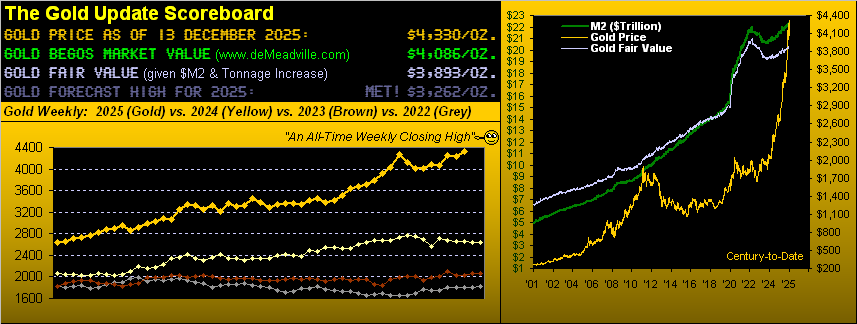

15 December 2025 – 08:37 Central Euro Time

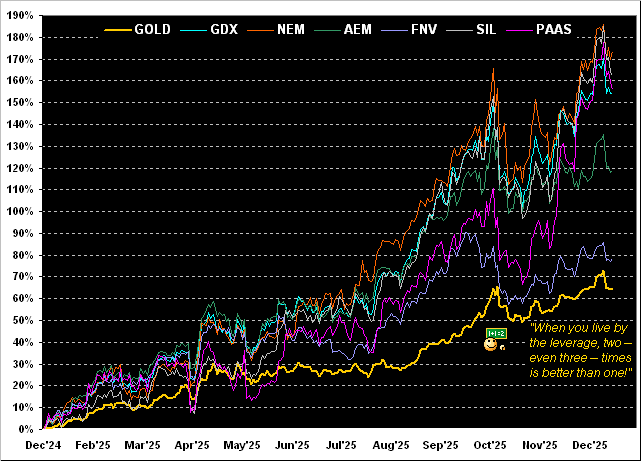

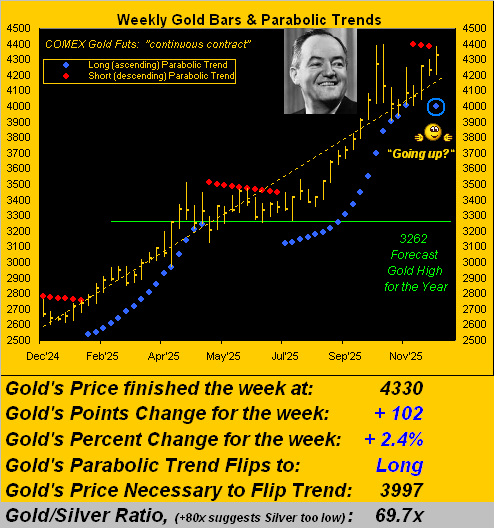

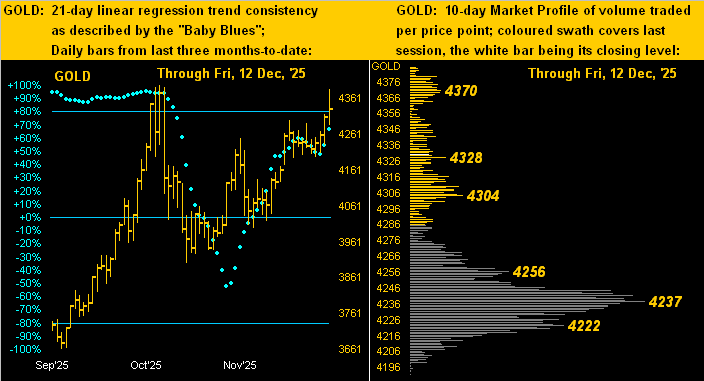

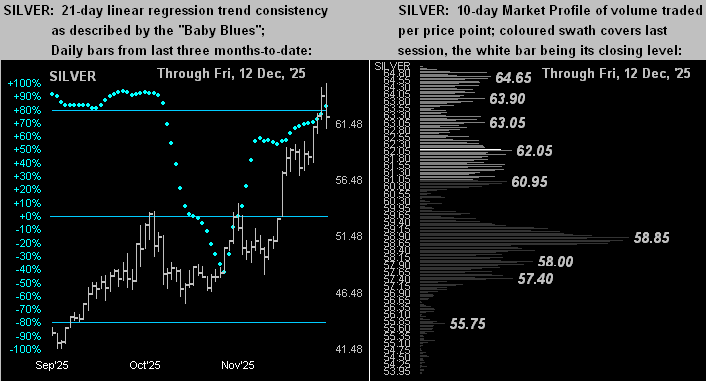

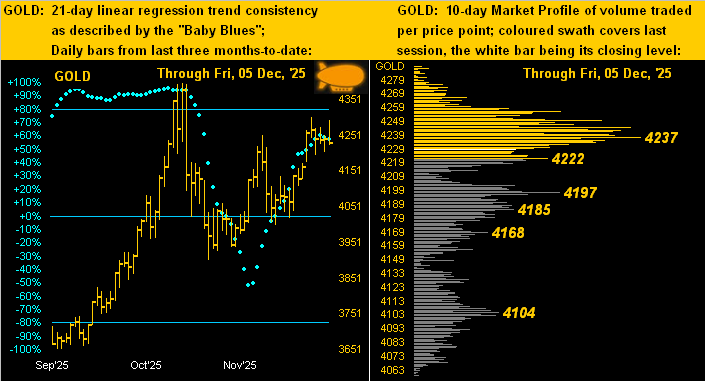

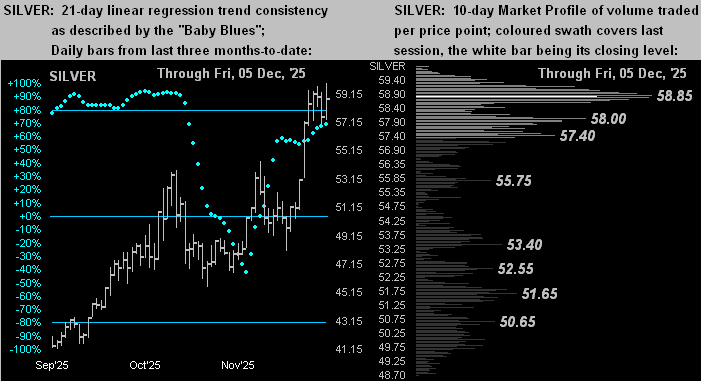

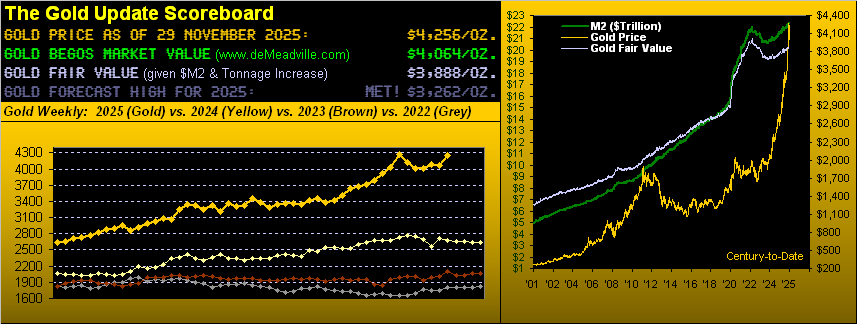

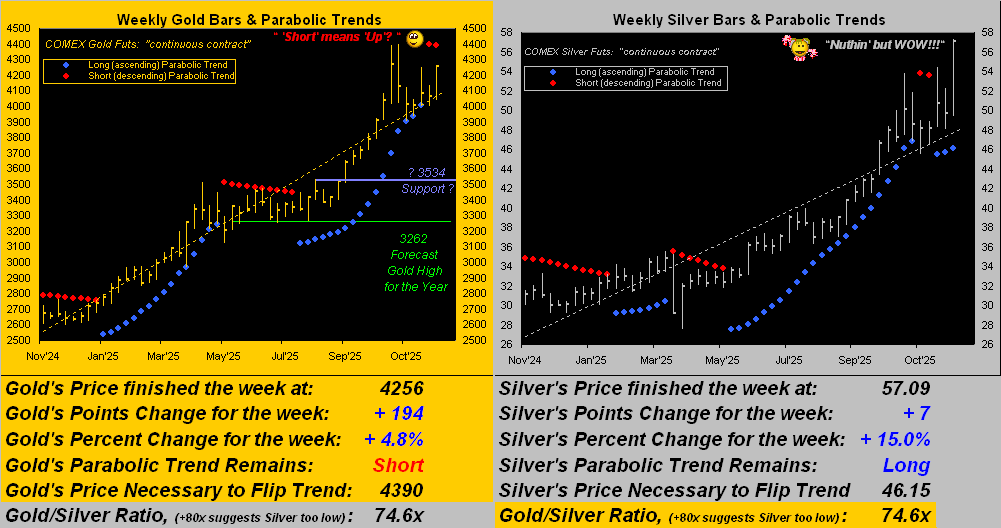

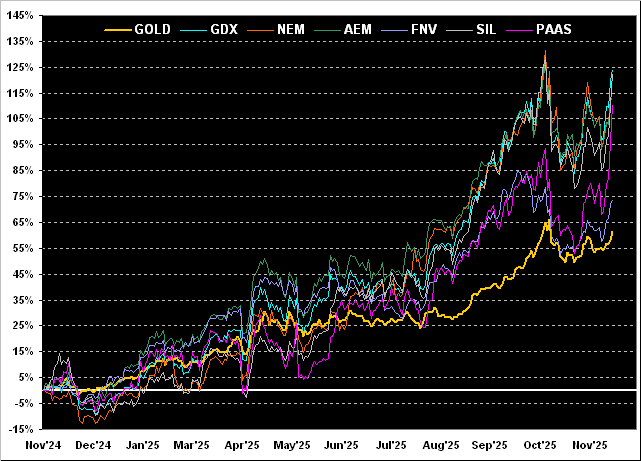

The final full trading week of the year begins, finding at present the Bond and Metals Triumvirate above their respective Neutral Zones for today; none of the other BEGOS Markets are below same, and session volatility is moderate. The Gold Update celebrates Silver having surpassed 60, and the yellow metal’s weekly parabolic trend having flipped from yet another “short-lived” Short stint (just 3 weeks) to Long; presently 4377, Gold is only -21 points below its record 4398 high; by their Market Profiles, Gold’s most volume-dominant support is 4237 and for Silver (currently 63.43) ’tis 58.85. Oil’s cac volume is moving from January into that for February, and that for the Spoo from December into March. Purportedly “scheduled” this week for the Econ Baro are 26 metrics, some delayed, some current: for today we await December’s NY State Empire Index and the NAHB Housing Index.

12 December 2025 – 08:39 Central Euro Time

Presently, all eight BEGOS Markets are within today’s Neutral Zones, and session volatility is light. Silver yesterday traded up to a record high of 64.72, however by Fair Value, the white metal has become quite overvalued: more on that in tomorrow’s 839th consecutive Saturday edition of The Gold Update. Amongst the five primary BEGOS components, we’ve currently no notable correlations. The Dollar Index yesterday traded down to its lowest level (98.135) since 24 October. The S&P 500 yesterday reached its highest level (6903) since the all-time high of 6920 on 29 October. Volume for the currencies (Euro, Swiss Franc and the non-BEGOS Yen) is moving from their respective December cacs into those for March. And nothing is scheduled today for the Econ Baro, albeit some four dozen metrics remain missing per the six-week Oct-Nov StateSide “shutdown”.

11 December 2025 – 08:41 Central Euro Time

The Bond is presently above its Neutral Zone for today, whilst below same are Copper, Oil and the Spoo; session volatility for the BEGOS Markets is firmly moderate. As anticipated, the FOMC voted with dissent to nonetheless cut the FedFunds rate -25 bps to the 3.50%-3.75% target range: the S&P 500 responded in moving to its highest level (6901) since 29 October (wherein the all-time high of 6920 still stands); however, overnight selling has pushed the Spoo (6840) lower towards its BEGOS Market Value (6801), the futs-adj’d “live” P/E at 57.7x. Silver has recorded another record high this morning at 63.25, however has since slipped back into today’s Neutral Zone. And incoming metrics “scheduled” in arrears today for the Econ Baro are both September’s Trade Deficit and Wholesale Inventories.

10 December 2025 – 08:42 Central Euro Time

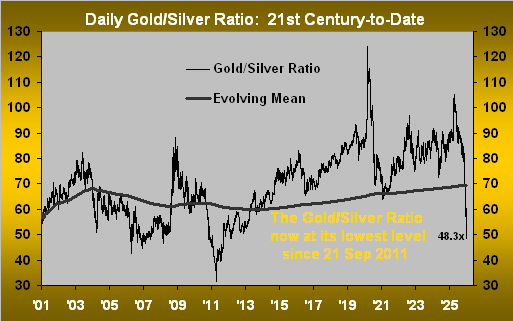

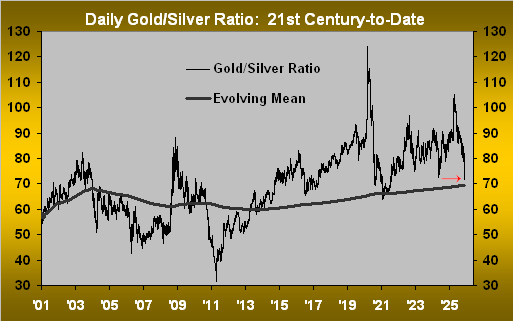

Silver yesterday topped 60.00 for the first time and thus far today has traded to as high as 62.14, the Gold/Silver ratio having fully reverted to its century-to-date evolving mean of 69.4x, the ratio currently 68.3x; the white metal is at present above its Neutral Zone for today, as is Copper; the rest of the BEGOS Markets are within same, and session volatility is light. Silver’s best Market Rhythm is currently (if seeking a targeted outcome of 0.52 points) is the 12hr MACD, or on a pure swing basis the 6hr MACD; of note, Gold these last couple of weeks continues not to confirm Silver’s rally. What is “scheduled” for the Econ Baro versus that which is actually released of late is patchy at best: expected for today is November’s Treasury Budget, plus in arrears, Q3’s Employment Cost Index. Then come 19:00, look for the FOMC (not unanimously) to lower the FedFunds rate by -0.25% to the 3.50-3.75% target range.

09 December 2025 – 08:37 Central Euro Time

Only Copper is at present outside (below) its Neutral Zone for today; moreover, it already has traced 106% of its EDTR (see Market Ranges); otherwise, BEGOS Market’s volatility is mostly light. By Market Rhythms, Copper’s best is its daily MACD. Too, ’tis unusual to see one market dominating our Top Three Rhythms for pure swing consistency, but on a 10-test basis, ’tis the Euro’s 15mn Parabolics, 1hr EMA, and 6hr MACD. Yesterday’s S&P 500’s MoneyFlow (+0.2%) was firmer than the Index itself (-0.3%); the Spoo’s trading range is narrowing: the EDTR just back on 25 November was 119 points; today ’tis 83 points. “Scheduled” today for the Econ Baro are the Q3 revisions to Productivity and Unit Labor Costs, the preliminary readings for which were not reported given the “shutdown”.

08 December 2025 – 08:42 Central Euro Time

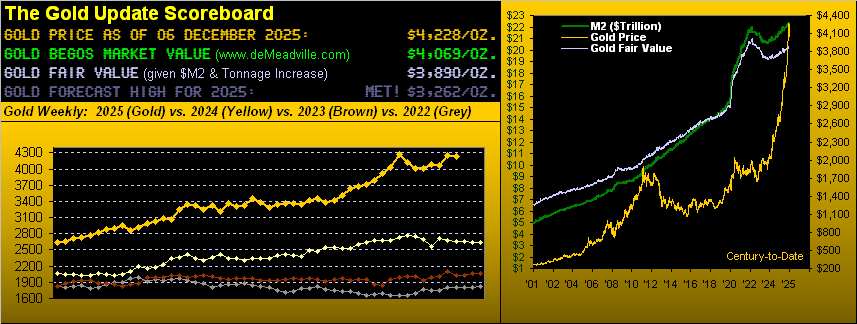

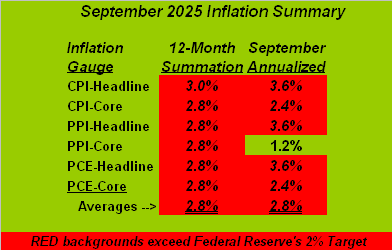

Presently, the Euro is the only BEGOS Market outside (above) its Neutral Zone for today; session volatility is light-to-moderate. The Gold Update points to Silver having nearly reached the milestone of 60.00 (59.90 on Friday); too, we calculated a Fair Value for Silver at 56.05. Also therein, September’s inflation summary table is indicative of paces running above the Fed’s desired 2% target range such that they ought not cut the Funds rate come Wednesday, but likely shall so do given a weakening jobs market at least by ADP data; (recall the BLS was shutdown for six weeks). As the Spoo meanders higher this morning, the S&P 500 looks to start its week with a “live” P/E of 58.2x. For the five primary BEGOS components per their Market Values (in real-time): the Bond is -2^10 points below its smooth valuation line, the Euro basically in sync nears its line, Gold +168 points above same, Oil in sync, and the Spoo +88 points over its line. Nothing is scheduled today for the Econ Baro.

05 December 2025 – 08:41 Central Euro Time

The EuroCurrencies and Metals Triumvirate are all above today’s Neutral Zones; none of the other BEGOS Markets are below same, and session volatility is on balance moderate, Copper however having already traced 130% of its EDTR (see Market Ranges). The Spoo has thus far traded up to 6884, its highest level since 13 November; too, the Spoo’s “Baby Blues” of linreg consistency (see Market Trends) have inched back above their 0% axis, the trend having rotated from negative to positive despite the “textbook overbought” condition of the S&P 500 itself; the Spoo settled last evening an excessive 126 points above its Market Magnet; currently 6882, the Spoo’s most volume-dominant supporter is 6863. Gold is completing its third week of the parabolic Short trend, the past two weeks of which have been up; more on that in tomorrow’s 838th consecutive Saturday edition of The Gold Update. And scheduled for the Econ Baro are December’s UofM Sentiment Survey, October’s Consumer Credit, plus purportedly in arrears, September’s Personal Income/Spending and “Fed-favoured” Core PCE.

04 December 2025 – 08:41 Central Euro Time

The Bond, Swiss Franc and Silver are all presently below their respective Neutral Zones for today; the balance of the BEGOS Markets are within same, and volatility to this point of the session is light-to-moderate. Silver’s daily bars have the appearance of a near-term top being put in place despite yesterday’s all-time high of 59.66, (price now 57.99); Silver’s best swing Market Rhythm if seeking a profit target (0.84 points) is the 6hr Moneyflow, whereas on a pure swing basis ’tis the 4hr Parabolics. Meanwhile the S&P 500 has worked its way up technically to a moderately “textbook overbought” condition; more importantly, the fundamental reality of the “live” (futs-adj’d) P/E of now 58.7x is essentially off the end of the Bell Curve. Metrics scheduled today for the Econ Baro include October’s Trade Deficit and September’s Factory Orders.

03 December 2025 – 08:33 Central Euro Time

Presently above today’s Neutral Zones are the Euro, Swiss Franc, Copper and Oil, whilst below same is Silver; session volatility for the BEGOS Markets is pushing toward moderate. Yesterday for the Swiss Franc, price settled above the most volume-dominant Market Profile resistor, as well as pierced above its Market Magnet. Currently topping our Market Rhythms for pure swing consistency are (on a 10-test basis) the Swiss Franc’s 8hr MACD and for Silver both its 2hr MACD and 4hr Parabolics, plus (on a 24-test basis) the Euro’s 4hr MACD, Silver’s 2hr Parabolics, and the non-BEGOS Yen’s 4hr MACD. The Econ Baro looks to November’s ADP Employment data ISM(Svc) Index, and perhaps in “shutdown” arrears September’s Ex/Im Prices and IndProd/CapUtil.

02 December 2025 – 08:44 Central Euro Time

Silver, after achieving another all-time high yesterday at 59.44 — then year-to-date +103% — is at present below today’s Neutral Zone; the balance of the BEGOS Markets are within same, and session volatility is light. The S&P 500’s mid-November correction of some -350 points and subsequent return back up was enough to unwind any textbook technical overbought/oversold conditions; however, the “live” (futs-adj’d) P/E of 56.1x remains our biggest overvaluation (understatement) concern. Specific to the Spoo by Market Trends, its linreg had rotated from positive to negative effective 17 November, but as the “Baby Blues” of trend consistency are recovering, such trend looks to rotate back to positive in a day or two, barring substantive selling; for consistent swing trading, the Spoo’s best Market Rhythm of late has been the 30mn Price Oscillator. Nothing is scheduled today for the Econ Baro.

01 December 2025 – 08:34 Central Euro Time

Both the Bond and Spoo are at present below today’s Neutral Zones, whilst above same is Oil; session volatility for the BEGOS Markets is firmly moderate as December commences. The Gold Update celebrates Silver’s remarkable year, through Friday +94.9%, and even more so this morning, having hit another all-time high at 58.61. Silver’s best Market Rhythm for pure swing consistency has been the 2hr MACD, or for targeted profit (0.84 points/cac) the 6hr Moneyflow; and Silver’s EDTR (see Market Ranges) is 2.13 points/day. Meanwhile Gold at 4275 is -123 points below its record high level of 4398 (20 October). For the Econ Baro we’ve November’s ISM(Mfg) Index plus (purportedly) September’s Construction Spending, one of 49 “missing” metrics from the StateSide “shutdown”.