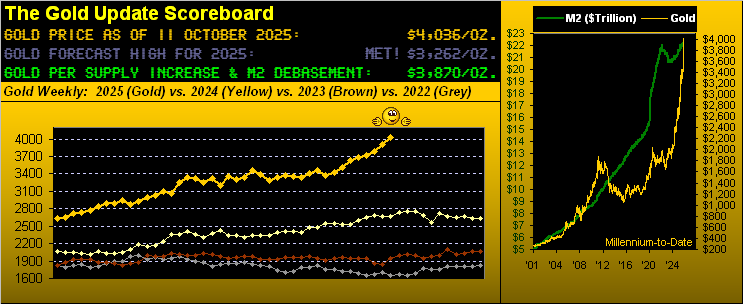

The Gold Update by Mark Mead Baillie — 830th Edition — Monte-Carlo — 11 October 2025 (published each Saturday) — www.deMeadville.com

“Silver’s New-Found Sky; Gold’s Gut-Punch from High; S&P’s Goodbye“

Ya gotta love October. Silver finds fresh sky above 50 even as Gold takes a gut-punch from its new 4081 high, and the S&P at long last says “Goodbye!” Recall our closing query from a week ago?

“I do, mmb. You wrote: ‘Have we crashed yet?’”

And, Squire, so the S&P has … or at least is appearing … to commence a crash. For after all, giving up a full month of stock market gains yesterday (Friday) in just six hours is serious! By Wall Street’s back-of-the-napkin estimate, stock market gains are generally given back at two-to-three times the pace of which they rise. But yesterday’s selling was 21x the pace of a month’s entire gain!

“Also, what do you now mean, mmb, that Gold took a gut-punch, because it is at record highs!”

Squire, let’s summarize all three of these: Silver, Gold, and the S&P.

- Silver was the darling of this past week even in netting a wee loss (-0.9%) by settling yesterday (Friday) at 47.52. Nonetheless, during both Thursday and Friday, “spot” Silver briefly traded for the first time ever over 50, indeed to as high in the sky as 51.24, albeit its more liquid December futures contract did not exceed 49.97, still an All-Time High of its own accord. So: Brava Brava Sista Silva!!

- Gold too recorded new highs in exceeding 4000 on Tuesday at 00:28 GMT as we posted on “X” (@deMeadvillePro), moving further on Wednesday to the new All-Time High of 4081. But come Thursday Gold got gut-punched in falling intraday high-to-low by -120 points, the eighth-largest same-day points’ loss thus far this century. “Fortunately”, come Friday’s inflationary “Trump Tariff!” scare, Gold recovered to a record weekly close (admittedly -45 points below the week’s high) at 4036. So: Gold wins over Trump n’ China rare earth tariff tricks!

- As for the S&P 500, we’ve gone on and on and on since its post-COVID recovery about the Index’s ridiculous overvaluation in this “Investing Age of Stoopid”; but the tariff indication of inflation — as we’ve oft cautioned stagflation — finally was the catalyst rightly to make it all go wrong. What was amazing, upon the S&P actually opening higher to begin its Friday session, the “live” price/earnings ratio actually touched 50.0x! ‘Twas as if those who actually can do math saw it and declared: “That’s IT! SELL!!“

Regardless of your catalytic choice, ‘twould appear “The Crash” at long last has perhaps begun. So, as to “How low does the S&P go?”, let’s update our 50-year view of the S&P 500 with its yellow-bounded regression channel and red “had COVID never happened” channel. The imbedded photo with the encircled p/e was taken just after Friday’s up opening. Does the S&P return to its regression channel?

“So that little down hitch at the right is a ‘crash’, mmb?”

Squire, remember the “little down hitch” on Monday, 27 March 2000? Come Thursday, 10 October 2002 that little S&P down hitch had morphed into a Huge Down Hitch of -50.5% across those two and one-half years, (aka “The DotComBomb”).

‘Course, no one knows if such magnitude of “crash” has again begun. To be sure, high-level warnings of a stock market “drawdown” (a rather gentle way of expressing it) have been put forth over the past week by Goldman Sachs, J.P. Morgan, and even the “oh hip-hip!” Bank of England. Either way, we’ll say this: the selling fear on Friday was nothing like we’ve sensed since 2007 into 2009, which for you WestPalmBeachers down there was “that other even worse” -57.7% plunge (aka “The FinCrisis”).

This time ’round, be it the “Look Ma! No Earnings!” crash, the “Look Ma! No Money!” crash or the “Look Ma! It’s that Assembled Inaccuracy!” crash, we remain wary of more significant S&P 500 downside, certainly in the near-term offing (a stinging double-entendre, if we may so say).

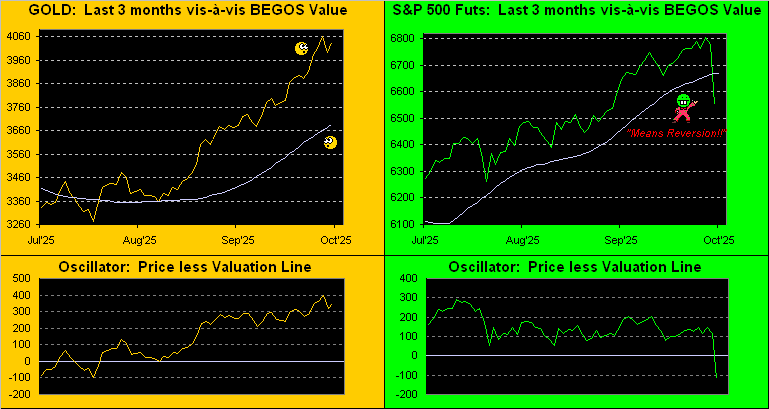

And despite Gold’s gut-punch, the metal on balance is likely good going forward, albeit levels continue to run extremely high above the smooth valuation line borne of price’s movement vis-à-vis those of the primary BEGOS components (Bond / Euro / Gold / Oil / S&P 500). To wit, courtesy of the “Reversion to the Mean Dept.” we offer the following two-panel graphic (gleaned from the website). Gold at left is presently priced better than +300 points above its smooth line, whereas the S&P (futures) at right on Friday alone fully reverted to same, and then some. To repeat: yesterday’s session saw the S&P give up a full month of gains since 11 September in a single day! That’s “fear”, baby:

As for Gold’s weekly bars, here they are. A fabulous picture … although perhaps worthy of reprising J.E. Levine’s “A Bridge Too Far” –[U.A., ’77]. Regardless, from a year ago-to-date, they’re certainly lookin’ GREAT!

Perhaps not so great, indeed running late, is the Economic Barometer. Of the 16 incoming metrics thus far due in October — given the ongoing StateSide government “shutdown” — a mere five have arrived live, including only two this past week. October’s University of Michigan’s “Go Blue!” Sentiment Survey down-ticked a pip, and August’s change in Consumer Credit moved nary a wit. So here’s how the Baro now sits:

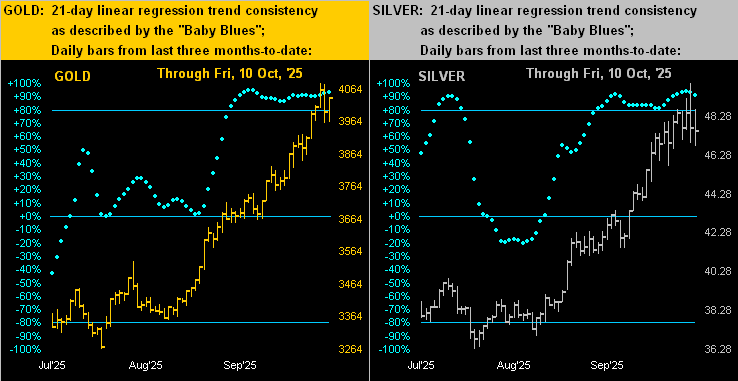

Yet sitting ever-pretty are the precious metals. Behold our two-panel graphic of the daily bars from three months ago-to-date for Gold on the left and for Silver on the right. In both cases, the “Baby Blues” of regression trend consistency have been above the key +80% axis for 23 consecutive trading days, (which for those of you scoring at home is longer than a whole month). However within Friday’s S&P 500 chaos, neither metal even as a safe-haven was able to reattain its prior day’s high. Remember the FinCrisis’ “Black Swan” during which “everything” initially went well down? ‘Tis just something of which to be aware:

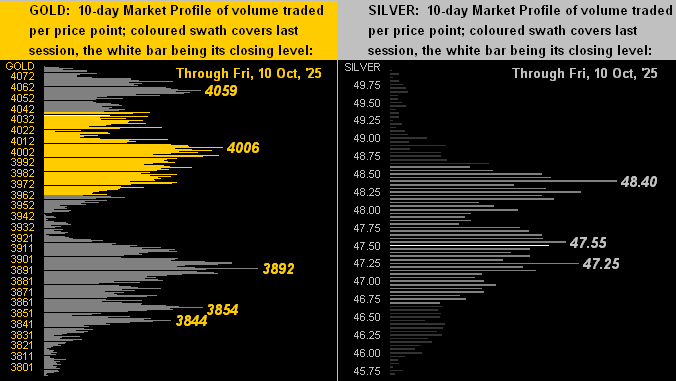

Too, we’ve the two-panel graphic of the 10-day Market Profiles for the yellow metal (below left) and white metal (below right). Per the volume-dominant price labels, Gold sees support at 4006 whilst Silver appears more contained for the moment between 48.40 on the upside and 47.25 on the downside. Indeed as Silver didn’t fully keep pace with Gold into week’s end, the Gold/Silver ratio rose from the prior Friday’s 81.6x level to now 84.9x:

Toward closing, we’ve not stacked it up since mid-August. So let’s have a look; note therein for the Stack’s first time that “Gold’s Value per Dollar Debasement” is not at present on top, the yellow metal having achieved (as you know if you are regular reader) such Fair Value a week earlier:

The Gold Stack (continuous contract pricing):

Gold’s All-Time Intra-Day High: 4081 (08 October 2025)

2025’s High: 4081 (08 October 2025)

10-Session directional range: up to 4081 (from 3793) = +288 points or +7.6%

Gold’s All-Time Closing High: 4061 (08 October 2025)

Trading Resistance: 4059

Gold Currently: 4036, (expected daily trading range [“EDTR”]: 69 points)

10-Session “volume-weighted” average price magnet: 3952

Trading Support: notable Profile nodes: 3892 / 3854 / 3844

Gold’s Value per Dollar Debasement, (from our opening “Scoreboard”): 3870

The Weekly Parabolic Price to flip Short: 3548

The 300-Day Moving Average: 3036 and rising

2025’s Low: 2625 (06 January)

The 2000’s Triple-Top: 2089 (07 Aug ’20); 2079 (08 Mar’22); 2085 (04 May ’23)

The Gateway to 2000: 1900+

The Final Frontier: 1800-1900

The Northern Front: 1800-1750

On Maneuvers: 1750-1579

The Floor: 1579-1466

Le Sous-sol: Sub-1466

The Support Shelf: 1454-1434

Base Camp: 1377

The 1360s Double-Top: 1369 in Apr ’18 preceded by 1362 in Sep ’17

Neverland: The Whiny 1290s

The Box: 1280-1240

To wrap, does another “Black Monday” await the S&P? Instead, shall the FinMedia (which typically suffers ratings declines in bear markets) come to the rescue emphasizing “all that money piling up on the sidelines will come back into the market”? Or in reality: is it the painful withdrawal of margin? “Uh-oh…”

Just don’t you get caught with with a hole in your bankroll! Rather, (hat-tip CDS), ride Gold’s rise above its blow hole! “WHOA!”

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro