The Gold Update by Mark Mead Baillie — 799th Edition — Monte-Carlo — 08 March 2025 (published each Saturday) — www.deMeadville.com

“Gold Goes Inside; Stocks Maintain Slide“

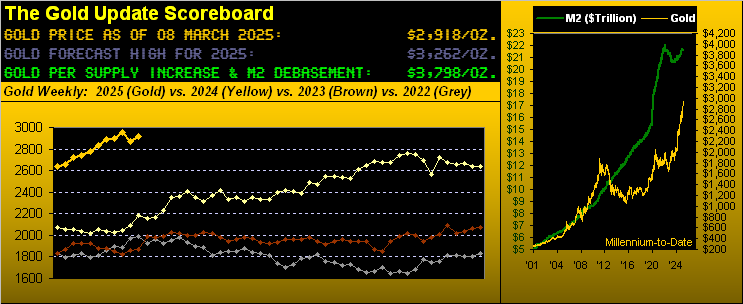

Whilst we’ve still our near-term negative bent for the price of Gold, nonetheless let’s reprise this from last week’s missive: “…one thing to watch is a stirring of geo-political jitters which as you regular readers know can quickly send Gold higher — but generally just briefly — before returning down from whence it came…”

And from the prior Friday’s White House brawl to yesterday morning’s RUS/UKR missile-drone attack, such geo-political jitters — in tandem with tariff tantrums — have kept Gold aloft, price settling the week at 2918 for a net five-day gain of +1.8% (+50 points).

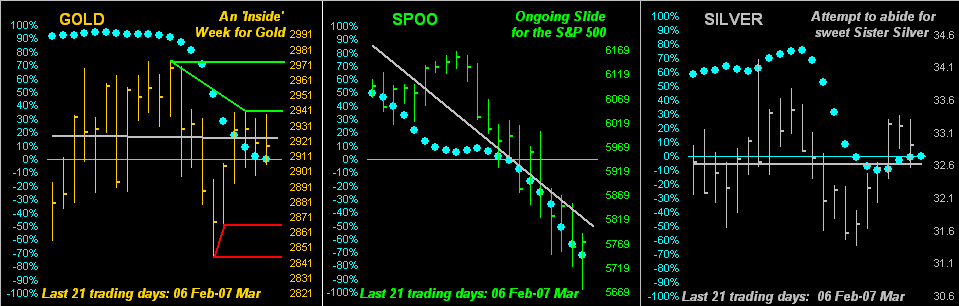

Yet, ’twas a so-called “inside week” for the yellow metal, meaning Gold printed both a higher-low but lower-high than in the week prior. ‘Tis depicted below in the left hand panel wherein the outermost green and red horizontal lines are the prior week’s range and the innermost two this past week’s range, the diagonal slants showing the difference. Still, in spite of it all, Gold’s “Baby Blues” of trend consistency continued to fall, paired here with the S&P’s folderol and Silver’s attempting a grip on the ball:

“But mmb, that’s more than just S&P folderol ’cause it’s down -6% from its high!”

We’ve on occasion been queried if Squire is paid for such “teeing-up” comments. (Rather, for the privilege of his presence on this page, he pays us).

But to the point, yes, the S&P 500 (now 5770) has lost -6% of its value from the all-time high (6147) of just 13 trading days ago (19 February). Yet from our purview ’tis “nuthin’ but noise” given the mighty Index today is +765% above its FinCrisis low of 667 (06 March 2009) as well as +163% over the COVID low of 2192 (23 March 2020). Thus for you WestPalmBeachers down there, the S&P’s -6% pullback is a statistical irrelevancy. And as our regular readers know all too well, relevancy shall have returned upon the S&P’s price/earnings ratio (the “live” reading now 41.0x) having reverted to its reasonable mean in the low 20s, (which always has occurred — either up or down — since the S&P 500’s inception 68 years ago in March 1957) And in turn, the otherwise ongoing Investing Age of Stoopid shall have been eradicated. (Nevertheless, we’ve more on the FinMedia “Panic!” toward today’s wrap).

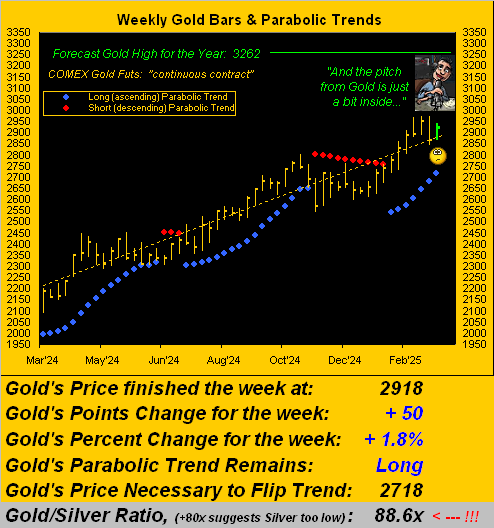

As to Gold’s ten trading weeks year-to-date, this past one (the rightmost green bar) is the first to be characterized as “inside”. Again, the inference as Gold continues to work off its extreme overbought condition is price having benefitted from geo-political and tariff trepidation; hence this past week’s buoyancy:

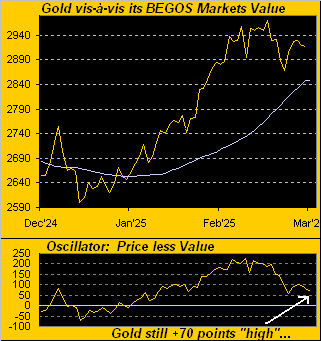

To be sure, Gold’s blue-dotted weekly parabolic remains safely Long. However, by our BEGOS Markets Values measure (in placing a near-term value on Gold per its movements relative to those of the four other primary BEGOS components, i.e. the Bond, Euro, Oil and S&P 500), price is still some +70 points “high” above its smooth grey valuation line; and of course, the two inevitibly shall eventually meet. Here they are from three months ago-to-date:

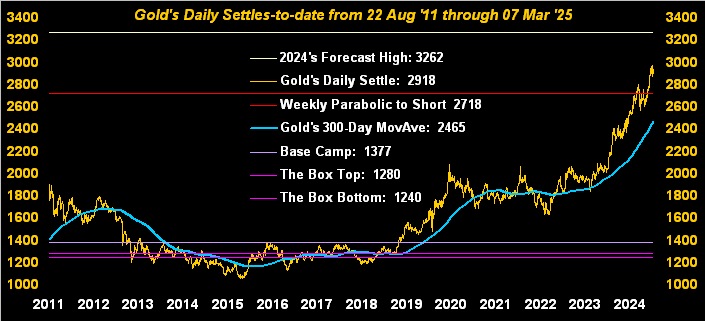

And again as you well know, we fully expect Golden Goal Two of “milestone” 3000 to trade this year, and further our forecast high for Golden Goal Three of 3262. Yet as the “Not in a Straight Line Dept.” reminds us, we see the route thereto traveling through the 2703-2641 zone, just in case you’re scoring at home.

‘Course, how lovely ‘twould be to be wrong and instead see Gold proceed from here at 2918 right up the road to the opening Scoreboard’s Dollar debasement value of 3798. Highly unlikely anytime soon, although in responding at a gathering this past week to the query “Is Gold now going to 10,000?” we said “No, and likely somewhat lower near-term, yet 4,000 perhaps is possible in two years or so…”

But obviously the bogeyman in the room is inflation — which most broadly is a Gold positive — but intermediately a threat to price should the Federal Open Market Committee resort to raising rates. The good news there, however, is both retail and wholesale inflation by consensii are expected to have somewhat slowed their February paces from those for January. Next Wednesday (the Consumer Price Index) and Thursday (the Producer Price Index) shall tell the tale.

Indeed let’s segue to the Economic Barometer which took a bit of a boffing during the week. Of the 15 incoming metrics, only five improved period-over-period. Most impressive were January’s Factory Orders which increased from December, that month’s decrease being favourably revised, and which beat consensus. But the stinker was the backup in January’s Wholesale Inventories, which accumulated over those for December, that month’s depletion revised to a slower pace, and were a bit more bloated than consensus. Too came the not so rare dichotomy of February’s Payrolls taking a rather severe hit per ADP, but by the Bureau of Labor Statistics actually increased. “What’s your source?” Here’s the Baro:

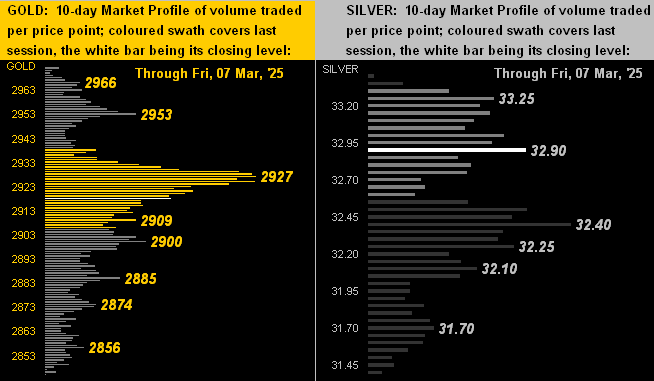

Meanwhile, let’s assess the state of the 10-day Market Profiles for both Gold on the left and Silver on the right. Notably for the yellow metal, price spent much of yesterday’s week-ending session clustered ’round the now volume-dominant 2927 level. As for the white metal, she settled the week smack on her volume-heavy 32.90 support/resistance bar:

More broadly with respect to Gold’s 300-day moving average across the last 14 years, price generally pulls back when ’tis +20% or higher above that measure (the blue line in the graphic). Just prior to the start of the current near-term price correction (which began from the All-Time High of 2974 on 24 February), Gold had settled as high as +22.2% above said average; at present ’tis still a lofty +18.4% above same. So again, we ought not be surprised should Gold further subside:

Toward closing, in light of the S&P 500 (which year-to-date is now down -1.9%, “OMG!”) having just recorded its weakest week (-3.1%) of the ten thus far this year, as we earlier teased, let’s check in with a few of Friday’s “FinMedia Freakout” finales:

Bloomy: “Wall Street’s Big Selloff Puts Pressure on America’s Rich Households” Lovin’ this one, for how many times have we written: “Marked-to-market everyone’s a millionaire; marked-to-reality nobody’s worth squat”;

DJNw: “Most Americans can’t afford life anymore…” So is DJNw’s assumption here the alternative? That’s a bummer.

CNBS: “The oversold stocks due for a technical bounce after a brutal week.” Truly ’tis dumbing down of the word “brutal”; we’ve haven’t had “brutal” since March 2020; and from 2008 into 2009, we regularly ate “brutal” for breakfast. So what leads to “brutal”? The aforenoted “live” S&P P/E of 41.0x.

“So then is the S&P about to crash, mmb?”

Obviously no one knows, Squire. What will eventuate over time is the reversion of the S&P’s P/E to a level of normalcy, as earlier cited in the low 20s via: 1) a doubling in earnings without the stock market rising, or 2) a 40%-50% stock market “correction”, or 3) a![]() “Combination of the Two”

“Combination of the Two”![]() –[Big Brother and the Holding Company, ’68]

–[Big Brother and the Holding Company, ’68]

Either way, we wrap with a wry note: per this penning, there remain two full weeks of winter. Yet for some reason of absurdity, StateSide folks early tomorrow move their clocks to summer hours. What that means for The Gold Update is — by adhering to its time-honoured traditional uploading each Saturday at 11:00 PacCoastTime — ’twill be an hour earlier here EuroSide at 19:00 for our next three editions (15, 22 and 29 March) until we then nudge our clocks forward come 30 March.

And specific to next week’s piece, beware the Ides of March, for it brings our 800th consecutive Saturday edition of The Gold Update…

He had Gold … do you? Currency then … Currency NOW!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro