The Gold Update by Mark Mead Baillie — 775th Edition — Monte-Carlo — 21 September 2024 (published each Saturday) — www.deMeadville.com

“Gold Flies as Dumbo* Whilst the Fed Goes Jumbo”

Thursday’s Prescient Commentary opened as follows: “We were wrong about the Fed, it having cut its Funds Rates -50bp rather than by our -25bp assertion; and as is our wont, when we’re flat out wrong, we fess up…”

Wrong indeed. Through many-a-missive in this year’s early months, we went on about the Federal Reserve needing to actually make a further FundsRate increase, given the mathematical proof of inflation remaining well away from the Fed’s “preferred target” of 2%.

But then came the month of May and it all started to go wrong for the Economic Barometer. So damaged became the Econ Baro that come the Federal Open Market Committee’s 31 July Policy Statement, we asserted that they’d have to vote to reduce the FundsRate by -0.25% from the then 5.25%-5.50% range to 5.00%-5.25%. Yet instead, the FOMC surprisingly stood pat.

Now just came the FOMC’s most recent vote this past Wednesday. Contrary to the FinMedia’s fervoured anticipation of a “Jumbo Cut”, we adamantly put forth time and again ‘twould be a -0.25% cut rather than a mouth-foaming -0.50% cut (even as the latter was already priced into the FedFundsFutures) for three key reasons:

- Unexpected inflation pop: for August, the “core” inflation readings at both the wholesale (Producer Price Index) and retail (Consumer Price Index) levels came in at an annualized +3.6% pace vs. consensus for +2.4%; pop goes the wallet;

- Poor Fed optics: as herein penned back on 24 August: “Our case for a rate cut back on 31 July did not come to pass, which lends credence to a two-pip reduction on 18 September. But then the optics would be poor for the Fed being too slow, thus we think ’twill be but one pip they’ll go.” But no, ’twas instead “Jumbo”;

- Rate cut history: So far this century — save during times of extreme financial distress — rate cuts otherwise have always been in units of -0.25%. The three exceptional periods were 1) 911 and the DotComBomb; 2) the FinCrisis; and 3) COVID.

Such logic circumvented, as Squire would say, ’tisn’t about us. Simply stated we were wrong; so let’s move on.

“But hang on mmb, ’cause maybe the Fed now thinks ‘extreme financial distress’ is coming…“

Oh come now, dear Squire. With “Old Yeller’s” Treasury Trillions desperately coming due, an electorate bent on lack of so-called “Presidential timber” even as the civil society collapses, and the S&P 500 truly trading at 41.9x earnings with a market cap of $49.8T supported by s StateSide liquid money supply (M2) of “just” $21.1T, what could possibly go wrong? Nothing to see here. So again, let’s move on … to Gold! Here’ tis, flying as does Helen Aberson’s and Harold Pearl’s fabulous Dumbo from 1939, (*later to be trademarked by what today is Disney Enterprises, Inc.):

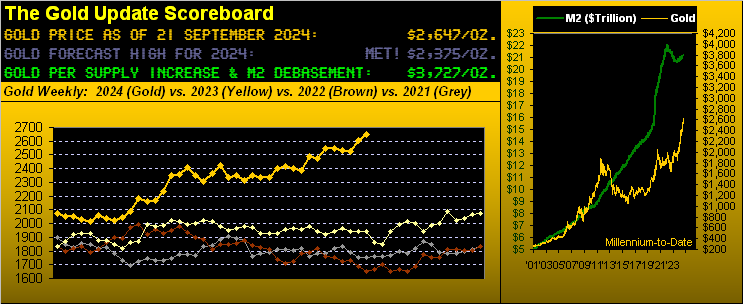

Suitable for framing is the above graphic of Gold’s weekly bars from one year ago-to-date. And yes, price having settled yesterday (Friday) at an All-Time Closing High of 2647, as therein noted ’tis still stunningly cheap relative to the debasement of the Dollar. Indeed per yesterday’s record intra-day high of 2651, Gold trades at a -29% discount to its 3727 debasement value, per the opening Scoreboard.

And then there’s Silver: per the graphic’s table, the Gold/Silver ratio of now 84.0x is well-above its century-to-date average ratio of 68.4x, so much so that were Silver to snap-adjust to such average, rather than priced today at 31.50, she’d be +23% higher at 38.67. Moreover, whilst Gold is at an All-Time High, Silver’s current 31.50 level is -37% below her own All-Time High of 49.82 recorded away back on 25 April 2011. Ad nauseum: “Don’t forget Sister Silver!”

Fortunately for the aforementioned Econ Baro, its multiple months (May into August) of nausea waves have morphed into somewhat blessed relief. Having bottomed one month ago to the day (on 21 August), the Baro has since been climbing out nicely. For this past week alone, nine of the Baro’s 14 incoming metrics improved period-over-period, notably including September’s New York State Empire Index and that for National Association of Homebuilders, plus August’s Housing Starts and Building Permits, as well as Industrial Production.

Still stumbling however (and not surprisingly so given the overall downward track of the Baro) was the Conference Board’s negative “lagging” indicator of Leading Indicators; (for you newer readers, we regularly refer to them as “lagging” given the Baro significantly leads them). Still, with the StateSide economy’s recent advance, add in the Fed’s “Jumbo” rate cut and what’ll we get? Renewed inflation? Yet if the economy resumes folding, indeed stagflation? (Right, we’re not supposed to go there…) Here’s the Baro:

‘Course, all the post-Fed excitement is over the stock market’s ![]() “Going to a Go-Go”

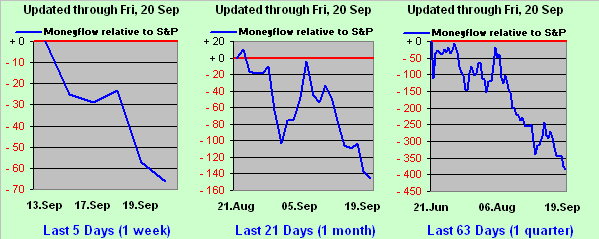

“Going to a Go-Go”![]() –[The Miracles, ’65]. But as we “X’d” (@deMeadvillePro) last evening, the MoneyFlow of the S&P 500 — as regressed into S&P points — is vastly underperforming the Index itself. Be it by the latest weekly, monthly, or quarterly measure, the euphoric buying to a record high (5734) is at best thin as we below see per one of our favourite market-leading indicators. We thus anticipate lower S&P levels near-term; after all, ’tis the first day of “fall”; (write it down):

–[The Miracles, ’65]. But as we “X’d” (@deMeadvillePro) last evening, the MoneyFlow of the S&P 500 — as regressed into S&P points — is vastly underperforming the Index itself. Be it by the latest weekly, monthly, or quarterly measure, the euphoric buying to a record high (5734) is at best thin as we below see per one of our favourite market-leading indicators. We thus anticipate lower S&P levels near-term; after all, ’tis the first day of “fall”; (write it down):

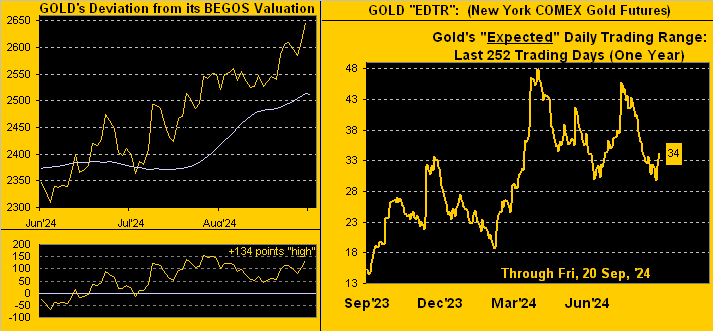

Specific to Gold, as does Dumbo, ‘twould be great to see it continue flying high in the sky. However price is getting somewhat stretched above its “smooth valuation line” relative to movements vis-à-vis those components comprising our five primary BEGOS Market (Bond / Euro / Gold / Oil / S&P 500). Per the panel at lower left, we see Gold denoted as presently being +134 points “high” by the oscillator (price less valuation). Obviously that is a near-term trading measure, given that Gold most broadly (as earlier noted) is better than -1000 points below its debasement value. Too, within this near-term trading vein, the panel at lower right is Gold’s EDTR (Expected Daily Trading Range), presently set for Monday’s session at 34 points. (Naturally, you can view all the daily updates to these metrics at the website):

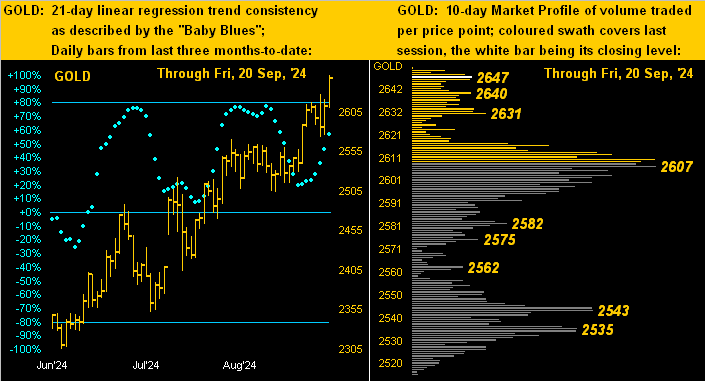

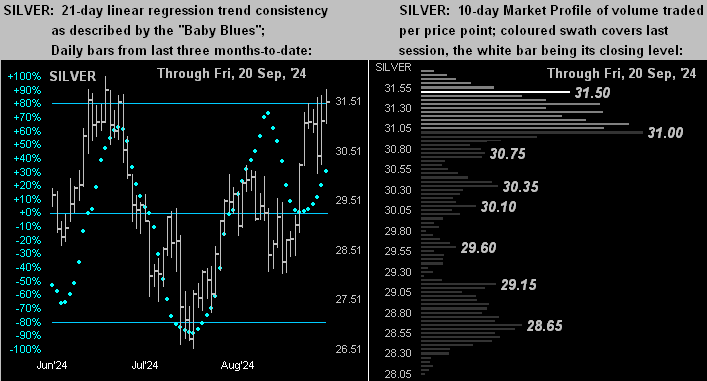

Next let’s go to Gold’s two-panel graphic of the daily bars from three months ago-to-date on the left and 10-day Market Profile on the right. To be sure, the “Baby Blues” of trend regression consistency have been spot-on brilliant: as we on occasion quip: “Follow the Blues instead of the news, else lose yer shoes”. Meanwhile, the Profile clearly shows 2607 as Gold’s firmest near-term volume-supportive price:

Looking ever more similar to Gold is Silver by her daily bars (below left) and Profile (below right). Still, given Sister Silver’s wayward tendencies to go waltzing off with Cousin Copper, we’re not that confident about 31.00 holding as the denoted dominant near-term trading supporter, (albeit Copper has been firming through the past six weeks). But as we’ve said, whereas Gold broadly is still cheap, Silver remains super cheap(!) Here’s the graphic:

Having opened with the Fed, let’s close with same. Over here, financial friends with whom we spoke almost all agreed that the Fed’s rate cut would be -0.25% (as, in fact, voted FOMC member Michelle Bowman), although a case was made for -0.50%, if for no other reason than a shift from the prior 5.25%-5.50% target range to now 4.75%-5.00% wasn’t that material of a change, (whereas from say 1.50% to 1.00% would be quite significant). But again as earlier cited, should the economy be garnering some renewed strength with money now a bit easier by which to come, then shall inflation add to a higher sum? Better to not be a dumbo without Gold, but fly as Dumbo with that which you hold.

Which brings us to this cool view of Disney’s Dumbo 1/4oz. Gold coin:

Now that really is the only way to fly: Gold High!

Cheers!

…m…

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro