The Gold Update by Mark Mead Baillie — 751st Edition — Monte-Carlo — 06 April 2024 (published each Saturday) — www.deMeadville.com

“Gold ‘Overbought’ is Great!“

We’ve penned it before, so let’s pen it again:

“Gold when technically overbought [as clearly now ’tis] might actually be considered a good thing … [as] great bull markets (or the resumption thereof) do breakout as such.”

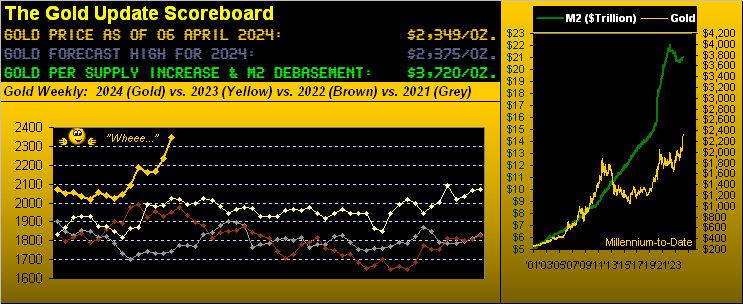

That quintessentially describes the nature of Gold’s price over the past five weeks. And the Gold bid is substantive: the combined COMEX trading volume of Gold from 04 March-to-date is the largest for any five-week stint since the world balked at COVID in 2020. Back then, the price of the yellow metal after having settled the prior year of 2019 at 1550, powered up to 2089 come 07 August 2020, a nearly +35% increase in 152 trading days: that All-Time High then remained in place until ’twas eclipsed more than three years later this past 27 December.

Moreover, Gold’s June contract settled yesterday (Friday) at 2349 inclusive of an intraday 2350 All-Time High, just 25 points shy of our predicted 2375 high for the entirety of this year. Further, Gold’s “expected daily trading range” (EDTR) is now 35 points: so priced today at 2349, Gold is within a day’s range of reaching our 2375 target. (Yes there are some +20 points of eroding premium in Gold’s futures price, but again given the EDTR is 35 points, such excess is at best noise).

“And it’s not too late to buy, right mmb?“

Actually, Squire, in the broader picture — especially as “under-owned” as remains Gold — hardly is it late: rather, ‘tis still early! We only mention this to dispel any investor concerns of having “missed the move” as Gold has still so far up to go. Oh to be sure, ‘twould be untoward technically for Gold not to pullback near-term; but fundamentally Gold remains extraordinarily inexpensive relative to U.S. Dollar debasement, such valuation by our opening Scoreboard now 3720.

The key point here is: Gold finally and rightly is getting repriced to a somewhat more reasonable level, albeit still well below said Scoreboard valuation. Again, that is broad-term. As for near-term, our 2375 looks ripe for the taking; indeed you may remember our couching that level as “conservative” when we first made the call; (see via the website The Gold Update from last 30 December, entitled “Gold – We Conservatively Forecast 2375 for 2024’s High”). And now year-to-date, Gold is +13.4%. As for year-over-year, ’tis +15.3% in turning to price’s weekly bars from 05 April a year ago, the rightmost blue-dotted parabolic Long trend now increasing its upside acceleration:

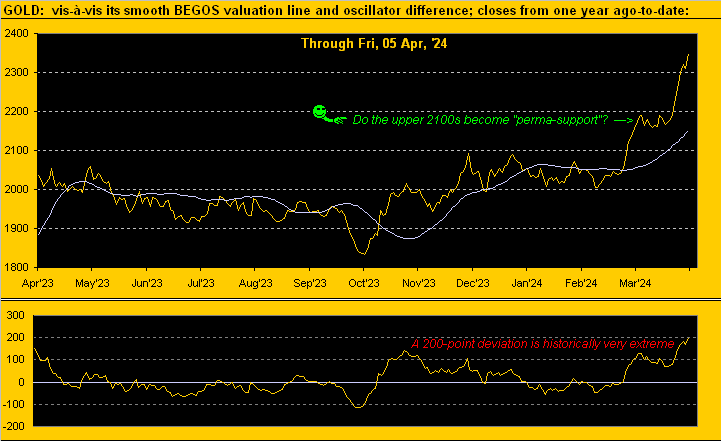

‘Course the thrust of this missive is that ’tis great when Gold becomes “overbought” as price climbs high into the sky. Still, from the infamous “Nothing Moves in a Straight Line Dept.” Gold right now is truly, technically over-extended. We thus update the following telling graphic from the website wherein we chart the daily closing prices from this time a year ago-to-date astride the smooth valuation line, (a near-term analytic unrelated to the broad-term Scoreboard valuation). Those of you familiar with this proprietary measure know the drill: when price breaks above or below the smooth line, ’tis the direction in which to trade, (albeit Shorting Gold is a bad idea). Recall the smooth line is derived from relative price changes amongst the five primary BEGOS Markets (Bond / Euro / Gold / Oil / S&P 500) as the flows between these critically important entities is significantly substantive; hence the inception of BEGOS some two decades ago. Here’s our two-panel valuation view:

Per the graphic’s lower panel (price less valuation), specific to Gold, a 100-point (on either side) deviation is considered “extreme”, and we’re essentially now +200 points above valuation. Such extreme distance in concert with Gold almost at our year’s forecast high of 2375 can present a near-term reversal of fortune, (and if anything, an opportunity to add to one’s pile). Whilst the extent of a reversal is unknown, the +200 level has basically been reached only three other times: first on 22 August 2011 after which price within a year dropped by -19.8%, then again briefly on COVID-crazy 15 April 2020, the third time being on 06 August 2020, which then saw price similarly drop within a year by -19.4%.

So is another -19%ish drop within Gold’s cards? We don’t see that a wit. For positively, note on the above graphic the remark pointing to recent structural support just below 2200. As we penned back in our 09 March piece: “…gone are the days of the 1900s…” Should this new “repricing” of Gold remain true to inevitable form, indeed those “days” ought well be histoire. Thus the bottom line is: Gold’s pending price plight shall morph into dip-buyers delight.

Yet for the StateSide economy, our Economic Barometer seems biased a bit more toward plight rather than delight. Job creation in March was fairly firm, notably per the ADP Employment data having bettered consensus, as well as having improved over that for February, that month in turn having been revised higher. But in looking at the past week’s Initial Jobless Claims as well as February’s Trade Deficit and Consumer Credit, all three worsened from the prior period, of which was revised lower in all three cases, and all three were worse than consensus. Indeed, have we of late mentioned the word stagflation? You know we have, especially given the graphic depictions in recent editions of inflation rising and/or still trending above the Federal Reserve’s 2% target. More on inflation specific to the BEGOS Markets following this view of the Baro (with the inane “Casino 500” in red) from one year ago-to-date, “Oops…”:

Indeed one wonders if the earnings-lacking, nearly-yieldless S&P is at long last putting in a top. (Yes, ’tis wishful thinking, right?) We nonetheless stick to history at some point repeating itself yet again — and that mathematically — a third “correction” of worse than -50% across the past 25 years is justifiably in the cards. ‘Course, preventing that is math no longer being employed in portfolio management. But just when ’tis said: “It’s different this time”, it turns out not to be. Perhaps “AI” shall save it all from going wrong … else hasten such. Would you board a plane piloted by Assembled Inaccuracy? “Have a nice fright…” There’s still a lot of “learning” to do out there.

As to inflation, per our musings since the start of this year, we reprise: “…might renewed inflation be taking first prize? In other words: what if the Fed instead tightens … surprise!” Or as Bloomy printed this past Tuesday: “Bond Selloff Builds as Fed Seen Delaying Rate Cuts” … Oh say it ain’t so!

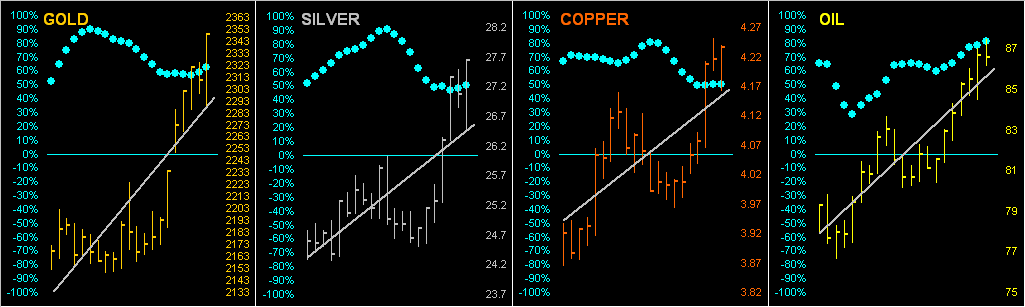

And yet, the old adage certainly seems in play: “The rising tide of inflation lifts all boats.” Or clearly so for the following BEGOS Markets. This next four-panel display shows the past 21 trading days (one month) for our Metals Triumvirate, plus Oil, all including their baby blue dots of trend consistency. Across the board ’tis up, up and away! And those of you seasoned investors and traders know that markets have a hankering to lead that which fundamentally is coming, (which in this case for you WestPalmBeachers down there means more inflation). Thus just maybe there’ll be a “Fed rate hike?” We know, “Don’t go there!” Here’s the graphic:

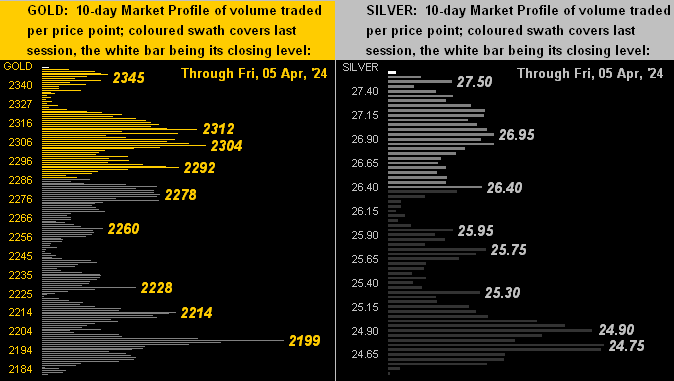

And specific to the precious metals, next is our two-panel display of the 10-day Market Profiles for Gold on the left and for Silver on the right. Per the wee white bars, there’s nothing like sitting atop the respective stacks, eh?

To wrap, in that we’ve mentioned inflation, again ’tis on full display next week as the March data arrives at both the retail (Consumer Price Index) and Wholesale (Producer Price Index) levels. In both cases, consensus expects cooling. (We’ll believe it when we see it; on this side of the Pond it sure doesn’t feel like it). Still toward staying first rate: ensure your nuggets of financial wisdom include both Gold and Silver, as being “overbought” is great!

Cheers!

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro