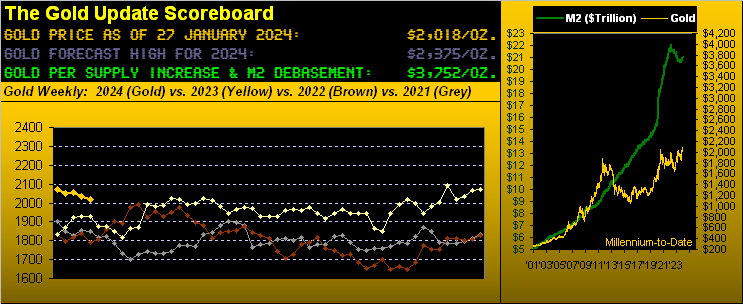

The Gold Update by Mark Mead Baillie — 741st Edition — Monte-Carlo — 27 January 2024 (published each Saturday) — www.deMeadville.com

“Gold Looks to Languish Lower“

On the heels of Gold having consecutively made four lower weekly lows, ‘twould appear there’s more languishing to go. ‘Course our being Pro-Gold, we hope we’re wrong as so.

But recall a week ago our opening with an array of “daily” technical studies for Gold, each with a negative bent. And now with Gold having since further declined — indeed settling yesterday (Friday) at 2018 — the “weekly” studies, too, are turning more notably negative.

Not to worry: we shan’t get as deep into the technical mumbo-jumo as we did last week, save to mention the following two Market Rhythms and their typically lower Gold price ramifications.

- First is Gold’s weekly Moneyflow (data provider’s classic calculation). It confirmed going negative at yesterday’s close. The last ten such negative crossovers (as far back as 27 May 2019) have then furthered maximum price declines ranging from -10 to -222 points (prior to the signal’s returning positive), the average maximum drop being -76 points. Were such “average” to repeat from here at Gold 2018, we’d see 1942.

- Second is Gold’s weekly MACD (“moving average convergence divergence”). There is a fair chance that it shall confirm a negative crossover in a week’s time, (albeit with Gold’s futures volume about to roll from the February contract into that for April with some +18 points of fresh price premium). Still, the last such 10 negative MACD crossovers (as far back as 23 April 2018) have produced further maximum price drops ranging from -12 to -265 points, the average maximum pullback in that case being -106 points.

Thereto, we’ve this quick sketch of Gold by the week since mid-year 2023-to-date with these two negative crosses (at right, Moneyflow having gone sub-50 and the MACD pending per next week):

The good news is: we don’t believe Gold shall decline by all that much as we put some degree of faith in the 2020-1936 structural support zone, again as presented here with Gold’s weekly bars from one year ago-to-date:

Now one might opine that Gold has its psychological 2000 milestone level for support. However: since first achieving that price back on 31 July 2020, hardly has it historically held its ground. Moreover as the wee observer in the above graphic points out, there essentially is no room left between price and the rightmost blue dot of parabolic Long trend. For should 2004 be eclipsed in the new week, said trend flips to Short and Gold shall find at least a near-term home in the 2020-1936 support zone. ‘Tis simply the way markets work, barring a fundamental awakening to Gold’s true valuation, (which at present by the opening Gold Scoreboard is 3752). But as the Investing Age of Stoopid sallies forth — the Casino 500 having already recorded eight record highs through just the first 18 trading days so far this year — Gold likely languishes in its wallflower guise.

Meanwhile, we say ’tis nothing but praise through these excellent Bidenomics days. To quote the late great Howard Cosell: “Look at him GO!”

Further, as the Economic Barometer rises, so does the stock market. In fact, the S&P 500’s “live” price/earnings ratio is now 50.0x. Isn’t that great? So exciting. And yet at the same time, how bizarre: as Q4 Earnings Season rolls along, 101 S&P constituents have reported, of which but 50% bettered their year-ago results. That is on pace for this to be the worst Earnings Season (save for Q1 and Q2 during COVID 2020) in our S&P database. And more broadly for 231 companies reporting thus far, just 41% have improved. Hence, math works: ![]() “So up with the “P” and down with the “E” and the P/E is Fif-Tee”

“So up with the “P” and down with the “E” and the P/E is Fif-Tee”![]() –[marcoMusique, ’24]. Here’s the Baro and record-setting Casino 500:

–[marcoMusique, ’24]. Here’s the Baro and record-setting Casino 500:

‘Course the highlight for us of the past week’s incoming metrics was the so-called “Fed-favoured” December read of Core Personal Consumption Expenditures as so deftly compiled by the Bureau of Economic Analysis. And its analysis found the Core PCE having doubled its inflation pace from +0.1% in November to now +0.2%. But ’tis OK, the mighty Dow Jones Newswires couching the increase as “mild”. Whew! And by such FinMedia directive, the Federal Open Market Committed in Wednesday’s forthcoming Policy Statement shall “…maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent…” Fairly firm however was Q4’s increase in the Gross Domestic Product (+3.3% annualized vs. +2.0% expected). And naturally — it having been the holiday season — folks spent at a greater pace (+0.7%) than that at which they earned (+0.3%). But all-in-all, things — as the above chap says — “Couldn’t be better!!!” (…tick…tick…tick…)

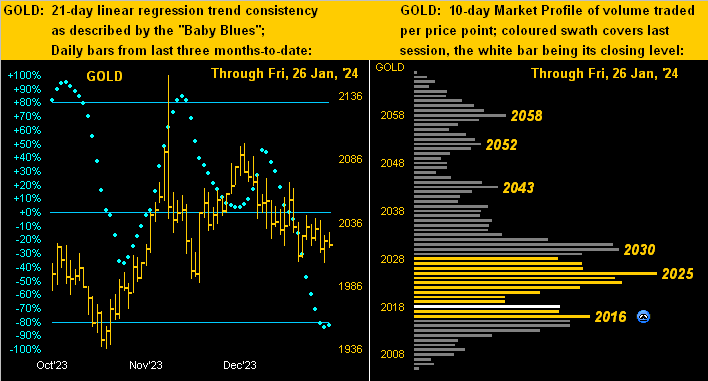

Ultimately better days await Gold even as it looks to succumb a bit near-term term should the aforementioned technicals will out. Still, there’s a hint of positive news as we go to Gold’s two-panel graphic and notably the daily bars from three months ago-to-date on the left. Therein, the “Baby Blues” of trend consistency have paused just below their -80% axis. The rule of thumb is: upon regaining that axis, price’s near-term tendency is to rise. ‘Course, it remains to been seen which quantitative measure wins the battle here, as on the right per Gold’s 10-day Market Profile, one is southerly gazing:

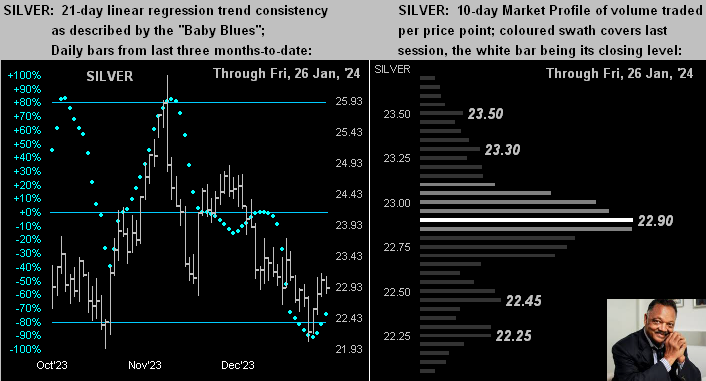

Gazing at same for Silver, her Baby Blues (at left) already have ascended back above the -80% axis. Again, is that price-positive, with price itself centered in the Profile (at right)? Indeed, can Sister Silver save the day for the precious metals? In this case we think not. However as ol’ Jesse Jackson movingly expounded back in ’88: “Keep hope alive!”

We’ll close it out for the week with this bit somewhat tongue-in-cheek, (which for you WestPalmBeachers down there means don’t take it too seriously).

You may recall a couple of missives back that we briefly bit into Bitcoin by broaching its “Baby Blues” which had just kinked lower ’round the $44,000/bit level, having since reached to as low as $38,540; at present (all per Futures pricing), Bitcoin is $42,335.

Yet as you know, what clearly perplexes us, is placing a proper valuation on Bitcoin versus its price. For example, we know ad nauseum that Gold today is priced at basically one-half its dollar debasement valuation. Too, we know that the Casino 500 today is essentially priced at double its earnings valuation. The good news in both those cases is that price historically reverts to valuation, (i.e. more broadly we’ll see higher Gold and a lower S&P). But for the present, irrespective of valuation and the market never being wrong, both Gold and the S&P are merely priced today where the investing/trading community has placed them. So is Bitcoin. Period. And as we’ve in the past quipped, “You cannot will the market to your desired level.”

Yet specific to Bitcoin, as we’ve asked in the past, upon what can one value something based on nothing? Well, for the balls-to-the-wall Bitcoiners out there, we came up with the following.

As is Bitcoin based on nothing, the same might be said of today’s fiat currencies. And in the Bitcoiners’ future of perfection, their beloved digital currency world shall basically become the world’s money supply. Thus can we given Bitcoin a proper valuation? Have a look.

Hat-tip Visual Capitalist, the global money supply of the industrialized world on an “M1” basis (i.e. hard currency, demand deposits and traveller’s cheques) as of 28 November 2022 amounted to some $48.9T. So let’s round that up to $50T.

Too, the current supply of Bitcoin is 19M which is en route to becoming permanently fixed at 21M. So let’s go with the latter. And what do we get?

$50,000,000,000,000 ÷ 21,000,000 = $2,380,952/bitcoin

We’ve thus encapsuled this in the following table, which one may enjoy viewing whilst listening to ![]() “All the Love in the World”

“All the Love in the World”![]() –[The Outfield, ’85]:

–[The Outfield, ’85]:

So in that construct, paying 1.8¢ today for $1 of Bitcoin by futuristic valuation perhaps seems attractive … (just a passing thought). But clearly this is not a prediction, let alone a recommendation.

Still, at the end of the day, there’s always Gold. Good Old Gold! Languish it may, but don’t keep it at bay!

Cheers!

www.TheGoldUpdate.com

www.deMeadville.com

and now on “X”: @deMeadvillePro