The Gold Update by Mark Mead Baillie — 703rd Edition — Monte-Carlo — 06 May 2023 (published each Saturday) — www.deMeadville.com

“Gold Nears Record Threshold … Then Gets Royally Rolled“

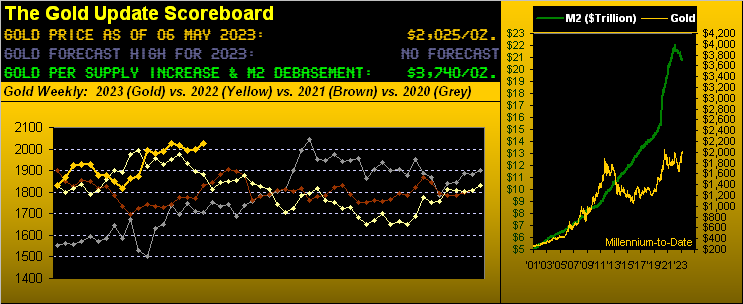

And if you blinked — literally — you missed it. In one of the most bizarre GLOBEX/COMEX session openings we’ve ever witnessed — that for this past Thursday, 04 May — Gold in mere seconds leapt 37 points from 2049 to 2085, just 4 points shy of the record threshold 2089 All-Time High … only to then get royally rolled into week’s end, settling yesterday (Friday) at 2025.

Thursday’s opening alone put us in mind of that 2000 Nicky Cage drive-in B-movie “Gone in 60 Seconds” as follows, emphasizing volume of 899 contracts upon some “entity” instantaneously hoovering away 13 full points of overhead offers in just one second! Here ’tis:

‘Course, upon Gold not reaching its record high threshold, price then got rolled — and quite royally so — come Friday’s Bureau of Labor Statistics Payrolls data for April coming in 41% (+253k) more plentiful than “expected” (+180k); [note: our own inhouse estimate was for +250k… but the “Pros” are far more informed than are we, right?]

Oh to be sure, the yellow metal did record an up week. BUT: from its high-to-settle ’twas Gold’s second-worst intra-week drop year-to-date (-60 points or -2.9%).

And whilst that “one-second wonder trade” may warily reek of an MSC (“Manipulative Short Clearout”), if not even an honest attempt to go for Gold’s All-Time High it being so nigh, hardly was the effort sustainable. The firm Labor report (plus as we’ll herein see the Economic Barometer’s recent recovery) almost certainly suggests the Federal Reserve is not set to “pause” come their Open Market Committee’s next Policy Statement (due 14 June).

And why pause at all? After all, as we a week ago saw, the Q1 Chain Deflator component (+4.0%) of Q1 Gross Domestic Product (+1.1%) basically means 80% of quarterly GDP “growth” was solely inflationary rather than real. Hence this opening sentence from Wednesday’s FOMC Statement: “Economic activity expanded at a modest pace in the first quarter.” Given that +1.1%, we can concur. But then came the opening sentence of paragraph two: “The U.S. banking system is sound and resilient.” Cue one John Patrick McEnroe: “You canNOT be SERious!”

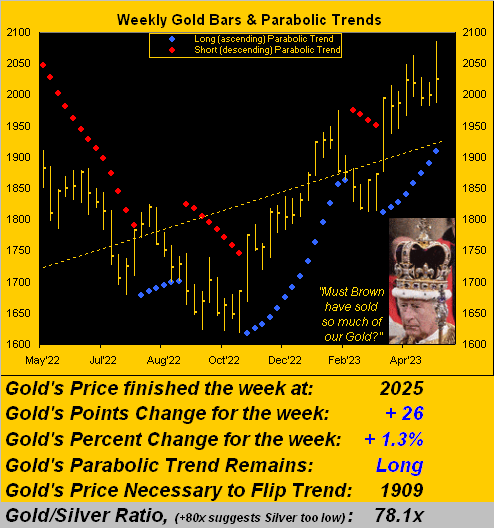

Regardless, Gold “expectedly” got creamed upon Labor’s strong jobs release as the rightmost weekly bar next shows. Yet the blue-dotted parabolic Long trend remains well intact, now 8 weeks in duration. And as you sharp-eyed regular readers already know, the average duration of the past ten such trends is 14 weeks, typically carrying enough average points follow-through to imply (within that vacuum) Gold reaching the mid-2100s on this run. You tell ’em, Charles, as here’s the graphic:

We mentioned the Econ Baro: here we go. Of the Baro’s 14 incoming metrics this past week, 11 of them were period-over-period improvements, including April’s Payrolls creation both per Labor and ADP, the Unemployment Rate, Hourly Earnings, and the Institute for Supply Management’s Indices for both Manufacturing and Services. Too for March came growth in Construction Spending, Factory Orders, Consumer Credit and a reduction in the Trade Deficit. Yes, the groaner therein was our first peek at Q1’s Productivity which shrank whilst Unit Labor Costs rose. But on balance, a bodacious week for the Baro, indeed its best five-day stint since that ending 08 February. “Slow that thing down!”

And how about that S&P 500 on Friday scoring its third-best points gain (+75 or +1.8%) year-to-date? Further: did you know that 60.3% of that gain (via capitalization-weighted moneyflow) was from Apple (AAPL) alone, the Q1 earnings for which were flat at that from Q1 a year ago (again $1.52/share) whilst revenue dropped -2.5%? (This is why we don’t “do” stocks: far too nonsensical). Oh and lest we forget, our “live” price/earnings ratio for the S&P settled the week at 54.2x. Too, (should you still be scoring at home), the market capitalization of S&P is now 73% greater (at $36.0T) than the U.S. liquid money supply (at $20.7T “M2” basis). But wait there’s more: as we avoid watching them, are the FinTv channels running a StateSide Default Countdown Clock? Indeed in so many ways “…tick tick tick goes the clock clock clock…”

Regardless, ticking down into week’s end were our precious metals. From high-to-low for Friday alone, Gold fell -2.6% and Silver -3.9%, both paying the freight when suddenly everything else is deemed just great as our two ol’ stock market buddies elate:

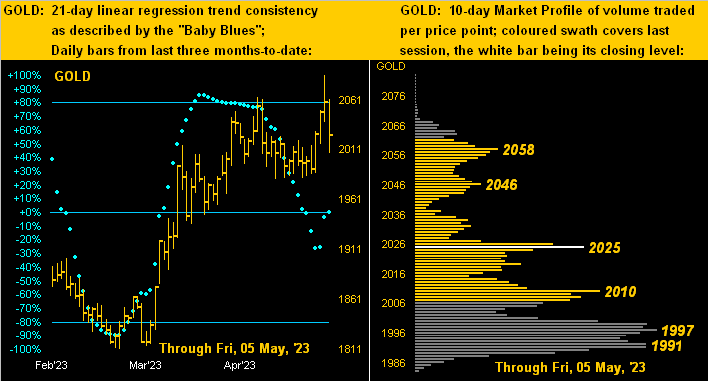

Thus to drill down into the precious metals we’ve first our two-panel display featuring Gold’s daily bars from three months ago-to-date on the left, and 10-day Market Profile on the right. ‘Tis rare that the “Baby Blues” go that askew, but price’s sudden up-and-down has affected consistency in this view. More importantly, whether by the aforeshown weekly view or this one, the dominant Gold trend remains up. Meanwhile per the Profile, we look to the denoted trading support in the high 1900s as sufficient:

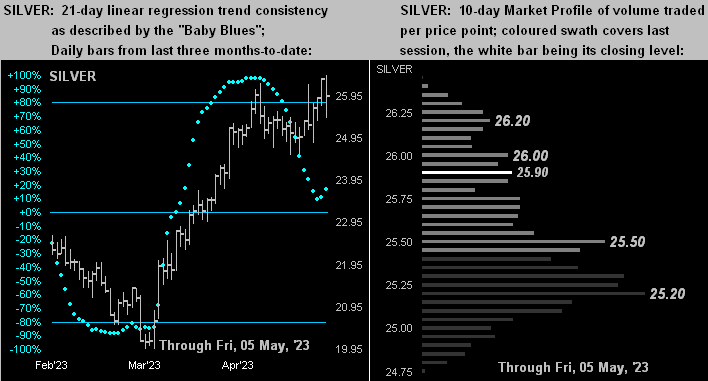

Silver’s similar view actually appears more stable. She too got somewhat sucked into Gold’s “spike n’ roll”. However week-over-week, Silver’s net gain was +2.3% versus Gold’s +1.3%. Indeed, the Gold/Silver ratio is now 78.1x, its lowest reading since this past 06 January, (albeit priced at the century-to-date average of 67.5x would find Silver today at 30.01 versus her Friday settle at 25.93). Still, her Profile’s low 25s suggest trading support:

“By the way, mmb, do you know what you’ve not yet posted this year?”

What might that be, Squire?

“The Gold Stack.”

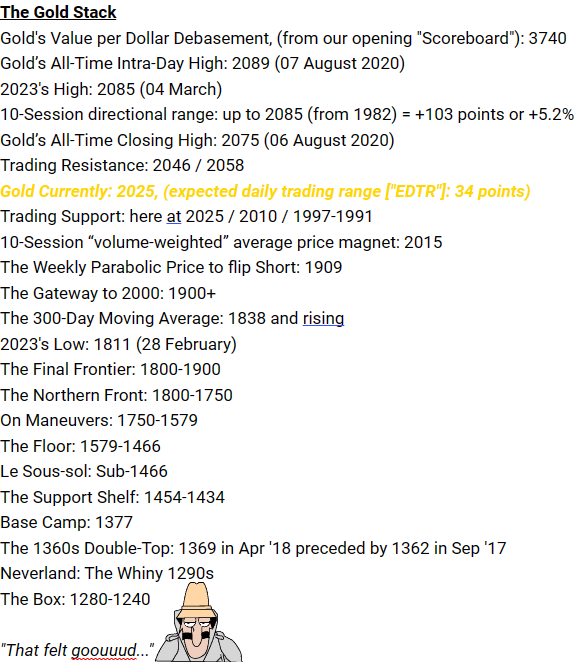

Super scrutineering there, Squire! Haven’t so done since last 26 November, Gold then at 1755. Thus without further ado, here ’tis:

Remerciements, cher Inspecteur. Now peering into the ensuing week we’ve the monthly round of both retail and wholesale inflation data. The Consumer Price Index is “expected” to have increased from March’s +0.1% pace to +0.4% for April; and for the Producer Price Index from -0.5% to +0.3%. How’s that erosion of purchasing power workin’ out for ya? ‘Tis a good time to grab some more Gold!